For aspiring mathematicians, computer scientists, and physicists looking to enter the world of finance, few roles are as prestigious or lucrative as that of a Quantitative Analyst ("Quant") at a top-tier hedge fund. Among these elite firms, Citadel stands out as a global leader, renowned for its technological prowess and, consequently, its highly competitive compensation.

Pursuing a career as a quant at Citadel is not just a job; it's an entry into one of the most intellectually demanding and financially rewarding fields in the world. For top-tier candidates, especially new graduates from PhD programs, first-year total compensation can soar well past $500,000, with senior quants earning multi-million dollar paychecks. This article will break down what a Citadel quant does, the components of their salary, and the key factors that drive these exceptional earnings.

What Does a Citadel Quant Do?

At its core, a Quantitative Analyst at Citadel is a sophisticated problem-solver who uses mathematical models and massive datasets to identify and capitalize on trading opportunities. They are the architects and engineers of the firm's trading strategies. Forget the old image of shouting traders on a stock exchange floor; today's markets are dominated by complex algorithms and high-speed execution, all designed and overseen by quants.

Key responsibilities include:

- Modeling: Designing and implementing mathematical models to price financial instruments, predict market movements, and manage risk.

- Data Analysis: Sifting through vast amounts of historical and real-time data to find statistically significant patterns (often called "signals").

- Strategy Development: Creating and back-testing automated trading strategies based on their models and analysis.

- Technology & Programming: Writing high-performance code (often in C++ or Python) to execute these strategies with millisecond precision.

They operate at the intersection of finance, statistics, computer science, and applied mathematics, engaging in an ongoing intellectual "arms race" to stay ahead of the market.

Average Citadel Quant Salary

Salaries at elite hedge funds like Citadel are famous for their high figures, but it's crucial to understand that "salary" is more than just the base pay. Compensation is typically broken down into three parts: a base salary, a sign-on bonus (for new hires), and a significant performance-based annual bonus.

While Citadel does not publicly disclose salary information, data from professional networking and salary aggregation sites provide a clear picture of the earning potential.

- Entry-Level (New Graduates - PhD/MS):

- Base Salary: $175,000 - $250,000

- Sign-on Bonus: $50,000 - $100,000

- Expected First-Year Performance Bonus: $150,000 - $250,000+

- Total First-Year Compensation: $400,000 - $600,000+

- Experienced Quant (3-7 years):

- Base Salary: $250,000 - $350,000

- Annual Performance Bonus: $300,000 - $1,000,000+. The bonus becomes the largest component of pay and is highly dependent on individual and team performance.

- Total Annual Compensation: $550,000 - $1,350,000+

- Senior Quant / Portfolio Manager:

- At this level, compensation is almost entirely performance-based and can easily exceed $2,000,000 per year, with top performers earning tens of millions.

*(Sources: Data compiled and synthesized from recent user-reported figures on Levels.fyi, Glassdoor, and Wall Street Oasis for "Quantitative Researcher" and "Quantitative Analyst" roles at Citadel and peer firms.)*

Key Factors That Influence Salary

Compensation isn't a flat number; it's a dynamic figure influenced by a combination of credentials, skills, and performance. Here are the primary drivers.

### Level of Education

Education is a primary gatekeeper for quant roles. While a bachelor's degree in a quantitative field is the minimum, the most sought-after candidates, who command the highest starting salaries, typically hold advanced degrees.

- PhD: This is the gold standard, particularly from a top university in a highly quantitative field like Physics, Mathematics, Statistics, or Computer Science. A PhD demonstrates deep research capabilities and the ability to solve unstructured, complex problems—a core skill for a quant. These candidates receive the highest offers.

- Master's Degree: A Master of Science (M.S.) or a specialized degree in Financial Engineering (MFE) is also highly valued and a common entry point.

- Bachelor's Degree: Exceptional undergraduates from top programs (e.g., MIT, Caltech, Carnegie Mellon) with significant research or competitive programming experience (like IMO or ICPC) can also secure these roles, though it's less common for pure research positions.

### Years of Experience

Experience directly correlates with earning potential, but more importantly, the *type* of experience matters. The compensation structure evolves significantly throughout a quant's career.

- 0-2 Years (Analyst): Focus is on learning, supporting senior quants, and contributing to existing models. The bonus is a significant part of pay but is more closely tied to team and firm performance.

- 3-7 Years (Senior Analyst/Researcher): Quants are expected to develop their own signals and strategies. The performance bonus grows dramatically and becomes more directly linked to the profitability (PnL) of their strategies.

- 8+ Years (Portfolio Manager/Director): At this stage, individuals are responsible for managing a significant book of capital. Their compensation is overwhelmingly tied to the returns they generate, leading to the multi-million dollar figures that define the industry.

### Geographic Location

Citadel has major offices in global financial hubs. While they pay top-of-market everywhere, there can be slight variations based on the cost of living and local competition for talent. The primary locations for quants are:

- Chicago (Headquarters)

- New York

- London

- Hong Kong

- Miami

Salaries in hubs like New York and Chicago are among the highest in the world, designed to attract the absolute best talent to these key financial centers.

### Company Type

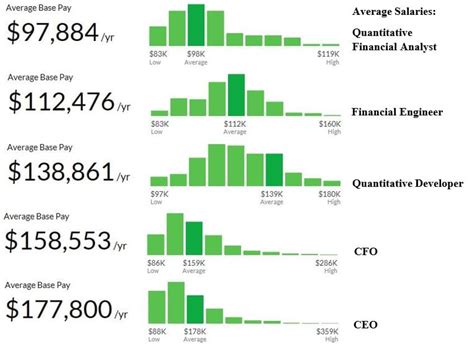

Not all quant jobs are created equal. The type of firm is arguably the biggest differentiator in compensation. According to Salary.com, the average "Quantitative Analyst" in the United States earns around $145,000, a far cry from the numbers at Citadel.

- Elite Hedge Funds (e.g., Citadel, Jane Street, Renaissance Technologies): These firms are at the pinnacle of the pay scale. They have lean structures and directly reward quants for generating profit, leading to massive performance bonuses.

- Investment Banks (e.g., Goldman Sachs, J.P. Morgan): Banks also hire many quants, but they are larger, more regulated institutions. Compensation, while excellent, is generally lower than at top hedge funds, and bonuses may include more deferred stock.

- Asset Management Firms & Fintech Companies: These firms also offer quant roles with strong, competitive salaries, but they typically cannot match the extreme upside potential of a top-performing hedge fund.

### Area of Specialization

Within the quant world, certain specializations are in higher demand and can command a premium.

- High-Frequency Trading (HFT): Requires exceptional C++ skills and a deep understanding of market microstructure.

- Statistical Arbitrage / Mid-Frequency: The classic domain of finding statistical relationships between securities.

- Machine Learning / AI: A rapidly growing field where quants use advanced techniques like deep learning to develop predictive models. Expertise here is extremely valuable.

- Derivatives Pricing and Risk: A more traditional but still vital area, especially in banking and for complex strategies.

Quants who can develop novel, profitable strategies in high-demand areas like ML or HFT are among the highest-paid in the industry.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Quantitative Analyst" as a specific occupation. However, we can look at related professions for a strong indicator of growth. For "Mathematicians and Statisticians," the BLS projects a job growth rate of 30% from 2022 to 2032, which is classified as "much faster than the average" for all occupations.

This exceptional growth is driven by the increasing computerization and data-dependency of the financial industry. As long as markets exist, firms like Citadel will be in a relentless pursuit of quantitative talent to find a competitive edge. The demand for individuals who can blend advanced mathematics with computer science to solve financial problems is only set to increase.

Conclusion

A quantitative analyst career at Citadel represents the apex of the finance and technology worlds. It is a path defined by immense intellectual challenges and extraordinary financial rewards. The journey requires an elite educational background, a mastery of mathematics and programming, and an unyielding drive to compete at the highest level.

For those who meet the high bar, the compensation is a direct reflection of the immense value they create. With first-year earnings comfortably exceeding half a million dollars and a nearly unlimited ceiling for top performers, it remains one of the most compelling and aspirational career paths for quantitative minds today.