In the intricate world of insurance, where risk and responsibility intersect, claims examiners are the critical investigators and decision-makers. They are the individuals who step in after a loss occurs—be it a car accident, a workplace injury, or a catastrophic storm—to determine liability and ensure that legitimate claims are paid fairly and accurately. If you're a detail-oriented problem-solver with a strong sense of ethics and a desire for a stable, rewarding career, the role of a claims examiner might be your perfect fit. But what does that career path look like financially? What is a realistic claims examiner salary you can expect to earn?

This guide is designed to be your definitive resource, moving beyond simple salary numbers to give you a panoramic view of the entire profession. We will dissect every factor that influences your earning potential, from your level of education and experience to the specific type of insurance you specialize in. I once had a family friend navigate a complex homeowner's claim after a fire, and it was the calm, methodical, and empathetic claims examiner who turned a devastating event into a manageable recovery process. That experience solidified for me the profound impact these professionals have, acting as the human link that fulfills an insurer's promise.

This article will provide you with the data, insights, and strategic advice you need to not only understand the claims examiner salary landscape but also to chart a course for maximizing your own career success.

### Table of Contents

- [What Does a Claims Examiner Do?](#what-does-a-claims-examiner-do)

- [Average Claims Examiner Salary: A Deep Dive](#average-claims-examiner-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as a Claims Examiner Right for You?](#conclusion-is-a-career-as-a-claims-examiner-right-for-you)

What Does a Claims Examiner Do?

Before we delve into the numbers, it's crucial to understand the substance of the role. A claims examiner is fundamentally an analytical professional who works on behalf of an insurance company to evaluate insurance claims. Their primary objective is to verify the validity of a claim, ensure the policy covers the loss, and authorize the appropriate payment to the policyholder. They are the gatekeepers who protect the insurance company from fraudulent or inflated claims while ensuring that legitimate policyholders receive the benefits they are contractually owed.

While often used interchangeably with "claims adjuster," there's a subtle distinction. Claims adjusters frequently work in the field, inspecting property damage or accident scenes. Claims examiners, conversely, are more often office-based (or remote), reviewing the complex files and reports submitted by adjusters, policyholders, and other third parties. They typically handle claims that are more complicated, contested, or involve significant financial or legal implications.

Core Responsibilities and Daily Tasks:

A claims examiner's day is a blend of investigation, analysis, communication, and decision-making. Their key duties include:

- Reviewing New Claims: The first step is to thoroughly review the initial claim report, the claimant's insurance policy, and any submitted documentation (e.g., police reports, medical records, repair estimates).

- Investigating the Loss: This is the heart of the job. It may involve interviewing the claimant, witnesses, and medical providers; consulting with experts like engineers, medical specialists, or legal counsel; and verifying all facts related to the incident.

- Analyzing Policy Coverage: Examiners must become experts in insurance policies. They meticulously check policy language, exclusions, and limits to determine if the specific loss is covered and to what extent.

- Determining Liability and Value: Based on their investigation, they determine who is at fault (liability) and calculate the monetary value of the claim. This requires a deep understanding of state laws, regulations, and industry standards.

- Negotiating Settlements: In many cases, especially with liability claims, the examiner will negotiate a settlement with the claimant or their attorney. This requires strong negotiation and communication skills.

- Authorizing or Denying Claims: The ultimate decision rests with the examiner. They authorize payment for valid claims or issue a formal denial for those that are not covered, fraudulent, or lack sufficient evidence, providing a clear explanation for their decision.

- Maintaining Meticulous Records: Documentation is paramount. Every conversation, finding, and decision must be carefully recorded in the claim file system.

### A Day in the Life of a Claims Examiner

To make this more concrete, let's imagine a day for "David," a mid-level workers' compensation claims examiner.

- 8:30 AM - 10:00 AM: David starts his day by reviewing his diary, a prioritized list of tasks. He opens three new claim files that came in overnight. One is a straightforward sprain, which he reviews and sets up for initial medical payments. The other two involve more serious injuries and require immediate contact with the employer and the injured employee.

- 10:00 AM - 12:00 PM: He spends the next two hours on the phone. He calls an employer to get a detailed incident report for a back injury claim. He then calls a doctor's office to request medical records for a long-term claimant to assess their work status. Finally, he speaks with an attorney representing another claimant to begin settlement negotiations.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 3:00 PM: David focuses on a complex case involving a potential repetitive-motion injury. He reads through months of medical reports and consults his company's internal medical review nurse for an opinion. He drafts a detailed summary of his findings and a recommendation for either acceptance or further investigation.

- 3:00 PM - 4:30 PM: It's documentation time. David meticulously updates all the claim files he worked on today, noting every conversation, every document received, and every decision made. This digital paper trail is essential for legal and regulatory compliance.

- 4:30 PM - 5:00 PM: He reviews his diary for tomorrow, plans his priorities, and responds to a final batch of emails before logging off.

This example illustrates the highly analytical and communication-intensive nature of the role. It's a job that requires a sharp mind, unwavering attention to detail, and the ability to manage multiple complex cases simultaneously.

Average Claims Examiner Salary: A Deep Dive

Now, let's get to the core of your query: compensation. The salary for a claims examiner is competitive and reflects the high level of responsibility and specialized knowledge required for the role. It's important to look at data from multiple authoritative sources to get a well-rounded picture.

The U.S. Bureau of Labor Statistics (BLS) is the gold standard for occupational data. In its May 2023 Occupational Employment and Wage Statistics report, the BLS categorizes this role under "Claims Adjusters, Examiners, and Investigators."

- Median Annual Salary: The BLS reports the median annual wage was $75,170 in May 2023. This means that half of all workers in this occupation earned more than this amount, and half earned less.

- Salary Range: The salary spectrum is wide. The lowest 10 percent earned less than $48,010, while the top 10 percent earned more than $107,350.

While the BLS provides a fantastic national benchmark, salary aggregator websites, which collect real-time data from users and job postings, can offer a slightly different and more granular perspective.

- Payscale.com: As of late 2023, Payscale reports the average salary for a Claims Examiner at $60,287 per year, with a typical range between $45,000 and $84,000.

- Salary.com: This site often shows higher figures, reflecting data from larger corporate roles. As of late 2023, it lists the median salary for a "Claims Examiner I" (entry-level) at $60,071, a "Claims Examiner II" at $69,333, and a "Claims Examiner III" (senior) at $80,899.

- Glassdoor.com: Based on user-submitted data, Glassdoor estimates the total pay for a Claims Examiner in the United States to be around $73,771 per year, with an average base salary of $62,501.

Why the differences? The BLS provides a comprehensive survey of all industries and locations, including lower-paying sectors. Salary aggregators can be influenced by the types of users who submit data, often skewing towards larger companies and major metropolitan areas. For the purpose of this guide, we can confidently state that a typical claims examiner can expect to earn a median salary in the $65,000 to $75,000 range, with significant potential for growth.

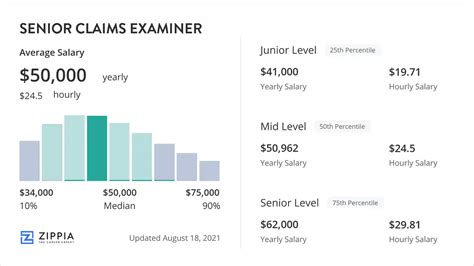

### Salary by Experience Level

Your earnings as a claims examiner will grow substantially as you gain experience, master complex claim types, and prove your ability to handle larger and more litigious files. Here is a typical salary progression, compiled from data from Payscale and Salary.com:

| Experience Level | Years of Experience | Typical Salary Range (Annual) | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level / Claims Trainee | 0-2 years | $48,000 - $62,000 | Learning company procedures, handling low-complexity, high-volume claims (e.g., basic auto physical damage, simple medical claims). Focus is on accuracy and efficiency under close supervision. |

| Mid-Career / Claims Examiner | 2-9 years | $60,000 - $80,000 | Managing a full caseload of moderate-complexity claims. Making more independent decisions, conducting in-depth investigations, and beginning to handle litigated files or minor injury claims. |

| Senior / Lead Claims Examiner | 10+ years | $75,000 - $95,000+ | Handling the most complex, high-value, and contentious claims. Specializing in areas like major litigation, catastrophic injuries, or commercial liability. Mentoring junior examiners and acting as a subject matter expert. |

| Claims Supervisor / Manager | 10-15+ years | $85,000 - $120,000+ | Moving into a leadership role. Managing a team of examiners, overseeing claim workflows, setting department goals, handling budgets, and resolving escalated issues. Focus shifts from handling files to managing people and processes. |

### Beyond the Base Salary: Understanding Total Compensation

Your annual salary is only one part of the equation. Insurance companies, particularly larger carriers, are known for offering robust benefits packages that significantly increase your total compensation. When evaluating a job offer, consider the full picture:

- Bonuses: Many claims departments operate on a performance-based bonus structure. These bonuses can be tied to individual metrics (e.g., file closure rates, accuracy, customer satisfaction scores) or team/company performance. Annual bonuses can range from 5% to 15% or more of your base salary.

- Profit Sharing: Some large mutual insurance companies (owned by policyholders) or publicly traded insurers offer profit-sharing plans, where a portion of the company's annual profits is distributed to employees.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is standard. Many companies also offer wellness programs, gym membership reimbursements, and generous contributions to Health Savings Accounts (HSAs).

- Retirement Plans: A 401(k) or 403(b) with a company match is a critical component of long-term financial health. A typical match might be 100% of your contributions up to 4-6% of your salary.

- Paid Time Off (PTO): Expect a competitive package of vacation days, sick leave, and paid holidays.

- Tuition Reimbursement & Professional Development: Insurers heavily invest in their employees' education. Many will pay for you to earn industry designations like the AIC or CPCU (more on this later), which can directly lead to promotions and higher pay.

When you factor in these benefits, the total compensation for an experienced claims examiner can easily exceed $100,000 per year.

Key Factors That Influence Salary

Two examiners with the same job title can have vastly different salaries. The single biggest mistake a job seeker can make is looking only at the national average. Your personal earning potential is a unique equation determined by a combination of powerful factors. Understanding these variables is the key to maximizing your income throughout your career.

###

1. Level of Education and Certification

While you can enter the field with a high school diploma, your educational background sets the foundation for your long-term earning potential.

- High School Diploma or Associate's Degree: This is often the minimum requirement for entry-level roles, such as a claims trainee or assistant. You can absolutely build a successful career from this starting point, but your initial salary may be on the lower end of the scale ($45,000 - $55,000). Success will depend on aggressive on-the-job learning and pursuing certifications.

- Bachelor's Degree: A bachelor's degree is the preferred qualification for most major insurance carriers and is often a prerequisite for management-track positions. While no single major is required, degrees in Business Administration, Finance, Economics, Criminal Justice, or Communications are highly relevant. A bachelor's degree can command a starting salary that is $5,000 to $10,000 higher than a non-degreed candidate and opens the door to faster advancement.

- Advanced Degrees (MBA, JD): A Master of Business Administration (MBA) or Juris Doctor (JD) is not necessary for most examiner roles but can be a massive accelerator for those aiming for senior leadership or highly specialized, complex claims. A JD, for example, is invaluable for an examiner handling multi-million dollar liability lawsuits, and an MBA is ideal for someone on the path to becoming a Vice President of Claims. These degrees can push salaries well into the six-figure range.

The Power of Professional Certifications:

In the insurance industry, professional designations are often more impactful on salary than a master's degree. They signal a deep commitment to the profession and a mastery of a specific domain. The most respected credentialing body is The Institutes.

- Associate in Claims (AIC): This is the foundational designation for claims professionals. Earning the AIC demonstrates proficiency in claim handling principles, practices, and policies. Many employers offer a raise or a one-time bonus upon completion and may consider it a prerequisite for promotion to a mid-career role.

- Chartered Property Casualty Underwriter (CPCU): This is the industry's premier designation, often called the "MBA of insurance." It is a rigorous program covering risk management, insurance law, finance, and specialized lines of coverage. Earning a CPCU is a significant achievement that can add 5-15% to your salary and is often a requirement for senior management and executive positions.

- Other Specialized Certifications: Other valuable credentials include the Senior Claim Law Associate (SCLA), Certified Workers' Compensation Professional (CWCP), and various fraud investigation certifications.

###

2. Years of Experience

As illustrated in the table above, experience is arguably the most significant driver of salary growth. This isn't just about time served; it's about the *quality* of that experience.

- 0-2 Years (The Learning Phase): You are absorbing information, learning the claims system, and handling a high volume of simple, "cookie-cutter" claims. Your value is in your efficiency and accuracy on routine tasks. Salary growth is steady but modest.

- 2-5 Years (The Competency Phase): You now operate independently on a full caseload of moderately complex claims. You've developed strong investigative and negotiation skills. This is where you'll see your first significant salary jumps as you prove your competence. You may begin to handle claims with some injury exposure or minor litigation.

- 5-10 Years (The Mastery Phase): You are a trusted, senior member of the team. You are assigned the more complex and high-dollar value claims. You might specialize in a difficult area like commercial auto liability or construction defect claims. You are seen as a mentor to junior staff. Your salary should be well above the national median.

- 10+ Years (The Expert/Leadership Phase): At this stage, you are either a top-level technical expert handling the company's most challenging claims, or you have transitioned into leadership. As a Claims Supervisor or Manager, your salary is now influenced by your ability to lead a team, manage performance, and contribute to the department's strategic goals.

###

3. Geographic Location

Where you live and work has a massive impact on your paycheck. This is driven by the cost of living and the concentration of insurance company headquarters or major operational hubs.

High-Paying States and Metropolitan Areas:

According to BLS data and salary aggregators, you can expect to earn significantly more than the national average in these areas:

- Northeast: States like New York, New Jersey, Massachusetts, and Connecticut consistently rank among the highest paying. Major cities like New York City, Boston, and Hartford (often called the "Insurance Capital of the World") have a high cost of living and a dense concentration of insurers. Salaries here can be 15-30% above the national average.

- West Coast: California and Washington are also top-tier locations for claims examiner salaries, particularly in metropolitan areas like Los Angeles, San Francisco, and Seattle. A senior examiner in San Jose, CA, might earn significantly more than one in a smaller city.

- Other Key Hubs: Cities like Chicago, IL, and Dallas, TX, are major regional hubs for insurance operations and offer competitive salaries that are often above the national average, even if the state-wide average is closer to the median.

Lower-Paying Regions:

Conversely, salaries tend to be lower in states with a lower cost of living, primarily in the Southeast and parts of the Midwest. States like Mississippi, Arkansas, Alabama, and South Dakota will typically have salaries that fall below the national median. However, the lower cost of living in these areas can mean your take-home pay has greater purchasing power.

The Rise of Remote Work: The COVID-19 pandemic accelerated the trend of remote work in the claims profession. This has started to partially flatten geographic pay scales. Some national carriers are moving towards location-agnostic pay bands, while others use a "geo-flex" model, adjusting salary based on the employee's location, even if they are 100% remote. This is a critical question to ask during the interview process.

###

4. Company Type and Size

The type of organization you work for is a major determinant of your salary and career path.

- Large National Insurance Carriers (e.g., State Farm, Progressive, Allstate, Liberty Mutual): These giants are the most common employers. They offer structured salary bands, excellent benefits, extensive training programs, and clear career ladders. While the salary might be highly standardized, the overall package (including bonuses, 401k match, and tuition reimbursement) is often top-tier.

- Third-Party Administrators (TPAs): TPAs are companies that handle claims administration on an outsourced basis for other entities, like self-insured corporations or smaller insurance companies. Salaries at TPAs can be very competitive, but the environment can be more fast-paced and demanding, with a heavy emphasis on productivity metrics.

- Independent Adjusting (IA) Firms: Some examiners work for IA firms that contract with multiple insurers, often to handle catastrophic events or specialized claims. The pay structure can be different, sometimes based on a fee schedule (a percentage of the claim settlement). This path offers high earning potential, especially for "CAT adjusters" who travel to disaster zones, but it comes with less stability and predictability.

- Government Agencies: Claims examiners also work for federal or state agencies, such as the Social Security Administration (disability claims), the Department of Veterans Affairs (VA benefits), or state workers' compensation funds. These jobs offer unparalleled job security, excellent benefits, and a pension. The salary is determined by a rigid government pay scale (like the GS scale), which may have a lower ceiling than the private sector but offers a very stable and predictable career.

###

5. Area of Specialization

Not all claims are created equal. The complexity, financial exposure, and specialized knowledge required for different lines of insurance create distinct salary tiers. Specializing in a high-demand, complex area is one of the fastest ways to increase your value and your salary.

- Property & Casualty (P&C) - Personal Lines (Auto, Home): This is the most common entry point. The claims are often high-volume and can range from simple (a minor fender bender) to complex (a total fire loss). Salaries here tend to align with the national average.

- Workers' Compensation: This is a highly specialized and regulated field. Examiners must navigate a complex web of medical management, state laws, and return-to-work programs. Due to this complexity, experienced workers' comp examiners often earn a premium over their personal lines counterparts.

- Liability and Litigation: This is a high-stakes specialization. These examiners handle claims where their insured is being sued (e.g., a major auto accident with severe injuries, a slip-and-fall at a business). They work closely with defense attorneys and must have a strong grasp of legal principles and negotiation tactics. Senior liability examiners are among the highest-paid non-management professionals in the field.

- Commercial Lines: Examining claims for businesses (e.g., commercial property, general liability, fleet auto) requires a different skillset. The policies are more complex and the financial stakes are higher. This specialization typically pays more than personal lines.

- Catastrophe (CAT) Claims: CAT examiners are deployed to areas hit by hurricanes, tornadoes, wildfires, or other disasters. This work is intense, demanding, and requires extensive travel. However, it is also extremely lucrative. CAT adjusters and examiners can often earn a full year's salary in just 6-9 months of work, though it comes at the cost of work-life balance.

- Medical/Health Claims: These examiners work for health insurance companies, processing claims from doctors and hospitals