Table of Contents

- [What Does a Collections Specialist Do?](#what-does-a-collections-specialist-do)

- [Average Collections Specialist Salary: A Deep Dive](#average-collections-specialist-salary-a-deep-dive)

- [Key Factors That Influence a Collections Specialist's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Collections Specialists](#job-outlook-and-career-growth)

- [How to Become a Collections Specialist: A Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Is a Career as a Collections Specialist Right for You?](#conclusion)

---

Introduction

Are you searching for a career that offers stability, tangible results, and a clear path for financial growth, all while playing a critical role in the economic health of businesses? The role of a collections specialist is often misunderstood, seen merely as a "debt collector." In reality, it's a nuanced profession that requires a sophisticated blend of negotiation, empathy, financial acumen, and legal knowledge. It's about problem-solving and finding resolutions that work for both the creditor and the debtor. The average collections specialist salary reflects this essential function, typically ranging from $35,000 to over $60,000 per year, with significant potential for higher earnings through performance-based bonuses and career advancement.

I once worked with a rapidly growing healthcare startup that was struggling with cash flow, not because of a lack of customers, but because of a massive backlog of unpaid invoices. They hired a skilled collections specialist who transformed their accounts receivable department. She didn't just make aggressive calls; she built systems, created flexible payment plans for patients in hardship, and preserved customer relationships, ultimately saving the company's financial future. This experience crystallized for me that a great collections specialist is not an antagonist but a financial navigator, a vital asset to any organization.

This guide is designed to be your definitive resource for understanding the collections specialist salary landscape and the career path as a whole. We will dissect every factor that impacts your earning potential, from your level of experience and geographic location to the specific skills that can make you an indispensable asset. Whether you're just starting to explore this field or are a seasoned professional looking to maximize your income, this article will provide the data-driven insights and actionable advice you need to succeed.

---

What Does a Collections Specialist Do?

At its core, a collections specialist is a professional responsible for recovering overdue payments and managing delinquent accounts on behalf of a company or a third-party agency. This role is a cornerstone of a company's financial health, ensuring a steady cash flow by turning outstanding accounts receivable into revenue. However, the job extends far beyond simply making phone calls. It is a strategic role that blends customer service, negotiation, investigation, and strict adherence to legal and ethical guidelines.

The perception of a collections professional as someone who aggressively hounds debtors is an outdated and inaccurate stereotype. Modern collections specialists are trained financial communicators who aim to understand a debtor's situation and collaboratively find a workable solution. Their primary goal is to secure payment while, whenever possible, preserving the customer relationship for the original creditor.

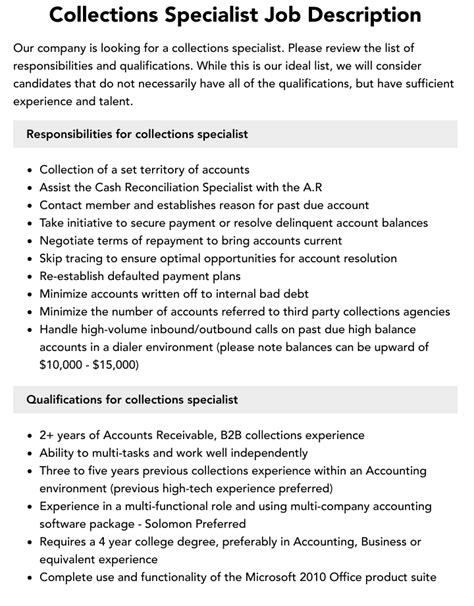

Core Responsibilities and Daily Tasks:

A collections specialist's work is structured and methodical. Key duties typically include:

- Account Monitoring and Identification: Regularly reviewing customer accounts to identify those that have become overdue. This often involves using specialized software like Customer Relationship Management (CRM) or accounting systems.

- Debtor Communication: Reaching out to customers with delinquent accounts via phone, email, and written letters. The initial contact is often a polite reminder, escalating in tone and strategy only as necessary.

- Negotiation and Payment Plans: This is the heart of the role. Specialists negotiate payment arrangements, settlements, or long-term payment plans that are feasible for the debtor and acceptable to the creditor.

- Information Gathering (Skip Tracing): If a debtor cannot be reached, the specialist may employ "skip tracing" techniques—using public databases, credit reports, and other legal tools to locate the individual.

- Maintaining Detailed Records: Documenting every interaction, payment promise, and conversation with a debtor is crucial for legal compliance and internal tracking. This creates a clear audit trail for each account.

- Compliance with Regulations: Adhering strictly to federal and state laws governing debt collection, most notably the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA). Violating these laws can result in severe penalties for the company.

- Reporting and Analysis: Preparing reports for management on collection rates, aging accounts, and overall portfolio performance.

### A Day in the Life of a Collections Specialist

To make this role more tangible, let's walk through a typical day for a specialist working in-house at a mid-sized B2B software company.

- 9:00 AM - 9:30 AM: Morning Review. The day begins by logging into the accounting software and CRM. The specialist reviews the "aged receivables" report to identify accounts that have just tipped over the 30-day, 60-day, and 90-day past-due marks. They prioritize the highest-value and most overdue accounts.

- 9:30 AM - 12:00 PM: Outbound Communication Block. This is prime calling time. The specialist starts with the "softest" accounts—those 30 days past due—with a friendly reminder call. "Hi, this is Alex from XYZ Software. I'm just calling to follow up on invoice #1234. Is there anything I can help with to get this processed?" As they move to the 60- and 90-day accounts, the tone becomes more direct, focusing on establishing a firm payment plan.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 2:30 PM: Research and Follow-up. After lunch, the focus shifts. The specialist responds to emails from the morning, documents all call outcomes, and sends out formal collection letters. They might also spend time on skip tracing for a "gone-silent" account, using professional databases to verify contact information.

- 2:30 PM - 4:00 PM: Negotiation and Problem-Solving. This block is for more complex cases. A client might call back claiming a billing dispute. The specialist must then investigate the issue, liaise with the sales or account management team to verify the invoice details, and work towards a resolution. Another call might involve negotiating a settlement for a percentage of the total debt with a company facing financial hardship.

- 4:00 PM - 5:00 PM: Reporting and End-of-Day Wrap-up. The final hour is spent updating the collections report for the department manager, scheduling follow-up calls for the next day, and ensuring all notes are meticulously entered into the system for compliance and continuity.

This structured day highlights that the role is not about random calls but about a systematic process of communication, negotiation, and documentation, all aimed at achieving a specific financial goal.

---

Average Collections Specialist Salary: A Deep Dive

Understanding the earning potential is a primary consideration for anyone exploring a new career. For collections specialists, compensation is a mix of a stable base salary and often, a highly motivating performance-based component. Let's break down the numbers from authoritative sources to give you a clear and realistic picture of what you can expect to earn.

### National Averages and Salary Ranges

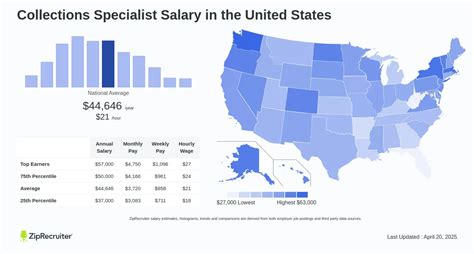

While figures can vary, several reputable sources provide a reliable benchmark for collections specialist salaries in the United States.

- The U.S. Bureau of Labor Statistics (BLS), in its May 2023 Occupational Employment and Wage Statistics report, places "Bill and Account Collectors" in a category where the median annual wage was $41,250, or approximately $19.83 per hour. The BLS data indicates that the lowest 10 percent earned less than $31,520, while the top 10 percent earned more than $59,770. It's important to note that the BLS captures a wide range of roles, including entry-level positions at third-party agencies, which can pull the median downward.

- Salary.com, which often reflects more corporate, in-house positions, provides a slightly higher range. As of late 2023, it reports that the median salary for a Collections Specialist I in the U.S. is around $44,901, with a typical range falling between $40,028 and $50,600. More experienced roles, like a Collections Specialist III, see a median salary of $61,003.

- Payscale.com offers data based on user-submitted profiles, giving a broad view of the market. It reports an average base salary of approximately $42,000 per year. The full salary range, according to Payscale, spans from $35,000 at the 10th percentile to over $58,000 at the 90th percentile.

- Glassdoor.com aggregates self-reported salaries and job postings, showing a total pay estimate (including bonuses and additional compensation) for a Collections Specialist to be around $50,154 per year in the U.S., with a likely base salary range of $38,000 to $53,000.

Key Takeaway: A reasonable expectation for a Collections Specialist in the U.S. is a base salary in the low-to-mid $40,000s, with a typical total compensation range of $38,000 to $60,000. However, as we will explore, this number is heavily influenced by experience, location, and performance.

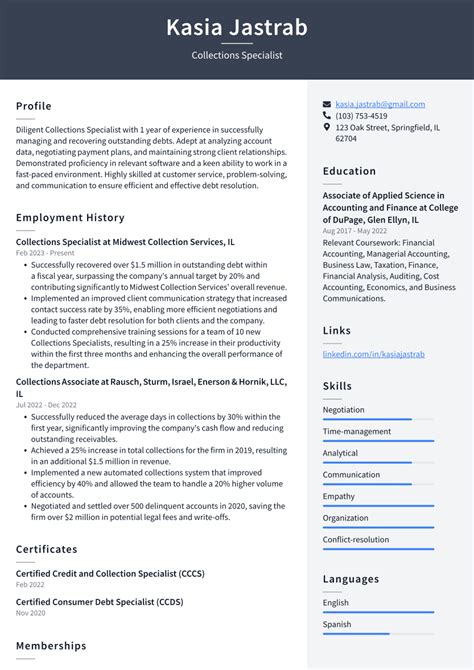

### Salary by Experience Level

Like most professions, a collections specialist's salary grows significantly with experience. As you develop your skills in negotiation, compliance, and handling complex accounts, your value—and your paycheck—increases accordingly.

Here is a typical salary progression based on data aggregated from Payscale and Salary.com:

| Level | Years of Experience | Typical Base Salary Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level Collections Specialist | 0-1 years | $35,000 - $42,000 | Focuses on learning the systems, scripts, and basic collection techniques. Handles less complex, early-stage delinquent accounts. |

| Mid-Career Collections Specialist | 2-5 years | $42,000 - $50,000 | Has a strong grasp of collection laws (FDCPA). Capable of negotiating payment plans and handling more difficult customer interactions. May begin to specialize. |

| Senior Collections Specialist | 5-9 years | $48,000 - $58,000+ | Handles the most complex and high-value accounts. May be involved in legal collections or B2B accounts. Often mentors junior specialists and has deep knowledge of skip tracing. |

| Collections Team Lead / Supervisor | 8+ years | $55,000 - $75,000+ | Manages a team of specialists, sets collection goals, handles escalated issues, and reports performance to upper management. |

| Collections Manager | 10+ years | $70,000 - $100,000+ | Oversees the entire collections department strategy, policy, and compliance. Works on high-level financial planning and risk management. |

### Understanding Total Compensation: Beyond the Base Salary

A collections specialist's base salary is only part of the story. Total compensation can be significantly higher, especially in roles with a strong performance-based structure.

- Bonuses and Commissions: This is the most significant additional earning component. Many collections roles, particularly at third-party agencies, operate on a commission structure. Specialists earn a percentage of the debt they successfully recover. This can add anywhere from $5,000 to $20,000+ to an annual salary for high performers. In-house roles may offer quarterly or annual bonuses based on achieving team-based collection targets (e.g., reducing the percentage of 90-day+ accounts receivable).

- Profit Sharing: Some companies offer profit-sharing plans where a portion of the company's profits is distributed among employees. As collections directly impact profitability, specialists can be included in these programs.

- Standard Benefits: Don't overlook the value of a comprehensive benefits package. This includes health, dental, and vision insurance, a 401(k) retirement plan (often with a company match), paid time off (PTO), and sick leave. These benefits can be worth thousands of dollars annually and are a critical part of the overall compensation picture.

- Overtime Pay: As the role is often hourly (non-exempt), specialists can earn time-and-a-half for any hours worked over 40 per week, which can be common during end-of-quarter or end-of-year pushes.

When evaluating a job offer, it's crucial to look beyond the base salary and calculate the potential total compensation. A lower base salary with a high, achievable commission structure might be more lucrative than a higher-base salary with no performance incentives, depending on your confidence and skills.

---

Key Factors That Influence a Collections Specialist's Salary

The national averages provide a great starting point, but a collections specialist's actual salary is determined by a complex interplay of several key factors. Understanding these variables is essential for negotiating your salary effectively and for charting a career path that maximizes your earning potential. This section provides an in-depth analysis of the six primary drivers of a collections specialist's income.

###

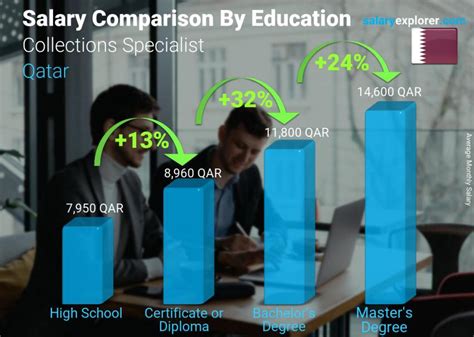

1. Level of Education and Certifications

While a four-year degree is not always a strict requirement to enter the field, your educational background can significantly impact your starting salary and long-term career trajectory.

- High School Diploma or GED: This is the typical minimum educational requirement for most entry-level collections specialist positions, particularly at third-party collection agencies. At this level, employers prioritize soft skills like communication, resilience, and a strong work ethic.

- Associate's or Bachelor's Degree: Holding a degree, especially in fields like Finance, Accounting, Business Administration, or Communications, can give you a considerable edge.

- Higher Starting Salary: Companies, especially larger corporations with structured pay scales, often offer a higher starting salary to candidates with a degree.

- Access to Better Roles: A degree is often a prerequisite for in-house positions at financial institutions, healthcare organizations, and large corporations. These roles typically offer better base pay, benefits, and working conditions compared to some high-volume agencies.

- Faster Advancement: A degree signals a higher level of analytical and critical thinking skills, making you a stronger candidate for promotion to senior, team lead, and management positions. A Bachelor's in Finance or Accounting is often essential for moving into high-level roles like Director of Credit.

- Professional Certifications: In the world of collections, certifications are a powerful tool to validate your expertise and boost your income. They demonstrate a commitment to professional development and a deep understanding of industry best practices and legal standards. Key certifications include those from ACA International (the Association of Credit and Collection Professionals):

- Professional Collection Specialist (PCS): Designates a collector's knowledge of the FDCPA and core collection techniques.

- Credit and Collection Compliance Officer (CCCO): A more advanced certification focused on building and managing a compliant collections department.

- Collection Industry Professional (CIP): A mark of broad industry knowledge.

Earning these certifications can directly lead to promotions and is a strong negotiating point for a higher salary.

###

2. Years of Experience

Experience is arguably the most significant factor influencing a collections specialist's salary. As you progress in your career, you move from following scripts to becoming a strategic problem-solver, a skill that companies are willing to pay a premium for.

- Entry-Level (0-2 Years): At this stage, you are learning the ropes. Your focus is on mastering communication techniques, understanding the FDCPA, and efficiently working through a queue of early-stage delinquent accounts. Salaries are at the lower end of the national range, typically $35,000 to $42,000.

- Mid-Career (2-5 Years): You are now a proficient and independent specialist. You can handle more challenging calls, negotiate complex payment plans, and may have started to develop a specialization (e.g., medical or B2B collections). Your proven track record of recovery allows you to command a higher salary, generally in the $42,000 to $50,000 range, plus performance bonuses.

- Senior Level (5-10+ Years): Senior specialists are experts in their field. They are trusted with the largest, oldest, or most complex accounts. They possess deep knowledge of skip tracing, legal collections processes, and industry-specific regulations. Many senior specialists also mentor junior team members. Their expertise warrants a salary in the $48,000 to $60,000+ range, and they often have the highest bonus potential.

- Leadership (Team Lead, Manager): With extensive experience, the natural next step is leadership. A Collections Team Lead or Supervisor can earn between $55,000 and $75,000, while a Collections Manager overseeing the entire department can command $70,000 to over $100,000, depending on the size and complexity of the operation.

###

3. Geographic Location

Where you work in the country has a massive impact on your salary, primarily due to variations in cost of living and the concentration of certain industries. A salary that feels comfortable in one state might be difficult to live on in another.

- High-Paying States and Metropolitan Areas: Salaries are typically highest in states with a high cost of living and major financial or corporate hubs. According to BLS data and salary aggregators, the top-paying locations often include:

- District of Columbia: Often leads the nation, with salaries potentially 20-30% above the national average.

- New York (especially the NYC metro area): A global financial center.

- California (especially San Francisco Bay Area and Los Angeles): Driven by tech and entertainment industries.

- Massachusetts (especially Boston): A hub for finance, healthcare, and education.

- Washington State (especially Seattle): Driven by tech and commerce.

In these areas, an experienced collections specialist could earn well over $60,000 to $70,000 annually.

- Lower-Paying States: Conversely, states with a lower cost of living tend to offer salaries below the national average. These often include states in the Southeast and Midwest, such as:

- Mississippi

- Arkansas

- West Virginia

- Alabama

- South Dakota

In these regions, salaries might align more with the lower end of the BLS range, from $32,000 to $40,000.

- The Rise of Remote Work: The increasing availability of remote collections specialist roles is a game-changer. It allows professionals in lower-cost-of-living areas to potentially access jobs with companies based in high-paying regions, creating a significant financial advantage.

###

4. Company Type & Size

The type of organization you work for is a major determinant of your salary, work environment, and bonus structure.

- Third-Party Collection Agencies: These companies are hired by other businesses (creditors) to collect debts. These roles are often high-pressure and heavily commission-based. While the base salary may be at the lower end of the spectrum, a highly successful specialist can earn significant commissions, potentially leading to a very high total compensation. The work environment can be fast-paced and demanding.

- In-House (First-Party) Collections: This involves working directly for the company that is owed money, such as a hospital, utility company, bank, or large retailer. These positions often have:

- Higher Base Salaries: Companies are investing in retaining their own customers.

- Better Benefits: Typically part of a larger corporate benefits structure.

- Focus on Customer Service: The goal is not just to collect the debt but to maintain the customer relationship.

- Salaries are generally more stable and less reliant on volatile commission structures.

- Government: Federal, state, and local governments also employ collections specialists to recover unpaid taxes, fines, or student loans (e.g., working for the IRS or a state's Department of Revenue). These roles are known for their exceptional job security, excellent benefits, and strict, process-driven work environments. Salaries are often set by standardized government pay scales (like the GS scale), providing clear and predictable career progression.

- Company Size: Larger corporations generally have more structured pay bands and can afford higher salaries and more comprehensive benefits packages than small businesses or startups. However, a smaller company might offer a greater share of commissions or more rapid advancement opportunities.

###

5. Area of Specialization

Not all debt is created equal. Specializing in a particular type of collections requires unique knowledge and skills, which can lead to higher pay.

- Commercial (B2B) Collections: Business-to-business collections involve recovering debts from other companies. The invoice amounts are typically much larger than in consumer collections, and the negotiation process is more complex, often involving purchase orders, contracts, and liaising with entire accounting departments. B2B specialists are highly valued and often earn 10-20% more than their B2C counterparts.

- Medical Collections: This is a highly specialized field due to the complexity of medical billing, insurance claims, and the strict privacy regulations of the Health Insurance Portability and Accountability Act (HIPAA). Specialists who understand medical coding, EOBs (Explanation of Benefits), and how to navigate the insurance system are in high demand and can command premium salaries.

- Legal Collections: Once a debt reaches a certain stage, it may be turned over for legal action. A legal collections specialist works closely with attorneys, prepares documents for court, and understands the legal framework of wage garnishments and asset liens. This specialization requires paralegal-like skills and is compensated accordingly.

- Student Loan Collections: This area is governed by a unique and complex set of federal regulations. Specialists who master the various deferment, forbearance, and loan rehabilitation programs are valuable assets to both government agencies and private lenders.

- Auto Finance or Mortgage Collections: These secured debts require knowledge of repossession and foreclosure laws, which vary significantly by state.

###

6. In-Demand Skills

Finally, your specific skill set is a direct driver of your value. Cultivating these skills can dramatically increase your salary and career opportunities.

- Hard Skills:

- Regulatory Knowledge (FDCPA, TCPA, HIPAA): Deep, demonstrable knowledge of the laws governing collections is non-negotiable and a key differentiator for senior roles.

- Skip Tracing Expertise: The ability to legally and effectively locate hard-to-find debtors is a highly prized and compensated skill.

- Software Proficiency: Expertise in specific collection software (e.g., CollectMax, Debtmaster) and major CRM/ERP systems (e.g., Salesforce, SAP) is highly valuable.

- Bilingualism: Being fluent in a second language, particularly Spanish, can open up more job opportunities and often comes with a pay differential, as it allows you to work with a broader segment of the population.

- Data Analysis: The ability to analyze collections data to identify trends, predict payment likelihood, and optimize collection strategies is a modern skill that is becoming increasingly important.

- Soft Skills:

- Advanced Negotiation: Moving beyond simple payment demands to creative problem-solving and finding win-win solutions.

- Empathy and Emotional Intelligence: The ability to connect with a debtor, understand their situation, and maintain a professional, respectful tone even in difficult conversations. This leads to better outcomes and lower customer complaints.

- Resilience and Stress Management: The ability to handle rejection and maintain motivation is fundamental to success and longevity in this career.

- Assertive Communication: Clearly and confidently stating expectations and consequences without being aggressive.

By strategically developing these six areas, you can actively steer your career towards higher earnings and more rewarding opportunities.

---

Job Outlook and Career Growth for Collections Specialists

When considering a long-term career, it's vital to look not