Have you ever wondered who decides how much a job is worth? Who determines whether a salaried employee is eligible for overtime pay? Behind every job offer, every pay raise, and every company’s benefits package, there is a meticulous and strategic process. The professionals driving this process are the hidden architects of the modern workplace: Compensation Analysts and Managers. They are the experts who definitively answer the complex question, "does salary get overtime?" for thousands of employees.

This career path is a unique blend of data analytics, human resources strategy, and legal compliance. It’s for the intellectually curious who love solving puzzles with numbers and have a strong sense of fairness. The demand for these specialists is steady, with the U.S. Bureau of Labor Statistics reporting a median annual salary of $74,720 for Compensation, Benefits, and Job Analysis Specialists as of May 2023, with top earners commanding well over $130,000. In my own career advising professionals, I once worked with a mid-level marketing manager who felt chronically underpaid and overworked. It wasn't until she consulted with her company's Compensation Manager that she understood the intricate market data, job leveling, and FLSA (Fair Labor Standards Act) classifications that determined her "exempt" status and salary band, empowering her to negotiate her next role far more effectively.

This guide will demystify the world of compensation professionals. We will explore everything from their daily responsibilities and earning potential to the exact steps you need to take to build a successful and lucrative career in this vital field.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation Analyst Do?

At its core, a Compensation Analyst is responsible for designing, implementing, and administering an organization's pay and rewards strategy. They are the guardians of internal equity (ensuring employees in similar roles are paid fairly relative to one another) and external competitiveness (ensuring the company’s pay is attractive enough to recruit and retain top talent).

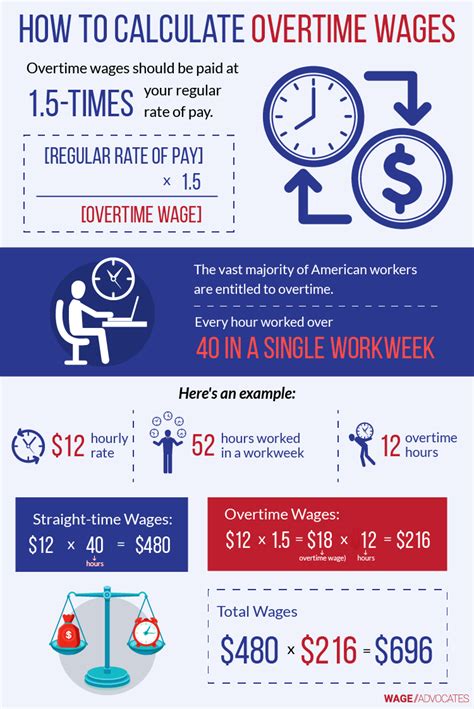

Their most critical function, and the one that directly relates to our central question, is determining a job's classification under the Fair Labor Standards Act (FLSA). The FLSA mandates that most employees must be paid at least minimum wage and receive overtime pay for hours worked over 40 in a workweek. However, it provides exemptions for certain executive, administrative, professional, computer, and outside sales employees—these are "salaried exempt" positions that do not receive overtime. A Compensation Analyst conducts a detailed "exemption test," analyzing a role's duties and responsibilities against strict legal criteria to make this classification. This single task carries enormous legal and financial weight for a company.

Beyond FLSA classifications, their responsibilities are vast and data-driven:

- Job Analysis and Evaluation: They analyze job descriptions to understand the core duties, skills, and requirements of every role in the organization. They then use formal job evaluation systems (like point-factor or market-pricing methods) to determine the relative value and level of each job.

- Market Pricing and Benchmarking: They purchase, analyze, and participate in salary surveys from third-party vendors. By comparing their company's jobs to similar roles in the external market, they can determine if their pay ranges are competitive.

- Salary Structure Development: They build the entire framework for pay, creating salary grades, pay ranges (with minimums, midpoints, and maximums), and policies for how employees progress through those ranges.

- Incentive Plan Design: They help design and administer short-term and long-term incentive plans, such as annual bonuses, sales commissions, profit-sharing, and stock options.

- Reporting and Analytics: They analyze pay data to identify trends, model the financial impact of pay increases, and conduct pay equity audits to ensure there are no disparities based on gender, race, or other protected characteristics.

### A Day in the Life of a Senior Compensation Analyst

To make this tangible, let's follow a day in the life of "Maria," a Senior Compensation Analyst at a mid-sized tech company.

- 9:00 AM: Maria starts her day reviewing a new job requisition for a "Lead DevOps Engineer." The hiring manager has requested a high salary. Maria’s first step is to read the job description carefully, noting the required skills (e.g., Kubernetes, AWS, Python scripting) and level of responsibility.

- 9:45 AM: She pulls up the company’s salary survey database (from a provider like Radford or Mercer). She "matches" the internal job to the appropriate benchmark role in the survey data, filtering by industry (SaaS), company revenue ($250M-$500M), and geographic location. She analyzes the 25th, 50th, and 75th percentile market data for base salary, bonus, and total cash compensation.

- 11:00 AM: Maria meets with the HR Business Partner and the hiring manager. She presents her findings: the requested salary is at the 90th percentile of the market, which is reserved for top-tier experts. She walks them through the data and recommends a competitive but appropriate salary range for the role, aligning it with the company’s compensation philosophy. They agree on a revised, data-backed range.

- 1:00 PM: After lunch, Maria dives into a major project: the annual salary planning cycle. She runs a report from the HRIS (Human Resources Information System) like Workday to calculate the "compa-ratio" (employee's salary / salary range midpoint) for every employee in the engineering department.

- 2:30 PM: She begins building a financial model in Excel to project the cost of different merit increase scenarios. What is the budget impact of a 3% average merit pool versus a 4% pool? How can they allocate more budget to high-performers and those with low compa-ratios?

- 4:00 PM: She receives an email from the legal department. A manager wants to reclassify a "Team Coordinator" role from non-exempt (hourly, gets overtime) to exempt (salaried, no overtime). Maria must now conduct a formal FLSA duties test, interviewing the manager and employee to see if the role's primary duties truly meet the "administrative exemption" criteria. This is a critical compliance task.

- 5:00 PM: She ends her day by documenting her findings on the FLSA test, preparing to send her official recommendation to HR and legal the next morning.

Average Compensation Analyst Salary: A Deep Dive

The compensation profession is, fittingly, well-compensated. Earnings are directly tied to the value these professionals bring in terms of attracting talent, retaining key employees, and mitigating legal risk. The salary structure is highly dependent on experience, specialization, and other factors we'll explore in the next section.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Compensation, Benefits, and Job Analysis Specialists was $74,720 in May 2023. This is the midpoint, meaning half of the workers in the occupation earned more than that amount and half earned less. The BLS also provides a wider range, showing that the lowest 10 percent earned less than $51,100, while the highest 10 percent earned more than $135,160.

However, salary aggregator sites, which often reflect more recent, user-submitted data and can capture bonus information more effectively, paint a slightly different picture.

- Salary.com, as of late 2023, reports the median base salary for a Compensation Analyst II (a mid-level role) in the United States to be around $83,235, with a typical range falling between $74,731 and $92,207.

- Payscale.com states the average base salary for a Compensation Analyst is approximately $71,500 per year, but this average includes entry-level roles. They also report an average annual bonus of around $5,000.

- Glassdoor lists the total pay (base plus additional compensation like bonuses) for a Compensation Analyst in the U.S. at an average of $88,683 per year, with a likely range between $72,000 and $113,000.

The disparity in these numbers highlights the importance of considering multiple sources and understanding the variables at play. The BLS provides a broad, stable government benchmark, while salary sites reflect more dynamic, real-time data that includes a wider variety of company sizes and types.

### Salary by Experience Level

Career progression in compensation has a clear and significant impact on earnings. As an analyst gains experience and moves from executing tasks to designing strategy, their value and salary increase commensurately.

| Experience Level | Typical Title(s) | Typical Years of Experience | Average Base Salary Range (U.S.) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Compensation Analyst I, HR Analyst (Comp Focus) | 0-2 years | $60,000 - $75,000 | Data entry, participating in salary surveys, running standard reports, responding to basic inquiries, assisting with job description updates. |

| Mid-Career | Compensation Analyst II, Senior Compensation Analyst | 3-7 years | $75,000 - $100,000 | Market pricing jobs independently, analyzing survey data, modeling merit/bonus plans, conducting FLSA exemption tests, advising HR business partners. |

| Senior / Lead | Principal Compensation Analyst, Compensation Manager | 8-15 years | $100,000 - $150,000+ | Designing salary structures, managing incentive programs, leading pay equity audits, managing a team of analysts, presenting to senior leadership. |

| Executive | Director/VP of Compensation, Head of Total Rewards | 15+ years | $180,000 - $300,000+ | Setting the global compensation philosophy, designing executive compensation packages, presenting to the Board of Directors' Compensation Committee. |

*Sources: Data compiled and synthesized from BLS, Salary.com, Payscale, and Glassdoor reports, accessed in late 2023/early 2024.*

### Beyond the Base: A Look at Total Compensation

Base salary is only one piece of the puzzle. A compensation professional's "total rewards" package often includes significant variable pay components.

- Annual Bonus / Short-Term Incentive (STI): This is the most common additional component. It's typically a percentage of base salary (e.g., 5-10% for an analyst, 15-25% for a manager) paid out based on a combination of company performance and individual performance.

- Profit Sharing: Some companies, particularly in manufacturing or finance, may offer a portion of their profits back to employees.

- Long-Term Incentives (LTI): Especially prevalent in publicly traded companies and tech startups, LTIs are designed to retain key employees over several years. This can include:

- Restricted Stock Units (RSUs): A grant of company stock that vests (becomes fully owned by the employee) over a set period, typically 3-4 years.

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Comprehensive Benefits: As experts in the broader "Total Rewards" field, these roles often come with excellent benefits packages, including top-tier health, dental, and vision insurance, generous 401(k) matching, and ample paid time off.

When evaluating a career in this field, it's crucial to look beyond the base salary and consider the full earning potential offered by these additional compensation elements.

Key Factors That Influence Salary

While experience is a primary driver of salary, several other factors create significant variance in the earning potential of a compensation professional. A senior analyst in a high-cost-of-living city working in the tech industry with a specialized skillset will earn vastly more than an entry-level analyst at a non-profit in a rural area. Let's break down these critical factors.

### 1. Level of Education and Certification

Formal education provides the foundational knowledge for a career in compensation, while professional certifications signal a deep, specialized expertise that employers pay a premium for.

- Bachelor's Degree: This is the standard entry-level requirement. The most relevant majors are Human Resources, Business Administration, Finance, Economics, or Mathematics. A degree in one of these fields demonstrates the necessary analytical and business acumen. An individual with a bachelor's degree can expect to start in the entry-level salary band ($60k-$75k).

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA) or a Master's in Human Resources (MHR), can accelerate a career trajectory. It is often a preferred or required qualification for senior management and director-level roles. An MBA can add a 10-20% premium to earning potential, especially when moving into strategic leadership positions that interface heavily with finance and corporate strategy.

- Professional Certifications (The Game Changer): In the compensation field, certifications are arguably more impactful on salary than a master's degree, especially in the mid-to-senior analyst levels. The undisputed global leader in compensation certification is WorldatWork.

- Certified Compensation Professional (CCP®): This is the gold standard. Earning a CCP requires passing a series of rigorous exams covering topics like base pay administration, market pricing, variable pay, job analysis, and statistics. According to WorldatWork's own salary survey data, professionals holding a CCP can earn up to 16% more than their non-certified peers. Possessing a CCP is often a prerequisite for senior analyst and manager roles.

- Advanced Certified Compensation Professional (ACCP™): For those looking to move into high-level strategy.

- Global Remuneration Professional (GRP®): For specialists who manage compensation across multiple countries.

- Certified Executive Compensation Professional (CECP®): A highly specialized and lucrative certification for those focusing on pay for top leadership.

### 2. Years of Experience

As detailed in the previous section's table, experience is paramount. However, the *quality* of that experience matters just as much as the quantity. Salary growth isn't just about time in the seat; it's about the expanding scope of responsibility.

- Analyst I (0-2 years): Focus is on learning the ropes—data submission for surveys, running pre-built reports, and answering basic employee questions. Salary growth is steady but modest.

- Analyst II / Senior Analyst (3-7 years): This is where significant growth happens. You move from "doing" to "analyzing and advising." You own projects, like market-pricing a whole department or modeling a new bonus plan. You gain the confidence of HR partners and business leaders. Leaping into the senior analyst level often comes with a 20-30% salary increase over an entry-level role.

- Manager/Principal (8+ years): The focus shifts from individual analysis to strategy and team leadership. You're no longer just pricing jobs; you're designing the entire salary structure and philosophy. You're managing budgets, leading complex projects like pay equity audits, and presenting to executives. This transition into management typically carries another substantial 30-50% jump in salary over a senior analyst role, plus a significantly higher bonus target.

### 3. Geographic Location

Where you work has a massive impact on your paycheck due to variations in cost of living and labor market demand. A salary that feels palatial in one city might be barely livable in another.

- High-Paying Metropolitan Areas: Major tech and finance hubs consistently offer the highest salaries for compensation professionals. These locations have a high concentration of large, complex organizations that require sophisticated compensation strategies.

- San Francisco Bay Area, CA: (San Francisco, San Jose, Silicon Valley) - Often 25-40% above the national average.

- New York, NY: 20-30% above the national average.

- Boston, MA: 15-25% above the national average.

- Seattle, WA: 15-25% above the national average.

- Average-Paying Areas: Most major cities will fall near the national average, perhaps with a slight premium.

- Chicago, IL

- Dallas, TX

- Atlanta, GA

- Denver, CO

- Lower-Paying Areas: Smaller cities and rural regions will typically pay below the national average. The cost of living is also significantly lower, so purchasing power may still be strong.

Example Comparison: According to Salary.com, a Compensation Analyst II with a median U.S. salary of $83,235 could expect to earn approximately $104,260 in San Francisco, CA, but only $77,492 in Orlando, FL. This demonstrates the powerful effect of geography on nominal income. The rise of remote work has added a new layer of complexity, with companies adopting different strategies (paying a national rate, a location-based rate, or a hybrid model), but high-cost areas still command the highest salaries.

### 4. Company Type & Size

The type of organization you work for dictates its compensation philosophy, complexity, and ability to pay.

- Large Corporations (Fortune 500): These companies offer highly structured, predictable career paths. They have large, specialized compensation teams and pay competitively to attract top talent. They are more likely to offer robust benefits, pensions, and long-term incentives like RSUs. Salaries are often at or slightly above market benchmarks.

- Tech Companies / Startups: This sector is known for aggressive compensation, particularly when it comes to variable pay. A pre-IPO startup might offer a slightly lower base salary but compensate with potentially lucrative stock options. A large, established tech firm (like Google, Meta, or Amazon) will offer very high base salaries *and* substantial RSU grants, often leading to total compensation packages that are the highest in the market.

- Consulting Firms: Compensation consultants (working for firms like Mercer, Willis Towers Watson, or Aon) advise multiple client companies on their pay strategies. This is a high-pressure, fast-paced environment that often pays a premium. Consultants gain broad exposure to many industries, which can make them highly valuable in corporate roles later.

- Non-Profit / Higher Education: These organizations are mission-driven, but their budgets are typically tighter. Salaries for compensation professionals in this sector are often 10-20% below the corporate average. The trade-off is often better work-life balance and strong benefits.

- Government: Federal, state, and local government roles offer immense stability, excellent benefits, and pensions. Pay is determined by rigid pay scales (like the federal GS scale). While the base salary may not reach the peaks of the private tech sector, the total lifetime value of the benefits and job security is a major draw for many.

### 5. Area of Specialization

As analysts become more senior, they can choose to specialize in high-demand, high-complexity areas, which leads to higher pay.

- Executive Compensation: This is one of the most lucrative specialties. These professionals design the complex pay packages (base, bonus, long-term incentives, perks, deferred compensation) for C-suite executives. It requires deep knowledge of SEC regulations, corporate governance, and working with the Board of Directors. Specialists can easily earn $150,000 - $250,000+.

- Sales Compensation: Designing incentive plans for sales teams is a highly specialized skill. It requires a deep understanding of sales cycles, quotas, and accelerators to create plans that drive revenue. A good sales compensation analyst can have a direct, measurable impact on the company's bottom line and is compensated accordingly.

- International/Global Compensation: For multinational corporations, managing pay across different countries, currencies, regulations, and cultural norms is a massive challenge. Global remuneration specialists are highly sought after and command premium salaries.

- Pay Equity Analysis: With a growing focus on Diversity, Equity, and Inclusion (DEI), specialists who can conduct statistically rigorous pay equity audits to identify and remediate pay gaps based on gender and race are in extremely high demand. This requires strong statistical skills.

### 6. In-Demand Skills

Beyond the core competencies, certain technical and soft skills can significantly boost your marketability and salary.

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, comfortable with VLOOKUP/INDEX(MATCH), pivot tables, complex formulas, and financial modeling. VBA macro skills are a major plus.

- HRIS Systems: Deep experience with a major HRIS like Workday, SAP SuccessFactors, or Oracle HCM Cloud is essential. The ability to build reports and manage compensation data within these systems is a core requirement for most mid-to-senior level jobs.

- Data Visualization Tools: Being able to tell a story with data is crucial. Skills in tools like Tableau or Power BI to create dashboards and compelling visuals for leadership are highly valued.

- Statistical Analysis: As the field becomes more quantitative, skills in statistical software or languages like SQL, R, or Python are becoming a major differentiator, especially for pay equity and predictive analytics roles.

- Legal Knowledge: A deep, practical understanding of labor laws, especially the FLSA, the Equal Pay Act, and emerging pay transparency laws, is critical for mitigating risk and is a hallmark of a senior professional.

- Business Acumen and Communication: You can have all the data in the world, but if you can't explain it clearly to a non-technical executive or negotiate with a hiring manager, its value is lost. Strong presentation, persuasion, and consulting skills are what separate top earners from the rest.

Job Outlook and Career Growth

For those considering a career in compensation, the future is stable and promising. As long as companies need to hire, retain, and motivate employees in a legally compliant manner, they will need compensation experts.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 7 percent from 2022 to 2032. This is faster than the average for all occupations. The BLS anticipates about 11,300 openings for these specialists each year, on average, over the decade. Most of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This steady growth is fueled by several powerful trends that are shaping the future of work and increasing the complexity—and importance—of the compensation function.

### Emerging Trends and Future Challenges

A savvy professional who can navigate these trends will be in the highest demand and command the best salaries.

1. Pay Transparency: The most significant trend is the wave of pay transparency legislation sweeping across the U.S. (in states like Colorado, California, Washington, and New York City). These laws require companies to disclose salary ranges in job postings. This shifts the power dynamic in negotiations and forces companies to be much more rigorous and defensible about their pay structures. Compensation analysts are on the front lines, ensuring their salary ranges are compliant, competitive, and equitable before they are made public.

2. Focus on Pay Equity: Driven by social movements and shareholder activism, there is intense pressure on companies to ensure fair pay for all employees, regardless of gender, race, or ethnicity. This has elevated the role of the compensation analyst from a back-office administrator to a strategic DEI partner. The ability to conduct sophisticated statistical pay equity audits and recommend remediation strategies is now a core competency for senior roles.

3. The Rise of Remote and Hybrid Work: The pandemic accelerated the shift to remote work, creating a massive headache for compensation teams. Should an employee in low-cost Iowa be paid the same as an employee doing the exact same job in high-cost San Francisco? Companies are grappling with different geographic pay policies (geo-pay), and compensation analysts are the ones building the models, creating location-based differentials, and communicating these complex policies to the workforce.

4. Data-Driven "Total Rewards": Companies are moving away from thinking about just "compensation" and toward a more holistic "Total Rewards" philosophy. This includes not only base salary and bonus but also benefits, work-life balance, career development opportunities, and company culture. Compensation professionals are increasingly expected to analyze and communicate the value of this entire package.

5. Skills-Based Pay: Some forward-thinking organizations are experimenting with moving away from traditional job-based pay to skills-based pay. In this model, an employee's salary is determined by the portfolio of skills they possess and can apply, rather than the specific job title they hold. This requires a completely new way of valuing and compensating work, and compensation analysts will be at the forefront of designing these new systems.

### How to Stay Relevant and Advance

To thrive and grow in this evolving landscape, professionals must be committed to continuous learning and adaptation.

- Embrace Technology: Don't just be a user of Excel; become a power user. Learn a data visualization tool like Tableau. If you have the aptitude, take an introductory course in SQL