Introduction

Imagine standing in the heart of a bustling city, looking up at the gleaming towers of glass and steel that form the skyline. These are not just buildings; they are dynamic ecosystems of commerce, innovation, and community. Behind every thriving office building, bustling retail center, and state-of-the-art industrial park is a skilled professional orchestrating its success: the Commercial Property Manager. If you are drawn to a career that blends financial acumen with operational expertise and human interaction, a role where your decisions have a tangible impact on valuable assets and the businesses within them, then you are in the right place.

The career of a Commercial Property Manager is not only rewarding in its daily challenges but also financially lucrative. While the specific figures can vary widely, the national average commercial property manager salary often hovers in the six-figure range, with top earners commanding compensation well over $150,000 or even $200,000 when bonuses and incentives are factored in. This guide will serve as your definitive resource, breaking down every component that contributes to this impressive earning potential.

I once spoke with a senior property manager who oversaw a landmark high-rise in Chicago. She recounted the night a major transformer blew during a blizzard, threatening the critical operations of her financial and tech tenants. Her calm, decisive leadership in coordinating with utility companies, communicating with C-suite executives, and managing building engineers through a crisis not only saved her tenants millions in potential losses but solidified her reputation as an indispensable asset—a testament to the fact that this role is about far more than just collecting rent.

This article will provide an exhaustive analysis of the commercial property manager salary, job responsibilities, career outlook, and the precise steps you can take to enter and excel in this dynamic field.

### Table of Contents

- [What Does a Commercial Property Manager Do?](#what-does-a-commercial-property-manager-do)

- [Average Commercial Property Manager Salary: A Deep Dive](#average-commercial-property-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Commercial Property Manager Do?

A Commercial Property Manager is the CEO of a building or a portfolio of properties. They are the crucial link between the property's owners (the investors) and the tenants (the businesses that occupy the space). Their primary mandate is to maximize the financial return of the asset by ensuring it is well-maintained, fully occupied by creditworthy tenants, and operated in the most efficient manner possible. This is a multifaceted role that demands a unique combination of financial expertise, operational knowledge, marketing savvy, and exceptional interpersonal skills.

The responsibilities are vast and can be broken down into several core functions:

1. Financial Management: This is the bedrock of the role. A PM is responsible for:

- Budgeting: Creating detailed annual operating and capital budgets that forecast income and expenses.

- Rent Collection: Ensuring timely payment from all tenants and managing delinquencies.

- Expense Control: Approving invoices, negotiating with vendors for better pricing, and finding opportunities for cost savings.

- Financial Reporting: Preparing monthly, quarterly, and annual reports for the owner, detailing property performance, variance analysis (budget vs. actual), and key metrics like Net Operating Income (NOI).

- CAM Reconciliations: Calculating and reconciling Common Area Maintenance charges, which are passed through to tenants—a complex and critical annual task.

2. Tenant Relations and Retention: Keeping tenants happy is paramount to maintaining a stable, income-producing asset.

- Leasing Support: Working with leasing brokers to attract new tenants, show spaces, and negotiate lease terms.

- Onboarding: Facilitating a smooth move-in process for new tenants.

- Communication: Acting as the primary point of contact for all tenant requests, concerns, and complaints.

- Retention Strategies: Proactively building relationships and implementing programs to encourage lease renewals, which are far more cost-effective than finding new tenants.

3. Operations and Maintenance: The physical integrity and smooth functioning of the property are a direct responsibility.

- Vendor Management: Sourcing, vetting, and managing contracts for landscaping, janitorial, security, HVAC, plumbing, and other essential services.

- Property Inspections: Regularly walking the property to identify maintenance issues, safety hazards, and opportunities for improvement.

- Capital Projects: Overseeing major projects like roof replacements, HVAC upgrades, or lobby renovations, from bidding to completion.

- Risk Management: Ensuring the property complies with all local, state, and federal regulations, including ADA, fire codes, and environmental laws.

### A Day in the Life of a Commercial Property Manager

To make this tangible, let's follow "Maria," a Property Manager for a 300,000-square-foot Class A office building.

- 8:00 AM: Maria arrives and immediately does a quick walk-through of the lobby and grounds, checking for cleanliness and any overnight issues. She greets the day-shift security guard and lead engineer.

- 8:30 AM: In her office, she reviews the daily engineering report and a stack of vendor invoices. She flags one from the HVAC contractor that seems unusually high and makes a note to call them.

- 9:30 AM: Maria meets with a prospective tenant and their broker for a tour of a vacant suite. She highlights the building's amenities, recent upgrades, and the high-quality tenant roster.

- 11:00 AM: She spends an hour working on the monthly financial report for the building's owner, a large pension fund. She writes a detailed narrative explaining why utility costs were over budget last month (due to a heatwave) and how she's mitigating it going forward.

- 12:30 PM: Lunch with a key tenant contact from the law firm on the top floor. It's a relationship-building meeting to discuss their upcoming lease expiration and gauge their interest in renewing.

- 2:00 PM: Back in the office, she deals with a flurry of emails: a tenant's AC is too cold, the janitorial supervisor needs to order supplies, and a broker is requesting a commission payment. She delegates the AC issue to her building engineer via a work order system.

- 3:00 PM: Maria leads her weekly staff meeting with her Assistant Property Manager and the Chief Engineer. They review outstanding work orders, discuss the progress of a parking lot re-striping project, and plan for an upcoming fire drill.

- 4:30 PM: She reviews the final bids for a lobby security desk upgrade. She analyzes the costs and capabilities of each vendor, preparing a recommendation for the owner.

- 5:30 PM: Before heading home, Maria does one last check of her email and drafts a "building memo" to be sent to all tenants tomorrow, informing them of the planned fire drill.

This "day in the life" illustrates the constant juggling of strategic financial goals and tactical, on-the-ground operational issues that defines the role.

Average Commercial Property Manager Salary: A Deep Dive

The compensation for a Commercial Property Manager is one of the most attractive aspects of the career. It reflects the immense responsibility of managing multimillion-dollar assets. While a single "average" salary can be misleading, a close look at data from multiple authoritative sources provides a clear and comprehensive picture of earning potential.

### National Averages and Typical Ranges

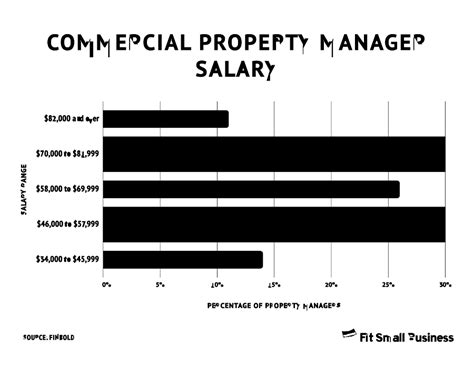

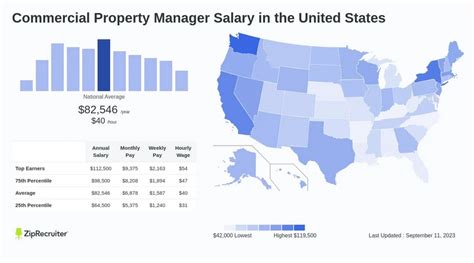

The overall salary landscape is robust. Let's synthesize the data from the most reputable sources to establish a reliable baseline.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups this role under "Property, Real Estate, and Community Association Managers." As of May 2023, the median annual wage for this category was $62,830. However, it's crucial to note that this BLS category is very broad and includes residential and community association managers, who typically earn less than their commercial counterparts. For commercial specialists, the figures are significantly higher.

- Salary.com: This platform provides more specific data. As of late 2023/early 2024, the median salary for a Commercial Property Manager in the United States is approximately $104,220. The typical salary range falls between $88,851 and $123,025. The top 10% of earners in this role can exceed $140,500 in base salary alone.

- Payscale: Payscale reports an average salary of $70,140, but with a wide range from $48k to $107k. It importantly highlights that bonuses can reach up to $20,000 and profit sharing can add another $15,000, significantly boosting total compensation.

- Glassdoor: According to Glassdoor data for early 2024, the estimated total pay for a Commercial Property Manager in the U.S. is $103,456 per year, with an average salary of $77,931. The difference, a significant $25,525, is comprised of additional pay, including cash bonuses, commissions, and profit sharing.

Conclusion on Averages: A conservative estimate for a mid-career Commercial Property Manager's base salary is between $75,000 and $110,000, with a median around $95,000 to $105,000. Total compensation, including bonuses, frequently pushes this into the $100,000 to $130,000 range.

### Salary Progression by Experience Level

Your salary as a Commercial Property Manager will grow substantially as you gain experience, take on larger or more complex properties, and move into leadership positions. Here is a typical trajectory, based on a synthesis of data from Payscale and Salary.com.

| Career Stage | Years of Experience | Typical Base Salary Range | Typical Role & Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $55,000 - $75,000 | Assistant Property Manager, Property Administrator. Focuses on administrative tasks, accounts payable/receivable, coordinating with vendors, and responding to basic tenant requests. Learning the fundamentals. |

| Early-Career | 2-5 Years | $70,000 - $95,000 | Property Manager. Manages a smaller property or assists on a larger one. Begins to handle budgeting, basic financial reporting, and more direct tenant relations. |

| Mid-Career | 5-10 Years | $90,000 - $125,000 | Property Manager / Senior Property Manager. Manages a significant asset or a small portfolio. Handles complex budgets, CAM reconciliations, supervises staff, and has input on capital projects. |

| Senior / Experienced | 10-20 Years | $120,000 - $160,000+ | Senior Property Manager / Group Manager / Regional Manager. Oversees a large portfolio of properties and a team of Property Managers. Focus is on portfolio-level strategy, client relations with major owners, and regional P&L. |

| Executive Level | 20+ Years | $160,000 - $250,000+ | Director of Property Management / Vice President. Sets strategy for an entire region or company. Responsible for business development, high-level client management, and the overall profitability of the management division. |

*Source: Synthesized from 2024 data from Payscale.com, Salary.com, and industry observations.*

### Deconstructing Total Compensation: More Than Just a Salary

A significant portion of a Commercial Property Manager's earnings comes from variable pay. It's essential to understand these components when evaluating a job offer.

- Annual Performance Bonus: This is the most common form of additional compensation. It is typically tied to both personal and property-level performance. Key metrics often include:

- Meeting budget targets (especially Net Operating Income).

- Tenant retention rates.

- Controllable expense savings.

- Successful completion of capital projects.

- Bonuses can range from 5% to 25% (or more) of the base salary. For a PM earning $100,000, this could mean an extra $10,000 to $25,000 per year.

- Profit Sharing: Some property owners, particularly smaller private firms, may offer a share of the property's profits. This directly aligns the PM's interests with the owner's and can be very lucrative in a good year.

- Leasing Commissions: While dedicated leasing brokers handle most new deals, a PM is often incentivized to retain existing tenants. They may receive a small commission or bonus for every successful lease renewal they facilitate.

- Car Allowance/Cell Phone Stipend: Since the job often requires travel between properties or to meet vendors, many companies provide a monthly stipend to cover vehicle and communication costs, which is a form of non-taxed or tax-advantaged income.

- Health and Retirement Benefits: Top-tier firms (like major REITs and third-party managers) offer excellent benefits packages, including comprehensive health insurance, generous 401(k) matching, and paid time off, which add tens of thousands of dollars in value to the total compensation package.

Understanding this complete picture is vital. A $95,000 base salary with a strong 20% bonus potential and a car allowance is superior to a flat $105,000 salary with no variable pay.

Key Factors That Influence Salary

While the national averages provide a useful benchmark, a Commercial Property Manager's actual salary is a mosaic built from several interconnected factors. Understanding these variables is the key to maximizing your earning potential throughout your career. This section provides an in-depth analysis of the six most significant drivers of compensation.

### 1. Level of Education and Professional Certifications

Your educational background and, more importantly, your professional credentials, are a foundational element of your salary structure.

#### Educational Degrees

- Bachelor's Degree: This is considered the standard entry requirement for most reputable commercial real estate firms. While a degree in any field can suffice if paired with relevant experience, certain majors provide a distinct advantage. Degrees in Real Estate, Finance, Business Administration, and Accounting are highly sought after because they provide a direct foundation for the financial management aspects of the job. A candidate with a finance degree will immediately be seen as more capable of handling complex budgeting and reporting.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA) or a specialized Master of Science in Real Estate (MSRE), is a significant salary accelerator. It is often a prerequisite for senior leadership roles like Director or Vice President of Property Management. An MBA can add $10,000 to $20,000 or more to a senior manager's salary and opens doors to strategic roles in asset management and acquisitions.

#### Professional Certifications: The True Salary Multipliers

In commercial real estate, certifications are arguably more impactful on salary than an advanced degree. They are a signal to employers that you have achieved a specific level of expertise and adhere to a professional code of ethics.

- Certified Property Manager (CPM®): Offered by the Institute of Real Estate Management (IREM), the CPM® is the undisputed "gold standard" in the industry. It requires a rigorous curriculum covering finance, operations, marketing, and ethics, as well as a comprehensive management plan project and a portfolio of qualifying experience. The impact on salary is profound. According to IREM's own data, professionals who hold the CPM designation earn up to 133% more in total compensation than those without it. Achieving your CPM is one of the single most effective actions you can take to elevate your career and salary.

- Real Property Administrator (RPA®): Offered by BOMI International (Building Owners and Managers Institute), the RPA is another highly respected designation. It has a strong focus on the operational aspects of a building, including building systems, design, operation, and maintenance. While the CPM is often seen as more finance and asset-management focused, the RPA is invaluable for managers who want to demonstrate deep technical and operational competence. It is a significant resume booster and can lead to higher pay, especially in roles managing complex, technically demanding buildings.

- State Real Estate License: In many states, a real estate salesperson or broker license is a legal requirement to perform property management duties, particularly those related to leasing. Even when not legally required, employers overwhelmingly prefer licensed candidates. It demonstrates a baseline knowledge of real estate law and ethics and is considered a non-negotiable for most mid-to-senior level positions.

### 2. Years of Experience and Career Progression

As detailed in the salary table above, experience is a direct and powerful driver of compensation. However, it's not just the number of years that matters, but the *quality* and *type* of experience gained.

- From Assistant to Manager (0-5 Years): The steepest learning curve occurs here. The salary jump from an Assistant Property Manager ($60k) to a Property Manager ($85k) is significant because it reflects a shift from task execution to ownership of an asset. In these years, focus on mastering the fundamentals: AP/AR, vendor relations, and basic reporting.

- The Senior Manager Leap (5-15 Years): The transition to Senior Property Manager or Group Manager marks another major salary increase. This leap is earned by demonstrating mastery over complex challenges: successfully managing a major capital project, turning around a troubled asset, or skillfully negotiating renewals with major tenants. At this stage, your value is measured not just in operational smoothness, but in your direct contribution to the property's Net Operating Income (NOI).

- Portfolio and People Management (10+ Years): Moving to a Regional Manager or Director role brings the highest salaries. This compensation reflects the scale of your responsibility—overseeing a portfolio worth hundreds of millions or even billions of dollars, and managing a team of property managers. Your experience in strategic planning, client relationship management with institutional owners, and talent development becomes your primary value proposition.

### 3. Geographic Location

Where you work is one of the most significant factors determining your salary. High cost-of-living areas with dense commercial real estate markets naturally offer higher compensation to attract and retain talent.

| High-Paying Metropolitan Areas | Typical Median Base Salary | Low-Paying Metropolitan Areas | Typical Median Base Salary |

| :--- | :--- | :--- | :--- |

| San Jose, CA | $135,000+ | Birmingham, AL | $80,000 |

| San Francisco, CA | $130,000+ | Oklahoma City, OK | $82,000 |

| New York, NY | $125,000+ | Louisville, KY | $85,000 |

| Boston, MA | $120,000+ | Memphis, TN | $85,000 |

| Los Angeles, CA | $118,000+ | Jacksonville, FL | $88,000 |

| Washington, D.C. | $115,000+ | Indianapolis, IN | $89,000 |

*Source: Data synthesized from Salary.com and Glassdoor geographic filters, early 2024.*

It's not just about the city, but also the submarket. A PM managing a portfolio of Class A office towers in Downtown Manhattan will earn substantially more than one managing Class B industrial properties in an outer borough, even within the same city.

### 4. Company Type and Size

The type of company you work for dramatically influences your salary structure, benefits, and career path.

- Large Third-Party Management Firms (e.g., CBRE, JLL, Cushman & Wakefield): These global giants offer structured career paths, excellent training, and the chance to work on trophy assets. Salaries are competitive and often come with well-defined bonus structures. The prestige of working for a top firm is also a significant resume builder.

- Real Estate Investment Trusts (REITs) (e.g., Boston Properties, Prologis, Simon Property Group): These companies own and operate their own properties. As an employee, you are working directly for the owner. This often leads to a strong alignment of interests, potentially higher bonuses tied directly to asset performance, and in some cases, stock options or equity participation, which can significantly enhance total compensation.

- Private Equity / Boutique Owner-Operators: Working for a smaller, private real estate owner can be a high-risk, high-reward scenario. Base salaries might be slightly lower than at a large REIT, but the bonus potential and opportunity for profit sharing or a "promote" (a share of the profits when a property is sold) can be immense. These roles are often more entrepreneurial.

- Corporate Real Estate Department: Large corporations (like Google, Amazon, or a major bank) have vast real estate portfolios to house their own operations. A PM in this role works on the "corporate" side. These positions often offer excellent work-life balance, strong benefits, and high base salaries, though bonus potential may be more modest than in a purely investment-focused firm.

### 5. Area of Specialization (Property Type)

All commercial real estate is not created equal. Specializing in a particular property type can shape your skillset and your salary.

- Office (Class A, B, C): This is the traditional domain of commercial PMs. Managing a Class A trophy tower in a central business district is often the most prestigious and highest-paying specialization due to the complexity, high-profile tenants, and value of the asset.

- Industrial / Logistics: This has become one of the hottest sectors in real estate. Managing large distribution centers and logistics parks for e-commerce giants and supply chain companies is in high demand. Specialists in this area are seeing rapid salary growth due to the sector's explosive expansion.

- Retail (Malls, Shopping Centers, Street-Front): Retail management requires a unique blend of operational skills and marketing/event planning to drive foot traffic. Managing a successful "experiential" retail center can be very lucrative, though the sector as a whole has faced challenges.

- Medical Office Buildings (MOBs): A highly specialized and resilient niche. Managing MOBs requires knowledge of healthcare regulations (like HIPAA and Stark Law), specialized tenant needs (e.g., plumbing for dental offices, specific power requirements for imaging equipment), and managing sensitive patient traffic. This specialized knowledge commands a salary premium.

- Life Sciences / Lab Space: Similar to MOBs but even more specialized, this is a rapidly growing and extremely high-paying niche. Managing buildings with wet labs, vivariums, and clean rooms requires deep technical knowledge of complex building systems and safety protocols. PMs with this expertise are rare and highly compensated.

### 6. In-Demand Skills

Beyond your resume's basic facts, the specific skills you cultivate and demonstrate have a direct impact on your value and your paycheck.

- Financial Acumen: This is non-negotiable. The ability to not just create a budget, but to analyze it, write a compelling narrative about its performance, and forecast future results is what separates average PMs from top-tier ones. Mastery of CAM reconciliations is a particularly valued and complex skill.

- Technological Proficiency: The industry is rapidly adopting new technologies ("PropTech"). Proficiency in property management software like Yardi Voyager or MRI Software is a baseline requirement. Experience with tenant experience platforms (like HqO or VTS), smart building systems (IoT sensors), and data analytics tools can set you apart and justify a higher salary.

- Sustainability and ESG: Knowledge of Environmental, Social, and Governance (ESG) principles is becoming a major differentiator. Owners are increasingly focused on achieving certifications like LEED (Leadership in Energy and Environmental Design) or BOMA 360 to attract tenants and investors. A PM who can lead ESG initiatives, reduce a building's carbon footprint, and report on sustainability metrics is a highly valuable asset.

- Negotiation and Conflict Resolution: Whether you are negotiating a multi-million