A career as a commodity trader is synonymous with high stakes, high pressure, and the potential for exceptionally high rewards. It’s a field that attracts the ambitious, the analytical, and those who thrive on the volatility of global markets. But what does that translate to in terms of actual compensation? For those considering this dynamic career, the key question is often: "What is a realistic commodity trader salary?"

The short answer is that compensation is impressive, with a typical total pay package well into the six figures. However, a trader's salary is one of the most variable in the financial world, heavily influenced by performance, location, and specialization. This article will break down every component of a commodity trader's earnings, backed by the latest data from authoritative sources.

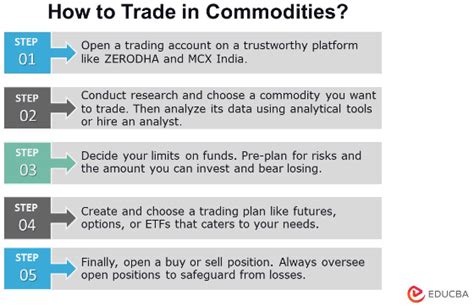

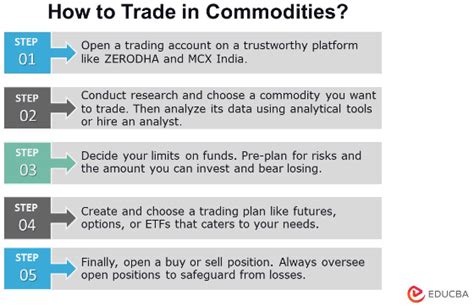

What Does a Commodity Trader Do?

Before we dive into the numbers, it's essential to understand the role. A commodity trader buys and sells raw materials, or "commodities." These fall into several categories:

- Energy: Crude oil, natural gas, gasoline.

- Metals: Gold, silver, copper, aluminum.

- Agriculture (Softs): Wheat, corn, soybeans, coffee, sugar.

Traders analyze market data, weather patterns, geopolitical events, and supply chain logistics to predict price movements. Their goal is to "buy low and sell high" (or "sell high and buy low" through short-selling) to generate a profit for their firm. They manage risk, execute complex trades, and must make split-second decisions with millions of dollars on the line.

Average Commodity Trader Salary

A commodity trader's compensation is famously composed of two parts: a base salary and a performance bonus. The bonus is often the largest component and is directly tied to the trader's profitability, making "average salary" a complex figure.

According to data from top salary aggregators, the total compensation for a commodity trader in the United States is substantial.

- Salary.com reports that the median salary for a Commodity Trader is $111,720 as of early 2024, with a typical range falling between $86,303 and $143,767.

- Glassdoor places the average total pay (base + additional pay like bonuses) higher, at approximately $135,000 per year, with a likely range from $97,000 to $191,000.

- The U.S. Bureau of Labor Statistics (BLS) groups commodity traders under the broader category of "Securities, Commodities, and Financial Services Sales Agents." The median annual wage for this group was $77,160 in May 2023. The top 10% of earners, where most successful commodity traders reside, earned more than $239,200.

The key takeaway is this: while the base salary is competitive, the performance bonus can elevate total earnings into the high six or even seven figures for top-performing, experienced traders.

Key Factors That Influence Salary

Your earning potential as a commodity trader isn't a single number; it's a spectrum defined by several critical factors.

Level of Education

A bachelor's degree is the standard entry point for a trading career. Degrees in Finance, Economics, Mathematics, Statistics, or Business Administration are most common. A strong quantitative background is non-negotiable. While not always required, a Master of Business Administration (MBA) from a top-tier university or a specialized master's degree (e.g., Master's in Financial Engineering) can lead to higher starting salaries and faster career progression into senior trading or management roles.

Years of Experience

Experience is arguably the most significant factor in determining a trader's compensation, as it directly correlates with skill, market knowledge, and a proven track record of profitability.

- Entry-Level (0-2 years): Junior traders or trading analysts often start with a base salary between $75,000 and $110,000. Their initial bonuses may be modest as they learn the ropes, bringing total compensation to the $100,000 - $140,000 range.

- Mid-Career (3-9 years): With a proven strategy and consistent profits, traders see their base salaries increase to the $120,000 - $180,000 range. More importantly, their performance bonuses grow substantially, often matching or exceeding their base salary. Total compensation frequently lands between $200,000 and $500,000, or higher in exceptional years.

- Senior-Level (10+ years): Senior traders with over a decade of experience command base salaries of $200,000+. At this level, the bonus is the main event. Total compensation for a highly profitable senior trader can easily surpass $500,000 and venture into the millions.

Geographic Location

Where you work matters immensely. Trading is concentrated in major financial hubs where salaries are inflated by a high cost of living and fierce competition for top talent. The primary U.S. hubs for commodity trading are:

- New York, NY: The epicenter of global finance, offering top-tier salaries for traders at investment banks and hedge funds.

- Chicago, IL: A historic hub for agricultural and futures trading, home to the CME Group (Chicago Mercantile Exchange).

- Houston, TX: The world's energy capital, making it the premier location for oil, gas, and power traders.

Salaries in these cities can be 20-40% higher than in other parts of the country. Internationally, cities like London, Geneva, and Singapore are also top-paying locations for commodity traders.

Company Type

The type of firm you work for fundamentally shapes your role and your pay structure.

- Investment Banks (e.g., Goldman Sachs, JPMorgan Chase): These firms offer structured training programs, high base salaries, and significant bonus potential. They are highly prestigious and competitive.

- Hedge Funds: Often seen as the pinnacle of earning potential, hedge funds offer a high-risk, high-reward environment. Pay is heavily skewed towards performance, with lower base salaries but a larger share of the profits for successful traders.

- Physical Trading Houses (e.g., Cargill, Glencore, ADM, Bunge): These giants deal in the physical sourcing, transport, and delivery of commodities. Traders here are experts in logistics and supply chains. Compensation is highly competitive, especially for traders managing profitable physical books.

- Energy Majors (e.g., BP, Shell): Major oil and gas companies have sophisticated trading arms to manage price risk and optimize their assets. They offer excellent, stable salaries and strong bonus structures, particularly in hubs like Houston.

Area of Specialization

Finally, what you trade influences your pay. Volatile and complex markets require more sophisticated skills and risk management, which often commands higher compensation.

- Energy (Oil & Gas): Historically the most lucrative area due to high volatility and the massive scale of the market. Power and natural gas traders are also among the top earners.

- Metals: Trading precious and industrial metals can be very profitable, closely tied to global economic health and industrial demand.

- Agriculture ("Softs"): While sometimes perceived as less glamorous, expert agricultural traders who can master the complexities of weather, crop yields, and government policy are highly valued and well-compensated.

Job Outlook

The future for skilled traders appears bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for "Securities, Commodities, and Financial Services Sales Agents" will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is driven by the increasing complexity of global financial markets, the need for companies to manage commodity price risk, and the continued globalization of the economy. While technology and algorithmic trading are on the rise, the need for human traders who can interpret complex, nuanced information and manage client relationships remains strong.

Conclusion: Is a Career in Commodity Trading for You?

A commodity trader salary reflects the demanding nature of the job. It offers one of the highest earning potentials in the financial industry, but this reward is directly tied to performance.

For aspiring professionals and students, the key takeaways are:

- Performance is Paramount: Your profitability will be the single biggest driver of your long-term earnings.

- Total Compensation is Key: Don't just look at the base salary; the annual bonus is where wealth is created in this field.

- Your Path Matters: Your salary will be shaped by your experience level, your physical location, the type of firm you join, and the specific commodity you master.

For those with a strong analytical mind, a high tolerance for risk, and an unyielding drive to succeed, a career as a commodity trader remains one of the most challenging and financially rewarding paths available in the professional world.