In a world of ever-increasing rules, regulations, and corporate scrutiny, the role of the compliance specialist has evolved from a back-office function to a critical strategic pillar of any successful organization. For those with a meticulous eye for detail and a strong ethical compass, a career in compliance is not only intellectually stimulating but also financially rewarding.

So, what can you expect to earn? While the exact figure varies, the national average salary for a compliance specialist typically falls between $75,000 and $85,000 per year, with entry-level positions starting around $60,000 and senior-level experts in high-demand fields earning well over $130,000. This article will break down the numbers, explore the key factors that dictate your salary, and provide a clear picture of what a future in this dynamic field holds.

What Does a Compliance Specialist Do?

At their core, compliance specialists are the guardians of an organization's integrity. They ensure that a company operates in a legal, ethical, and responsible manner by adhering to all relevant industry regulations, government laws, and internal policies.

Their day-to-day responsibilities are diverse and crucial, often including:

- Developing and Implementing Policies: Creating and maintaining the internal rulebook that guides employee conduct and business operations.

- Conducting Risk Assessments and Audits: Identifying potential areas of non-compliance and evaluating the effectiveness of internal controls.

- Training and Education: Ensuring all employees understand their compliance obligations.

- Monitoring and Reporting: Staying current on new and changing regulations and reporting on the company's compliance status to management.

- Investigating Issues: Looking into potential violations and recommending corrective actions.

This role is essential for mitigating risk, avoiding costly fines, and protecting the company's public reputation.

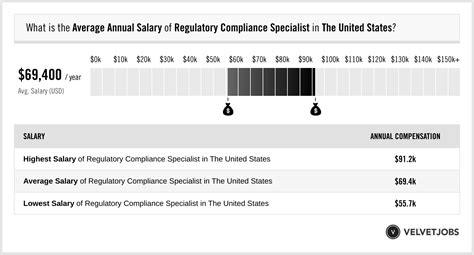

Average Compliance Specialist Salary

To understand the earning potential, it's helpful to look at data from several authoritative sources. By synthesizing this information, we can build a reliable salary landscape.

- The U.S. Bureau of Labor Statistics (BLS) groups compliance specialists under the broader category of "Compliance Officers." As of May 2023, the BLS reports a median annual wage of $76,860 for this group. The lowest 10% earned less than $45,840, while the top 10% earned more than $124,530.

- Salary.com reports a slightly higher median salary for a "Compliance Specialist III" (an experienced, non-managerial role) at around $95,307 as of early 2024, with a typical range falling between $84,954 and $106,478.

- Glassdoor's data, which aggregates user-submitted salaries, places the total pay (including base and additional compensation) for a compliance specialist in the U.S. at an average of $88,683 per year.

Across these sources, a clear picture emerges: a mid-career compliance specialist can confidently expect a salary in the $75,000 to $95,000 range, with significant room for growth.

Key Factors That Influence Salary

Your specific salary is not just one number; it's a dynamic figure influenced by a combination of your qualifications, choices, and market forces. Here are the most critical factors.

### Level of Education

Education forms the foundation of your compliance career. A bachelor's degree in fields like business, finance, accounting, or pre-law is typically the minimum requirement. However, advanced credentials directly translate to higher earning potential.

- Advanced Degrees: A Master's degree (like an MBA with a focus on risk management) or a Juris Doctor (JD) can provide a significant salary bump, as these roles often require a deep understanding of legal and business complexities.

- Professional Certifications: This is where you can truly stand out. Certifications demonstrate specialized expertise and a commitment to the profession. In-demand certifications that command higher salaries include:

- Certified Compliance & Ethics Professional (CCEP): Offered by the Society of Corporate Compliance and Ethics (SCCE), this is a widely respected credential.

- Certified Regulatory Compliance Manager (CRCM): Offered by the American Bankers Association, this is essential for those in the financial services industry.

- Certified in Healthcare Compliance (CHC): A must-have for those navigating the complex regulations of the healthcare sector.

### Years of Experience

Like most professions, experience is a primary driver of salary growth in compliance.

- Entry-Level (0-2 years): In these roles, you are typically assisting senior specialists, conducting research, and handling documentation. Salaries often range from $55,000 to $70,000.

- Mid-Career (3-7 years): With a solid foundation, you'll take on more responsibility, leading audits, managing smaller projects, and developing training materials. Expect a salary in the $70,000 to $95,000 range.

- Senior-Level / Manager (8+ years): At this stage, you are a subject matter expert, managing a team, shaping compliance strategy, and advising executive leadership. Senior specialists, compliance managers, and directors can earn from $100,000 to $150,000+, with Chief Compliance Officers in major corporations earning significantly more.

### Geographic Location

Where you work matters. Salaries are adjusted to reflect the cost of living and the concentration of corporate headquarters in a given region. Major metropolitan areas, particularly financial and tech hubs, offer the highest pay.

According to data from salary aggregators, top-paying states and cities include:

- New York, NY

- San Francisco, CA

- Washington, D.C.

- Boston, MA

- Los Angeles, CA

A compliance specialist in a high-cost city like San Francisco may earn 20-30% above the national average to compensate for the higher cost of living.

### Company Type

The industry you work in has a massive impact on your salary, primarily driven by the complexity of the regulatory environment and the financial resources of the company.

- Finance, Banking, and Insurance: This sector consistently offers the highest salaries due to the intense and high-stakes regulations from bodies like the SEC, FINRA, and the Federal Reserve. Specialists in areas like Anti-Money Laundering (AML) are in particularly high demand.

- Healthcare and Pharmaceuticals: With complex rules from HIPAA, the FDA, and other agencies, healthcare compliance is a lucrative field.

- Technology: As data privacy becomes a global concern (think GDPR and CCPA), tech companies are heavily investing in compliance talent, offering competitive salaries to navigate these new frontiers.

- Energy and Manufacturing: These industries require specialists to navigate complex environmental (EPA) and safety (OSHA) regulations.

- Government and Non-Profit: While often offering lower base salaries, these roles can provide excellent benefits, job security, and a strong sense of public service.

### Area of Specialization

Within the broad field of compliance, specializing in a high-demand niche can dramatically increase your value. Hot areas that currently command premium pay include:

- Anti-Money Laundering (AML) & Know Your Customer (KYC)

- Cybersecurity & Data Privacy Compliance

- Environmental, Social, and Governance (ESG) Compliance

- Trade and Sanctions Compliance

- Healthcare (HIPAA) Compliance

Job Outlook

The future for compliance specialists is bright and stable. The U.S. Bureau of Labor Statistics projects that employment for Compliance Officers will grow by 4 percent from 2022 to 2032, which is as fast as the average for all occupations. This translates to about 13,800 new job openings each year.

This steady demand is fueled by an increasingly complex global regulatory landscape, the constant threat of data breaches, a greater focus on corporate ethics, and the expansion of businesses into new, regulated markets. Simply put, as long as there are rules, there will be a need for people who know how to follow them.

Conclusion

A career as a compliance specialist offers a powerful combination of purpose, stability, and significant earning potential. While a national average salary provides a good benchmark, your personal trajectory will be defined by your commitment to continuous learning and strategic career choices.

To maximize your salary, focus on:

1. Gaining Experience: Build a strong foundation and progressively take on more complex responsibilities.

2. Pursuing Education and Certification: Invest in credentials that prove your expertise in high-demand areas.

3. Specializing Strategically: Target industries and niches like finance, healthcare, or data privacy where your skills are most valued.

For individuals who are diligent, analytical, and dedicated to upholding ethical standards, the path of a compliance specialist is a clear route to a prosperous and impactful career.