Have you ever wondered about the intricate systems that determine how much people are paid? Perhaps you’ve stumbled upon a public resource like the UNC System Salary Database and found yourself fascinated by the sheer volume of data, realizing that behind every number is a complex calculation of value, experience, and market demand. This database isn't just a list of names and figures; it's the final product of a critical, strategic, and increasingly data-driven profession: compensation analysis. If you're analytical, detail-oriented, and passionate about creating fair and competitive pay structures, a career as a compensation analyst might be your calling.

This guide will demystify the profession responsible for creating and maintaining systems like the UNC database. We'll explore a career path that offers a compelling blend of human resources, data science, and business strategy. The professionals in this field are the architects of organizational pay equity, wielding data to ensure that employees are compensated fairly and competitively. The average salary for these specialists reflects their critical importance, typically ranging from $70,000 to over $125,000 annually, depending on a host of factors we'll explore in detail. I once worked with a junior analyst who, through meticulous market research and data modeling, identified a significant pay gap affecting a whole department. Her work, which started with a simple spreadsheet, led to a company-wide pay structure overhaul, directly impacting hundreds of employees for the better. It was a powerful reminder that this career isn't just about numbers; it's about making a tangible, positive impact on people's lives and livelihoods.

This comprehensive article will serve as your roadmap, whether you're a student contemplating your future or a professional considering a career change. We will dissect every facet of the compensation analyst role, providing you with the authoritative data, expert insights, and actionable steps needed to launch a successful career in this rewarding field.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation Analyst Do?

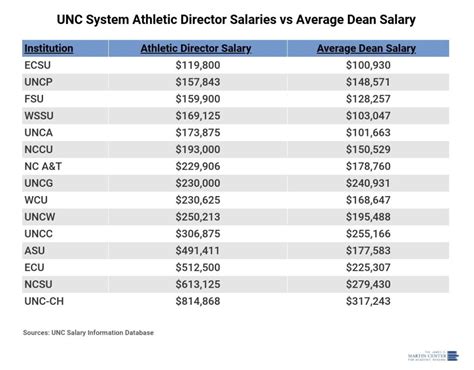

At its core, a compensation analyst is a specialized Human Resources (HR) professional who designs, implements, and administers an organization's compensation programs. They are the guardians of pay equity and competitiveness. They ensure that an organization's pay practices are not only fair and legally compliant but also effective in attracting, retaining, and motivating top talent. The public UNC System Salary Database is a perfect example of the output of their work in a public institution—a transparent, structured system that maps roles to pay grades based on extensive research and analysis.

These professionals don't just pick numbers out of thin air. Their work is a meticulous blend of art and science. They use sophisticated analytical techniques, market data, and a deep understanding of business strategy to build compensation structures that align with organizational goals. This involves everything from base salary and hourly wages to bonuses, commissions, and long-term incentives.

Core Responsibilities and Daily Tasks:

The day-to-day responsibilities of a compensation analyst are varied and data-intensive. Here’s a breakdown of their typical duties:

- Job Analysis and Evaluation: They analyze the duties, responsibilities, and requirements of every job within the organization. Using established methodologies (like point-factor or job ranking), they determine the relative value of each position to establish an internal hierarchy.

- Market Pricing and Salary Surveys: Analysts benchmark their organization's jobs against the external market. They participate in and analyze third-party salary surveys from firms like Radford, Mercer, or Willis Towers Watson to understand what other companies are paying for similar roles. This is crucial for staying competitive.

- Salary Structure Development: Using the internal job evaluation and external market data, they design and maintain salary structures. This involves creating pay grades, each with a minimum, midpoint, and maximum salary range. The goal is to provide a clear framework for pay decisions.

- Data Analysis and Reporting: A significant portion of their time is spent in spreadsheets and HR Information Systems (HRIS). They model the financial impact of compensation programs (e.g., annual merit increases, bonus payouts), conduct pay equity audits to identify and remedy gender or race-based pay gaps, and create reports for leadership to inform strategic decisions.

- Compliance: They ensure all pay practices comply with federal, state, and local laws, such as the Fair Labor Standards Act (FLSA), Equal Pay Act, and emerging pay transparency laws.

- Collaboration and Communication: They work closely with HR Business Partners, talent acquisition teams, and business leaders to provide guidance on individual salary offers, promotions, and other compensation-related issues.

### A Day in the Life of a Compensation Analyst

To make this role more tangible, let's imagine a day for "Maria," a Compensation Analyst at a large technology company.

- 9:00 AM: Maria starts her day by reviewing data integrity reports from the HRIS (like Workday or SAP SuccessFactors). She spots a few new job titles that haven't been mapped to a pay grade yet and flags them for evaluation.

- 10:00 AM: A talent acquisition partner pings her. They have a top candidate for a Senior Software Engineer role but need to make a competitive offer. Maria quickly pulls market data for that specific role in the relevant geographic location (e.g., Austin, TX), considers the candidate's experience level and internal equity with the current team, and provides a recommended salary range and sign-on bonus.

- 11:00 AM: Maria joins a project meeting for the upcoming annual compensation review cycle. The team is discussing the budget for merit increases and promotion pools. Her task is to model different scenarios—a 3% vs. 4% budget—and project the impact on the company's finances and competitive position.

- 1:00 PM: After lunch, Maria dedicates a solid two-hour block to a major project: a company-wide pay equity audit. She exports anonymized employee data and uses statistical analysis software (like R or even advanced Excel) to analyze pay differences across gender and ethnicity, controlling for factors like job level, tenure, and performance.

- 3:00 PM: Maria meets with the Director of Marketing. The director wants to create a new "Digital Marketing Manager" role. Maria conducts a "job intake" session, asking detailed questions about the role's responsibilities, required skills, and reporting structure so she can properly evaluate and price it against the market.

- 4:30 PM: She spends the last part of her day documenting the methodology for the new marketing role evaluation and responding to a few emails from managers with questions about their team's salary ranges.

This "day in the life" illustrates the dynamic nature of the role—it's a constant switch between deep analytical work, strategic planning, and collaborative problem-solving.

Average Compensation Analyst Salary: A Deep Dive

Compensation for those who manage compensation is, unsurprisingly, a well-researched and competitive field. The salary of a compensation analyst is a reflection of the significant value they bring to an organization's financial health and talent strategy. While a public database like the UNC System's shows salaries for a specific public entity, we'll look at the broader national data to provide a comprehensive picture of earning potential in this career.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Compensation, Benefits, and Job Analysis Specialists" was $77,570 as of May 2023. The BLS data also shows a wide spectrum of earnings: the lowest 10 percent earned less than $51,130, while the highest 10 percent earned more than $126,830. This wide range highlights how factors like experience, specialization, and location dramatically impact pay.

Reputable salary aggregators provide a similar, and often more granular, view.

- Salary.com, as of late 2023, reports the median salary for a Compensation Analyst II (typically with 2-4 years of experience) in the United States to be around $83,032, with a typical range falling between $75,014 and $91,666.

- Payscale.com indicates a slightly lower average base salary of around $73,200 per year, but emphasizes the significant growth potential as one moves into senior and management roles.

- Glassdoor, which aggregates self-reported user data, shows a total pay average of $95,570 per year for Compensation Analysts in the US, which includes an estimated average of $8,995 in additional pay like cash bonuses and profit sharing.

This data paints a clear picture: this is a well-compensated profession with a solid mid-career salary and a six-figure earning potential for experienced practitioners.

### Salary by Experience Level

One of the most significant drivers of salary is experience. The career ladder for a compensation analyst is well-defined, and each step comes with a substantial increase in both responsibility and pay.

| Experience Level | Typical Years of Experience | Typical Salary Range (Annual) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level Compensation Analyst (Analyst I) | 0-2 years | $60,000 - $75,000 | Assisting with salary surveys, data entry, running basic reports, responding to routine compensation queries, learning job evaluation methodologies. |

| Mid-Career Compensation Analyst (Analyst II/III) | 2-5 years | $75,000 - $95,000 | Managing salary survey participation, performing job evaluations, market pricing new roles, administering bonus programs, conducting basic pay equity analysis. |

| Senior Compensation Analyst | 5-8 years | $95,000 - $125,000+ | Leading complex projects (e.g., salary structure redesign), conducting in-depth pay equity audits, advising senior leadership, mentoring junior analysts, managing incentive plan design. |

| Compensation Manager/Principal Analyst | 8+ years | $120,000 - $160,000+ | Managing a team of analysts, developing the overall compensation strategy, designing executive compensation programs, presenting to the board's compensation committee. |

| Director/VP of Compensation | 12+ years | $160,000 - $250,000+ | Setting the global compensation philosophy for the entire organization, overseeing all compensation and benefits functions, ensuring alignment with long-term business objectives. |

*(Note: Salary ranges are national averages and can vary significantly based on location, industry, and company size. Data compiled and synthesized from BLS, Salary.com, and industry observations.)*

### A Closer Look at the Full Compensation Package

Base salary is only one piece of the puzzle. A compensation analyst's total rewards package often includes several other valuable components.

- Annual Bonus/Incentive Pay: Most private-sector analysts are eligible for an annual bonus tied to individual and company performance. This can range from 5% of base salary at the junior level to 20% or more for senior and management roles. In public institutions like the UNC System, annual bonuses may be less common or smaller, with more emphasis placed on job security and benefits.

- Benefits: This is a major component of total compensation. These roles typically come with comprehensive benefits packages, including:

- Health Insurance: Medical, dental, and vision coverage.

- Retirement Savings: Access to a 401(k) or 403(b) plan, often with a generous company match. Public universities and government agencies frequently offer defined-benefit pension plans, which are increasingly rare in the private sector and highly valuable.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies.

- Stock/Equity: In publicly traded companies, particularly in the tech sector, compensation analysts (especially at the senior level) may receive stock options or Restricted Stock Units (RSUs) as part of their long-term incentive package. This can add significantly to their total earnings.

- Professional Development: Many organizations will pay for expensive and valuable certifications, such as the Certified Compensation Professional (CCP), and for attendance at industry conferences.

- Tuition Assistance: A standout benefit in higher education environments like the UNC System is often free or heavily discounted tuition for employees and sometimes their families, a benefit worth thousands of dollars per year.

When evaluating a job offer, it's crucial to look beyond the base salary and consider the full value of the total rewards package, as these additional components can add tens of thousands of dollars in value annually.

Key Factors That Influence Salary

While we've established a baseline for compensation analyst salaries, the actual figure on your paycheck can vary dramatically. Several key factors interact to determine your precise market value. Understanding these levers is essential for maximizing your earning potential throughout your career. This section, the most detailed in our guide, will break down each of these influencing factors with specific data and examples.

###

Level of Education and Professional Certifications

Your educational background serves as the foundation for your career and directly impacts your starting salary and long-term growth.

- Bachelor's Degree: This is the standard entry requirement. A bachelor's degree in a relevant field such as Human Resources, Business Administration, Finance, Economics, or Statistics is highly preferred. Employers see these degrees as evidence of the quantitative and analytical skills necessary for the role. An entry-level analyst with a relevant degree can expect to start at the higher end of the entry-level salary band.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA), a Master's in Human Resource Management (MHRM), or a Master's in Industrial-Organizational Psychology, can provide a significant salary advantage. It signals a higher level of strategic thinking and specialized knowledge. According to Payscale, professionals with an MBA often earn a premium of 10-15% or more compared to their bachelor's-only counterparts in similar roles. A graduate with a relevant master's degree may be able to enter the field at an Analyst II level, skipping the initial entry-level rung and its associated pay scale.

- Professional Certifications: In the world of compensation, certifications are the gold standard for demonstrating expertise and commitment to the profession. They are a powerful tool for salary negotiation. The most recognized certification is the Certified Compensation Professional (CCP®) from WorldatWork. Obtaining a CCP designation typically requires passing a series of rigorous exams on topics from base pay administration to executive compensation. Industry data consistently shows that professionals holding a CCP earn a significant salary premium—often between 5% and 15%—over non-certified peers with similar experience. Other valuable certifications include the Professional in Human Resources (PHR) from HRCI or the SHRM-CP from the Society for Human Resource Management, which provide a broader HR context.

###

Years and Quality of Experience

As shown in the previous section, experience is arguably the single most important factor in salary progression. However, it's not just about the number of years; it's about the quality and type of experience gained.

- Entry-Level (0-2 Years): At this stage, you're learning the ropes. Your work is focused on execution and support: pulling data, filling out survey templates, and learning the company's specific processes. Salary growth is steady as you prove your competence.

- Mid-Career (2-5 Years): You're now a fully functional analyst. You own processes, lead small projects, and begin to act as a consultant to managers and HR partners. Your salary growth accelerates as you demonstrate independent problem-solving and analytical capabilities. An analyst who successfully prices a new, critical business unit or helps implement a new salary structure will be far more valuable than one who has only performed routine tasks for five years.

- Senior Level (5-8+ Years): At this stage, you transition from *doing* to *strategizing*. You're not just running reports; you're interpreting the data to tell a story and influence leadership. You're leading complex, high-impact projects like M&A due diligence on compensation programs or designing a new sales incentive plan from scratch. Your salary reflects this strategic impact, often crossing well into six figures.

- Management/Leadership (8+ Years): Moving into a manager or director role involves a significant leap in responsibility and pay. Your success is now measured by your team's output and your ability to shape the entire organization's compensation philosophy. This is where salaries can climb into the high $100s and beyond.

###

Geographic Location

Where you work has a massive impact on your paycheck. Companies adjust salary ranges based on the local cost of labor and cost of living. A job in a high-cost metropolitan area will pay significantly more than the exact same job in a rural area.

- High-Paying Metropolitan Areas: Major tech and finance hubs consistently offer the highest salaries for compensation analysts. According to Salary.com and BLS data, cities like San Jose, CA; San Francisco, CA; New York, NY; Boston, MA; and Washington, D.C. often pay 15-35% above the national average. A Senior Compensation Analyst earning $110,000 nationally might command $140,000 or more in the Bay Area.

- Average-Paying Areas: Many large cities fall around the national average. For instance, cities within the UNC System's sphere of influence, such as Raleigh, NC, and Charlotte, NC, offer competitive salaries that are generally in line with or slightly above the national median. While not as high as a coastal tech hub, the lower cost of living can make the effective take-home pay very attractive.

- Lower-Paying Areas: Salaries tend to be lower in smaller cities and more rural regions of the South and Midwest. These areas may offer salaries 10-20% below the national average. However, the significantly lower cost of living can sometimes offset the lower nominal wage.

- The Rise of Remote Work: The post-pandemic shift to remote work has complicated geographic pay. Some companies have adopted location-agnostic pay, paying the same regardless of where the employee lives. However, a more common approach is geo-differentiation, where companies adjust pay based on the employee's location, even if they are 100% remote. This is a hot topic in the compensation world and a challenge that analysts themselves are now tasked with solving.

###

Company Type & Size

The type of organization you work for is a major determinant of your salary and the nature of your work.

- Large Public Corporations (Fortune 500): These companies typically offer the most structured and often highest-paying compensation roles. They have large, specialized compensation teams and offer clear career progression. An analyst at a major tech firm like Google or a financial giant like JPMorgan Chase will likely have a higher base salary and a much larger bonus and equity potential than in any other sector.

- Startups and Pre-IPO Tech Companies: Startups might offer a lower base salary compared to their established corporate counterparts. However, they often compensate for this with significant equity (stock options), which can have a massive upside if the company is successful. The work is often more varied and less structured, offering a chance to build compensation programs from the ground up.

- Public Sector (Government and Higher Education): Working for an entity like the UNC System or a federal agency offers a different value proposition. As seen in public salary databases, base salaries may be slightly lower than in the top-tier private sector. However, this is often balanced by exceptional job security, robust defined-benefit pension plans, excellent work-life balance, and phenomenal benefits like tuition remission.

- Non-Profit Organizations: Non-profits typically operate with tighter budgets and tend to offer lower salaries than the for-profit sector. The trade-off for many who choose this path is the alignment of their work with a social cause or mission they are passionate about.

###

Area of Specialization

Within the broader field of compensation, several specializations exist, each commanding different skill sets and pay scales.

- Generalist/Broad-Based Compensation: This is the most common path, focusing on salary structures, merit cycles, and job evaluations for the majority of the employee population.

- Sales Compensation: This is a highly specialized and often lucrative niche. Sales compensation analysts design and administer complex commission and bonus plans for sales teams. Their work has a direct and measurable impact on revenue, and they are compensated accordingly. Experienced sales comp analysts often earn a premium over their generalist peers.

- Executive Compensation: This is the pinnacle of the profession in terms of complexity and pay. These analysts deal with compensation for C-suite executives, which includes base salary, annual bonuses, long-term equity awards, deferred compensation, and complex contracts. This work requires a deep understanding of finance, corporate governance, and SEC regulations. Senior and manager-level roles in executive compensation are among the highest-paid in the entire HR function.

- Global Compensation: For multinational corporations, these specialists manage compensation programs across different countries, navigating a maze of different currencies, labor laws, market data, and cultural norms. This specialization requires a global mindset and is highly valued.

- HRIS/Data Analytics Focus: Some analysts specialize more on the systems and data science side. They are experts in the HRIS (e.g., Workday), SQL, and data visualization tools (e.g., Tableau). They build the dashboards and models that the rest of the team uses. As compensation becomes more data-driven, these technical skills are in extremely high demand and command a salary premium.

###

In-Demand Skills

Beyond formal qualifications, possessing a specific set of high-value skills can directly translate into a higher salary offer and faster career progression.

- Advanced Microsoft Excel: This is non-negotiable. You must be a master of Excel, including complex formulas, VLOOKUP/INDEX-MATCH, pivot tables, and data modeling. This is the fundamental tool of the trade.

- SQL (Structured Query Language): The ability to pull and manipulate data directly from databases is a massive advantage. Job postings that require SQL often pay more than those that don't, as it allows for more sophisticated and independent analysis.

- Data Visualization Tools (Tableau, Power BI): Being able to not only analyze data but also present it in a clear, compelling, and visual way to non-technical audiences is a critical skill for influencing leadership. Creating interactive dashboards is a highly sought-after capability.

- HRIS Expertise (Workday, SAP SuccessFactors): Deep knowledge of a major HR Information System, particularly its advanced compensation module, makes you incredibly valuable. Companies invest millions in these systems and need experts to leverage them effectively.

- Statistical Analysis (R or Python): While not always required, knowledge of statistical programming languages is a game-changer. It allows for advanced pay equity analysis, predictive modeling, and a level of analytical rigor that sets you apart, especially for senior and data-focused roles.

- Financial Acumen: Understanding concepts like P&L statements, budgeting, and financial modeling is crucial for demonstrating the business impact of compensation programs.

By strategically developing these skills, pursuing relevant education and certifications, and targeting high-paying locations and industries, you can actively steer your career towards its maximum earning potential.

Job Outlook and Career Growth

Investing time and effort into a career path requires a clear understanding of its future viability. For compensation analysts, the outlook is stable and promising, driven by an ever-increasing corporate focus on data-driven decision-making, talent competition, and pay equity.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for "Compensation, Benefits, and Job Analysis Specialists" will grow by 7 percent from 2022 to 2032. This is faster than the average for all occupations. The BLS anticipates about 11,500 openings for these specialists each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different