Introduction

In the intricate machinery of modern business, where every partnership, acquisition, and transaction is codified in writing, the Contract Analyst stands as a crucial guardian. They are the meticulous architects and vigilant overseers of the documents that form the very bedrock of commerce. If you are a detail-oriented individual with a penchant for logic, a flair for negotiation, and a desire for a career that is both intellectually stimulating and financially rewarding, you may have found your calling. But beyond the intellectual challenge lies a practical question: what does a career as a Contract Analyst actually pay?

The answer is compelling. A career in contract analysis offers a robust salary trajectory that can climb well into the six-figure range, supported by a strong and growing demand for skilled professionals. While entry-level positions offer a competitive starting point, the earning potential for experienced, specialized analysts is substantial. I remember early in my career, consulting for a mid-sized tech company that was hemorrhaging money due to a series of poorly negotiated software licensing agreements. The Contract Analyst they finally hired not only renegotiated those deals, saving the company over a million dollars annually, but also implemented a new contract lifecycle management system that prevented such costly oversights from ever happening again. That single hire demonstrated, in stark financial terms, the immense value a skilled analyst brings to the table.

This guide is designed to be your definitive resource on the contract analyst salary. We will dissect every component of compensation, explore the critical factors that influence your earning power, and map out the career path from novice to seasoned expert. Whether you are a student contemplating your future, a professional considering a career change, or a current analyst aiming for the next level, this article will provide the data-driven insights and actionable advice you need to succeed.

### Table of Contents

- [What Does a Contract Analyst Do?](#what-does-a-contract-analyst-do)

- [Average contract analyst salary: A Deep Dive](#average-contract-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Contract Analyst Do?

At its core, a Contract Analyst is a professional responsible for the drafting, evaluation, negotiation, and execution of contracts. They act as a critical bridge between the legal, financial, and operational departments of an organization. Their primary goal is to ensure that all contracts entered into by the company are advantageous, compliant with all relevant laws and regulations, and minimize potential risks. They are not typically lawyers, but they possess a deep, practical understanding of contract law and business principles.

The role is far more dynamic than simply reading fine print. It requires a unique blend of analytical rigor, business acumen, and interpersonal finesse. A Contract Analyst must be able to decipher complex legal jargon, model the financial implications of contract terms, and effectively communicate and negotiate with both internal stakeholders (like sales teams and project managers) and external parties (like vendors, clients, and partners).

Core Responsibilities and Daily Tasks:

The day-to-day work of a Contract Analyst can vary significantly based on the industry and company, but it generally revolves around these key functions:

- Drafting and Preparation: Creating new contracts from scratch or using established templates for new deals, partnerships, or employment agreements. This involves ensuring all necessary clauses, terms, and conditions are included and clearly articulated.

- Review and Analysis: Scrutinizing incoming contracts from vendors, clients, or other third parties. The analyst will identify and flag any unfavorable terms, potential risks, ambiguities, or deviations from company policy.

- Negotiation: Collaborating with sales, procurement, or legal teams to negotiate contract terms. This involves redlining documents (proposing changes) and communicating directly with the other party to reach a mutually acceptable agreement.

- Contract Lifecycle Management (CLM): Managing the entire lifecycle of a contract, from initial request and drafting through negotiation, execution, renewal, and eventual termination. This often involves using specialized CLM software to track key dates (like renewal or termination deadlines), obligations, and compliance requirements.

- Risk Mitigation: Identifying and assessing potential financial, operational, and legal risks within a contract. They may suggest alternative language, insurance requirements, or liability caps to protect the company's interests.

- Compliance and Regulation: Ensuring all contracts adhere to internal corporate policies as well as external laws and industry-specific regulations (e.g., FAR/DFARS for government contracts, HIPAA for healthcare, GDPR for data privacy).

- Stakeholder Collaboration: Acting as the central point of contact for all contract-related inquiries. They work closely with virtually every department—from legal and finance to HR and sales—to ensure contracts align with business objectives.

### A Day in the Life of a Contract Analyst

To make this tangible, let's imagine a day for "Sarah," a Mid-Career Contract Analyst at a growing software-as-a-service (SaaS) company.

- 9:00 AM - 9:45 AM: Sarah starts her day by reviewing her dashboard in the company's CLM system. She sees an urgent alert: a major client's contract is up for renewal in 60 days. She also flags three new contract review requests that came in overnight from the European sales team.

- 9:45 AM - 11:00 AM: Her top priority is a high-value enterprise sales contract. The sales lead wants to offer a non-standard discount and a custom service-level agreement (SLA). Sarah analyzes the financial impact of the discount and reviews the proposed SLA for operational feasibility and risk. She redlines the document, suggesting language that protects the company while still meeting the client's needs, and sends her feedback to the sales lead.

- 11:00 AM - 12:00 PM: Sarah joins a video call with the procurement team and a potential new marketing analytics vendor. She leads the discussion on the vendor's Master Service Agreement, focusing on key clauses related to data privacy, liability limitations, and termination rights. Her deep knowledge of GDPR allows her to ask targeted questions that protect her company's data obligations.

- 1:00 PM - 3:00 PM: After lunch, Sarah focuses on creating a new contract template for influencer marketing agreements. The marketing team is scaling its efforts, and a standardized template will streamline the process and ensure consistency. She researches best practices and incorporates clauses covering content rights, FTC disclosure requirements, and payment terms.

- 3:00 PM - 4:30 PM: Sarah works through her queue of standard contract reviews, including a non-disclosure agreement (NDA) for a potential partnership and a renewal for an office supply vendor. Because these are more routine, she can process them efficiently, ensuring they comply with company policy before approving them for signature.

- 4:30 PM - 5:00 PM: She ends her day by updating the CLM system with the status of all active negotiations, uploading the executed NDA, and sending a reminder to the account manager about the upcoming client renewal she flagged in the morning.

This snapshot reveals a role that is both reactive (addressing urgent requests) and proactive (creating templates, managing renewals), requiring constant context-switching between legal detail, financial analysis, and strategic communication.

---

Average contract analyst salary: A Deep Dive

Now, let's get to the heart of the matter: compensation. The salary for a Contract Analyst is influenced by a multitude of factors, which we'll explore in the next section. However, by examining data from reputable sources, we can establish a clear baseline and understand the typical earning potential at various career stages.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) does not have a dedicated category for "Contract Analyst." Instead, this role is often grouped within broader categories like "Budget Analysts," "Management Analysts," or "Business Operations Specialists, All Other." Therefore, to get a precise picture, we must rely on data aggregated from real-world job postings and self-reported salaries on platforms like Salary.com, Payscale, and Glassdoor.

National Average Salary and Typical Range

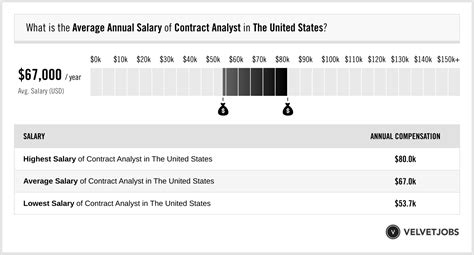

Across the United States, the salary for a Contract Analyst is highly competitive. Here's a summary of what the leading salary aggregators report as of late 2023 and early 2024:

- Salary.com reports the median salary for a Contract Analyst I (entry-level) is around $68,800, while a Contract Analyst III (senior) has a median salary of $107,300. The overall median for the role falls around $85,000. The typical salary range for all levels spans from approximately $60,000 to over $120,000.

- Payscale.com indicates an average base salary of approximately $72,500 per year. Their data shows a range from roughly $53,000 for the 10th percentile (likely early-career professionals) to $101,000 for the 90th percentile (experienced specialists).

- Glassdoor, which aggregates self-reported data, shows a total pay average of around $84,000, with a likely base salary range of $65,000 to $111,000.

Taking these sources together, a reasonable expectation for a mid-level Contract Analyst in the U.S. is a base salary in the $75,000 to $95,000 range. However, this is just the midpoint. Your personal earnings can be significantly higher or lower based on your experience, location, industry, and skillset.

### Salary by Experience Level

Salary progression in this field is strong and directly correlated with experience. As an analyst gains expertise, takes on more complex and high-value contracts, and demonstrates strategic value, their compensation rises accordingly.

Here is a typical salary progression, combining data from the sources mentioned above:

| Career Stage | Typical Years of Experience | Average Base Salary Range | Key Responsibilities & Focus |

| :--- | :--- | :--- | :--- |

| Entry-Level Contract Analyst | 0-2 years | $55,000 - $72,000 | Processing standard contracts (NDAs, SOWs), using templates, data entry into CLM systems, supporting senior analysts. |

| Mid-Career Contract Analyst | 3-8 years | $70,000 - $98,000 | Independently managing moderately complex contracts, redlining and negotiating terms, collaborating with business units, identifying risks. |

| Senior/Lead Contract Analyst | 9-15+ years | $95,000 - $130,000+ | Handling high-stakes, complex, and non-standard agreements, developing contract strategy, mentoring junior staff, managing key vendor/client relationships. |

| Contracts Manager/Director | 10+ years (with management) | $120,000 - $180,000+ | Overseeing the entire contract department, setting corporate policy, managing a team of analysts, reporting to executive leadership (e.g., General Counsel). |

*Disclaimer: These are national averages and can vary significantly. The upper end of these ranges is typically found in high-cost-of-living areas and high-paying industries like tech and pharmaceuticals.*

### Beyond the Base Salary: Understanding Total Compensation

A Contract Analyst's base salary is only one part of their overall compensation package. When evaluating a job offer, it's crucial to consider the "total rewards," which can add significant value.

- Annual Bonuses: This is a very common component of compensation for contract analysts. Bonuses are typically tied to individual performance (e.g., number of contracts processed, value of savings negotiated) and company performance (e.g., meeting revenue or profit targets). According to Payscale, annual bonuses can range from $2,000 to $15,000 or more, depending on seniority and performance.

- Profit Sharing: Some companies, particularly private or smaller firms, offer profit-sharing plans. This can add an additional 3% to 10% of one's salary in a good year, directly tying the analyst's compensation to the company's success.

- Retirement Benefits: A strong 401(k) or 403(b) plan with a generous company match is a significant part of long-term compensation. A 50% match on the first 6% of your contributions, for example, is equivalent to an extra 3% of your salary each year.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a standard expectation. The value of a good plan with low deductibles and premiums can be worth thousands of dollars annually. Many companies also offer wellness stipends for gym memberships or mental health services.

- Professional Development Funds: Companies that invest in their employees often provide a budget for professional development. This can be used to pay for valuable certifications from organizations like the National Contract Management Association (NCMA), attend industry conferences, or take specialized legal or business courses. This is an investment that pays dividends in future salary growth.

- Stock Options or Restricted Stock Units (RSUs): In publicly traded companies or tech startups, equity can be a major component of compensation. RSUs or stock options can become extremely valuable over time, potentially dwarfing the annual salary, especially in a successful, high-growth company.

When comparing job offers, it's essential to look beyond the base salary and calculate the potential value of the entire compensation and benefits package. A job with a slightly lower base salary but with a substantial bonus potential and excellent benefits may ultimately be the more lucrative option.

---

Key Factors That Influence Salary

While national averages provide a useful benchmark, a Contract Analyst's actual salary is a mosaic of several interlocking factors. Understanding these variables is the key to maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of what moves the needle on compensation.

### 1. Level of Education and Certifications

Your educational background is the foundation upon which your career is built. While a specific "Contract Analysis" degree is rare, certain fields of study and advanced credentials directly correlate with higher starting salaries and faster advancement.

- Bachelor's Degree (The Standard): A bachelor's degree is the minimum requirement for virtually all Contract Analyst positions. The most relevant and sought-after majors include:

- Business Administration: Provides a strong foundation in finance, management, and operations, which is essential for understanding the business implications of contracts.

- Finance/Accounting: Highly valued for roles that involve analyzing the financial risks and benefits of contract terms, pricing structures, and payment schedules.

- Pre-Law/Paralegal Studies: Directly equips candidates with an understanding of legal principles, terminology, and document structure, making the learning curve much less steep.

- Advanced Degrees (The Accelerators):

- Juris Doctor (JD): While not always required, a law degree is a significant differentiator and can command a substantial salary premium, often $15,000 to $25,000 or more annually. Companies are willing to pay more for analysts who can provide a near-attorney level of review, reducing the reliance on the in-house legal department. JD-holders are often fast-tracked to Senior Analyst or Contracts Manager roles, especially in legally complex industries.

- Master of Business Administration (MBA): An MBA is particularly valuable for roles with a heavy strategic or financial focus. It signals a deep understanding of business strategy, financial modeling, and risk management. Analysts with an MBA are well-positioned for leadership roles and can often negotiate higher compensation, particularly in large corporate environments.

- Professional Certifications (The Specializers): Certifications are one of the most effective ways to validate your expertise and increase your market value. The premier certifying body in the field is the National Contract Management Association (NCMA).

- Certified Commercial Contracts Manager (CCCM): Focuses on commercial-sector contracting.

- Certified Federal Contracts Manager (CFCM): The gold standard for those in or aspiring to government contracting. Essential for understanding the Federal Acquisition Regulation (FAR).

- Certified Professional Contracts Manager (CPCM): The most prestigious certification, demonstrating mastery of the entire contract management competency framework. Achieving a CPCM can significantly boost earning potential and open doors to senior leadership positions.

Holding one or more of these certifications signals a commitment to the profession and can justify a salary 5% to 15% higher than that of non-certified peers with similar experience.

### 2. Years of Experience

As highlighted in the previous section, experience is arguably the single most powerful driver of salary growth. The value you provide evolves from tactical execution to strategic oversight.

- 0-2 Years (The Foundation Phase): At this stage, you are learning the ropes. Your value lies in your ability to learn quickly, your attention to detail on standard documents, and your support of the team. Salary is reflective of this training period.

- 3-8 Years (The Growth Phase): You are now a trusted, independent contributor. You handle complex negotiations, manage important vendor or client accounts, and are the go-to person for specific types of contracts. This is where the most significant percentage-based salary growth occurs as you prove your value. You can expect your salary to increase by 30% to 50% or more from your starting point.

- 9+ Years (The Strategic Phase): You are no longer just managing contracts; you are managing risk and strategy for the company. You handle multi-million-dollar deals, develop company-wide contracting policies and templates, and mentor junior analysts. Your salary reflects your status as an expert and a leader. Senior analysts in high-demand specializations can easily command salaries north of $130,000, with managers and directors earning significantly more.

### 3. Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted for the local cost of living and the concentration of companies that require contract analysis expertise.

- High-Paying Metropolitan Areas: Major business hubs and tech centers consistently offer the highest salaries. This is driven by intense competition for talent and a higher cost of living.

- San Jose, CA & San Francisco, CA: The heart of Silicon Valley. Tech companies pay a premium for analysts who understand SaaS agreements, intellectual property, and data privacy. Salaries here can be 25-40% above the national average.

- New York, NY: A hub for finance, media, and international business. Expertise in financial services contracts or large corporate agreements is highly valued. Expect salaries 20-35% above average.

- Washington, D.C.: The epicenter of government contracting. Analysts with deep knowledge of FAR and DFARS are in constant demand by federal agencies and the thousands of government contractors in the region. Salaries are often 20-30% above average.

- Boston, MA & Seattle, WA: Major hubs for biotechnology, pharmaceuticals, and technology, all of which rely on complex, high-stakes contracts. Expect salaries 15-25% above average.

- Mid-Tier and Lower-Paying Regions: Salaries tend to be closer to or slightly below the national average in smaller cities and regions with a lower cost of living and fewer large corporate headquarters. However, the purchasing power of a salary in cities like Kansas City, MO, or Indianapolis, IN, can still be very strong.

- The Rise of Remote Work: The shift to remote work has complicated geographic pay scales. Some companies have adopted location-agnostic pay, while others adjust salaries based on the employee's location, even if the role is fully remote. This is a critical point to clarify during the interview process. A remote role based out of a San Francisco company may still pay a premium, even if you live in a lower-cost area.

### 4. Company Type and Size

The type of organization you work for will define your role, your responsibilities, and your compensation structure.

- Large Corporations (e.g., Fortune 500):

- Salary: Generally offer high base salaries, structured pay bands, and strong benefits packages.

- Environment: Roles are often more specialized. You might focus exclusively on IT procurement contracts or sales agreements. The path for advancement is clear but can be competitive.

- Startups and High-Growth Tech Companies:

- Salary: Base salary may be at or slightly below the market rate, but this is often supplemented with potentially lucrative stock options or equity. Total compensation can be very high if the company succeeds.

- Environment: Roles are much broader. A single analyst might handle sales, vendor, HR, and partnership agreements. It's a high-pressure, fast-paced environment that offers incredible learning opportunities.

- Government (Federal, State, Local):

- Salary: Highly structured and transparent, based on established pay scales like the General Schedule (GS) for federal employees. A Contract Analyst might start at a GS-9 or GS-11 level and advance to GS-13 or GS-14, with salaries ranging from ~$60,000 to over $130,000 depending on the level and location.

- Environment: The work is stable, and the benefits (pension, healthcare) are typically excellent. The focus is exclusively on public-sector procurement, requiring deep specialized knowledge of acquisition regulations.

- Non-Profits and Universities:

- Salary: Tend to be on the lower end of the spectrum compared to for-profit entities.

- Environment: Often mission-driven. Roles might focus on grant agreements, research contracts, and vendor management. The work-life balance can be a significant benefit.

### 5. Area of Specialization

Generalist contract analysts are always needed, but specialists who possess deep knowledge of a particular industry's unique contracting challenges can command premium salaries.

- Information Technology (IT) / Technology: This is one of the highest-paying specializations. It requires understanding complex terms related to software licensing (SaaS, on-premise), cloud services (IaaS, PaaS), data privacy (GDPR, CCPA), cybersecurity, and SLAs. Tech Contract Analysts are vital and well-compensated.

- Government Contracting: As mentioned, this is a highly lucrative and stable field. Expertise in the Federal Acquisition Regulation (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS) is a rare and valuable skill that companies will pay a premium for.

- Pharmaceuticals / Biotechnology / Healthcare: This sector is governed by a web of complex regulations (e.g., HIPAA, FDA regulations). Analysts who can navigate contracts for clinical trials, research agreements, and medical device procurement are in high demand and command high salaries.

- Energy / Oil & Gas: Involves large-scale, high-risk projects with complex contracts covering exploration, joint ventures, construction, and environmental compliance. Expertise here is highly valued.

- Construction & Real Estate: Requires knowledge of construction law, liens, subcontractor agreements, and lease agreements. It's a specialized field with strong earning potential.

### 6. In-Demand Skills

Beyond your formal background, a specific set of hard and soft skills can directly increase your salary. These are the skills to highlight on your resume and develop throughout your career.

- Hard Skills:

- Contract Lifecycle Management (CLM) Software Proficiency: Expertise in leading CLM platforms like Icertis, Conga, SAP