The world of C-suite executive compensation is often a subject of intense curiosity, with salaries and total pay packages reaching figures that can be difficult to comprehend. A query like "SanDisk David Goeckeler salary" is a perfect example, pointing to the compensation of a top leader in the global technology and data storage industry. While a specific individual's salary isn't a career path in itself, it serves as an excellent case study for understanding the role, responsibilities, and earning potential of a Chief Executive Officer (CEO) at a major publicly traded tech company.

Executive compensation isn't just a salary; it's a complex package of salary, bonuses, and equity often totaling tens of millions of dollars, designed to reward leadership and drive shareholder value. This article will deconstruct the compensation of a tech CEO, using David Goeckeler as an example, and explore the factors that shape this high-stakes career.

What Does a Tech CEO Like David Goeckeler Do?

Before diving into the numbers, it's essential to understand the role. David Goeckeler is the CEO of Western Digital, the parent company of the well-known SanDisk brand. A CEO at this level is the highest-ranking executive, responsible for the overall success and strategic direction of the entire organization.

Key responsibilities include:

- Setting the Vision: Defining the company's long-term strategy, mission, and vision in a rapidly evolving tech landscape.

- Making Major Corporate Decisions: Overseeing all major strategic, financial, and operational decisions, from large-scale acquisitions to significant capital investments.

- Managing People and Resources: Leading the executive team, allocating capital, and ensuring the company has the talent and resources to achieve its goals.

- Being the Public Face: Acting as the primary liaison between the board of directors, shareholders, employees, and the public. They are the chief communicator and brand ambassador.

- Driving Performance: Ultimately, the CEO is accountable for the company's performance, including revenue growth, profitability, and stock market valuation.

Average CEO Salary and Compensation Structure

It is crucial to differentiate between "salary" and "total compensation." For a top executive, the base salary is often just a fraction of their total earnings. Total compensation is a package that includes a base salary, performance-based cash bonuses, and, most significantly, equity awards (stock and options).

Let's use David Goeckeler as a specific, publicly-documented example. According to Western Digital's 2023 Proxy Statement filed with the U.S. Securities and Exchange Commission (SEC), Mr. Goeckeler's total compensation for the fiscal year 2023 was approximately $33.4 million. This was composed of:

- Base Salary: ~$1.4 million

- Stock Awards: ~$32 million

- All Other Compensation: ~$70,000

This illustrates a key point: over 95% of his compensation was "at-risk" pay, tied directly to the company's performance and stock value.

Looking more broadly, Salary.com reports that the median total compensation for a CEO at a large public company (over $10 billion in revenue) in the United States is around $15.7 million as of early 2024. However, this can range dramatically, with top-tier tech CEOs often earning significantly more, well into the tens or even hundreds of millions, depending on stock performance.

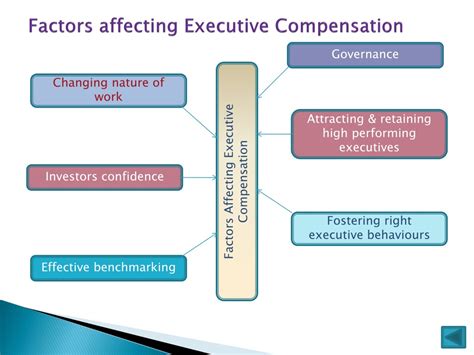

Key Factors That Influence CEO Compensation

The compensation of a CEO is not arbitrary. It is determined by a company's board of directors (specifically, the compensation committee) and is influenced by a number of powerful factors.

### Years of Experience

There is no "entry-level" CEO role at a company like Western Digital. The position is the culmination of a long and successful career. CEOs typically have decades of experience, having risen through the ranks of one or more major corporations. For example, before joining Western Digital, David Goeckeler spent 19 years at Cisco, where he was the Executive Vice President and General Manager of the multi-billion dollar Networking and Security Business. This extensive, high-level experience is a prerequisite and a primary driver of compensation.

### Level of Education

While experience is paramount, education is the foundational ticket to the game. The vast majority of Fortune 500 CEOs hold at least a bachelor's degree, and many possess advanced degrees. According to a study by Korn Ferry, over two-thirds of S&P 500 CEOs have a graduate degree, with the Master of Business Administration (MBA) being the most common. Mr. Goeckeler holds a master's degree in computer science from the University of Illinois and an MBA from Columbia University, a combination of technical and business acumen highly valued in the tech industry.

### Company Type and Size

This is one of the most significant factors.

- Public vs. Private: CEOs of publicly traded companies, whose compensation is disclosed in SEC filings, generally earn far more than those at private companies. This is due to greater scale, complexity, and the use of stock-based compensation tied to a public market valuation.

- Revenue and Market Cap: Compensation is directly correlated with the size of the company. A CEO running a $40 billion company like Western Digital has vastly more responsibility than one running a $500 million company. Reports by firms like Equilar consistently show a strong positive correlation between company revenue and CEO pay.

### Geographic Location

For C-suite roles, geographic location matters less in terms of a simple cost-of-living adjustment and more in terms of the business ecosystem. A company headquartered in a major tech hub like Silicon Valley, where Western Digital is based, operates in a highly competitive market for executive talent. Boards in these locations often benchmark compensation against other major tech giants, leading to higher pay packages compared to companies based in other regions.

### Area of Specialization (Industry and Performance)

The industry plays a massive role. CEOs in sectors like technology, finance, and healthcare historically receive higher compensation than those in manufacturing or utilities. However, the most critical factor within an industry is company performance. Modern executive compensation is heavily weighted towards performance-based stock awards. If the company's stock price soars and it meets its financial targets, the CEO's total compensation can skyrocket. If it underperforms, the value of those stock awards can plummet, significantly reducing their take-home pay.

Job Outlook for Top Executives

The path to the C-suite is exceptionally competitive. The U.S. Bureau of Labor Statistics (BLS) groups CEOs under the category of "Top Executives." The BLS projects employment for top executives to grow by 3 percent from 2022 to 2032, which is about as fast as the average for all occupations.

While the overall number of new CEO positions is limited (as it's tied to the number of large companies), the demand for skilled, visionary, and adaptable leaders remains perpetually high. The need for executives who can navigate global supply chains, cybersecurity threats, artificial intelligence disruption, and economic uncertainty ensures that top-tier talent will always be sought after and highly rewarded.

Conclusion

Analyzing "David Goeckeler's salary" provides a fascinating window into the world of elite executive compensation. The key takeaways for any aspiring professional are clear:

- Focus on Total Compensation: Understand that for senior executives, a base salary is only a small part of a much larger, performance-driven pay package.

- The Path is a Marathon: Reaching the C-suite is the result of decades of proven performance, continuous learning, and strategic career moves.

- Performance is Paramount: Your value, and ultimately your compensation, will be directly tied to the results you can deliver for the organization.

- Blend Your Skills: A combination of deep industry expertise (like technology) and broad business acumen (like an MBA) is a powerful formula for leadership.

While a CEO's compensation package is astronomical, it reflects the immense responsibility, intense pressure, and global scale of the role. For those with the ambition, resilience, and strategic vision, the path to executive leadership remains one of the most challenging and rewarding in the professional world.