Considering a career in the high-stakes world of corporate banking? You're likely drawn to its dynamic nature, intellectual challenges, and significant earning potential. A role in corporate banking is more than just a job; it's a launchpad for a financially rewarding and influential career. Salaries in this field are highly competitive, with entry-level professionals often starting in the high five figures and senior leaders earning well into the six-figure range, complemented by substantial bonuses.

This guide will break down everything you need to know about a corporate banker's salary, from average compensation figures to the key factors that can dramatically increase your earnings.

What Does a Corporate Banker Do?

Before diving into the numbers, it's essential to understand the role. A corporate banker acts as the primary financial partner for large corporations, institutions, and sometimes government agencies. They are the face of the bank to its most important clients.

Key responsibilities include:

- Relationship Management: Building and maintaining long-term relationships with corporate clients.

- Providing Financial Solutions: Offering a suite of products and services, including large-scale loans, lines of credit, cash management services, and trade finance solutions.

- Credit Analysis: Evaluating a company's financial health to assess the risk of lending money.

- Deal Structuring & Execution: Working with internal teams (like investment banking and capital markets) to structure and execute complex financial transactions for clients.

In essence, a corporate banker helps large businesses manage their capital and achieve their strategic financial goals.

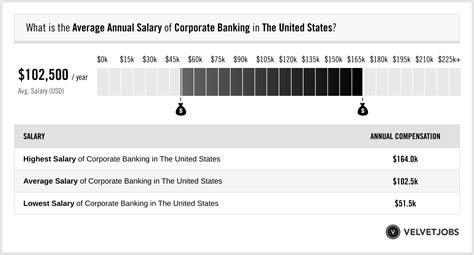

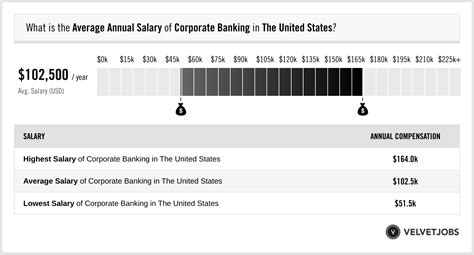

Average Corporate Banking Salary

Compensation in corporate banking is typically structured with a strong base salary and a significant annual performance bonus. This bonus can range from 20% to over 100% of the base salary, depending on individual, group, and bank performance.

While exact figures vary, we can establish a reliable baseline by synthesizing data from reputable sources like Salary.com, Glassdoor, and industry reports.

- Entry-Level (Analyst): Professionals entering the field, typically after completing an undergraduate degree, can expect a base salary between $85,000 and $115,000. With a year-end bonus, total first-year compensation often falls between $110,000 and $150,000.

- Mid-Career (Associate / Assistant Vice President): After 2-3 years or upon entering with an MBA, an Associate's base salary increases to $130,000 to $180,000. Total compensation, including a larger bonus, typically ranges from $180,000 to $250,000.

- Senior-Level (Vice President / Director): With significant experience and a strong client portfolio, a Vice President (VP) can command a base salary from $190,000 to $275,000. Their total compensation, heavily influenced by performance bonuses, often reaches $300,000 to $500,000+.

- Executive Level (Managing Director): At the highest level, Managing Directors (MDs) are responsible for leading teams and driving business strategy. Their base salaries often start around $300,000 to $500,000, with total compensation packages frequently exceeding $1,000,000 through large bonuses and other incentives.

*(Sources: Data synthesized from 2024 reports by Glassdoor, Salary.com, and industry recruitment specialists.)*

Key Factors That Influence Salary

Your specific salary within these ranges is determined by several critical factors. Understanding these levers is key to maximizing your earning potential throughout your career.

### Level of Education

While a bachelor's degree in finance, economics, or accounting is the standard entry requirement, advanced education can provide a significant salary boost and accelerate your career trajectory. A Master of Business Administration (MBA), particularly from a top-tier business school, is highly valued. MBA graduates often enter directly at the Associate level, bypassing the Analyst program and starting at a substantially higher salary than their undergraduate counterparts. Professional certifications like the Chartered Financial Analyst (CFA) can also enhance credibility and earning potential.

### Years of Experience

Experience is arguably the most significant driver of salary growth in corporate banking. The career path is well-defined, with compensation increasing substantially at each promotional step.

- Analyst (0-3 Years): Focuses on financial modeling, credit analysis, and preparing presentations.

- Associate (3-6 Years): Takes on more client-facing responsibilities and begins managing parts of the deal process.

- Vice President (6-10+ Years): Manages key client relationships, leads deal teams, and is responsible for generating revenue.

- Director / Managing Director (10+ Years): Drives strategy, originates major deals, and manages a large book of business.

Each promotion comes with a significant jump in both base salary and bonus potential, rewarding expertise and a proven track record.

### Geographic Location

Where you work matters immensely. Banks in major financial hubs pay a premium to attract top talent and account for a higher cost of living. According to data from salary aggregators and professional recruiters, compensation follows a tiered structure.

- Top Tier (Highest Pay): New York City, San Francisco

- Second Tier: Chicago, Charlotte, Los Angeles

- Third Tier: Houston, Dallas, Atlanta

For example, a VP in New York may earn a 15-25% higher base salary than a counterpart with the same level of experience in Atlanta.

### Company Type

The type of bank you work for directly impacts your compensation.

- Bulge Bracket Banks (e.g., J.P. Morgan, Bank of America, Citigroup): These global financial giants generally offer the highest compensation packages, including larger bonuses. The work is demanding and highly competitive.

- Middle Market Banks (e.g., Truist, KeyBank, U.S. Bank): These banks serve mid-sized corporations and offer very competitive salaries that are often close to bulge bracket levels, sometimes with a better work-life balance.

- Boutique and Regional Banks: While their overall compensation might be slightly lower than the top-tier banks, they can offer excellent specialized experience and strong regional connections.

### Area of Specialization

Within corporate banking, certain specializations are more lucrative than others. This is often tied to the complexity and profitability of the products or industries served.

- Industry Groups: Bankers covering high-growth or transaction-heavy sectors like Technology, Media & Telecom (TMT), Healthcare, or Energy often see higher bonuses due to greater deal flow.

- Product Groups: Specialized teams like Leveraged Finance, which deals with high-yield debt for buyouts and acquisitions, are known for being among the highest-paid areas within corporate and investment banking due to the high-risk, high-reward nature of their work.

Job Outlook

The future for financial professionals, including corporate bankers, looks bright. While the U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Corporate Banker," the closely related professions of Financial Analysts and Loan Officers provide strong positive indicators.

The BLS projects that employment for Financial Analysts will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations. This growth is driven by the increasing complexity of financial products and the need for in-depth geographic and industry expertise. For Loan Officers, while overall growth is slower, the demand for specialists in commercial and corporate lending remains robust as businesses continue to seek capital for expansion and operations.

*(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook)*

Conclusion

A career in corporate banking offers a clear path to a high income, but it demands strong analytical skills, dedication, and excellent interpersonal abilities. Your earning potential is not static; it is something you can actively influence.

Key Takeaways:

- High Earning Potential: Total compensation starts strong and grows significantly, with senior professionals earning well over $300,000 annually.

- Bonuses are Key: Performance-based bonuses are a major component of your total earnings.

- Experience Pays: Salary grows substantially with each promotion from Analyst to Managing Director.

- Strategic Choices Matter: Your choice of location, employer, and specialization will directly impact your salary.

- Strong Outlook: The demand for skilled financial professionals remains strong, promising a stable and prosperous career path.

For those willing to invest in their education and build a strong track record, corporate banking offers one of the most financially rewarding and professionally stimulating careers in the finance industry.