In the intricate machinery of any successful corporation, there is a role that acts as the company's financial heart, pumping the lifeblood of capital to where it's needed most, protecting it from risk, and ensuring its long-term health. This role is the Treasury Manager. It’s a career that combines the analytical rigor of a mathematician, the strategic foresight of a chess grandmaster, and the negotiation skills of a diplomat. For those drawn to the high-stakes world of corporate finance, the path of a Treasury Manager offers not just intellectual stimulation but also substantial financial rewards. The question on many aspiring professionals' minds is, "What exactly is the treasury manager salary?" The answer is as complex and multifaceted as the role itself, with a national median salary often exceeding $145,000, and top earners pushing well past the $200,000 mark with bonuses and incentives.

During my early years as a financial consultant, I witnessed a treasury team at a mid-sized manufacturing firm navigate the volatile currency fluctuations of an unexpected geopolitical event. While chaos erupted in the markets, their calm, data-driven approach to hedging saved the company millions in potential losses. It was a powerful lesson that treasury isn't just about managing cash; it's about safeguarding the future. This guide is designed to be your definitive resource, pulling back the curtain on compensation, career trajectory, and what it truly takes to succeed in this critical and lucrative field.

### Table of Contents

- [What Does a Treasury Manager Do?](#what-does-a-treasury-manager-do)

- [Average Treasury Manager Salary: A Deep Dive](#average-treasury-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Treasury Career Right for You?](#conclusion-is-a-treasury-career-right-for-you)

What Does a Treasury Manager Do?

Before we dive into the numbers, it's essential to understand the immense responsibility that commands a six-figure salary. A Treasury Manager is the primary steward of a company's financial assets. Their core mission is to ensure the organization has the right amount of cash, in the right currency, in the right place, at the right time, while managing and mitigating financial risks. They operate at the strategic intersection of accounting, finance, and economics.

Unlike an accountant who primarily looks backward at historical financial data, the Treasury Manager is fundamentally forward-looking. They are constantly forecasting, modeling, and planning for the company's future liquidity needs and risk exposures.

Core Responsibilities of a Treasury Manager include:

- Cash Management: This is the bedrock of the treasury function. It involves monitoring daily cash balances, managing bank accounts, and optimizing cash levels to ensure operational needs are met without holding excess, non-productive cash. This includes managing complex systems for cash concentration, pooling, and disbursements.

- Liquidity and Cash Forecasting: Treasury Managers develop sophisticated short-term and long-term cash flow forecasts. These models are crucial for identifying future funding gaps or investment opportunities and are used by senior leadership (like the CFO) to make strategic decisions about capital allocation.

- Risk Management: This is a vast and critical area. The Treasury Manager is responsible for identifying, measuring, and mitigating financial risks, which primarily include:

- Foreign Exchange (FX) Risk: For multinational companies, this involves hedging against adverse movements in currency exchange rates.

- Interest Rate Risk: Managing the company's exposure to fluctuations in interest rates on its debt and investments.

- Commodity Risk: In certain industries (e.g., manufacturing, airlines), hedging against the price volatility of raw materials.

- Counterparty Risk: Assessing the creditworthiness of banks and other financial partners.

- Bank Relationship Management: They are the primary point of contact for the company's banking partners. This involves negotiating bank fees, credit facilities, and other financial services, and ensuring the company receives best-in-class service.

- Debt and Investment Management: Treasury Managers oversee the company's debt portfolio, ensuring compliance with covenants and managing repayment schedules. On the other side, they manage the investment of the company's surplus cash, seeking to maximize returns while adhering to strict investment policies focused on capital preservation and liquidity.

- Capital Markets and Funding: When a company needs to raise money, the Treasury Manager is heavily involved in activities like issuing bonds, securing loans, or managing credit facilities.

---

### A Day in the Life of a Treasury Manager

To make this more concrete, let's imagine a typical day for a Treasury Manager at a mid-sized technology firm with international operations.

- 7:30 AM: The day begins by logging into the Treasury Management System (TMS) and various banking portals. The first task is to review the prior day's closing cash positions across all global bank accounts. They analyze any unexpected variances and ensure all planned payments were executed correctly.

- 8:30 AM: Review overnight market news, paying close attention to foreign exchange rates (especially USD/EUR and USD/JPY) and interest rate movements. A quick check of the company’s stock price and credit default swap levels provides a pulse on market sentiment.

- 9:00 AM: Daily cash forecasting meeting with the treasury analyst. They update the 13-week cash flow forecast with new data from accounts payable, accounts receivable, and sales. They identify a potential cash shortfall in the European entity in two weeks and begin planning an intercompany loan to cover it.

- 10:30 AM: Conference call with one of their main relationship banks. They are renegotiating the terms of a revolving credit facility and discussing new fraud prevention services the bank is offering.

- 12:00 PM: Lunch while reading industry reports from the Association for Financial Professionals (AFP) on new trends in treasury technology.

- 1:00 PM: Project work. The current major project is implementing a new module in their TMS to automate hedge accounting. This involves meeting with the IT and accounting teams to ensure the system specifications meet everyone’s needs and comply with accounting standards (ASC 815).

- 3:00 PM: The CFO requests an ad-hoc analysis on the potential impact of a 50-basis-point interest rate hike by the Federal Reserve on the company's debt service costs for the next fiscal year. The Treasury Manager builds a sensitivity analysis model in Excel to present the financial impact.

- 4:30 PM: Prepare the daily/weekly treasury dashboard for senior management. This report summarizes key metrics: total cash, debt outstanding, investment portfolio performance, and FX exposures.

- 5:30 PM: Final check of end-of-day cash positions and a quick review of the plan for tomorrow before heading home.

This "day in the life" illustrates the dynamic blend of routine monitoring, strategic analysis, and project-based work that defines the role. It's a demanding but highly engaging career for those who thrive on making a tangible impact on a company's financial stability and success.

Average Treasury Manager Salary: A Deep Dive

The compensation for a Treasury Manager is a direct reflection of the critical nature of their work. They are entrusted with managing a company's most vital resource—its cash—and their expertise directly impacts profitability and shareholder value. As such, their salaries are highly competitive and often come with significant performance-based incentives.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups Treasury Managers under the broader category of "Financial Managers." While this category is useful for understanding the general health of the profession, more specialized salary aggregators provide a clearer picture specifically for treasury roles.

### National Average and Salary Range

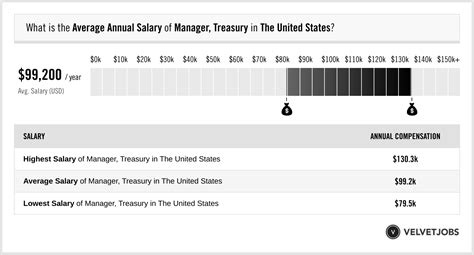

Based on data from multiple reputable sources, the compensation landscape for a Treasury Manager in the United States is robust.

- Salary.com: As of early 2024, Salary.com reports the median base salary for a Treasury Manager in the U.S. is $145,502. The typical salary range falls between $129,754 and $164,577. This range generally excludes bonuses and other forms of compensation.

- Payscale.com: Payscale provides a slightly broader range, showing an average base salary of approximately $118,500. Their data indicates that salaries can range from $83,000 for those in the 10th percentile (likely early-career or in smaller companies) to over $158,000 for the 90th percentile, before accounting for additional compensation.

- Glassdoor.com: Combining base salary and additional pay (bonuses, profit sharing), Glassdoor reports the median total pay for a Treasury Manager is $167,823 per year as of late 2023. The "likely range" for total pay spans from $134,000 to $212,000.

Consolidated View: Taking these sources together, a reasonable expectation for a mid-career Treasury Manager at a mid-to-large-sized company is a base salary in the $125,000 to $160,000 range, with total compensation pushing into the $150,000 to $190,000+ bracket when bonuses are included.

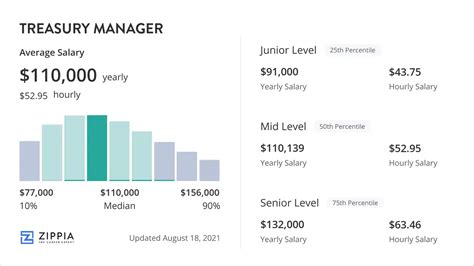

### Salary by Experience Level

Compensation grows significantly with experience, responsibility, and demonstrated expertise. A professional's journey from analyst to director sees substantial increases in earning potential.

| Experience Level | Typical Job Title(s) | Typical Base Salary Range | Typical Total Compensation Range (with Bonus) |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 Years) | Treasury Analyst, Financial Analyst | $65,000 - $90,000 | $70,000 - $100,000 |

| Mid-Career (4-9 Years) | Treasury Manager, Senior Treasury Analyst | $110,000 - $150,000 | $125,000 - $180,000 |

| Senior/Experienced (10+ Years)| Senior Treasury Manager, Treasury Director | $150,000 - $200,000+ | $180,000 - $275,000+ |

| Executive Level (15+ Years)| VP of Treasury, Treasurer | $220,000 - $350,000+ | $300,000 - $750,000+ (significant equity component) |

*Source: Consolidated analysis of Salary.com, Payscale, Glassdoor, and industry recruitment reports.*

### Beyond the Base Salary: Unpacking Total Compensation

A Treasury Manager's base salary is only one piece of the puzzle. Total compensation is a much more accurate reflection of their earnings and often includes several lucrative components.

- Annual Bonuses: This is the most common form of additional compensation. Bonuses are typically tied to a combination of company performance (e.g., meeting revenue or profit targets) and individual performance (e.g., successfully implementing a new TMS, achieving cost savings on bank fees, or outperforming investment benchmarks). For a Treasury Manager, an annual bonus of 10% to 25% of their base salary is standard. For Senior Managers and Directors, this can climb to 30% to 50% or more.

- Profit Sharing: Some companies, particularly privately held ones, offer a profit-sharing plan where a portion of the company's profits is distributed to employees. This can add a significant, albeit variable, amount to annual income.

- Long-Term Incentives (LTI): Especially prevalent in publicly traded companies and high-growth startups, LTIs are designed to retain top talent. These can include:

- Stock Options: The right to buy company stock at a predetermined price, which becomes valuable if the stock price rises.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of several years. Once vested, they are owned by the employee and have immediate cash value.

- Performance Shares: These are RSUs where the amount of stock you receive is tied to the company achieving specific long-term performance goals.

- Retirement and Benefits: While not direct cash compensation, a strong benefits package is a crucial part of the overall value proposition. This includes a 401(k) or 403(b) with a generous company match, comprehensive health, dental, and vision insurance, life and disability insurance, and generous paid time off (PTO).

When evaluating a job offer, it is critical to look beyond the base salary and calculate the total potential value of the compensation package. A role with a slightly lower base salary but a substantial, achievable bonus and strong long-term incentives could ultimately be far more lucrative.

Key Factors That Influence Salary

The wide salary ranges discussed above are driven by a confluence of factors. Understanding these variables is key for both aspiring professionals who want to maximize their earning potential and for companies seeking to attract top treasury talent. This section provides an exhaustive breakdown of what truly moves the needle on a treasury manager's paycheck.

###

1. Level of Education and Professional Certifications

Your academic and professional credentials serve as the foundation of your career and have a direct impact on your starting salary and long-term earning potential.

Educational Degrees:

- Bachelor's Degree: A bachelor's degree in Finance, Accounting, or Economics is the standard entry requirement for a career in treasury. It provides the essential knowledge of financial principles, markets, and analytical methods. Candidates with a strong GPA from a reputable university will have a competitive edge for entry-level analyst roles.

- Master's Degree (MBA or Master's in Finance): While not always required to become a Treasury Manager, an advanced degree can be a powerful accelerator.

- An MBA (Master of Business Administration), particularly from a top-tier program, is highly valued. It signals a mastery of not just finance but also strategy, leadership, and operations. An MBA can often help a professional command a 15-25% higher salary and is frequently a prerequisite for senior leadership roles like Treasury Director or VP of Treasury.

- A Master's in Finance (MScF) or a similar specialized degree provides deep, technical expertise in financial theory, quantitative analysis, and derivatives. This is particularly valuable for roles with a heavy focus on complex risk management or capital markets.

Professional Certifications:

Certifications are a critical way to demonstrate specialized expertise and a commitment to the profession. They are often a key differentiator in a competitive job market.

- Certified Treasury Professional (CTP): This is the gold standard certification for the treasury profession, administered by the Association for Financial Professionals (AFP). Earning the CTP designation validates your expertise in liquidity management, capital management, and risk management. Many job descriptions for Treasury Manager and above either require or strongly prefer the CTP. Holding a CTP can add 5% to 15% to a professional's salary compared to a non-certified peer with similar experience.

- Certified Public Accountant (CPA): While focused on accounting, the CPA is highly respected in the finance world. It demonstrates a deep understanding of financial reporting, regulations, and internal controls, all of which are relevant to treasury (e.g., hedge accounting, SOX compliance).

- Chartered Financial Analyst (CFA): The CFA charter is the premier designation for investment management professionals. For treasury roles with a significant investment management component (e.g., managing a large corporate investment portfolio), the CFA is extremely valuable and can command a significant salary premium.

###

2. Years of Experience and Career Progression

Experience is arguably the single most important factor in determining salary. The treasury field values a proven track record of successfully navigating complex financial situations.

- 0-3 Years (Treasury Analyst): At this stage, professionals are learning the ropes. Their work involves daily cash reporting, wire transfers, forecast data entry, and supporting senior team members. Base salaries typically range from $65,000 to $90,000. The focus is on building a solid technical foundation.

- 4-9 Years (Treasury Manager / Senior Analyst): After gaining foundational experience, a professional can step into a manager role. They take ownership of key processes like cash forecasting, bank relationship management, and basic hedging. They begin to manage a small team or complex projects. This is where salaries jump significantly into the $110,000 to $150,000 base range.

- 10-15 Years (Senior Treasury Manager / Director): With a decade of experience, professionals take on more strategic responsibilities. They might oversee a specific region (e.g., North American Treasury Director), a specific function (e.g., Director of Capital Markets), or the entire treasury function for a smaller company. They are deeply involved in setting treasury policy and advising senior leadership. Base salaries at this level frequently range from $150,000 to $200,000+, with total compensation reaching well into the mid-$200s.

- 15+ Years (VP of Treasury / Treasurer): This is the executive level. The Treasurer or VP of Treasury is a senior leader who sets the company's overall financial strategy regarding capital structure, risk appetite, and liquidity. They interact with the board of directors and are a key strategic partner to the CFO. Base salaries start around $220,000 and can easily exceed $350,000, with total compensation, heavily weighted with bonuses and equity, reaching $500,000 to $1,000,000 or more at large, complex multinational corporations.

###

3. Geographic Location

Where you work has a massive impact on your salary, largely driven by the cost of living and the concentration of corporate headquarters.

Top-Tier Metropolitan Areas: Major financial hubs offer the highest salaries but also have the highest cost of living.

- New York, NY: Often 20-30% above the national average. A Treasury Manager here can expect a base salary in the $160,000 - $190,000 range.

- San Francisco Bay Area, CA: Similar to New York, with salaries frequently 25%+ above average, driven by the tech industry. Expect base salaries of $165,000 - $195,000.

- Boston, MA: A hub for finance, biotech, and technology. Salaries are typically 15-20% above the national average.

- Chicago, IL: A major corporate and financial center. Salaries trend 10-15% above average.

Mid-Tier and High-Growth Cities: These cities offer a strong combination of job opportunities and a more manageable cost of living.

- Dallas, TX; Atlanta, GA; Charlotte, NC: These cities have become major corporate centers and offer salaries close to or slightly above the national average. A Treasury Manager might earn $135,000 - $155,000.

- Denver, CO; Austin, TX; Seattle, WA: High-growth tech and business hubs where salaries are competitive and often 5-10% above the national average.

Lower Cost-of-Living Areas: In smaller cities and more rural regions, salaries will be lower, but the purchasing power of that salary may be equivalent or even greater.

- In these areas, a Treasury Manager salary might be 10-20% below the national average, potentially in the $100,000 - $125,000 range.

The rise of remote work has slightly complicated this, but most companies still adjust salaries based on a "geo-differential" tied to the employee's physical location.

###

4. Company Type & Size

The type and scale of the organization you work for are significant salary determinants. Complexity, risk, and available resources all play a role.

- Large Corporations (Fortune 500): These companies offer the highest base salaries and most structured compensation packages. The scale of their operations (often global, with billions in revenue) means the treasury function is incredibly complex, managing massive cash flows, intricate FX hedging programs, and large debt portfolios. A Treasury Manager at a Fortune 500 company will typically be at the high end of the salary spectrum.

- High-Growth Startups & Tech Companies: Compensation here can be a mixed bag. The base salary might be slightly below that of a large corporation, but this is often offset by a significant equity component (stock options or RSUs). The potential upside can be enormous if the company is successful. The treasury role in a pre-IPO or newly public company is also incredibly dynamic and offers unparalleled learning experiences.

- Mid-Sized Private Companies: Salaries here are generally competitive and often near the national median. Bonuses might be more directly tied to the company's profitability. The role often offers broader responsibilities than at a larger company, as the treasury team is typically smaller.

- Non-Profit & Government: These sectors typically offer lower salaries than their for-profit counterparts. A Treasury Manager at a large university or hospital system, for example, might earn 15-25% less in base salary. However, these roles often come with excellent benefits, strong work-life balance, and a sense of mission-driven purpose.

###

5. Area of Specialization

Within the broader treasury function, certain specializations are in higher demand and command a salary premium.

- International Treasury & FX Management: In our globalized economy, expertise in managing cross-border cash flows, international banking structures, and complex currency hedging strategies is highly valuable. Treasury managers with a proven track record in this area are sought after by multinational corporations and can command top-tier salaries.

- Capital Markets & Corporate Finance: Professionals who specialize in raising capital (debt issuance, syndicated loans), managing the company's capital structure, and executing share repurchase programs have a direct line to the CFO's strategic agenda. This expertise is highly compensated.

- Treasury Technology & Systems (TMS): As treasury becomes more automated, professionals who can lead the selection and implementation of Treasury Management Systems (TMS) like Kyriba, FIS, or Coupa are in high demand. This blend of finance and tech expertise is a powerful and lucrative combination.

- Risk Management (Derivatives): Deep technical knowledge of financial derivatives (forwards, futures, options, swaps) and how to apply them to mitigate interest rate and commodity risk is a niche but highly paid specialty.

###

6. In-Demand Skills

Beyond formal qualifications, a specific set of skills will directly influence your value and, therefore, your salary.

High-Value Hard Skills:

- Financial Modeling: The ability to build robust, flexible, and accurate financial models in Excel is non-negotiable. This is the primary tool for cash forecasting, sensitivity analysis, and valuation.

- Treasury Management System (TMS) Expertise: Proficiency with major TMS platforms is a huge plus. It shows you can step in and manage a company's core treasury infrastructure from day one.

- Enterprise Resource Planning (ERP) Systems: Familiarity with the financial modules of major ERPs like SAP or Oracle is crucial, as this is where much of the source data for treasury forecasting originates.

- Data Analytics & Visualization: The ability to analyze large datasets and present findings clearly using tools like Tableau or Power BI is a rapidly growing requirement. This allows treasury to move from reporting the news to making the news with predictive insights.

- Knowledge of Accounting Standards: A strong understanding of U.S. GAAP or IFRS, particularly as it relates to financial instruments and hedge accounting (ASC 815), is critical for ensuring compliance.

Crucial Soft Skills:

- Strategic Thinking: The ability to see the big picture and understand how treasury activities support the company's overall strategic goals.

- Communication & Presentation Skills: Treasury managers must be able to clearly and concisely explain complex financial topics to non-financial stakeholders, including senior executives.

- Negotiation Skills: Whether negotiating fees with banks, terms on a credit agreement, or contracts with vendors, strong negotiation skills directly save the company money.

- Attention to Detail: In a role