Considering a career that combines meticulous financial analysis with strategic business impact? The role of a cost accountant may be the perfect fit. This specialized field is not only intellectually challenging but also financially rewarding. For those with a keen eye for detail and a passion for optimizing business performance, it offers a stable and lucrative career path.

So, what can you expect to earn? While salaries vary, a cost accountant in the United States can typically expect to make a competitive salary ranging from $65,000 for entry-level positions to well over $120,000 for experienced managers and specialists. This article will break down what a cost accountant does, the average salaries you can expect, and the key factors that will directly influence your earning potential.

What Does a Cost Accountant Do?

Before we dive into the numbers, let's clarify the role. A cost accountant is a financial specialist who acts as an internal detective for a company's operational costs. They are crucial for businesses—especially in manufacturing, construction, and healthcare—that need a deep understanding of the costs associated with producing a product or delivering a service.

Their core responsibilities often include:

- Cost Analysis: Collecting, analyzing, and reporting on production costs, from raw materials to labor overhead.

- Budgeting and Forecasting: Helping create budgets and financial forecasts by providing accurate cost data.

- Inventory Valuation: Determining the value of a company's inventory and the cost of goods sold (COGS).

- Variance Analysis: Comparing standard, budgeted costs against actual costs to identify and explain discrepancies.

- Process Improvement: Recommending ways to reduce costs and improve financial efficiency without sacrificing quality.

- Pricing Strategy: Providing the data needed for management to set competitive and profitable prices for products and services.

In essence, a cost accountant provides the critical data that empowers leadership to make smarter, more profitable decisions.

Average Cost Accountant Salary

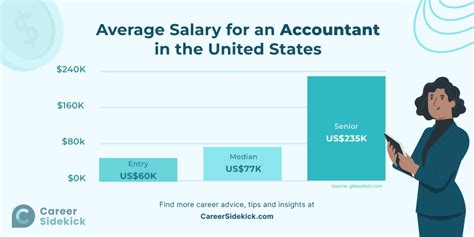

Across the United States, the salary for a cost accountant is strong and reflects the specialized skills required. While figures vary slightly between data aggregators, a clear picture emerges.

According to Salary.com, the median annual salary for a Cost Accountant in the United States is approximately $77,500 as of late 2023, with a typical range falling between $68,800 and $87,200.

Similarly, Payscale reports an average base salary of around $72,000 per year. Their data shows a broad range, starting near $55,000 for early-career professionals and climbing to over $95,000 for those with significant experience.

The U.S. Bureau of Labor Statistics (BLS) groups cost accountants under the broader category of "Accountants and Auditors." For this group, the median annual wage was $78,000 in May 2022. The lowest 10 percent earned less than $48,560, and the highest 10 percent earned more than $132,690. This demonstrates a significant potential for growth within the profession.

Key Factors That Influence Salary

Your base salary isn't set in stone. Several key factors can dramatically increase your earning potential. Understanding these levers is the first step toward maximizing your career compensation.

###

Level of Education

A bachelor's degree in accounting, finance, or a related field is the standard entry requirement for a cost accountant. However, advanced education and professional certifications provide a significant salary boost.

- Master's Degree: Pursuing a Master of Accountancy (M.Acc.) or an MBA with a concentration in finance can open doors to higher-level positions and command a higher starting salary.

- Certifications (CPA and CMA): While a Certified Public Accountant (CPA) license is always valuable in the accounting world, the Certified Management Accountant (CMA) is the gold standard for cost and management accountants. According to a global salary survey by the Institute of Management Accountants (IMA), professionals holding the CMA certification earn significantly more than their non-certified peers. This certification directly validates your expertise in financial planning, analysis, control, and decision support.

###

Years of Experience

Experience is one of the most significant drivers of salary growth in cost accounting. As you gain expertise, you can take on more complex projects and leadership responsibilities.

- Entry-Level (0-2 years): Professionals starting their careers can expect a salary in the range of $60,000 to $75,000. They typically handle routine tasks like data collection, standard cost entry, and basic variance reports.

- Mid-Career (3-9 years): With several years of experience, cost accountants can expect to earn between $75,000 and $95,000. They take on more complex analysis, contribute to budgeting, and may supervise junior staff.

- Senior / Managerial (10+ years): Senior Cost Accountants and Cost Accounting Managers with a decade or more of experience can command salaries from $95,000 to $125,000+. At this level, they oversee the entire cost accounting function, develop strategic recommendations, and work directly with senior leadership.

###

Geographic Location

Where you work matters. Salaries for cost accountants are often higher in major metropolitan areas and states with a high cost of living and a high concentration of large corporations.

According to data from various salary aggregators, some of the top-paying metropolitan areas include:

- San Francisco, CA

- New York, NY

- Boston, MA

- San Jose, CA

- Washington, D.C.

Conversely, salaries may be lower in rural areas and states with a lower cost of living. However, the purchasing power in these locations can often balance out the lower nominal wage.

###

Company Type

The type and size of your employer play a major role in your compensation.

- Industry: The manufacturing sector is the traditional home for cost accountants and remains a primary employer. However, high-paying opportunities are also abundant in technology, pharmaceuticals, healthcare systems, and large-scale construction.

- Company Size: Large, publicly traded corporations (Fortune 500) generally offer higher salaries, more comprehensive benefits, and more opportunities for advancement than smaller, private companies. This is due to the greater complexity of their operations and the larger financial resources at their disposal.

###

Area of Specialization

Within cost accounting, developing a niche expertise can make you a more valuable—and higher-paid—asset. Specializations that can boost your salary include:

- ERP Systems: Expertise in complex enterprise resource planning (ERP) systems like SAP or Oracle Financials is highly sought after.

- Supply Chain Finance: Specializing in the analysis of supply chain and logistics costs.

- Plant Controller: Advancing from a cost accountant role to a Plant Controller, where you are the lead finance person for an entire manufacturing facility.

- Activity-Based Costing (ABC): Mastering this complex costing methodology to provide highly accurate product and service cost information.

Job Outlook

The future for cost accountants is bright and stable. The U.S. Bureau of Labor Statistics (BLS) projects employment for "Accountants and Auditors" to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady demand is driven by the constant need for financial accountability and efficiency. As businesses face global competition and economic pressures, the role of a cost accountant—who can identify savings and improve profitability—becomes more critical than ever. Globalization, a growing economy, and a complex tax and regulatory environment will continue to create consistent demand for these skilled professionals.

Conclusion

A career as a cost accountant offers a potent mix of job stability, intellectual challenge, and excellent financial rewards. While the average salary is already competitive, you are in the driver's seat when it comes to your earning potential.

To maximize your salary, focus on these key takeaways:

- Invest in Certification: Earning your CMA is one of the most direct ways to increase your value and salary.

- Gain Diverse Experience: Don't shy away from complex projects or roles in large, dynamic industries like manufacturing or technology.

- Embrace Technology: Become an expert in the ERP and data analysis tools your company uses.

- Consider Your Location: Be strategic about where you build your career, weighing higher salaries against the cost of living.

For the detail-oriented individual who enjoys solving complex financial puzzles, a career in cost accounting offers a clear and rewarding path to professional and financial success.