So, you’re contemplating a career as a Certified Public Accountant (CPA) in the Sunshine State. It’s a decision brimming with potential. You’re likely picturing a life of professional respect, intellectual challenge, and financial stability, all set against a backdrop of palm trees and vibrant economic growth. You’re not just chasing a job; you’re building a future. The great news? A CPA career in Florida can deliver on all those fronts, and more.

The demand for skilled financial professionals in Florida is robust, and the compensation reflects that value. A CPA isn't just a number-cruncher; they are a strategic advisor, a guardian of financial integrity, and a key driver of business success. While salaries can range significantly based on a multitude of factors, the average CPA salary in Florida typically falls between $85,000 and $120,000, with top earners and partners in major firms exceeding $200,000 or even $300,000 annually.

I remember a conversation early in my career with a mentor, a seasoned CPA partner at a Tampa firm. I was bogged down in complex audit paperwork and questioned the big-picture impact. He stopped me and said, "We're not just checking boxes. We're providing the confidence that allows a small business to secure a loan to expand, an entrepreneur to sell their company for a fair price, and a non-profit to prove to donors their money is making a difference. We deal in trust, and trust is the most valuable commodity in business." That perspective was a game-changer, and it perfectly encapsulates the profound importance of the CPA designation.

This guide is designed to be your definitive resource, a comprehensive exploration of what it truly means—and what it truly pays—to be a CPA in Florida. We will dissect every component of your potential career, from the day-to-day realities of the job to the long-term financial and professional trajectory.

### Table of Contents

- [What Does a CPA in Florida Actually Do?](#what-does-a-cpa-in-florida-do)

- [Average CPA Salary in Florida: A Deep Dive](#average-cpa-salary-in-florida-a-deep-dive)

- [Key Factors That Influence Your CPA Salary](#key-factors-that-influence-your-cpa-salary)

- [Job Outlook and Career Growth in Florida](#job-outlook-and-career-growth-in-florida)

- [How to Become a CPA in Florida: Your Step-by-Step Guide](#how-to-become-a-cpa-in-florida-your-step-by-step-guide)

- [Conclusion: Is a CPA Career in Florida Right for You?](#conclusion-is-a-cpa-career-in-florida-right-for-you)

What Does a CPA in Florida Actually Do?

Before we dive into the numbers, it's essential to understand the substance of the profession. The CPA license is the accounting industry's gold standard, signifying a deep level of expertise, a commitment to ethical standards, and a mastery of complex financial principles. While the stereotype might be a solitary figure hunched over tax forms, the reality is far more dynamic, collaborative, and strategic.

A CPA in Florida navigates a diverse landscape of industries, from international trade in Miami and tourism in Orlando to healthcare innovation in Tampa and logistics in Jacksonville. Their work is not monolithic; it falls into several key domains:

- Public Accounting: This is the most traditional path, where CPAs work for firms that provide services to other businesses and individuals. Core services include:

- Assurance and Audit: Examining a company's financial statements to ensure they are accurate, free of material misstatement, and compliant with regulations (like GAAP). This is the bedrock of financial trust.

- Tax Services: Preparing federal, state, and local tax returns for corporations, partnerships, and individuals. This also involves strategic tax planning to minimize liability and ensure compliance.

- Advisory and Consulting: This is a major growth area. CPAs advise on everything from mergers and acquisitions (M&A) and risk management to IT systems implementation and business strategy.

- Corporate Accounting (Industry): Here, CPAs work "in-house" for a single company, whether it's a tech startup or a Fortune 500 conglomerate. Their roles can include:

- Financial Controller: Overseeing all accounting operations, including accounts payable/receivable, payroll, and general ledger.

- Chief Financial Officer (CFO): A top-level executive role responsible for the company's entire financial health, strategy, and long-term planning.

- Internal Auditor: Reviewing the company's internal controls and processes to identify inefficiencies and mitigate risk.

- Government and Non-Profit: CPAs are crucial in the public sector, ensuring the responsible use of taxpayer and donor funds. They work for federal agencies (like the FBI or IRS), state agencies in Tallahassee, and municipal governments, as well as universities, hospitals, and charities.

- Specialized Niches: Many CPAs build lucrative careers in focused areas like Forensic Accounting (investigating financial crimes), Personal Financial Planning (helping individuals manage their wealth), or IT Auditing (assessing cybersecurity and information systems).

### A Day in the Life: A Senior Tax Associate in Miami

To make this tangible, let's imagine a day for "Sofia," a Senior Tax Associate at a mid-sized public accounting firm in the Brickell financial district.

- 8:30 AM: Sofia arrives, grabs a *cafecito*, and scans her emails. A major real estate client has a question about the tax implications of a property sale. She flags it for immediate research. She then reviews the work of a junior associate on a complex partnership tax return for a hospitality group.

- 10:00 AM: Team meeting to discuss workflow for the upcoming tax deadline. The partner outlines a new client acquisition—a tech company that just received venture capital funding—and assigns Sofia to lead the initial tax planning strategy.

- 11:00 AM: Sofia dives into tax law research for the real estate client, consulting IRS code and state statutes. She drafts a clear, concise email explaining the capital gains implications and suggesting a tax-deferral strategy.

- 1:00 PM: Lunch with a colleague where they discuss challenges with a particular software implementation, sharing tips and solutions.

- 2:00 PM: A long-scheduled call with the controller of a large import/export client. They discuss international tax provisions and ensure the company is structured optimally to handle transactions with its Latin American partners.

- 4:00 PM: Sofia dedicates the rest of her afternoon to mentoring the junior associate, walking them through the corrections on the partnership return and explaining the "why" behind the complex allocations.

- 5:30 PM: Before heading home, she maps out her priorities for the next day, focusing on the new tech client strategy. The work is challenging, but she feels a sense of accomplishment, having solved problems and guided both clients and colleagues.

Average CPA Salary in Florida: A Deep Dive

Now for the central question: What can you expect to earn as a CPA in Florida? The compensation for CPAs is compelling, reflecting the high level of skill, responsibility, and educational investment required. It's crucial to look at a range of data points to get a complete picture.

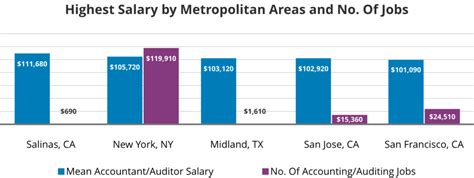

According to the U.S. Bureau of Labor Statistics (BLS), the national median annual wage for Accountants and Auditors was $78,000 in May 2022. However, the CPA designation acts as a powerful salary accelerant. A CPA license can boost a standard accountant's salary by 10-15% or more, and the gap widens significantly with experience.

For Florida specifically, salary data aggregators provide a more granular view:

- Salary.com (as of late 2023/early 2024) reports that the average salary for a CPA in Florida falls within the range of $78,165 to $146,056, with a median salary often cited around $95,000 - $105,000.

- Glassdoor data, which incorporates user-submitted salaries, shows a total pay estimate for a CPA in the Miami, FL area averaging around $101,000 per year, with a likely range between $82,000 and $125,000.

- The 2024 Robert Half Salary Guide for Finance & Accounting, a highly respected industry benchmark, provides detailed percentile data. For roles often held by CPAs in a market like Miami or Tampa, salaries can start around $70,000 for a new public accountant and climb well into the $150,000 - $250,000+ range for senior management roles like Controller or Finance Director.

### Salary by Experience Level in Florida

Your earning potential grows substantially as you accumulate experience and take on more responsibility. Here is a typical salary progression for a CPA in Florida, compiled from industry reports and salary data.

| Experience Level | Typical Role(s) | Typical Salary Range (Florida) | Description |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 Years) | Staff Accountant, Audit/Tax Associate | $65,000 - $85,000 | Focuses on executing tasks under supervision, learning foundational skills, and working towards or having just passed the CPA exam. |

| Mid-Career (4-8 Years) | Senior Accountant, Senior Auditor, Tax Manager | $85,000 - $130,000 | Manages projects, reviews the work of junior staff, develops client relationships, and begins to specialize. |

| Experienced/Senior (8-15+ Years)| Controller, Senior Manager, Director | $130,000 - $200,000+ | Leads entire departments, drives financial strategy, has significant client or executive-level interaction. |

| Executive/Partner Level | CFO, VP of Finance, Public Accounting Partner | $200,000 - $500,000+ | Highest level of strategic and financial oversight for an organization or firm. Compensation is heavily tied to performance. |

*(Note: These are general estimates and can vary significantly based on the factors discussed in the next section.)*

### Beyond the Base Salary: Understanding Total Compensation

A CPA's base salary is only one piece of the puzzle. Total compensation packages in Florida are often highly competitive and can add significant value.

- Bonuses: Annual performance-based bonuses are standard in both public accounting and corporate roles. In public accounting, these can range from 5% to 20% (or more) of base salary, often tied to billable hours and firm profitability. In corporate roles, bonuses are linked to company and individual performance goals.

- Profit Sharing: Partners in public accounting firms and some senior executives in private companies participate in profit-sharing plans, which can lead to massive increases in total annual income.

- Retirement Savings: Nearly all employers will offer a 401(k) plan. A competitive package will include a company match, often ranging from 3% to 6% of your salary, which is essentially free money for your retirement.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a given. Many Florida firms also offer wellness stipends, gym memberships, and generous mental health resources.

- Paid Time Off (PTO): Expect a competitive PTO package, often starting at 3 weeks and increasing with seniority. Public accounting firms may have busier seasons but often compensate with more flexible time off during slower periods.

- Professional Development: Companies that hire CPAs understand the importance of staying current. They will almost always pay for the annual license renewal fees and provide a budget for Continuing Professional Education (CPE) courses, which are mandatory to maintain your license.

Key Factors That Influence Your CPA Salary

Your salary is not a static number determined by a single formula. It's a dynamic figure influenced by a powerful combination of your background, choices, and market forces. Understanding these levers is the key to maximizing your earning potential throughout your career in Florida.

### ### Level of Education and Certifications

While the CPA is the pinnacle certification, your educational foundation and any additional credentials play a significant role.

- The 150-Hour Requirement: To be licensed as a CPA in Florida (and every other state), you must complete 150 semester hours of college education. This typically means a standard 120-hour bachelor's degree plus 30 additional hours. Many aspiring CPAs fulfill this by pursuing a Master of Accountancy (MAcc) or Master of Science in Taxation (MST). A master's degree not only satisfies the hour requirement but also signals a higher level of specialized knowledge to employers, often resulting in a higher starting salary and faster promotion track.

- Beyond the CPA: While the CPA is paramount, stacking it with other certifications can open doors to higher-paying, specialized niches.

- Certified Fraud Examiner (CFE): Essential for forensic accounting roles, leading to salaries that can be 15-20% higher than general accounting positions.

- Certified Information Systems Auditor (CISA): Incredibly valuable for CPAs working in IT audit and cybersecurity assurance. Given the tech boom, CISAs are in high demand and command a significant salary premium.

- Chartered Global Management Accountant (CGMA): This certification, offered by the AICPA, focuses on strategic management accounting and is highly valued for corporate finance and leadership roles like Controller and CFO.

### ### Years of Experience: The Career Trajectory

Experience is arguably the single most powerful driver of salary growth. Your value to an employer increases exponentially as you move from executing tasks to managing projects, and finally, to driving strategy.

- Associate/Staff (0-3 years): At this stage, you're building your technical skills. Your salary growth is steady but moderate, tied to annual performance reviews and cost-of-living adjustments. The biggest jump comes after you pass the CPA exam and become licensed.

- Senior (3-5 years): This is a critical inflection point. As a Senior, you're no longer just a doer; you're a leader of small teams and the primary point of contact on many engagements. This increased responsibility comes with a significant salary bump and the beginning of larger performance bonuses.

- Manager (5-10 years): As a Manager, you own client relationships and are responsible for the profitability of your projects. You manage entire teams, review all work, and are involved in business development. Salaries at this level take another substantial leap, and bonus potential increases dramatically.

- Senior Manager/Director/Controller (10+ years): You are now part of the firm's or company's leadership. Your focus shifts from day-to-day operations to long-term strategy, department management, and high-level decision-making. Your compensation structure often includes a larger bonus component and potentially equity or profit-sharing.

### ### Geographic Location within Florida

Florida is not a monolith. The cost of living and the concentration of certain industries create distinct salary zones across the state. A CPA in Miami will almost certainly earn more than a CPA in Pensacola, but their living expenses will also be significantly higher.

CPA Salary Comparison: Major Florida Metropolitan Areas

| Metropolitan Area | Average Salary Range (Mid-Career CPA) | Economic Drivers & Salary Factors |

| :--- | :--- | :--- |

| Miami-Fort Lauderdale-West Palm Beach | $95,000 - $140,000+ | Highest cost of living. A major hub for international trade, banking, finance, and wealth management. High demand for CPAs with international tax and foreign language skills. |

| Tampa-St. Petersburg-Clearwater | $88,000 - $125,000 | Rapidly growing hub for financial services, healthcare, and technology. Major presence of large corporate headquarters and shared service centers (e.g., Deloitte, PwC). |

| Orlando-Kissimmee-Sanford | $85,000 - $120,000 | Strong in tourism/hospitality, but also has a growing tech, defense, and simulation industry. A slightly lower cost of living than Miami or Tampa. |

| Jacksonville | $82,000 - $115,000 | A major center for logistics, banking, and insurance. Home to several Fortune 500 headquarters. Offers a lower cost of living, providing high purchasing power. |

| Tallahassee & Smaller Markets | $75,000 - $105,000 | Dominated by state government, universities, and regional businesses. Salaries are generally lower, reflecting the lower cost of living and different industry mix. |

*(Source: Data compiled and synthesized from Salary.com, Robert Half, and Glassdoor, 2024.)*

### ### Company Type & Size

Where you work is just as important as what you do. The resources, client base, and compensation philosophies vary dramatically between different types of organizations.

- Public Accounting: "The Big Four" (Deloitte, PwC, EY, KPMG): These global firms generally offer the highest starting salaries and most prestigious training. They also demand the longest hours, especially during busy season. The "up-or-out" culture is intense, but the experience is a powerful career launchpad. A Senior Manager at a Big Four firm in Miami can easily earn $150,000 - $180,000+.

- Public Accounting: National & Regional Firms (e.g., BDO, Grant Thornton, CBIZ): These firms offer a competitive alternative to the Big Four, with salaries that are often very close. They are known for providing a slightly better work-life balance and a more direct path to partnership for top performers.

- Corporate Accounting (Industry): Salaries here are highly dependent on company size.

- Large Corporations (Fortune 500): Companies like NextEra Energy, Publix, or Raymond James offer highly structured, competitive salary bands, excellent benefits, and significant bonuses. A Director of Finance could earn $170,000 - $250,000+.

- Startups & Small/Medium-Sized Businesses (SMBs): Base salaries might be slightly lower than at large corporations, but the compensation package could include stock options, which offer massive upside potential if the company succeeds. The roles are often broader, providing incredible learning experiences.

- Government: A CPA working for the State of Florida in Tallahassee or a federal agency will typically have a lower base salary than their private sector counterparts. However, this is offset by exceptional job security, robust pension plans, and an excellent work-life balance.

- Non-Profit: Similar to government, base salaries are generally lower. The reward comes from aligning your professional skills with a personal mission, whether in healthcare, education, or social services.

### ### Area of Specialization

General accounting skills provide a solid foundation, but specialization is the key to becoming a highly sought-after, top-earning expert.

- Mergers & Acquisitions (M&A) / Transaction Advisory: This is one of the most lucrative fields. CPAs in this niche perform due diligence on deals, advise on structuring, and handle post-merger integration. It's high-stakes, high-pressure, and very high-paying.

- International Tax: With Florida's role as a gateway to Latin America and Europe, CPAs who can navigate the labyrinth of cross-border tax treaties, transfer pricing, and foreign entity structuring are invaluable.

- IT Audit & Cybersecurity: As business operations become inseparable from technology, the need for CPAs who can audit complex IT systems, assess cybersecurity risks, and consult on data privacy is exploding. This specialization carries a significant salary premium.

- Forensic Accounting: These financial detectives are brought in for litigation support, fraud investigations, and divorce proceedings. Their specialized skills command high hourly rates and salaries.

- Environmental, Social, and Governance (ESG) Reporting: A rapidly emerging field where CPAs provide assurance on a company's non-financial reporting related to its environmental impact and social policies. This is becoming a critical skill for working with large, publicly traded companies.

### ### In-Demand Skills

Beyond your formal credentials, a specific set of technical and soft skills can directly impact your salary negotiations and career trajectory.

- Technical Skills:

- Data Analytics & Visualization: Proficiency in tools like Tableau, Power BI, and Alteryx is no longer a "nice to have"; it's a core competency. The ability to analyze large datasets and present insights visually is a major differentiator.

- ERP Systems Expertise: Deep knowledge of major Enterprise Resource Planning systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly valued in corporate accounting roles.

- Advanced Excel: Moving beyond VLOOKUPs to master Power Query, Power Pivot, and complex financial modeling is essential.

- Soft Skills:

- Client Relationship Management: In public accounting, the ability to build trust and become a valued advisor to clients is what separates a manager from a partner.

- Strategic Communication: The ability to explain complex financial information clearly and persuasively to non-financial stakeholders (like CEOs, marketing leads, or boards of directors) is a hallmark of a senior leader.

- Business Acumen: Understanding the industry you're in, the competitive landscape, and how financial decisions impact overall business strategy is crucial for moving into leadership roles.

Job Outlook and Career Growth in Florida

Choosing a career isn't just about the salary today; it's about the security and opportunity of tomorrow. For CPAs in Florida, the future looks exceptionally bright.

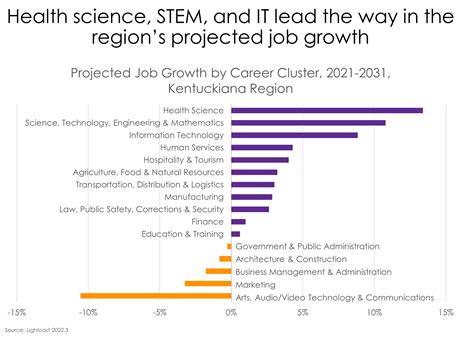

The U.S. Bureau of Labor Statistics projects that employment of accountants and auditors will grow 4 percent from 2022 to 2032, about as fast as the average for all occupations. This will result in about 126,500 openings each year, on average, over the decade.

However, the outlook in Florida is even more promising. The state's economy is booming for several key reasons, all of which fuel the demand for high-level accounting professionals:

1. Population and Business Growth: Florida is one of the fastest-growing states in the nation. This influx of people and businesses creates a continuous need for accounting services, from setting up new company books to providing tax services for new residents and advising on real estate transactions.

2. Favorable Tax Environment: Florida's lack of a state income tax makes it an attractive destination for high-net-worth individuals and relocating businesses (a trend known as "business migration"). These complex financial situations require sophisticated tax planning and wealth management, driving demand for expert CPAs.

3. Diverse and Expanding Industries: While tourism remains a staple, Florida's economy has diversified significantly into financial services, healthcare, life sciences, logistics, and technology. Each of these industries has unique and complex accounting and regulatory needs.

4. Globalization: Miami's position as the "Capital of Latin America" ensures a steady flow of international business, creating a robust and permanent need for CPAs specializing in international tax and cross-border transactions.

### Emerging Trends and Future Challenges

The accounting profession is not static. It's evolving rapidly, and staying ahead of these trends is critical for long-term success.

- The Rise of AI and Automation: Repetitive tasks like data entry and basic reconciliation are increasingly being automated. This is not a threat but an opportunity. It frees up CPAs to focus on higher-value activities: analysis, strategy, client advisory, and interpretation. The future CPA is less of a data processor and more of a data strategist.

- The Shift to Advisory: The most successful CPAs of the future will be those who move beyond compliance (tax returns, audits) and lean into advisory. Businesses are looking for partners who can help them navigate complexity, manage risk, and make strategic decisions.

- Increasing Regulatory Complexity: Tax laws and financial reporting standards are constantly changing. This complexity, while a challenge, also solidifies the job security of CPAs, as they are the only ones qualified to navigate it effectively.

- The ESG Mandate: As mentioned earlier, reporting on Environmental, Social, and Governance metrics is becoming a major focus for investors and regulators. CPAs will be at the forefront of developing standards and providing assurance for this new class of information.

### How to Stay Relevant and Advance

1. Embrace Lifelong Learning: Your CPA license requires Continuing Professional Education (CPE). Don't just check the box. Use your CPE to learn skills in emerging areas like data analytics, ESG, or a new industry niche.

2. Develop Your Tech Stack: Become the go-to person on your team for a particular software or technology. Master data visualization tools or become an expert in your firm's audit automation software.

3. Cultivate Soft Skills: Technical skills will get you the job, but communication, leadership, and relationship-building skills will get you promoted. Join Toastmasters, take a leadership training course, and actively seek out opportunities to present to clients or senior management.

4. Network Intelligently: Build relationships not just within your firm, but across the industry. Join the Florida Institute of CPAs (FICPA) and attend their events. Connect with recruiters and peers on LinkedIn. Your network is your most valuable career asset.

How to Become a CPA in Florida: Your Step-by-Step Guide

The path to becoming a licensed CPA in Florida is a rigorous one, a multi-year journey of education, examination, and experience. But with a clear plan, it is an achievable and incredibly rewarding goal. Here is your roadmap.

### Step 1: Meet the Educational Requirements ("The Three E's")

Florida,