Table of Contents

- [Introduction](#introduction)

- [What Does a Deputy General Counsel Do? The Strategic Second-in-Command](#what-does-a-deputy-general-counsel-do)

- [Average Deputy General Counsel Salary: A Deep Dive into Compensation](#average-deputy-general-counsel-salary-a-deep-dive)

- [The 6 Key Factors That Influence Deputy General Counsel Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Deputy General Counsel](#job-outlook-and-career-growth)

- [Your Roadmap: How to Become a Deputy General Counsel](#how-to-get-started-in-this-career)

- [Conclusion: Is a Deputy General Counsel Career Right for You?](#conclusion)

Introduction

For the ambitious, strategic-minded lawyer, the path beyond the traditional law firm partner track leads to the executive suite. It's a world where legal acumen is fused with business strategy, where you are not just an advisor but a core architect of a company's future. At the pinnacle of this in-house legal career ladder, just shy of the top spot, sits the Deputy General Counsel (DGC). This role represents a potent combination of influence, responsibility, and significant financial reward, with a Deputy General Counsel salary often soaring well into the mid-to-high six figures, and in many cases, beyond.

The allure is undeniable. A typical total compensation package for an experienced DGC can range from $250,000 to over $500,000 annually, with top earners at major public corporations commanding even more. But this isn't just about the money. It’s about being the trusted right hand to the General Counsel, managing vast legal teams, and navigating the complex legal and regulatory seas that modern businesses must sail. It's about having a seat at the table where the most critical decisions are made.

I once had the opportunity to observe a DGC at a Fortune 500 tech company during a potential PR crisis involving a new product feature and data privacy concerns. While the executive team was focused on market impact and messaging, she calmly and authoritatively mapped out the legal risks, potential regulatory actions across three continents, and a clear, defensible path forward. In that moment, she was not just a lawyer; she was the company's strategic anchor, demonstrating the immense value and power vested in the DGC position.

This guide is designed to be your definitive resource for understanding every facet of a Deputy General Counsel career, with a laser focus on compensation and the factors that drive it. We will move beyond simple salary numbers and delve into the nuances of bonuses, equity, and the strategic choices you can make to maximize your earning potential. Whether you're a law student dreaming of a corporate career, an associate at a firm contemplating a move in-house, or a seasoned corporate counsel looking to take the next step, this article will provide the data-driven insights and actionable advice you need to chart your course.

What Does a Deputy General Counsel Do? The Strategic Second-in-Command

The title "Deputy General Counsel" can sound straightforward, but it belies a role of immense complexity and strategic importance. The DGC is the second-in-command of a corporate legal department, acting as the General Counsel's (GC) primary lieutenant and often the heir apparent to the top legal job. Their primary function is to bridge the gap between high-level legal strategy set by the GC and the day-to-day execution handled by the broader legal team, including Associate General Counsels and Senior Counsel.

Think of the GC as the "CEO of Legal," setting the vision and interfacing with the C-suite and the Board of Directors. The DGC, in turn, is the "COO of Legal," responsible for the operational excellence, management, and tactical implementation of that vision.

Core Responsibilities and Daily Tasks:

The DGC's workload is a dynamic mix of management, high-stakes legal work, and strategic planning. Their key responsibilities often include:

- Team Leadership and Management: A significant portion of a DGC's time is spent managing other lawyers and legal professionals. This includes hiring, training, mentoring, performance reviews, and allocating work across various legal specialties like litigation, M&A, intellectual property, and employment law.

- Complex Legal Matters: While they delegate heavily, DGCs personally handle the most sensitive, complex, and high-risk legal issues facing the company. This could be a "bet-the-company" lawsuit, a major international acquisition, or a significant government investigation.

- Operational Oversight: They are responsible for the legal department's budget, managing outside counsel relationships and costs, and implementing legal technology (LegalTech) to improve efficiency.

- Risk Management and Compliance: The DGC plays a crucial role in identifying, assessing, and mitigating legal and regulatory risks across the entire organization. They often oversee the development and implementation of company-wide compliance programs (e.g., anti-bribery, data privacy).

- Acting as GC: When the General Counsel is unavailable, the DGC steps in, advising senior executives and the board and making critical decisions. This makes the DGC role a crucial training ground for the top job.

A "Day in the Life" of a Deputy General Counsel:

To make this tangible, let's walk through a hypothetical day for a DGC at a large, publicly-traded software company.

- 8:00 AM - 9:00 AM: Review overnight legal alerts and urgent emails. Huddle with the international legal team in Europe to discuss a new GDPR-related inquiry from a regulator.

- 9:00 AM - 10:30 AM: Lead a weekly litigation review meeting. The team discusses strategy for a major patent infringement lawsuit and reviews the quarterly budget for outside counsel spend. The DGC provides guidance on settlement strategy and pushes the team on cost-containment.

- 10:30 AM - 11:30 AM: One-on-one meeting with the General Counsel. They discuss the upcoming board meeting, the progress on the M&A deal codenamed "Project Phoenix," and a succession planning issue within the IP legal team.

- 11:30 AM - 12:30 PM: Meet with the VP of Product Development and the Chief Privacy Officer. They are beta-testing a new AI feature, and the DGC needs to understand the data inputs and outputs to provide a thorough risk assessment and ensure the feature is designed with "privacy by design" principles.

- 12:30 PM - 1:30 PM: Working lunch at their desk, reviewing a draft of a new global anti-corruption policy prepared by a Senior Counsel. The DGC makes several annotations, strengthening the language and clarifying the reporting procedures.

- 1:30 PM - 3:00 PM: Call with outside counsel from a top-tier law firm to prepare for a key deposition in a class-action lawsuit. The DGC challenges assumptions and refines the questioning strategy.

- 3:00 PM - 4:30 PM: Departmental management time. Approve expense reports, review performance goals for direct reports, and interview a candidate for a Senior Counsel, Corporate & Securities position.

- 4:30 PM - 5:30 PM: Join a cross-functional strategy meeting with leaders from Sales and Finance to advise on the legal and regulatory implications of expanding into a new market in Southeast Asia.

- 5:30 PM onwards: Respond to non-urgent emails and begin reviewing materials for the next day's M&A steering committee meeting.

This snapshot reveals a role that is less about deep, solitary legal research and more about management, communication, and strategic problem-solving at the intersection of law and business.

Average Deputy General Counsel Salary: A Deep Dive into Compensation

The compensation for a Deputy General Counsel is substantial, reflecting the immense responsibility, extensive experience, and strategic value they bring to an organization. It's a role where legal expertise is directly translated into corporate leadership, and the pay structure mirrors that of other senior executives.

When analyzing the Deputy General Counsel salary, it's crucial to look beyond the base salary and consider the full compensation package, which typically includes a significant performance-based bonus and, in many cases, long-term incentives like stock options or restricted stock units (RSUs).

National Averages and Salary Ranges

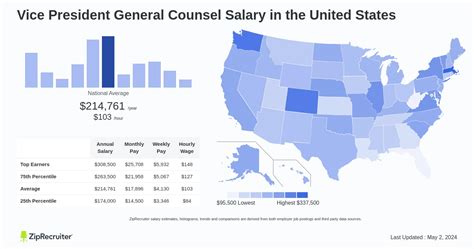

According to leading compensation data aggregators, the figures for a Deputy General Counsel in the United States paint a picture of a highly lucrative career.

- Salary.com: As of early 2024, the median base salary for a Deputy General Counsel in the U.S. is $299,699. However, the typical range is quite broad, generally falling between $259,079 and $357,105. This range primarily reflects variations in company size, industry, and geographic location.

- Payscale.com: Payscale reports a slightly different average base salary of around $210,000, but their data highlights the enormous impact of bonuses and profit sharing. They show that total pay, including these elements, can reach as high as $358,000 or more.

- Glassdoor.com: Based on user-submitted data, Glassdoor estimates the total pay for a DGC to be around $349,761 per year in the United States, with a median base salary of $242,544. The "likely range" for total pay on their platform stretches from $248,000 to $508,000.

What does this tell us? The base salary is only part of the story. The true earning potential lies in the variable components of the compensation package, which can easily add another 30-50% (or more) to the base figure.

Salary Progression by Experience Level

A lawyer does not simply graduate and become a DGC. The role requires a minimum of 10-15 years of sophisticated legal experience. The salary progression reflects this long and demanding career path. While there isn't an "entry-level" DGC, we can categorize the role by the stage of the DGC's career, which often corresponds to the size and complexity of the company they work for.

| Career Stage / Title Progression | Typical Years of Experience | Estimated Base Salary Range | Estimated Total Compensation Range (incl. Bonus/Equity) |

| :--- | :--- | :--- | :--- |

| Senior Counsel / Associate GC (Stepping stone to DGC at a larger company) | 8 - 12 years | $180,000 - $240,000 | $220,000 - $300,000+ |

| Deputy General Counsel (Mid-sized or private company) | 12 - 18 years | $240,000 - $290,000 | $300,000 - $450,000 |

| Senior Deputy General Counsel (Large, publicly-traded corporation) | 15 - 25+ years | $290,000 - $360,000+ | $450,000 - $700,000+ |

*Sources: Data compiled and synthesized from Salary.com, Payscale, Glassdoor, and 2023 Major, Lindsey & Africa In-House Compensation Survey.*

As the table illustrates, the jump to the DGC level represents a significant increase in both base and total compensation. The most senior DGCs, often at Fortune 100 companies, function as true executives, with compensation packages that can rival C-suite members at smaller organizations.

Dissecting the Full Compensation Package

To truly understand a Deputy General Counsel's salary, you must break down its components.

1. Base Salary: This is the fixed, guaranteed portion of pay. As shown above, it typically starts in the low-to-mid $200s and can exceed $350,000 at the highest levels. It's the foundation of the package but rarely the largest part for top earners.

2. Annual Cash Bonus / Short-Term Incentive (STI): This is a variable cash payment tied to performance. It is usually calculated as a percentage of the base salary, with the target percentage set by the company's compensation committee.

- Target Bonus: A DGC might have a target bonus of 30% to 60% of their base salary.

- Performance Metrics: The payout can be higher or lower than the target based on both individual performance (e.g., successful litigation outcomes, M&A deal closures) and company performance (e.g., revenue growth, stock price). For a DGC with a $300,000 base salary and a 50% target bonus, this could mean an additional $150,000 in a good year.

3. Long-Term Incentives (LTI): This is often the most lucrative part of the package, especially at publicly-traded companies. LTI aligns the DGC's financial interests with those of shareholders over a multi-year period.

- Restricted Stock Units (RSUs): The company grants the DGC a certain number of shares that vest over a period of time (typically 3-4 years). For example, a grant of $400,000 in RSUs might vest 25% each year for four years. This provides a powerful retention tool and significant upside if the company's stock performs well.

- Stock Options: These give the DGC the right to buy company stock at a predetermined price (the "strike price") in the future. They only have value if the stock price rises above the strike price.

- LTI Value: The annual LTI grant for a DGC can range from $50,000 to over $500,000, depending entirely on the company's size, industry, and compensation philosophy. According to the 2023 Major, Lindsey & Africa survey, the average LTI cash-out value for DGCs at the largest companies was well over $300,000.

4. Other Benefits and Perks:

- Executive-Level Health Insurance: Premium health, dental, and vision plans with low deductibles.

- 401(k) Match: Generous company matching contributions, often exceeding the standard employee match.

- Deferred Compensation Plans: Tax-advantaged retirement savings vehicles available to high-income earners.

- Professional Development: Budget for Continuing Legal Education (CLE), bar association fees, and executive coaching.

- Other Perks: May include a car allowance, club memberships, or enhanced severance packages.

In summary, when evaluating a DGC role, an offer of a "$280,000 base salary" is just the starting point. The critical questions to ask are about the target bonus percentage and the value and structure of the annual LTI grant, as these components can easily double the base salary in total compensation.

The 6 Key Factors That Influence Deputy General Counsel Salary

While we've established a broad salary range, the specific compensation a Deputy General Counsel earns is determined by a complex interplay of factors. Understanding these drivers is essential for any lawyer aiming to reach and maximize their earnings in this role. Here, we'll provide a granular breakdown of the six most critical elements that shape the DGC compensation package.

### 1. Level of Education and Pedigree

In the legal field, pedigree matters, and this holds true for senior in-house roles. While the foundational requirement is a Juris Doctor (J.D.) degree and admission to at least one state bar, where you earned that degree can have a lasting impact on your career trajectory and earning potential.

- Top-Tier Law Schools: A J.D. from a "T14" (top 14) law school is a significant differentiator. Graduates from schools like Harvard, Yale, Stanford, Columbia, and Chicago are disproportionately represented in the senior legal ranks of Fortune 500 companies. This isn't just about the quality of education; it's about the powerful alumni network, the on-campus recruiting opportunities with elite "Big Law" firms, and the signal of intellectual rigor it sends to employers. Landing that first job at a prestigious law firm is often a critical stepping stone to a top in-house position, and a T14 J.D. opens that door wide. While it's difficult to quantify the direct salary premium, it's undeniable that this educational background provides access to the highest-paying career paths.

- Advanced Degrees: While not required, an additional graduate degree can provide a competitive edge and justify a higher salary, particularly in specialized industries.

- LL.M. (Master of Laws): An LL.M. in a relevant field like Tax, Intellectual Property, or International Law can be valuable for DGCs at companies where these are core business issues.

- M.B.A. (Master of Business Administration): An M.B.A. is perhaps the most powerful complementary degree for an aspiring DGC. It signals a deep understanding of finance, strategy, and operations, reinforcing the DGC's role as a business partner, not just a legal advisor. A DGC with a J.D./M.B.A. is uniquely positioned to advise the C-suite and is often on the fast track to a General Counsel role. This combination can easily add a 10-15% premium to a compensation package.

- Certifications: In today's data-driven world, specialized certifications are increasingly valuable. For a DGC, the most impactful is the Certified Information Privacy Professional (CIPP) from the IAPP. With data privacy (GDPR, CCPA) being a top-tier risk for almost every company, a DGC who is a certified expert in this area is a massive asset and can command a higher salary.

### 2. Years and Quality of Experience

Experience is arguably the single most important factor in determining a DGC's salary. It’s not just about the number of years since you passed the bar; it's about the *quality* and *relevance* of that experience. The path to a DGC role is a marathon, not a sprint.

- The "Big Law" Foundation (Years 2-8): The most common and lucrative path starts with several years at a large, prestigious law firm (an "Am Law 100" firm). Here, young lawyers are exposed to high-stakes, complex work for sophisticated corporate clients. They develop rigorous analytical skills, exceptional work ethic, and expertise in a specific practice area (e.g., M&A, capital markets, litigation). This experience is considered the gold standard by corporate legal departments. An attorney who has made it to Mid-Level or Senior Associate at a top firm is a prime candidate to move in-house to a Counsel or Senior Counsel role.

- The In-House Progression (Years 8-15+): After moving in-house, the lawyer must demonstrate a different set of skills. They transition from a pure legal specialist to a business-savvy generalist. The typical progression looks like this:

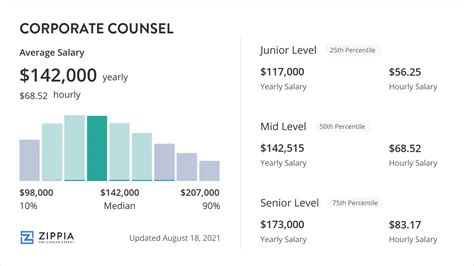

- Counsel / Corporate Counsel: Focus on day-to-day legal work, contract negotiation, and advising specific business units.

- Senior Counsel / Managing Counsel: Begin to manage smaller projects, mentor junior lawyers, and handle more complex legal matters.

- Associate General Counsel (AGC): This is a key step. The AGC typically has management responsibility for a specific legal function (e.g., AGC of Litigation, AGC of Commercial) or a business division. This is where lawyers prove they can lead teams and manage budgets.

- Deputy General Counsel (Years 15+): To make the final leap to DGC requires demonstrating broad expertise across multiple legal areas, strong leadership over large teams, and the executive presence to confidently advise the C-suite.

The salary climbs steeply with each step. An AGC at a large company might earn a total compensation of $300,000 - $400,000. The DGC role represents the next tier, often adding another $100,000 to $200,000+ to that total package, justified by the broader scope of responsibility and proximity to the General Counsel.

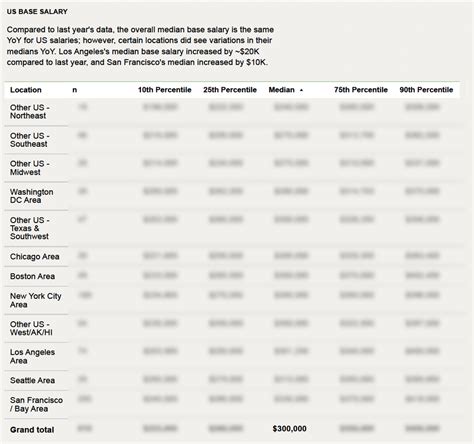

### 3. Geographic Location

Where a company is headquartered has a massive impact on salary, driven primarily by the local cost of living and the concentration of corporate headquarters. High-cost metropolitan areas with a high demand for top legal talent command significant salary premiums.

Top-Tier Metropolitan Areas: These cities consistently offer the highest DGC salaries, often 20-35% above the national average.

- San Francisco Bay Area (San Francisco, Silicon Valley/San Jose): The epicenter of the tech industry, this region pays a premium for lawyers with expertise in IP, data privacy, and venture capital. DGC total compensation here can easily exceed $600,000.

- New York City, NY: The hub of finance, media, and international business. DGCs at major banks, private equity firms, and media conglomerates in NYC are among the highest-paid in the world.

- Los Angeles, CA & Washington, D.C.: LA's media/entertainment industry and D.C.'s concentration of government contractors and regulatory-heavy industries also drive up compensation.

- Boston, MA & Chicago, IL: Major hubs for biotech/pharma (Boston) and a diverse range of industries (Chicago), both offering DGC salaries well above the national median.

Mid-Tier Metropolitan Areas: These cities offer competitive salaries that are closer to the national average.

- Dallas/Fort Worth, TX

- Atlanta, GA

- Denver, CO

- Seattle, WA

Lower-Paying Regions: Salaries tend to be lower in smaller cities and rural areas, particularly in the Midwest and Southeast, where the cost of living is significantly less. A DGC role in Omaha, Nebraska, while still a very high-paying job for the area, might have a total compensation package 15-25% below the national median.

Compensation Comparison by Major Metro Area (Illustrative)

| Metro Area | Median DGC Base Salary | Total Compensation (Est. Range) | Cost of Living Index (US Avg = 100) |

| :--- | :--- | :--- | :--- |

| San Jose, CA | $374,623 | $500k - $800k+ | ~215 |

| New York, NY | $359,638 | $450k - $750k+ | ~180 |

| Chicago, IL | $317,680 | $400k - $600k+ | ~105 |

| Dallas, TX | $293,705 | $350k - $550k+ | ~102 |

| Atlanta, GA | $287,710 | $330k - $520k+ | ~100 |

*Sources: Salary.com (base salary by metro), with total compensation ranges estimated based on industry reports. Cost of living data is illustrative from various public sources.*

### 4. Company Type, Size, and Industry

The specific characteristics of the employing company are a massive driver of compensation. A DGC at a small non-profit and a DGC at a Fortune 10 public company are worlds apart in terms of pay.

- Public vs. Private: This is the biggest dividing line.

- Publicly-Traded Companies: These companies generally pay the most. Their compensation structures are heavily weighted towards LTI (RSUs, stock options) to align executives with shareholder interests. The larger the company's revenue and market capitalization, the higher the pay. A DGC at a Fortune 100 company is in the top 1% of earners for the profession.

- Privately-Held Companies: Large private companies (e.g., Cargill, Koch Industries) pay very well, often with competitive base salaries and significant cash bonuses. However, their LTI may be in the form of "phantom stock" or other profit-sharing units, which can be less liquid and have less explosive upside than public stock.

- Company Size (by Revenue): Industry compensation surveys, like those from Major, Lindsey & Africa, consistently segment data by company revenue, as it's a direct proxy for complexity and responsibility.

- < $500 Million: DGCs here might see total compensation in the $250k - $350k range.

- $500 Million - $2 Billion: Total compensation often moves into the $350k - $500k range.

- $2 Billion - $10 Billion: This is where DGC compensation regularly exceeds $500k, with significant LTI grants.

- $10 Billion+: These are the top-paying roles, where total compensation can reach $700,000 to over $1 million annually.

- Industry: The profitability and growth profile of the industry heavily influences pay scales.

- Top-Paying Industries: Technology, Financial Services (banking, private equity, hedge funds), Pharmaceuticals/Biotechnology, and Energy. These industries are either high-growth, highly regulated, or highly profitable, and they compete fiercely for top legal talent.

- Mid-Range Industries: Manufacturing, Consumer Packaged Goods (CPG), Media, and Telecommunications.

- Lower-Paying Sectors: Non-Profit, Higher Education, and Government. While still offering comfortable upper-middle-class salaries, these sectors cannot compete with the for-profit world, especially on bonus and LTI components. A DGC at a large university or foundation might earn a total compensation package in the $200k - $300k range.

- Startups: Venture-backed startups are a special case. The base salary and cash bonus for a DGC (or often a "VP of Legal") might be *lower* than at an established public company. However, the compensation package will be heavily weighted towards equity (stock options). This is