Ever wondered who holds the keys to the financial kingdom? Who makes the critical call on whether a startup gets the funding to change the world, a corporation secures a multi-billion dollar loan for a merger, or a family is approved for their dream home mortgage? Behind these monumental decisions stands a sharp, analytical mind: the Credit Risk Analyst. This isn't just a job; it's a position of immense trust and responsibility, acting as the financial guardian for banks, investment firms, and corporations.

If you possess a knack for numbers, a detective's curiosity, and a desire for a stable, lucrative, and intellectually stimulating career, then the world of credit risk analysis might be your calling. The financial rewards are significant, with a typical credit risk analyst salary in the United States often ranging from a strong starting point of around $70,000 to well over $150,000 for experienced professionals in major financial hubs.

I once worked with a mid-sized manufacturing company teetering on the edge. Their ambitious expansion plan, which was their only path to survival in a competitive market, depended entirely on securing a significant line of credit. It wasn't the CEO's charismatic pitch that sealed the deal; it was the meticulous, almost forensic, analysis performed by the bank's senior credit risk analyst. She dug deep into their cash flow projections, stress-tested their business model against market volatility, and ultimately built a compelling case that the risk was manageable and the reward was substantial. Her analysis convinced the loan committee, the company got its funding, and hundreds of jobs were saved. That is the tangible, real-world impact of this critical profession.

This guide will serve as your comprehensive roadmap to understanding not just the salary, but the entire ecosystem of a career in credit risk analysis. We will dissect every factor that influences your earnings, explore the future of the profession, and provide a clear, step-by-step plan to help you launch your own successful journey.

### Table of Contents

- [What Does a Credit Risk Analyst Do?](#what-does-a-credit-risk-analyst-do)

- [Average Credit Risk Analyst Salary: A Deep Dive](#average-credit-risk-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Credit Risk Analyst Do?

At its core, a Credit Risk Analyst is a financial detective who assesses the likelihood that a borrower—be it an individual, a company, or even a government—will be unable to repay its debt. Their primary objective is to protect their employer from financial loss by making informed, data-driven recommendations on lending decisions. They are the gatekeepers of capital, balancing the desire for profitable lending with the prudent management of risk.

The role is a dynamic blend of quantitative analysis, qualitative judgment, and strategic thinking. It goes far beyond simply looking at a credit score. Analysts delve into the intricate details of financial health, market conditions, and management competency to paint a complete picture of a borrower's creditworthiness.

Core Responsibilities and Daily Tasks:

A credit risk analyst's workload is varied and project-based. Key responsibilities typically include:

- Financial Statement Analysis: This is the bedrock of the job. Analysts meticulously scrutinize balance sheets, income statements, and cash flow statements to evaluate a company's performance, liquidity, and solvency. They calculate key financial ratios (e.g., debt-to-equity, current ratio, interest coverage ratio) to benchmark the borrower against industry peers.

- Credit Modeling and Scoring: They build and utilize sophisticated financial models, often in Excel or more advanced statistical software, to project future financial performance and assess debt repayment capacity under various economic scenarios (stress testing).

- Due Diligence and Research: Analysts conduct in-depth research on the borrower's industry, competitive landscape, market position, and the overall macroeconomic environment. This includes reading industry reports, analyst calls, and news to understand potential threats and opportunities.

- Risk Assessment and Mitigation: Based on their analysis, they assign a credit rating or risk score to the borrower. They may also structure loan covenants—specific conditions that borrowers must adhere to—to mitigate potential risks.

- Credit Memorandum/Report Writing: A crucial part of the job is communicating their findings. Analysts write detailed, persuasive credit reports and memoranda that summarize their analysis, highlight key risks, and provide a clear recommendation (e.g., approve, decline, or approve with specific conditions).

- Portfolio Monitoring: The job doesn't end once a loan is approved. Analysts continuously monitor the financial health of existing borrowers in their portfolio to identify any deteriorating credit quality and take preemptive action.

- Compliance and Regulation: They must ensure that all lending activities comply with internal policies and external regulations, such as those set by the Federal Reserve, the OCC (Office of the Comptroller of the Currency), or international standards like Basel III.

### A Day in the Life of a Corporate Credit Risk Analyst

To make this more tangible, let's walk through a typical day for an analyst at a mid-sized commercial bank:

- 8:30 AM - 9:30 AM: Market and Portfolio Review. The day begins by catching up on market news, interest rate movements, and any significant economic data releases. They'll quickly scan their existing loan portfolio for any red flags or news alerts related to the companies they cover.

- 9:30 AM - 12:00 PM: Deep Dive on a New Loan Application. The main task for the morning is a new $15 million loan request from a logistics company looking to expand its fleet. The analyst downloads the company's last three years of financial statements, spreading them in a detailed Excel model. They analyze revenue trends, profit margins, and debt levels, making notes on areas of concern.

- 12:00 PM - 1:00 PM: Lunch & Learn. The analyst attends a brown-bag lunch session where a senior economist from the bank presents an outlook on the transportation sector for the next 18 months. This provides crucial industry context for the loan application they're working on.

- 1:00 PM - 3:30 PM: Modeling and Stress Testing. Back at their desk, the analyst builds out financial projections for the logistics company. What happens to their ability to repay if fuel costs spike by 20%? What if their largest client goes bankrupt? They run these "stress tests" through their model to quantify the potential risk.

- 3:30 PM - 5:00 PM: Drafting the Credit Memorandum. With the quantitative analysis complete, the analyst begins writing the credit memo. They synthesize all their findings into a clear narrative, outlining the company's strengths, weaknesses, and the key risks of the proposed loan. They draft an initial recommendation to present to the loan committee.

- 5:00 PM - 5:30 PM: Follow-up and Collaboration. The analyst sends a few emails to the relationship manager with clarifying questions about the company's management team and sends a preliminary risk summary to their direct manager for feedback before finalizing the report the next day.

This example illustrates the blend of solitary, focused analysis and collaborative, communicative work that defines the role.

Average Credit Risk Analyst Salary: A Deep Dive

The salary potential is a primary motivator for many considering a career in credit risk analysis. The field offers a highly competitive compensation structure that rewards expertise, diligence, and experience. While exact figures vary based on the numerous factors we'll explore in the next section, we can establish a clear and reliable picture using data from authoritative sources.

It's important to note that job titles can sometimes be used interchangeably. "Credit Analyst," "Credit Risk Analyst," and "Financial Analyst" with a credit specialization often have overlapping responsibilities and salary bands. For this guide, we will aggregate data across these closely related titles to provide a comprehensive view.

National Average and Typical Salary Range

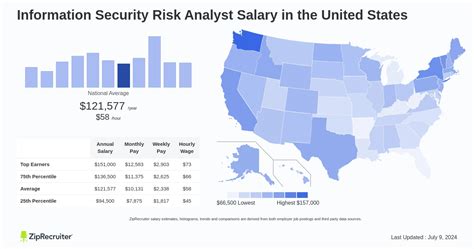

According to recent 2023 and 2024 data from several reputable sources, the average base salary for a Credit Risk Analyst in the United States falls into a strong upper-middle-class bracket.

- Salary.com: As of early 2024, Salary.com reports the median salary for a Credit Analyst III (a mid-to-senior level role) in the U.S. is approximately $92,570, with a typical range falling between $81,374 and $104,800. For a more senior Credit Risk Manager, the median jumps to $129,576.

- Payscale: Payscale.com provides a broader view, stating the average base salary for a Credit Risk Analyst is around $73,500 per year. However, it shows a wide range from $55,000 for entry-level positions to over $105,000 for those with significant experience, not including bonuses.

- Glassdoor: Glassdoor, which relies on user-submitted data, estimates the total pay (including bonuses and other compensation) for a Credit Risk Analyst in the U.S. to be approximately $99,800 per year, with a likely range between $80,000 and $125,000.

- U.S. Bureau of Labor Statistics (BLS): While the BLS doesn't have a specific category for "Credit Risk Analyst," it groups them under "Financial Analysts." The median pay for Financial Analysts was $95,570 per year as of May 2022. This government-backed data point strongly corroborates the figures from other salary aggregators.

Synthesizing the data, we can confidently establish that a mid-career Credit Risk Analyst can expect a base salary in the $85,000 to $110,000 range, with total compensation often pushing well into six figures.

### Salary by Experience Level

Salary growth in credit risk analysis is predictable and substantial. As you gain experience, develop specialized skills, and demonstrate sound judgment, your value—and your paycheck—will increase significantly.

Here is a typical salary progression you can expect throughout your career:

| Experience Level | Typical Years of Experience | Typical Base Salary Range (USD) | Key Responsibilities & Scope |

| :--- | :--- | :--- | :--- |

| Entry-Level Credit Analyst | 0-2 Years | $65,000 - $80,000 | Learning the ropes, financial statement spreading, calculating ratios, assisting senior analysts, writing sections of credit reports, portfolio monitoring. Focus is on technical execution and accuracy. |

| Mid-Career Credit Analyst | 3-7 Years | $80,000 - $115,000 | Managing a dedicated portfolio of clients, conducting full-cycle credit analysis independently, building financial models, making initial credit recommendations, and presenting findings to internal committees. |

| Senior Credit Risk Analyst / Team Lead | 8-15 Years | $110,000 - $150,000+ | Handling the largest and most complex credit applications (e.g., syndicated loans, leveraged buyouts), mentoring junior analysts, taking a lead role in credit committee discussions, developing risk policy, and acting as a subject matter expert. |

| Credit Risk Manager / Director | 15+ Years | $140,000 - $250,000+ | Managing a team of analysts, setting the overall credit risk strategy for a department or region, holding ultimate approval authority for large loans, and interfacing with executive leadership and regulators. |

*Note: These ranges are national averages and can be significantly higher in major financial centers.*

### Beyond the Base Salary: Understanding Total Compensation

A crucial aspect of financial careers is that base salary is only one part of the equation. Total compensation for a credit risk analyst is often significantly higher due to variable pay components.

- Annual Bonuses: This is the most common form of additional compensation. Bonuses are typically tied to both individual performance (quality of analysis, deals completed) and the overall performance of the bank or firm. For a mid-career analyst, a bonus can range from 10% to 30% of their base salary. For senior roles at investment banks, bonuses can be substantially larger.

- Profit Sharing: Some firms, particularly smaller banks, credit unions, and private companies, offer profit-sharing plans. A portion of the company's annual profits is distributed among employees, directly aligning their incentives with the firm's success.

- Stock Options / Equity (FinTech): In the rapidly growing FinTech sector, credit risk analysts may receive stock options or restricted stock units (RSUs) as part of their compensation. While riskier, this can offer enormous upside potential if the company performs well.

- Comprehensive Benefits: Financial institutions are known for offering robust benefits packages, which represent significant financial value. These typically include:

- 401(k) or 403(b) with Generous Matching: It's common for firms to match employee contributions up to 5-6% of their salary.

- Excellent Health Insurance: Top-tier medical, dental, and vision insurance plans with low premiums.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies.

- Tuition Reimbursement: Many banks will sponsor employees pursuing relevant advanced degrees (like an MBA) or professional certifications (like the CFA or FRM).

When evaluating a job offer, it's essential to look at the entire compensation package. A role with a slightly lower base salary but a larger bonus potential and excellent benefits could be more lucrative in the long run.

Key Factors That Influence a Credit Risk Analyst Salary

While the national averages provide a solid benchmark, your individual credit risk analyst salary will be determined by a specific combination of factors. Understanding these levers is the key to maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of what truly drives compensation in this field.

###

Level of Education

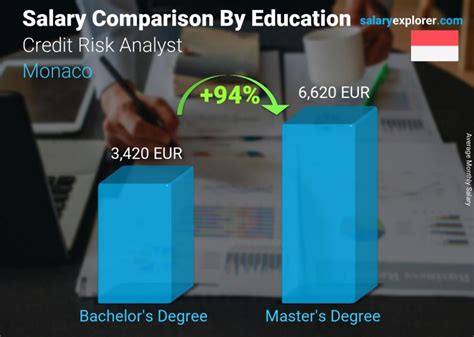

Your educational background is the foundation upon which your career—and salary—is built. While a bachelor's degree is the standard entry requirement, the type of degree and any advanced qualifications you hold can create a significant salary differential.

- Bachelor's Degree: A bachelor's degree in a quantitative-heavy field is virtually mandatory. The most common and desirable majors are Finance, Accounting, Economics, and Business Administration. A degree in Mathematics or Statistics is also highly regarded. This level of education will qualify you for entry-level roles in the $65k-$80k range.

- Master's Degree: Pursuing a master's degree can provide a substantial salary boost and open doors to more senior or specialized roles right out of school.

- Master of Business Administration (MBA): An MBA, especially from a top-tier business school, is a powerful accelerator. It not only deepens financial knowledge but also hones strategic thinking and leadership skills. Graduates can often command starting salaries 20-40% higher than their bachelor's-only peers and are placed on a faster track to management.

- Master of Science in Finance (MSF): An MSF is a more specialized, quantitative-focused degree. It is highly respected for roles requiring deep financial modeling and analytical rigor, particularly in investment banking or asset management.

- Professional Certifications: In the world of finance, professional certifications are a clear signal of expertise and dedication. They are a proven way to increase your salary and competitiveness.

- Chartered Financial Analyst (CFA): The CFA charter is the gold standard in the investment management industry. While incredibly rigorous (requiring three challenging exams), holding the charter can add a 15-25% premium to your salary. It demonstrates mastery of investment tools, asset valuation, portfolio management, and wealth management, all of which are relevant to credit risk.

- Financial Risk Manager (FRM): Offered by the Global Association of Risk Professionals (GARP), the FRM is the premier certification specifically for risk management professionals. It covers quantitative analysis, market risk, credit risk, and operational risk. Holding an FRM is a direct signal of expertise in the field and can lead to significant salary increases and promotions, particularly for those aiming for senior risk management roles.

###

Years of Experience

As illustrated in the previous section, experience is arguably the single most powerful driver of salary growth. However, it's not just the number of years that matters, but the *quality* and *type* of experience gained at each stage.

- 0-2 Years (Analyst I): Salary: $65k-$80k. At this stage, you are building your core technical skills. Your value is in your ability to accurately process information, learn quickly, and be a reliable team member. The focus is on mastering financial statement analysis and the firm's specific credit processes.

- 3-7 Years (Analyst II/III): Salary: $80k-$115k. You are now expected to work independently. Your value comes from your ability to manage a portfolio, identify nuanced risks, and form well-reasoned, independent opinions. You begin to develop a reputation for sound judgment. Analysts who can handle more complex deals (e.g., those with multiple layers of debt) will move to the higher end of this range.

- 8+ Years (Senior/Lead Analyst): Salary: $110k-$150k+. At this level, your value is strategic. You are not just analyzing deals; you are shaping them. You handle the firm's most important clients and most complex transactions. You mentor junior staff and are a key voice in high-level risk discussions. Your experience in navigating past economic cycles (e.g., the 2008 crisis, the COVID-19 pandemic) becomes invaluable.

###

Geographic Location

Where you work has a dramatic impact on your salary, primarily due to cost of living and the concentration of financial jobs. A credit risk analyst salary in a major financial hub can be 30-50% higher than in a smaller regional market.

High-Paying Metropolitan Areas:

- New York, NY: The undisputed financial capital of the world. Salaries here are the highest across the board to compensate for the extremely high cost of living and the concentration of high-stakes roles in investment banking and global markets. A mid-career analyst in NYC could easily earn $120,000 - $140,000+ in base salary.

- San Francisco Bay Area, CA: Driven by the venture capital and tech industries, the Bay Area needs skilled analysts to assess both startup funding and large corporate tech debt. Salaries are comparable to New York.

- Charlotte, NC: A major banking hub, home to Bank of America's headquarters and Wells Fargo's large East Coast operations. It offers a lower cost of living than NYC but with highly competitive banking salaries.

- Chicago, IL: A historic center for finance and commodities, with a robust commercial banking and trading scene. Salaries are strong, sitting just below the coastal hubs.

- Boston, MA: A key center for asset management and private equity firms, which all require sophisticated credit risk analysis.

Mid-Tier & Lower-Paying Areas:

Cities like Dallas, Atlanta, Minneapolis, and Phoenix have strong and growing financial sectors with plenty of opportunities, but salaries will generally be 10-20% lower than in the top-tier hubs. Smaller cities and rural areas will be on the lower end of the national salary spectrum, though the lower cost of living can sometimes offset this.

###

Company Type & Size

The type and size of your employer create distinct career paths and compensation structures.

- Investment Banks (e.g., Goldman Sachs, J.P. Morgan): This is the pinnacle of pay. Analysts here work on high-stakes, complex deals like leveraged buyouts (LBOs) and mergers and acquisitions (M&A). The hours are long and the pressure is intense, but the compensation, particularly the bonus component, is unmatched. Senior analysts can see total compensation well in excess of $250,000.

- Commercial Banks (e.g., Bank of America, U.S. Bank): This is the most common employer for credit risk analysts. They offer a wide range of roles from small business lending to large corporate and institutional clients. The pay is excellent and the work-life balance is generally better than in investment banking. Salaries align closely with the national averages previously discussed.

- Credit Rating Agencies (e.g., Moody's, S&P Global, Fitch): Here, the role is slightly different. You aren't deciding whether to lend money, but rather assigning a public credit rating to a company's debt. This is highly analytical, research-intensive work. Compensation is competitive and often provides a great platform to move into other areas of finance.

- FinTech Companies (e.g., Stripe, Block, SoFi): This is a high-growth, dynamic sector. Analysts here work with non-traditional data sets and cutting-edge machine learning models to assess risk. Base salaries are competitive, and the potential for life-changing wealth through stock options is a major draw, though it comes with the volatility of the startup world.

- Asset Management & Hedge Funds: These firms hire credit analysts to assess the risk of the bonds and other debt instruments they purchase for their investment portfolios. This is a highly sought-after, "buy-side" role that is intellectually demanding and pays extremely well.

- Credit Unions & Community Banks: These smaller, often member-owned institutions focus on local lending. The scale is smaller, and the salaries will be on the lower end of the spectrum, but they often offer excellent work-life balance and a strong sense of community impact.

###

Area of Specialization

Within the broad field of credit risk, specializing in a particular area can significantly enhance your value and salary.

- Corporate/Commercial & Industrial (C&I) Credit: This involves analyzing loans for medium to large businesses. It is the most common specialization and forms the basis for much of the salary data.

- Consumer Credit Risk: This focuses on pools of consumer debt like mortgages, auto loans, and credit cards. It is highly quantitative and often involves statistical modeling of large datasets.

- Leveraged Lending / High-Yield Debt: This is a high-risk, high-reward niche focusing on lending to companies that are already heavily indebted, often for buyouts. It requires exceptional analytical skill and pays a significant premium.

- Sovereign Risk: This involves analyzing the creditworthiness of entire countries. These roles are rare and typically found at rating agencies, large investment banks, or international organizations like the IMF.

- Counterparty Risk: This specialization focuses on the risk that the other party in a financial transaction (like a derivative trade) will default. It is a critical function within investment banks and is highly quantitative.

- ESG Risk Analysis: An emerging and increasingly important field. Analysts specialize in evaluating how Environmental, Social, and Governance factors impact a company's creditworthiness. Expertise in this area is becoming a high-value differentiator.

###

In-Demand Skills

Finally, the specific skills you bring to the table can directly translate into a higher salary. Employers will pay a premium for analysts who are more efficient, more insightful, and more technically adept.

- Advanced Financial Modeling: Going beyond basic models to build complex, dynamic, three-statement models with scenario and sensitivity analysis is a key differentiator.

- Data Analysis & Programming: Proficiency in tools beyond Excel is a massive advantage.

- SQL: The ability to query large databases to pull your own data is a highly valued skill that makes you more efficient.

- Python or R: Using programming languages to automate tasks, run statistical analyses, and even build machine learning risk models is a skill that can put you in the top tier of earners.

- Statistical Software: Experience with statistical packages like SAS, Stata, or MATLAB is particularly valuable in consumer credit risk and quantitative modeling roles.

- Communication and Presentation Skills: Your analysis is useless if you can't communicate it effectively. Analysts who can write clear, concise reports and confidently present their findings to senior management are always in high demand and are promoted faster.

- Business Acumen & Judgment: This is the intangible skill that develops with experience. It's the ability to see beyond the numbers, understand the story of the business, and make a sound judgment call in the face of uncertainty. This is what separates a good analyst from a great one.

Job Outlook and Career Growth

When investing years in building a career, understanding its long-term viability is just as important as the initial salary. Fortunately, the outlook for credit risk analysts is