Have you ever stood in line for a warm, gooey Crumbl cookie, looked around at the bustling store, and thought, *“I could do this. I wonder what the owner of this place actually makes?”* It’s a tantalizing thought—transforming a passion for a viral, beloved brand into a thriving business and a substantial personal income. For many aspiring entrepreneurs, the dream of owning a franchise like Crumbl represents the perfect blend of structured support and personal autonomy. But before you trade in your day job for a sea of pink boxes, it’s crucial to look beyond the hype and understand the financial realities.

The truth is, there is no simple "Crumbl franchise owner salary." An owner's income isn't a fixed paycheck; it's the profit that remains after every single expense is paid. This figure can vary dramatically, with potential annual take-home profits ranging from a modest $50,000 to well over $500,000 per location for top-performing stores. The path to the higher end of that spectrum is paved with exceptional management, strategic decision-making, and a deep understanding of the business's mechanics.

I once advised a client who was leaving a stable corporate career to purchase a food-service franchise. His biggest hurdle wasn't securing the loan; it was shifting his mindset from that of an employee collecting a salary to an owner responsible for *creating* the profit. This guide is designed to help you make that same mental shift, providing an expert, data-driven analysis of what it truly takes to succeed financially as a Crumbl franchise owner. We will dissect the numbers, explore the critical factors that dictate your profitability, and lay out a clear roadmap to getting started.

### Table of Contents

- [What Does a Crumbl Franchise Owner Actually Do?](#what-does-a-crumbl-franchise-owner-actually-do)

- [Average Crumbl Franchise Owner 'Salary': A Deep Dive into Profitability](#average-crumbl-franchise-owner-salary-a-deep-dive-into-profitability)

- [Key Factors That Influence a Crumbl Owner's Income](#key-factors-that-influence-a-crumbl-owners-income)

- [Business Outlook and Growth Potential for Crumbl Franchisees](#business-outlook-and-growth-potential-for-crumbl-franchisees)

- [How to Become a Crumbl Franchise Owner](#how-to-become-a-crumbl-franchise-owner)

- [Conclusion: Is a Crumbl Franchise Your Recipe for Success?](#conclusion-is-a-crumbl-franchise-your-recipe-for-success)

What Does a Crumbl Franchise Owner Actually Do?

Many people fantasize about the "fun" parts of owning a cookie franchise: tasting the weekly flavors, engaging with happy customers, and being the face of a popular local spot. While those are certainly perks, the reality is that a successful Crumbl franchise owner is a multi-faceted business operator who wears numerous hats simultaneously. You are not just buying a cookie recipe; you are buying a complex operational system that you are responsible for executing flawlessly.

At its core, the role of a Crumbl owner is to be the CEO, CFO, and COO of their own small-to-medium-sized business. Your primary responsibility is to maximize revenue while diligently controlling costs to generate a healthy profit margin. This involves a delicate balance of high-level strategy and in-the-weeds, day-to-day management.

Core Responsibilities & Daily Tasks:

- Financial Management: This is paramount. You are constantly monitoring your Profit & Loss (P&L) statement. This includes tracking daily sales, managing payroll (often the largest single expense), paying suppliers for ingredients and paper goods, handling rent and utilities, and ensuring you pay your franchise royalties and marketing fees to Crumbl corporate on time.

- Human Resources & Leadership: You are responsible for hiring, training, and retaining a team of "Crumblrs" (bakers and front-of-house staff). This means creating a positive work culture, managing schedules, conducting performance reviews, and ensuring compliance with all labor laws. A happy, efficient team is the engine of a profitable store.

- Operations & Quality Control: Crumbl's success is built on consistency. A cookie in your Ohio store must taste and look exactly like a cookie from a California store. You are responsible for enforcing all of Crumbl's proprietary recipes, baking procedures, and store cleanliness standards. This includes inventory management to ensure you have enough dough, toppings, and signature pink boxes without creating excessive, costly waste.

- Marketing & Community Engagement: While Crumbl corporate runs massive national campaigns (especially on social media like TikTok), you are the brand's ambassador in your local community. This involves managing local social media pages, building relationships with other local businesses, executing local marketing initiatives, and ensuring an exceptional customer experience to drive repeat business and positive reviews.

- Customer Service: You are the ultimate backstop for all customer issues. When an order is wrong or a customer has a complaint, the buck stops with you. Resolving these issues professionally is key to protecting your store's reputation.

### A "Day in the Life" of a Crumbl Owner

To make this tangible, here's a glimpse into a typical Tuesday for a hands-on owner:

- 7:00 AM: Arrive at the store before the opening crew. Review the previous day's sales reports and key performance indicators (KPIs) like labor cost percentage and food cost. Check the inventory of key ingredients for the week's rotating menu.

- 8:00 AM: The morning baking crew arrives. You lead a quick huddle, discussing the goals for the day and highlighting one of the new weekly flavors to ensure everyone knows the recipe and presentation standards.

- 10:00 AM: The store opens. You might work the counter for the first hour, greeting customers and observing the team's efficiency. You notice the line is moving a bit slow and provide some in-the-moment coaching to a new employee on the point-of-sale system.

- 12:00 PM: Lunch rush. You're in a "player-coach" role—jumping in to fold boxes, run cookies to the warming station, or even mix dough if the team gets overwhelmed.

- 2:00 PM: The rush subsides. You retreat to the back office to work on the schedule for next week, ensuring you have adequate coverage for the busy weekend without overspending on labor. You also place the main ingredient order for the week.

- 4:00 PM: Conference call with your Crumbl Franchise Business Consultant. You discuss your store's performance against regional benchmarks and brainstorm ideas for a local marketing push.

- 5:00 PM: You spend an hour responding to customer reviews on Google and Yelp, thanking people for positive feedback and privately reaching out to resolve any negative experiences.

- 6:00 PM: The evening shift is settled in. You do one last walkthrough to check on quality and cleanliness before heading home, knowing you'll still be checking the sales dashboard on your phone throughout the evening.

This is not a passive investment. It's a demanding, hands-on leadership role that requires a relentless focus on operational excellence and financial discipline.

Average Crumbl Franchise Owner 'Salary': A Deep Dive into Profitability

This is the section every prospective franchisee wants to see. But as we've established, "salary" is a misnomer. We need to talk about profitability. An owner's income is the Net Profit or Owner's Benefit, which is what's left after all the bills are paid. The primary source for this information is the Franchise Disclosure Document (FDD), a legal document that franchisors must provide to prospective buyers. Item 19 of the FDD contains Financial Performance Representations (FPRs), which detail the sales and, sometimes, costs of existing franchise locations.

According to a detailed analysis of Crumbl's 2023 FDD by franchise industry experts at Vetted Biz, the financial potential is significant. It's important to note these are averages and your results could be substantially different.

- Median Annual Revenue (for stores open at least 12 months in 2022): $1,838,499

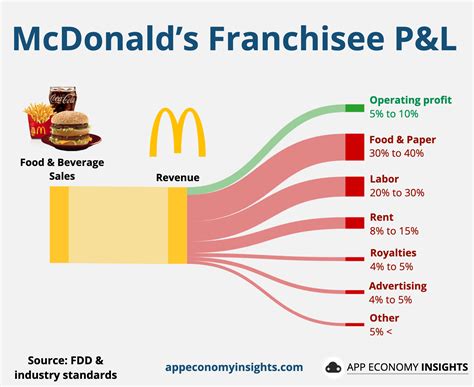

This is a staggering revenue figure for a cookie shop, showcasing the brand's immense popularity. However, high revenue does not automatically equal high profit. We must subtract the costs. The journey from Gross Revenue to Net Profit is a path of a thousand cuts—each expense chipping away at the top line.

### Breaking Down the Compensation: From Revenue to Take-Home Pay

Let's build a hypothetical Profit & Loss (P&L) statement for an average-performing Crumbl store based on industry averages and FDD data.

Hypothetical P&L for an Average Crumbl Store (Annual)

| Item | Percentage of Revenue | Dollar Amount (based on $1.84M Revenue) | Description |

| :--- | :--- | :--- | :--- |

| Gross Revenue | 100% | $1,840,000 | Total sales from cookies, drinks, etc. |

| Cost of Goods Sold (COGS) | ~24-28% | ~$480,000 | Flour, sugar, chocolate, packaging, etc. |

| *Gross Profit* | *~72-76%* | *$1,360,000* | Revenue minus direct costs of goods. |

| Operating Expenses | | | |

| - Labor & Payroll Taxes | ~25-30% | ~$510,000 | Staff wages, manager salary, payroll taxes. This is the largest expense. |

| - Rent & Occupancy | ~6-10% | ~$147,000 | Lease payments, property taxes, utilities. Highly location-dependent. |

| - Royalty Fee | 8% | $147,200 | Paid to Crumbl corporate on gross sales. |

| - National Marketing Fee | 2% | $36,800 | Paid to Crumbl corporate for national ads. |

| - Technology & POS Fees | ~1-2% | ~$27,600 | Software, point-of-sale system, online ordering platform. |

| - Local Marketing | ~1-2% | ~$27,600 | Your local ad spend budget. |

| - Professional Services | ~1% | ~$18,400 | Accounting, legal, payroll services. |

| - Repairs & Maintenance | ~1% | ~$18,400 | Fixing mixers, ovens, HVAC, etc. |

| - Insurance, Licenses, Etc. | ~1% | ~$18,400 | Business liability insurance and permits. |

| - Miscellaneous | ~2% | ~$36,800 | Office supplies, bank fees, unforeseen costs. |

| Total Operating Expenses | ~68-76% | ~$1,080,000 | The total cost to run the business. |

| EBITDA (Profit Before Interest, Taxes, Depreciation, Amortization) | ~10-18% | ~$280,000 | A key indicator of operational profitability. |

| - Debt Service (Loan Pymt) | Varies | Varies | Payments on business loans (e.g., SBA loan). |

| - Taxes | Varies | Varies | Federal, state, and local income taxes. |

| Net Profit (Owner's Potential Take-Home) | ~8-15% | ~$147,200 - $276,000 | This is the "salary" figure. |

Source: P&L structure is standard business practice. Percentages are derived from analyses of Crumbl's FDD by sources like *Vetted Biz* and *SharpSheet*, combined with general food franchise industry benchmarks.

### Store Performance Tiers: Not All Franchises are Created Equal

As the P&L shows, a franchisee's income is a *percentage* of their revenue. This means that a store with higher sales and tighter cost controls will yield a significantly higher income. We can model this out into performance tiers.

| Store Performance Tier | Median Annual Revenue | Estimated Profit Margin | Estimated Annual Owner Income | Characteristics |

| :--- | :--- | :--- | :--- | :--- |

| Lower Quartile / Underperforming | ~$1,200,000 | ~5-8% | $60,000 - $96,000 | Poor location, high competition, inefficient operations, high staff turnover, or a new store in its first year. |

| Median / Average-Performing | ~$1,840,000 | ~8-12% | $147,200 - $220,800 | A well-run store in a decent market, meeting the brand's operational standards. This is the target for most owners. |

| Top Quartile / High-Performing | ~$2,500,000+ | ~12-18%+ | $300,000 - $450,000+ | Prime location, exceptional operational efficiency, strong local marketing, and often a more mature store with a loyal customer base. |

Important Caveat: This income is before the owner pays their own personal income taxes. It also assumes the owner is actively managing the store. If an owner hires a full-time General Manager for ~$60,000-$80,000 per year to run the daily operations, that salary comes directly out of the Net Profit, reducing the owner's take-home pay.

Key Factors That Influence a Crumbl Owner's Income

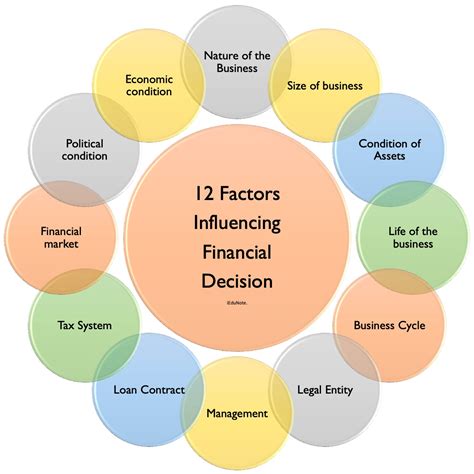

The massive variance in potential income—from $60,000 to over $450,000—is not random. It is the direct result of a combination of strategic choices, market realities, and the owner's own skills. Understanding these factors is the single most important step in assessing your own potential for success. An expert franchisee doesn't just run the playbook; they optimize every variable they can control.

### Level of Education & Prior Experience

While you don't need a Ph.D. to own a cookie store, your background has a profound impact on your learning curve and ability to avoid costly rookie mistakes.

- Business Education (BBA, MBA): A formal business degree is a significant advantage. An owner with an MBA already understands how to read a P&L statement, calculate cash flow, and develop a marketing strategy. This foundational knowledge can save tens of thousands of dollars in accounting fees and mismanaged budgets.

- Hospitality/Restaurant Management Experience: This is arguably more valuable than a business degree. Someone who has previously worked as a General Manager for a brand like Starbucks, Panera, or Chick-fil-A already knows the trenches of food service. They understand labor scheduling, inventory cycles, health code compliance, and the relentless pace of the industry. This hands-on experience is directly transferable and invaluable.

- Previous Entrepreneurial Experience: Have you owned another business before, even a small one? This experience, successful or not, teaches resilience, financial discipline, and the art of negotiation. First-time entrepreneurs often face a steep, stressful learning curve on all fronts simultaneously.

Salary Impact: An owner with a strong business or restaurant background is far more likely to achieve profitability faster. They might reach the 12-15% profit margin in Year 2, while a novice might struggle to hit 8% in the same timeframe. On a $1.8M revenue store, that's the difference between a $144,000 income and a $270,000 income.

### Years of Experience as a Franchise Owner

Your income potential evolves dramatically over the lifespan of your franchise ownership.

- Year 1: The Ramp-Up & Survival Phase. The first year is often the least profitable. You are dealing with grand opening costs, training a new team, establishing a customer base, and servicing the debt you took on to open the store. Many owners pay themselves a very modest "survival" salary or reinvest all profits back into the business to build a cash reserve. The focus is on breaking even and stabilizing operations.

- Years 2-5: The Optimization Phase. By now, your store is established. Your focus shifts to optimization. You refine schedules to perfect your labor cost percentage. You analyze sales data to minimize food waste. You build a core of reliable, long-term employees, reducing training costs. Your income should grow steadily during this period as you dial in every aspect of the P&L. This is where you can expect to hit those median profit margins of 8-12%.

- Years 5+ / Multi-Unit Ownership: The Scaling Phase. This is where true wealth is often built in franchising. A seasoned, successful owner doesn't just optimize one store; they use their proven system to open a second, third, or even a portfolio of locations. With multiple stores, you gain economies of scale. You can have one District Manager overseeing several locations, negotiate better rates with local suppliers, and average out the performance of individual stores. An owner with three "average" performing stores could generate a combined personal income of $450,000 - $600,000+ per year.

In real estate, the mantra is "location, location, location." For a retail franchise like Crumbl, this is an absolute, non-negotiable driver of success. The same owner with the same skills will have wildly different outcomes based on their store's location.

- Real Estate Costs: The single biggest location-based variable. A lease in a prime Manhattan location or a trendy Los Angeles shopping center could be $20,000+ per month. A similar-sized space in a suburban Des Moines strip mall might be $5,000 per month. This difference of $180,000 per year in rent flows directly to the bottom line. High-rent areas *must* generate significantly higher revenue just to break even.

- Local Labor Market: Labor costs are a massive part of the P&L. A state with a $15/hour minimum wage has a much higher baseline labor cost than a state with the federal minimum of $7.25/hour. According to the U.S. Bureau of Labor Statistics (BLS), the 2023 median pay for Food and Beverage Serving Workers was $14.00 per hour, but this varies from over $18/hour in states like Washington and California to under $12/hour in states like Alabama and Mississippi. This has a direct, significant impact on profitability.

- Market Saturation & Demographics: Is your store the only Crumbl within a 30-mile radius, located in a high-income suburb with lots of families? That's a recipe for success. Conversely, if your store is the fifth to open in a city, competing for the same customers in a lower-income area, you will face an intense, uphill battle for revenue.

- High-Paying vs. Low-Paying Areas (Hypothetical):

- High-Potential Area: A brand-new market in a high-growth suburb of Austin, Texas. High disposable income, strong "foodie" culture, and relatively reasonable business costs. *Potential Profit Margin: 15-20%*.

- Challenging Area: An oversaturated market in Southern California. Extremely high rent and labor costs, intense competition from dozens of other trendy dessert spots. Even with high revenue, the costs can compress margins. *Potential Profit Margin: 5-10%*.

### Operational Efficiency & Management (The "Company" You Build)

This factor is entirely within your control. Two stores in the same city with identical locations can have drastically different profit levels based purely on how they are managed.

- Labor Management: A savvy owner uses historical sales data to build a perfect schedule, ensuring enough staff for rushes but no one standing around during slow periods. A 2% reduction in labor costs on a $1.8M store is $36,000 in pure profit per year.

- Waste Control (COGS): Every cookie that's dropped, burned, or made incorrectly is money thrown away. Every bit of expired frosting or unused topping is lost profit. Meticulous inventory management and baker training can keep food costs at 24% of revenue, while a sloppy operation can see them balloon to 30%. That 6% difference is $108,000 annually.

- Customer Experience: Great service, a sparkling clean store, and fast-moving lines lead to better online reviews and more repeat customers. This drives top-line revenue without any additional marketing spend.

### In-Demand Entrepreneurial Skills

Beyond formal experience, certain innate skills directly correlate with higher owner income. These are the intangible assets that separate good owners from great ones.

- Financial Acumen: The ability to instantly understand your numbers—what's your break-even point for the day? What is your labor cost *right now*? If sales drop 10%, how does that impact your bottom line? Owners who live and breathe their financial statements make smarter, faster decisions.

- Leadership & People Management: The ability to inspire and motivate a team of mostly young, hourly employees is a superpower. An owner who is a great leader will have lower turnover, which means less time and money spent on hiring and training. Their team will be more productive and provide better service.

- Resilience & Problem-Solving: The walk-in freezer will break on a Friday afternoon. Your top two employees will quit on the same day. A bad batch of dough will ruin the morning's prep. An owner who panics will lose money. An owner who calmly and creatively solves problems will protect their profit.

- Sales & Marketing Instincts: This is the ability to be the face of your brand locally. It's forging a partnership with the local high school for their fundraiser, running a "buy 4, get one free" promo during a slow Tuesday afternoon, or creating engaging content for your store's Instagram page. This drives incremental revenue that a more passive owner would miss.

Business Outlook and Growth Potential for Crumbl Franchisees

Investing in a franchise is a long-term commitment, typically involving a 10-year franchise agreement. Therefore, it's essential to analyze not just the current hype but also the long-term viability of the brand and the industry. You are not just buying a business for today; you're investing in a career for the next decade.

### The Crumbl Brand Trajectory

Crumbl's growth has been nothing short of meteoric. Founded in 2017, it has exploded to