Introduction

In every car dealership, beyond the bustling showroom floor filled with gleaming vehicles and eager salespeople, lies a small, quiet office. To the uninitiated, it’s just the place where you sign the final papers. But to those in the automotive industry, this office is known as "the box," and it represents the single most profitable department in the entire dealership. At the heart of this profit center sits the Finance & Insurance (F&I) Manager, a role that is part financial wizard, part master negotiator, and part legal compliance officer. If you've ever dreamt of a high-stakes, high-reward career where your performance directly translates into a six-figure income, the F&I manager path deserves your full attention.

The potential is immense. While compensation is heavily performance-based, it's not uncommon for skilled F&I managers to earn well over $150,000 annually, with top performers at high-volume luxury dealerships soaring past the $250,000 mark. This isn't just a job; it's a career that offers a direct pathway to financial success for those with the right blend of grit, intelligence, and interpersonal skills. As a career analyst, I once interviewed a former car salesman who had transitioned into an F&I manager role. He told me, "On the sales floor, I was making a living. In the F&I office, I started building a legacy. The complexity and the direct link between my skill and my paycheck were game-changers."

This comprehensive guide is designed to be your definitive resource for understanding the F&I manager career. We will pull back the curtain on the dealership F&I manager salary, exploring every facet of their compensation, the factors that dictate their earnings, and the roadmap to becoming one. We'll dive deep into data from authoritative sources, outline the day-to-day realities of the job, and provide an actionable plan for you to launch your own successful career in this lucrative field.

### Table of Contents

- [What Does a Dealership F&I Manager Do?](#what-does-a-dealership-fi-manager-do)

- [Average Dealership F&I Manager Salary: A Deep Dive](#average-dealership-fi-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Dealership F&I Manager Do?

The title "Finance & Insurance Manager" is a concise but somewhat sterile description of a multifaceted and dynamic role. At its core, the F&I manager is the final, crucial link in the vehicle sales process. After a customer agrees on a vehicle price with a salesperson, they are "turned over" to the F&I manager to finalize the transaction. This is where the real financial engineering happens.

The F&I manager has three primary objectives:

1. Secure Financing for the Customer: They act as an intermediary between the customer and a network of banks, credit unions, and other lenders. Their goal is to find a loan or lease package that the customer qualifies for and is willing to accept.

2. Generate Revenue Through Aftermarket Products: This is the "Insurance" part of the title and a massive profit driver for the dealership. F&I managers present and sell a menu of optional products, including extended service contracts (warranties), GAP (Guaranteed Asset Protection) insurance, tire and wheel protection, and vehicle appearance packages.

3. Ensure Legal and Regulatory Compliance: A single car deal involves a mountain of paperwork, all governed by strict federal and state laws (like the Truth in Lending Act). The F&I manager is responsible for ensuring every document is accurate, every signature is in place, and the entire transaction is legally sound, protecting both the customer and the dealership from liability.

To achieve these goals, their daily tasks and responsibilities are extensive and varied. They include:

- Credit Analysis: Reviewing and analyzing customer credit applications and credit reports to assess their financial standing.

- Lender Relations: Maintaining strong relationships with dozens of lenders, understanding their specific programs, and negotiating with bank underwriters to get deals approved.

- Deal Structuring: Manipulating variables like down payment, loan term, and interest rate to create an affordable payment for the customer while maximizing profitability for the dealership.

- Product Presentation: Conducting a professional, transparent, and persuasive presentation of F&I products tailored to the customer's vehicle and driving habits.

- Objection Handling: Skillfully addressing customer concerns and objections regarding financing terms or product costs.

- Contracting and Paperwork: Meticulously completing and verifying all legal documents, titles, and state registration forms.

- Funding: Assembling and submitting the completed contract package to the lender to ensure the dealership gets paid promptly—a process known as "funding the deal."

### A Day in the Life of an F&I Manager

To make this tangible, let's walk through a typical high-pressure day:

- 9:00 AM: Arrive at the dealership. First task: review the "deal log." Check the status of deals from the previous night. Are they funded? Does a lender need more information ("stips")? Check the daily interest rate sheets from primary lenders.

- 10:15 AM: The first "turnover" of the day. A salesperson brings in a young couple buying their first new SUV. You greet them warmly, build rapport, and review the buyer's order to ensure the figures match what they agreed to on the floor.

- 10:30 AM: You run their credit application. The score is solid. You "shotgun" the application to three of your prime lenders to see who comes back with the best rate.

- 11:00 AM: Bank A offers 6.9% for 72 months. Bank B offers 6.75%. You call your representative at Bank A, with whom you have a strong relationship, and ask if they can match or beat Bank B's offer. They agree to 6.65%. You've just secured a better rate for your customer and protected the dealership's "finance reserve" (the profit made on the interest rate spread).

- 11:30 AM: You bring the couple into your office. You confirm the financing terms, which they happily accept. Now, you pivot to the product presentation, using a digital menu on a large screen. You explain the benefits of an extended service contract and GAP insurance for their new vehicle. They initially decline, citing the extra cost.

- 11:45 AM: You don't argue; you ask questions. "I understand completely. Just so I'm clear, your plan is to cover a potential $4,000 transmission repair out of pocket?" You break down the cost of the protection into the monthly payment—"for just an extra $35 per month, you have total peace of mind." They agree to both products.

- 12:30 PM: You print the final contracts, explaining each document as they sign. You ensure all paperwork is perfectly in order.

- 1:00 PM - 6:00 PM: The showroom is busy. You repeat this process three more times with different customers—one with a challenging credit situation that requires calling a subprime lender, and another paying cash who you still successfully sell a pre-paid maintenance plan to.

- 6:30 PM: The last customer is gone. You spend the final hour packaging the day's contracts, scanning documents to the lenders, and ensuring everything is ready for funding the next morning. You check your PVR (Per Vehicle Retail)—the average profit per deal—and see you had a strong day, averaging over $2,200 per car. That's a good day in "the box."

---

Average Dealership F&I Manager Salary: A Deep Dive

Analyzing the salary of a dealership F&I manager is more complex than for a typical salaried professional. The role is a prime example of "pay for performance," where a small base salary or "draw" is dwarfed by commissions, bonuses, and incentives. This structure means that while there's a floor, the ceiling is exceptionally high and directly tied to an individual's skill and the dealership's sales volume.

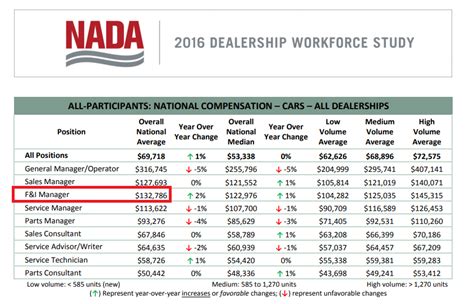

According to Salary.com, as of late 2023, the median dealership F&I manager salary in the United States is $140,016. However, the typical salary range is exceptionally broad, falling between $118,220 and $165,346. This range represents the bulk of earners, but it doesn't tell the whole story. Top-tier F&I managers—the top 10%—are reported to earn $191,914 or more.

Data from other reputable aggregators paints a similar picture of high earning potential:

- Glassdoor reports a national average total pay of $139,337 per year, combining an average base salary of around $69,000 with an average of $70,000 in additional pay (commissions, bonuses, etc.).

- Payscale shows a slightly more conservative average salary of $72,593, but notes that total pay, including bonuses and commissions, ranges from $44,000 to $179,000. This highlights the vast difference between an underperformer at a small lot and a star at a major dealership.

- Zippia places the average salary at $103,165, with a range from $63,000 to $168,000. Their data suggests that the top 10% of F&I managers earn over $168,000 annually.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) does not track "F&I Manager" as a distinct profession. They are often grouped under the broader category of "Financial Managers." The BLS reported a median annual wage for Financial Managers of $139,790 in May 2022, with the top 10 percent earning more than $208,000. While this category includes many other corporate finance roles, it confirms that management positions involving finance are among the highest-paid professions in the country.

### Salary Brackets by Experience Level

Salary progression in an F&I role is steep and rewarding for those who master the craft. Here’s a breakdown of what you can expect at different stages of your career, based on aggregated industry data.

| Experience Level | Years in Role | Typical Annual Compensation Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level / Trainee | 0 - 2 years | $55,000 - $85,000 | Learning the role, often under the mentorship of a senior manager. Focus is on mastering compliance and the basics of deal structuring. Pay might be a higher base salary with smaller commissions. |

| Mid-Career / Proficient | 2 - 7 years | $90,000 - $160,000 | Fully independent and proficient. Manages a steady flow of customers, has strong lender relationships, and consistently hits PVR and product penetration goals. Compensation is heavily commission-based. |

| Senior / Top Performer | 8+ years | $160,000 - $250,000+ | A master of the craft, often working at a high-volume luxury or import store. May have F&I Director responsibilities. Can handle any deal (prime, subprime, fleet) with ease and generates elite-level PVR. |

### Understanding the Compensation Components

To truly grasp the F&I manager salary, you must look beyond a single number and understand how the pay plan is constructed. It’s a puzzle of several moving parts:

- Base Salary or "Draw": Most F&I managers don't receive a traditional salary. Instead, they get a "draw," which is a modest monthly payment (e.g., $3,000 - $5,000) that is essentially an advance against their future commissions. If their monthly commission is $12,000, they receive their $3,000 draw throughout the month, and then a commission check for the remaining $9,000. If they fail to earn enough commission to cover their draw, they may owe the difference back to the dealership. This system heavily incentivizes performance.

- Commission on Finance Reserve: This is the profit a dealership makes on the interest rate. If a bank approves a customer for a loan at 5%, the F&I manager might present the loan to the customer at 6.5%. That 1.5% difference is the "reserve" or "spread." On a $40,000 loan over 72 months, this can amount to significant profit for the dealership. The F&I manager typically earns a percentage (e.g., 15-25%) of this reserve.

- Commission on Product Sales: This is the largest and most controllable part of an F&I manager's income. They earn a commission on the net profit of every aftermarket product they sell, such as a $3,000 service contract or a $900 GAP waiver. Commission rates on product profit can be as high as 30-40% in some aggressive pay plans.

- Unit Bonuses & "Spiffs": Many dealerships offer "spiffs," which are small cash bonuses for selling a specific product. There may also be tiered bonuses for the number of deals completed in a month (e.g., an extra $1,000 for funding over 100 deals).

- PVR (Per Vehicle Retail) Bonus: The holy grail metric for an F&I department is PVR. It's the total F&I profit divided by the number of retail cars sold. A dealership will set a monthly PVR goal (e.g., $1,800). If the F&I manager exceeds this goal, they often receive a significant bonus, sometimes retroactively on all deals for the month.

- Benefits and Perks: Standard benefits like health insurance and a 401(k) plan are common. However, a highly valued perk in the industry is the "demo" car. This is a dealership-owned vehicle that the manager can drive for personal use, with the dealership covering the insurance, maintenance, and sometimes even the fuel. This benefit can be worth thousands of dollars a year in saved transportation costs.

---

Key Factors That Influence Salary

The vast salary range for an F&I manager, from $55,000 to over $250,000, is not arbitrary. It's dictated by a combination of a manager's skills, their choices, and their work environment. Understanding these levers is the key to maximizing your earning potential in this field. This section provides an exhaustive breakdown of the variables that have the most significant impact on an F&I manager's income.

### ### Level of Education & Certification

While the automotive industry has traditionally valued experience over formal education, this trend is shifting, especially for a role as complex as F&I.

Formal Education: A high school diploma is the minimum requirement, but a bachelor's degree in Finance, Business Administration, or a related field is increasingly preferred by larger dealer groups and can be a significant differentiator. A degree signals a foundational understanding of financial principles, business ethics, and communication skills. An applicant with a relevant degree may command a higher starting base pay or be fast-tracked into a trainee program over a candidate without one. While it won't replace the need for in-dealership sales experience, it provides a powerful bedrock of knowledge that can accelerate learning and growth.

Industry Certification: In the world of F&I, professional certification is arguably more impactful on day-to-day effectiveness and trustworthiness than a college degree. The gold standard is the AFIP (Association of Finance & Insurance Professionals) Certification.

- What it is: The AFIP certification is a rigorous program that covers federal and state regulations, ethics, and best practices for F&I operations. It requires passing a comprehensive exam to become a Certified F&I Professional.

- Why it matters: An AFIP certification signals to dealership management, lenders, and customers that you are a true professional committed to ethical conduct and legal compliance. In an era of heightened regulatory scrutiny from bodies like the Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC), a certified manager is a valuable asset who can protect the dealership from massive fines and legal action. Holding this certification can lead to better job opportunities and is often a prerequisite for advancement to F&I Director roles.

Beyond AFIP, many third-party training companies (like JM&A Group, UDS, or the Automotive Dealership Institute) and even manufacturers (e.g., Toyota Financial Services) offer their own intensive F&I training and certification programs. Completing these courses demonstrates initiative and provides specialized skills in product presentation and objection handling that directly translate to a higher PVR and, consequently, a higher income.

### ### Years of Experience

Experience is perhaps the single most powerful driver of salary growth for an F&I manager. The learning curve is steep, and the skills required—negotiation, compliance, and poise under pressure—are honed over thousands of customer interactions.

- Salesperson (The Feeder Role): The journey to the F&I office almost universally begins on the sales floor. A successful 2-4 year track record in car sales is essential. This is where you learn the product, the customers, and the fundamental art of the sale. Top salespeople can earn $70,000 to $120,000, but they see the F&I office as the next level.

- Entry-Level (0-2 Years): During this phase, you are an F&I Trainee or a junior manager at a smaller store. Your primary goal is to master the process and avoid costly mistakes in paperwork. Your PVR might be a modest $800-$1,200. Annual compensation typically falls in the $55,000 to $85,000 range as you build your skills and lender relationships.

- Mid-Career (2-7 Years): You are now a seasoned, reliable producer. You can handle most deals efficiently, have a deep understanding of lender programs, and have mastered your product presentation. Your PVR is consistently in the $1,500 to $2,200 range. Your income reflects this proficiency, landing squarely in the $90,000 to $160,000 bracket. This is where most F&I managers operate.

- Senior/Elite (8+ Years): You are at the top of your game. You are likely an F&I Director or the lead manager at a high-volume, premium dealership. You can structure the most complex subprime deals, hold gross profit on almost every transaction, and train junior managers. Your PVR consistently exceeds $2,500, sometimes even reaching $3,000+. Your compensation is in the top decile, regularly exceeding $160,000 and often pushing past $250,000. These elite performers are the most sought-after professionals in the retail automotive world.

### ### Geographic Location

Where you work matters immensely. Salary expectations are heavily influenced by the local cost of living and, more importantly, the volume and type of vehicles sold in that market.

Data from Salary.com illustrates these stark differences. For example, the median salary for an F&I manager in San Jose, CA, is significantly higher than in a smaller Midwestern city.

High-Paying States & Metro Areas:

- California (Los Angeles, San Francisco Bay Area): High cost of living, massive population, and a strong market for luxury vehicles create a perfect storm for high F&I salaries.

- Texas (Dallas, Houston): A huge truck market and booming economy lead to high-volume dealerships and significant earning potential.

- Florida (Miami, Orlando): A massive, competitive market with high sales volume and a strong luxury and import presence.

- New York / New Jersey (NYC Metro Area): High cost of living and a dense population fuel high salaries, particularly in luxury brand stores.

- Major Metro Hubs (Chicago, Atlanta, Phoenix): Any large metropolitan area with multiple high-volume dealer groups will offer substantial opportunities.

Lower-Paying Areas:

- Rural Regions: Dealerships in smaller towns and rural areas have lower sales volumes and typically sell lower-priced vehicles, naturally capping F&I income potential.

- States with Lower Cost of Living: States in the Midwest and parts of the South, outside of major metro areas, will generally have lower average salaries, though the purchasing power may still be strong.

Here is a comparative table of median F&I manager salaries across different U.S. cities, based on data from late 2023:

| Metro Area | Median Salary (Source: Salary.com) | Why it's Higher/Lower |

| :--- | :--- | :--- |

| San Jose, CA | ~$176,000 | Extremely high cost of living, affluent tech-industry customer base. |

| New York, NY | ~$168,00