Ever pictured yourself at the forefront of the global economy, shaping the financial landscape from within one of the world's most prestigious professional services firms? For many aspiring finance and accounting professionals, a career at Deloitte represents the pinnacle of achievement—a launchpad for a lifetime of success. But beyond the prestige lies a practical question that every ambitious individual must ask: What does a career as a Deloitte accountant actually pay?

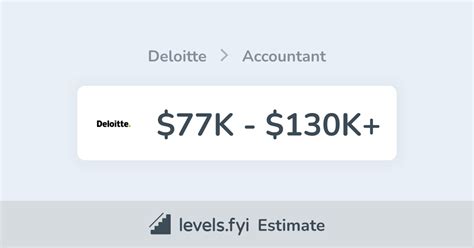

The answer is far more nuanced than a single number. A Deloitte accountant salary is a dynamic figure, influenced by a complex interplay of experience, location, specialization, and performance. While entry-level associates can expect a highly competitive starting salary, often in the $70,000 to $95,000 range, the earning potential skyrockets as one climbs the corporate ladder, with senior managers and partners commanding well into the six figures, supplemented by substantial bonuses and benefits.

I once mentored a brilliant young graduate who was about to start her journey in audit at a Big Four firm. She was intimidated, not by the work, but by the sheer scale of the clients. I told her, "Never forget that behind every billion-dollar balance sheet is a story about people, strategy, and ambition. Your job isn't just to check the numbers; it's to understand that story." That perspective is the key to thriving at a firm like Deloitte, where your financial acumen becomes the lens through which you view the pulse of global business.

This guide will demystify the Deloitte accountant salary and the career path that accompanies it. We will explore every facet of compensation, dissect the factors that drive your earning potential, and provide a clear roadmap for how you can secure a coveted position at this industry titan.

### Table of Contents

- [What Does a Deloitte Accountant Do?](#what-does-a-deloitte-accountant-do)

- [Average Deloitte Accountant Salary: A Deep Dive](#average-deloitte-accountant-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Deloitte Accountant Do?

To understand the salary, you must first understand the role. The term "accountant" at Deloitte is a broad descriptor for a range of highly specialized professionals. Deloitte is a massive, multi-disciplinary organization, and its accountants are not monolithic. They operate within distinct service lines, each with its own focus, client base, and daily responsibilities.

Your experience as a Deloitte professional will be fundamentally shaped by which of these core functions you join:

1. Audit & Assurance: This is the most traditional and well-known function. Auditors provide an independent opinion on a company's financial statements, ensuring they are free from material misstatement and comply with relevant accounting standards (like GAAP or IFRS). This "assurance" is critical for investors, regulators, and the public to trust the financial information released by companies.

2. Tax: Deloitte's tax professionals help clients navigate the labyrinthine complexity of local, state, federal, and international tax laws. Their work goes beyond simple compliance and filing returns. It involves strategic tax planning, advising on the tax implications of major business decisions (like mergers and acquisitions), and specializing in niche areas like transfer pricing or international tax.

3. Advisory (Risk & Financial Advisory): This is a broad and often highly lucrative service line. Advisory accountants use their financial expertise to help clients solve specific business problems. This can include forensic accounting (investigating fraud), M&A transaction services (performing due diligence on potential acquisitions), business valuation, and advising on risk management and regulatory compliance.

4. Consulting: While some finance experts work in Deloitte's main Consulting arm, many accounting-adjacent roles exist here as well. These professionals might help clients implement new financial systems (like an ERP), optimize their finance function, or manage large-scale business transformations, using their deep understanding of financial processes to drive efficiency and growth.

### A "Day in the Life" of a First-Year Audit & Assurance Associate

To make this more concrete, let's imagine a day for "Chloe," a new Audit & Assurance Associate at Deloitte during the busy season (January-March).

- 7:30 AM: Chloe arrives at the client's office. The Deloitte audit team has been assigned a conference room, which has become their home base. She grabs a coffee and syncs up with her Senior Associate on the day's priorities.

- 8:00 AM: The team has a quick stand-up meeting to discuss progress. Chloe's task today is to "test cash." This means verifying the client's bank balances by agreeing them to bank statements and confirmations, and documenting every step meticulously in Deloitte's proprietary audit software.

- 10:00 AM: Chloe needs a specific report from the client's Accounts Payable Manager. She drafts a professional email, sends her request, and follows up with a polite visit to the manager's desk to introduce herself and ensure he understands what she needs. This client interaction is a crucial skill.

- 12:30 PM: The Deloitte team orders lunch together. This is an important part of the culture—a chance to decompress, build camaraderie, and learn from the more experienced team members in an informal setting.

- 1:30 PM: Chloe receives the data she requested. She spends the next few hours performing the audit procedures, documenting her findings, noting any discrepancies, and preparing her workpapers for the Senior's review. She uses Excel heavily, but also Deloitte's advanced data analytics tools to sample transactions.

- 5:00 PM: The Senior Associate sits with Chloe to review her work. He asks probing questions, points out areas for improvement in her documentation, and provides constructive feedback. This is a primary mechanism for on-the-job training.

- 6:30 PM: Chloe has finished incorporating the feedback and signs off on her workpapers for the day. She packs up, says goodbye to the team, and heads home. During busy season, days can be long, but the learning curve is incredibly steep.

This example illustrates that the role is a blend of technical accounting, project management, client communication, and teamwork—all skills that command a premium salary.

Average Deloitte Accountant Salary: A Deep Dive

Now, let's get to the core of the matter: compensation. A Deloitte salary is more than just a base number; it's a comprehensive package designed to attract and retain top-tier talent. We'll break down the base salary by experience level and then explore the other crucial components of total compensation.

It's important to note that salary data is constantly in flux and can vary significantly. The figures presented here are synthesized from recent data from authoritative sources like Glassdoor, Payscale, LinkedIn Salary, and Fishbowl, reflecting late 2023 and early 2024 reporting for major U.S. markets.

### Salary by Experience Level at Deloitte

Public accounting firms like Deloitte have a very structured and transparent career progression. Your title is a direct indicator of your experience and, consequently, your salary band.

| Level / Title | Typical Years of Experience | Typical Base Salary Range (U.S. National Average) | Key Responsibilities |

| ------------------------- | --------------------------- | --------------------------------------------------- | -------------------------------------------------------------------------------------- |

| Associate / Staff | 0-2 Years | $70,000 - $95,000 | Performing detailed testing, documenting workpapers, direct client data interaction. |

| Senior Associate | 2-5 Years | $95,000 - $130,000 | Supervising associates, reviewing work, managing smaller engagements, client contact. |

| Manager | 5-9 Years | $130,000 - $180,000+ | Managing multiple engagement teams, project budgets, client relationships, final review. |

| Senior Manager | 9-13+ Years | $180,000 - $250,000+ | Developing new business, managing large client portfolios, strategic oversight. |

| Partner / Principal | 13+ Years | $400,000 - $1,000,000+ | Firm leadership, ultimate client responsibility, driving firm strategy and revenue. |

*Source Note:* *These salary ranges are aggregated estimates based on self-reported data from Glassdoor, Payscale, and other professional forums for major U.S. metropolitan areas. They are intended as a general guide and can vary significantly based on the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

Focusing solely on the base salary would be a mistake. Deloitte's total compensation package is a significant part of its value proposition. Here are the key components you can expect:

- Signing Bonus: Highly common for new campus hires and experienced hires. For undergraduate and master's program graduates, this can range from $5,000 to $15,000, serving as a major incentive to accept an offer.

- Performance Bonus: An annual bonus tied to both individual performance and the firm's overall profitability. At the Associate and Senior levels, this might be 5-15% of the base salary. At the Manager and Senior Manager levels, this percentage grows substantially and becomes a critical part of total earnings.

- CPA Exam Bonus & Support: This is a cornerstone of the Big Four's recruitment strategy. Deloitte typically offers a significant bonus, often between $3,000 and $5,000, for passing the CPA exam within a certain timeframe (usually the first or second year of employment). Furthermore, they often pay directly for expensive CPA review courses (like Becker or Roger), a benefit worth several thousand dollars.

- Retirement Savings (401(k)): Deloitte offers a 401(k) plan with a competitive employer match. For example, they might match 25% of the employee's contribution up to the first 6% of their salary, which essentially equates to a 1.5% salary increase directly into your retirement fund.

- Health and Wellness Benefits: This includes comprehensive medical, dental, and vision insurance. Increasingly, firms like Deloitte are investing heavily in mental health resources, wellness stipends (which can be used for gym memberships, fitness apps, etc.), and generous parental leave policies. Deloitte's "Live Well" program is a testament to this focus.

- Paid Time Off (PTO): New hires typically start with around 3-4 weeks of PTO, which increases with seniority. This is in addition to firm-wide holidays and a collective "firm shutdown" week, often during the summer or end-of-year holidays.

- Professional Development & Training: While not a direct cash payment, the value of Deloitte's training is immense. New hires attend extensive national training programs at "Deloitte University" in Texas, an investment worth tens of thousands of dollars per employee. This continuous learning is a form of deferred compensation that pays dividends throughout your career.

When you sum these components, the "total compensation" for a first-year associate with a base salary of $80,000 could easily approach or exceed $100,000 in value, especially when factoring in the CPA bonus and the value of benefits.

Key Factors That Influence Your Deloitte Accountant Salary

While the career ladder provides a structural guide to salary, your specific pay within those bands is determined by a potent mix of factors. Understanding these levers is the key to maximizing your earning potential both when you receive an offer and throughout your career at the firm.

###

Level of Education & Professional Certifications

Your educational foundation is the price of entry, and advanced credentials are the accelerators.

- Bachelor's Degree: A Bachelor's degree in Accounting, Finance, or a related field is the absolute minimum requirement. Your GPA, the reputation of your university, and your leadership roles in student organizations (like Beta Alpha Psi) are key differentiators during the initial recruitment process.

- Master's Degree (MAcc/MST): Many states require 150 semester hours of education to be eligible for the CPA license. A one-year Master of Accountancy (MAcc) or Master of Science in Taxation (MST) is the most common way to meet this requirement. Pursuing a master's degree often results in a higher starting salary—potentially $5,000 to $10,000 more per year than a candidate with only a bachelor's degree—and can position you for faster promotion. The firm sees it as a signal of commitment and advanced technical knowledge.

- The CPA License (Certified Public Accountant): This is the gold standard. In Audit & Assurance and Tax, obtaining your CPA is not just recommended; it's a de facto requirement for promotion to Manager. Passing the CPA exam unlocks an immediate bonus and is the single most powerful catalyst for salary growth in your early career. It demonstrates a verified level of expertise and professionalism that clients and the firm value immensely. Without it, your career progression in these service lines will hit a hard ceiling.

- Other Certifications (CISA, CFA, etc.): Depending on your specialization, other certifications can provide a salary uplift. For those in IT audit or risk advisory, the Certified Information Systems Auditor (CISA) is highly valued. For those in valuation or M&A transaction services, a Chartered Financial Analyst (CFA) or Certified Valuation Analyst (CVA) designation can be a significant differentiator.

###

Years of Experience: The Up-or-Out Trajectory

Deloitte, like its Big Four peers, operates on a structured, merit-based promotion system often described as "up-or-out." You are expected to advance along a predictable timeline, and your salary grows in significant steps with each promotion.

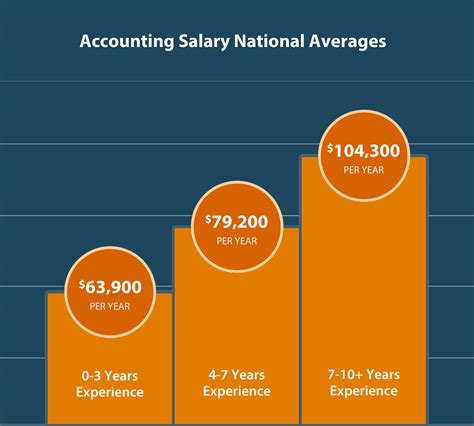

- Entry-Level (Associate, 0-2 years): Base salary is set by a market-driven process for campus hires. Growth in the first two years comes primarily from annual cost-of-living adjustments and performance-based raises.

- Promotion to Senior (2-3 years): This is the first major jump. A promotion from Associate to Senior typically comes with a 15-25% increase in base salary. Your responsibilities expand from "doing" to "reviewing and leading," which justifies the significant pay bump.

- Promotion to Manager (5-6 years): This is another substantial leap. The promotion to Manager can see a 20-30% or greater increase in salary, plus a much larger performance bonus potential. You are now responsible for project management, client relationship management, and the development of junior staff. This is a critical transition from a technical expert to a team leader.

- Promotion to Senior Manager (8-10 years): At this level, you are an established leader in the firm. The salary jump reflects your deep expertise and your emerging role in business development. Bonuses become a very significant portion of your total compensation as you are evaluated on the profitability of your engagements and your ability to cultivate client relationships.

- Making Partner/Principal/Managing Director: This is the pinnacle. It is not a promotion but an admission into the ownership/leadership ranks of the firm. Compensation changes structure entirely, moving from a salary-plus-bonus model to a share of the firm's profits. This results in a monumental increase in earnings.

###

Geographic Location: The Cost-of-Living Adjustment

Where you work is one of the most significant factors determining your exact salary figure. Deloitte adjusts its salary bands based on the cost of living and market competitiveness in different metropolitan areas.

- High-Cost-of-Living (HCOL) Cities: Major hubs like New York City, San Francisco, San Jose, Los Angeles, and Boston will have the highest starting salaries to compensate for exorbitant housing and living expenses. A first-year Associate might start at $85,000 - $95,000+ in these locations.

- Medium-Cost-of-Living (MCOL) Cities: Large but more affordable cities like Chicago, Dallas, Atlanta, Charlotte, and Austin will have strong but slightly lower salaries. An entry-level offer here might be in the $75,000 - $85,000 range.

- Low-Cost-of-Living (LCOL) Cities: Smaller metropolitan areas like Kansas City, St. Louis, Cleveland, or Omaha will have the lowest starting salaries in absolute dollar terms, but they may offer superior purchasing power. A starting salary might fall in the $70,000 - $78,000 range.

It's crucial to analyze an offer in the context of the local cost of living. A higher salary in San Francisco may not result in more disposable income than a lower salary in Dallas.

###

Service Line & Area of Specialization

Not all "accountants" at Deloitte are paid the same. Your service line and niche specialization have a direct and profound impact on your compensation, driven by market demand and the perceived value of the service.

- Audit & Assurance: As the core, foundational service, audit salaries are highly competitive but often serve as the baseline for the firm's compensation structure.

- Tax: Tax professionals, especially those with in-demand specializations, often earn a slight premium over their audit counterparts. Niches like International Tax, M&A Tax, or Transfer Pricing are highly complex and can command higher salaries due to a shortage of expert talent.

- Advisory (Risk & Financial Advisory): This is consistently one of the highest-paying service lines. Roles in M&A Transaction Services, Forensic Accounting, and Cybersecurity Risk are project-based, highly specialized, and directly tied to high-stakes business events. This value creation translates to higher billing rates and, consequently, higher salaries and bonuses for practitioners. It's not uncommon for an Advisory professional to earn 10-20% more than an Audit professional at the same level.

- Consulting (Finance & Enterprise Performance): Professionals in the consulting practice who focus on finance transformation, ERP implementation (like SAP or Oracle), or corporate strategy also command very high salaries, often on par with or exceeding those in Advisory.

###

In-Demand Skills for Salary Maximization

In the modern accounting world, your technical accounting knowledge is just the starting point. The skills that create a gap between an "average" and a "top-tier" salary are increasingly technological and analytical.

- Data Analytics and Visualization: Proficiency in tools like Alteryx, Tableau, or Power BI is no longer a "nice-to-have"; it's a core competency. The ability to independently analyze large datasets, identify anomalies, and present findings visually is immensely valuable in both audit and advisory.

- Programming & Automation: While you don't need to be a full-fledged software developer, basic skills in Python or SQL to automate data extraction and repetitive tasks can make you significantly more efficient and valuable to your team.

- ESG (Environmental, Social, and Governance) Expertise: This is one of the fastest-growing areas in the accounting profession. As regulations around climate risk and sustainability reporting become more stringent, professionals with expertise in ESG frameworks and assurance are in extremely high demand and can command a premium salary.

- Industry-Specific Knowledge: Developing a deep understanding of a particular industry (e.g., financial services, technology, healthcare) makes you a more effective and insightful advisor. The firm can bill you out at a higher rate because you understand the specific risks, regulations, and business models of your clients.

- Cybersecurity & IT Audit Skills: For those in Risk Advisory, knowledge of IT general controls, cybersecurity frameworks (like NIST), and cloud computing environments is critical and highly compensated.

Job Outlook and Career Growth

Investing years in education and demanding workweeks is only worthwhile if the career has a promising future. Fortunately, the outlook for accountants, particularly those with the pedigree of a Deloitte background, is exceptionally strong.

### The Data-Driven Outlook

The U.S. Bureau of Labor Statistics (BLS) provides a robust forecast for the profession.

> According to the BLS's Occupational Outlook Handbook, employment of accountants and auditors is projected to grow 4 percent from 2022 to 2032, about as fast as the average for all occupations. The BLS anticipates about 126,500 openings for accountants and auditors each year, on average, over the decade.

While a 4% growth rate might seem modest, it represents a stable and consistent demand. These openings arise not just from new job creation but also from the need to replace workers who transfer to different occupations or exit the labor force, such as through retirement.

What this data means for a Deloitte accountant is even more positive. The "average" accountant role may be susceptible to automation, but the complex, advisory-focused work performed at a firm like Deloitte is far more secure. Deloitte professionals are trained to be analysts, strategists, and problem-solvers—skills that are augmented, not replaced, by technology.

### Emerging Trends and Future Challenges

The accounting profession is in the midst of a profound transformation. Staying ahead of these trends is key to long-term career success and salary growth.

1. The Rise of AI and Automation: Repetitive, rules-based tasks like data entry and reconciliation are being increasingly automated. This is not a threat but an opportunity. It frees up accountants to focus on higher-value activities: interpreting data, advising clients on strategy, assessing complex risks, and exercising professional judgment. The future accountant is an AI-powered advisor.

2. The ESG Revolution: As mentioned earlier, the demand for ESG assurance and consulting is exploding. Companies need experts to help them measure, manage, and report on their environmental impact, social policies, and governance structures. This has created an entirely new and lucrative career path within accounting firms.

3. Data Analytics as a Core Service: Audits are no longer just about sampling. Firms are moving towards analyzing 100% of a client's transactions using powerful data analytics tools. This requires a new skill set, blending accounting principles with data science.

4. The War for Talent: There is a well-documented shortage of new accounting graduates and CPA candidates. This supply-and-demand imbalance works in favor of qualified professionals, driving up salaries, bonuses, and benefits as firms compete fiercely for top talent.

### Staying Relevant and Advancing Your Career

A career at Deloitte is often described as a "launchpad" because of the incredible exit opportunities it provides. After several years in public accounting, professionals are highly sought after for roles in private industry. It's common for a Senior or Manager at Deloitte to leave for a Senior Financial Analyst, Accounting Manager, or Controller position at a Fortune 500 company, often with a significant salary increase and a better work-life balance.

However, for those who stay, the path to Partner is clear, albeit challenging. Advancement depends on:

- Technical Excellence: Mastering your craft.

- Leadership and Mentorship: Developing the people on your teams.

- Client Relationship Management: Becoming a trusted advisor.

- Business Acumen: Understanding your clients' businesses and industries.

- Business Development (at senior levels): Bringing new work into the firm.

How to Get Started in This Career

Securing a position at Deloitte is a highly competitive process that begins long before you submit an application. It requires a strategic, multi-year plan. Here is a step-by-step guide for aspiring professionals.

### Step 1: Build the Right Educational Foundation

- Enroll in a reputable undergraduate program with a major in Accounting or Finance. Focus on achieving a high GPA (typically 3.5 or higher is recommended to be competitive).

- Plan for the 150-credit hour requirement for the CPA license from day one. This may involve taking extra classes, community college courses in the summer, or enrolling in a dedicated Master of Accountancy (MAcc) or Master of Science in Taxation (MST) program. The latter is often the most direct and effective path.

### Step 2: Get Actively Involved on Campus

- Join and seek leadership roles in relevant student organizations, especially Beta Alpha Psi, the international honor organization for accounting, finance, and information systems students. This is the single most important extracurricular activity for networking with firms like Deloitte.

*