A career as an escrow officer places you at the very heart of some of life's most significant financial transactions. As the neutral third party ensuring that real estate deals close smoothly and accurately, you are an indispensable figure in the property market. But beyond the critical responsibilities, what is the financial outlook for this profession?

If you're considering this career path, you'll be pleased to know that it offers a competitive and stable income. Nationally, an escrow officer's salary typically ranges from $48,000 to over $80,000 per year, with a strong potential for growth based on experience, location, and specialization. This article will break down what you can expect to earn and how to maximize your income as an escrow officer.

What Does an Escrow Officer Do?

Before we dive into the numbers, it's essential to understand the value an escrow officer provides. Think of them as the trusted project manager and financial gatekeeper for a real estate transaction. They are entrusted by the buyer, seller, and lender to handle all the funds and documents according to a mutually agreed-upon contract.

Key responsibilities include:

- Holding and safeguarding all funds, including earnest money deposits and closing costs.

- Reviewing and preparing closing documents, such as settlement statements (Closing Disclosures) and deeds.

- Ordering title searches, property inspections, and payoff information for existing mortgages.

- Ensuring all conditions of the purchase agreement are met before the deal is finalized.

- Disbursing funds to the appropriate parties at closing and recording the legal documents.

Their meticulous attention to detail prevents fraud, minimizes risk, and provides peace of mind to everyone involved.

Average Escrow Officer Salary

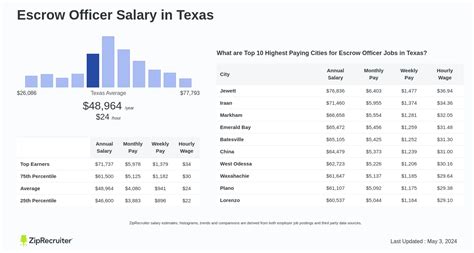

While salaries can vary significantly, we can establish a strong baseline by looking at data from leading compensation sources.

According to data compiled from reputable sources like Salary.com, Payscale, and Glassdoor, the average base salary for an escrow officer in the United States falls between $55,000 and $65,000 per year.

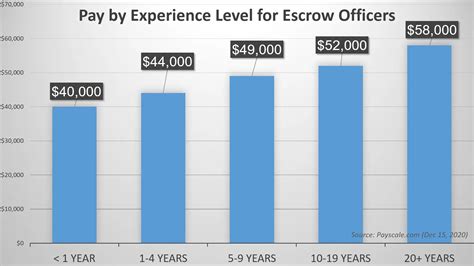

However, the base salary is only part of the picture. The overall compensation package is often influenced by experience level:

- Entry-Level (0-2 years): An Escrow Assistant or Junior Escrow Officer can expect to start in the $45,000 to $52,000 range.

- Mid-Career (3-8 years): A proficient Escrow Officer with a proven track record typically earns between $55,000 and $70,000.

- Senior-Level (8+ years): A Senior or Lead Escrow Officer, often managing a branch or handling highly complex files, can command a salary of $75,000 or more.

It's crucial to note that many escrow officers, especially those working for high-volume title companies, can also earn significant bonuses or commissions based on the number and value of the files they close, which can substantially increase their total annual earnings.

Key Factors That Influence Salary

Your earning potential is not a fixed number. It's a dynamic figure influenced by several critical factors. Understanding these can help you strategically navigate your career for maximum financial reward.

###

Level of Education

While a bachelor's degree is not always a strict requirement for becoming an escrow officer, it is increasingly preferred by top-tier employers. A degree in finance, business administration, real estate, or pre-law can provide a competitive advantage and may lead to a higher starting salary. Most positions require at least a high school diploma or an associate's degree. More importantly, many states require escrow officers to be licensed, certified, or bonded, which involves specific coursework and examinations that demonstrate professional competence.

###

Years of Experience

Experience is arguably the most significant driver of an escrow officer's salary. The real estate industry values a proven ability to manage complex, high-stakes transactions without error. As you build your career, your reputation for accuracy, efficiency, and problem-solving becomes your most valuable asset. A senior escrow officer who has cultivated strong relationships with real estate agents, lenders, and attorneys is an invaluable asset to their company and is compensated accordingly.

###

Geographic Location

As with most real estate professions, location is everything. Salaries are directly correlated with the cost of living and the health of the local real estate market.

- Top-Tier Markets: In major metropolitan areas with high property values like San Francisco, Los Angeles, Seattle, and New York City, escrow officers can earn 15-30% above the national average to compensate for the higher cost of living and deal complexity.

- Mid-Tier & Rural Markets: In smaller cities and rural areas, salaries will likely align more closely with or be slightly below the national average.

According to Salary.com, an escrow officer in San Jose, CA, may earn a median salary far exceeding that of an officer in a smaller midwestern city, showcasing the dramatic impact of geography on compensation.

###

Company Type

Where you work plays a major role in your compensation structure. The primary employers for escrow officers include:

- Title and Escrow Companies: These are the most common employers. Compensation is often a mix of base salary and a performance-based bonus or commission structure tied to closing volume.

- Law Firms: Firms with real estate law practices often employ escrow officers or paralegals with escrow duties. These roles may offer a higher base salary, particularly if they involve complex commercial transactions.

- Banks and Lenders: Financial institutions that handle their own closings may offer more structured corporate salary bands, excellent benefits, and stable pay, though often with less variable bonus potential than a dedicated title company.

###

Area of Specialization

Developing expertise in a specific niche can significantly boost your value and your paycheck.

- Residential vs. Commercial Escrow: Commercial real estate transactions (e.g., office buildings, retail centers, industrial properties) are typically far more complex and involve much larger sums of money than residential deals. Consequently, commercial escrow officers are specialized professionals who command higher salaries and commissions.

- Niche Transactions: Expertise in handling difficult files like short sales, foreclosures (REO), new construction developments, or multi-state transactions can make you a sought-after specialist, leading to higher earning potential.

Job Outlook

The future of the escrow profession is evolving with technology. The U.S. Bureau of Labor Statistics (BLS), which groups escrow officers with "Title Examiners, Abstractors, and Searchers," projects a slight decline of 2 percent in employment from 2022 to 2032. This is largely due to automation streamlining some of the more routine, data-entry aspects of the job.

However, this data point should be viewed with context. While technology can handle simple tasks, it cannot replace the critical thinking, problem-solving, and client management skills of an experienced escrow officer. The need for a human expert to navigate the legal and financial complexities of a transaction, especially when unforeseen issues arise, remains paramount. The role is shifting from being purely administrative to one of a high-level transaction coordinator and risk manager, ensuring job security for skilled professionals.

Conclusion

A career as an escrow officer offers a clear path toward a stable and rewarding professional life. With an average salary in the solid mid-range and the potential to earn well over $80,000 with experience and specialization, the financial prospects are strong.

Your earning potential is directly in your hands. By focusing on gaining experience, seeking relevant certifications, specializing in high-value areas like commercial real estate, and positioning yourself in a robust market, you can build a lucrative and respected career. For detail-oriented individuals who thrive under pressure and find satisfaction in guiding people through major life milestones, becoming an escrow officer is an excellent and financially sound choice.