Introduction

Have you ever looked at a job offer and wondered, "Is this fair?" Have you questioned the real difference between a bi-weekly paycheck and an annual salary, or why your colleague in another state earns more for the same role? These questions aren't just about money; they're about value, equity, and strategy. Behind every well-structured job offer and every company's pay philosophy is a highly skilled professional: the Compensation Analyst. This is a career path for the meticulous, the analytical, and the strategic—a role that sits at the critical intersection of human resources, finance, and business strategy.

The field of compensation analysis is not only intellectually stimulating but also financially rewarding. Professionals in this domain are tasked with ensuring that employees are paid fairly and competitively, directly impacting a company's ability to attract, retain, and motivate top talent. According to the U.S. Bureau of Labor Statistics, the median salary for Compensation, Benefits, and Job Analysis Specialists was $74,730 per year in May 2023, with top earners reaching well into the six figures. This is a career with a clear trajectory for growth, significant strategic influence, and a tangible impact on both employee morale and the company's bottom line.

Early in my own professional journey, I was presented with two competing job offers. One offered a higher hourly wage, while the other provided a lower annual salary but included stock options and a generous benefits package. It was a consultation with a company's HR compensation specialist that illuminated the concept of "total rewards." She broke down the long-term value of the equity and the dollar value of the health benefits, revealing that the salaried position was far more lucrative over time. That conversation didn't just help me make a better decision; it sparked my fascination with the science and art of compensation, a field dedicated to creating clarity and fairness in the often-opaque world of pay.

This comprehensive guide will serve as your roadmap to a career in compensation analysis. We will dissect the role's core responsibilities, delve deep into salary potential, explore the factors that can maximize your earnings, and provide a step-by-step plan to help you launch your journey.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Compensation Analyst Do?

At its core, a Compensation Analyst is a data-driven storyteller and a strategic partner to the business. Their primary objective is to design, implement, and manage a company's compensation programs, ensuring they are internally equitable, externally competitive, and legally compliant. This role is far more than just "running the numbers"; it's about understanding the "why" behind them and using that insight to shape organizational strategy.

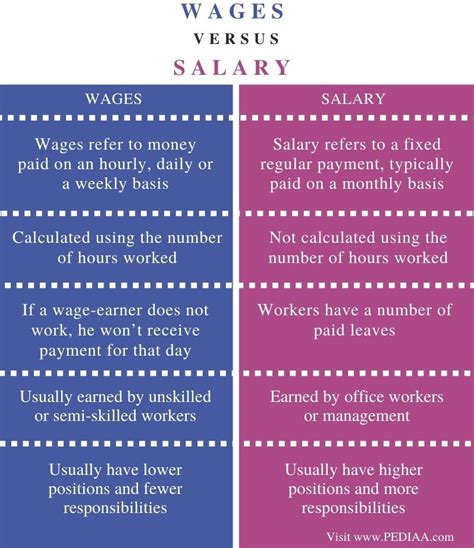

The foundational concept every analyst masters is the difference between wage and salary. A wage is typically paid on an hourly basis. Wage-earning employees are considered "non-exempt" under the Fair Labor Standards Act (FLSA), meaning they are eligible for overtime pay for any hours worked beyond 40 in a week. This structure is common in retail, manufacturing, and food service. A salary, conversely, is a fixed amount paid over a year, distributed in regular pay periods (e.g., bi-weekly or monthly). Salaried employees are often "exempt" from overtime, as their compensation is based on fulfilling the duties of their role, not the hours logged. A Compensation Analyst is responsible for correctly classifying these roles (exempt vs. non-exempt), a critical compliance function that carries significant legal weight.

Beyond this fundamental distinction, their responsibilities are broad and varied. They spend their time:

- Conducting Job Analysis and Evaluation: They work with managers to understand the duties, responsibilities, and requirements of every role in the organization. Using established methodologies (like point-factor or job ranking), they determine the relative value of each job to create a logical internal hierarchy.

- Market Benchmarking: Analysts are detectives of the labor market. They purchase, analyze, and interpret salary survey data from third-party vendors (like Radford, Mercer, or Willis Towers Watson) to see how their company's pay stacks up against competitors in the same industry and geographic location. This process, known as "benchmarking," is crucial for setting competitive pay ranges.

- Developing and Maintaining Salary Structures: Based on job evaluations and market data, they build the company's salary structure. This involves creating "pay grades" or "bands," each with a minimum, midpoint, and maximum salary. This structure provides a consistent and fair framework for all compensation decisions.

- Administering Incentive and Bonus Programs: They design and manage short-term and long-term incentive plans, such as annual bonuses, sales commissions, and stock-based compensation. This involves modeling potential payouts, tracking performance metrics, and ensuring the programs motivate the desired behaviors.

- Ensuring Compliance: They are the guardians of pay-related laws and regulations, including the FLSA, Equal Pay Act, and emerging pay transparency laws. A key part of their job is conducting regular pay equity audits to identify and remedy any pay disparities based on gender, race, or other protected characteristics.

### A Day in the Life of a Compensation Analyst

To make this more concrete, let's imagine a typical day:

- 9:00 AM - 11:00 AM: Data Analysis. The morning starts in the depths of a spreadsheet. The analyst is preparing for the upcoming annual salary review cycle. They export employee data from the Human Resource Information System (HRIS) and merge it with market survey data. Using Excel's VLOOKUPs and PivotTables, they analyze the "compa-ratio" (an employee's salary divided by the salary range midpoint) for every department to identify teams that are lagging behind the market.

- 11:00 AM - 12:00 PM: Business Partner Meeting. The analyst meets with the Director of Engineering. The director wants to create a new "Lead Machine Learning Engineer" role. The analyst asks probing questions to understand the role's scope, impact, and required skills. This is the first step in the job evaluation process.

- 1:00 PM - 2:30 PM: Benchmarking the New Role. Back at their desk, the analyst scours salary survey databases to find comparable "Machine Learning Engineer" roles in the tech industry. They "match" the internal job to the external survey job and pull the market data (25th, 50th, and 75th percentile salaries) for the San Francisco Bay Area.

- 2:30 PM - 4:00 PM: Building a Recommendation. The analyst drafts a proposal. They recommend placing the new role in a specific pay grade (e.g., Grade 12) and establish a competitive salary range based on the market data they just pulled. They also model the potential cost of hiring three such engineers over the next quarter.

- 4:00 PM - 5:00 PM: Ad-Hoc Inquiries. An HR Business Partner pings them with an urgent question: An employee in Colorado is asking about the company's pay transparency policy in light of new state laws. The analyst pulls up their compliance documentation and provides the HRBP with the correct talking points and the legally required salary range for the employee's role.

This blend of deep analytical work, strategic partnership, and compliance oversight is what makes the role of a Compensation Analyst both challenging and deeply rewarding.

---

Average Compensation Analyst Salary: A Deep Dive

Compensation for those who manage compensation is, fittingly, quite competitive. The salary for a Compensation Analyst reflects the specialized knowledge, analytical rigor, and strategic importance of the role. Earnings can vary significantly based on factors we'll explore in the next section, but we can establish a strong baseline using data from authoritative sources.

The U.S. Bureau of Labor Statistics (BLS) groups this role under "Compensation, Benefits, and Job Analysis Specialists." According to their May 2023 Occupational Employment and Wage Statistics, the national picture looks like this:

- Median Annual Wage: $74,730 (This means 50% of people in the profession earned more, and 50% earned less).

- Mean Annual Wage: $80,210

- 10th Percentile: $49,830 (Typically represents entry-level positions).

- 90th Percentile: $118,500+ (Represents highly experienced senior specialists, leads, and those in high-paying industries/locations).

While the BLS provides a reliable, broad overview, salary aggregators offer more granular, real-time data based on user-submitted profiles and job postings. These platforms help us see the salary progression as an analyst gains experience.

### Salary by Experience Level

The career path in compensation has a clear and rewarding salary trajectory. As an analyst moves from learning the ropes to leading complex projects and eventually to managing strategy, their earning potential increases substantially.

| Experience Level | Typical Title(s) | Years of Experience | Typical Salary Range | Data Sources & Notes |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Compensation Analyst I, HR Analyst (Comp Focus) | 0-2 years | $60,000 - $75,000 | Payscale.com and Salary.com data show this range for early-career professionals. Focus is on learning systems, running reports, and assisting with survey submissions. |

| Mid-Career | Compensation Analyst II, Senior Compensation Analyst | 2-5 years | $75,000 - $95,000 | Glassdoor and Salary.com data reflect this bracket. At this stage, analysts own projects, manage relationships with business units, and perform complex benchmarking and analysis. |

| Senior/Lead | Senior Compensation Analyst, Lead Analyst, Principal Analyst | 5-10+ years | $95,000 - $125,000+ | Professionals in this range often specialize (e.g., executive or sales compensation) or act as a team lead. They tackle the most complex analytical challenges, such as pay equity audits or M&A integration. |

| Managerial | Compensation Manager, Manager of Total Rewards | 8+ years | $120,000 - $160,000+ | This level involves people management, budget ownership, and strategy development. They present to senior leadership and are responsible for the entire compensation function. |

| Director/VP | Director of Compensation, VP of Total Rewards | 12+ years | $160,000 - $250,000++ | At the executive level, these leaders set the global compensation and benefits philosophy for the entire organization. Their work is highly strategic and directly tied to C-suite objectives. |

*(Note: These ranges are national averages and can be significantly higher in high-cost-of-living areas and certain industries like technology and finance. Sources accessed in late 2023/early 2024.)*

### Beyond the Base Salary: Understanding Total Compensation

A Compensation Analyst's pay isn't just about their base salary. True to their profession, their "total rewards" package is often robust and includes several key components:

- Annual Bonus / Short-Term Incentive (STI): This is nearly universal in the field. The bonus is typically a percentage of the analyst's base salary, tied to both individual and company performance.

- Analysts: Target bonuses often range from 5% to 15%.

- Managers/Directors: Target bonuses can be 15% to 30% or more.

- Profit Sharing: Some companies, particularly those with a strong financial performance, may offer a portion of their annual profits to employees. This is a direct reward for contributing to the company's success.

- Long-Term Incentives (LTI): Especially prevalent in publicly traded companies and tech startups, LTIs are a powerful wealth-building tool. These come in the form of:

- Restricted Stock Units (RSUs): A grant of company shares that vest (become owned by the employee) over a period of time, typically 3-4 years.

- Stock Options: The right to buy company stock at a predetermined price in the future. Their value increases as the company's stock price grows.

- Comprehensive Benefits: As experts in "total rewards," compensation professionals often enjoy top-tier benefits packages. This includes:

- Health Insurance: Premium medical, dental, and vision plans.

- Retirement Savings: A 401(k) or 403(b) plan, often with a generous company match (e.g., matching 100% of employee contributions up to 6% of their salary).

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies.

- Other Perks: This can include wellness stipends, tuition reimbursement for certifications or master's degrees, and professional development budgets.

When evaluating a job offer in this field, it's essential to look beyond the base salary and calculate the full value of the total compensation package, just as a Compensation Analyst would advise any other employee to do.

---

Key Factors That Influence Salary

While the national averages provide a solid baseline, a Compensation Analyst's actual earnings are determined by a complex interplay of several key factors. Mastering or strategically positioning yourself within these areas can dramatically increase your earning potential over the course of your career. This section provides an in-depth analysis of the variables that have the most significant impact on your paycheck.

###

Level of Education and Professional Certifications

Your educational foundation and commitment to ongoing professional development are powerful salary drivers.

- Bachelor's Degree: A bachelor's degree is the standard entry requirement for a Compensation Analyst role. The most common and relevant majors include Human Resources, Business Administration, Finance, Economics, and Statistics. These fields provide the necessary grounding in business principles, quantitative analysis, and HR fundamentals. Having a degree from a well-regarded university can provide an edge, but the specific major and relevant coursework are more important.

- Master's Degree: While not required for most analyst-level roles, a master's degree can be a significant differentiator, particularly for leadership positions.

- Master's in Human Resources (MHR, MSHR): This degree deepens expertise in all facets of HR, including talent management and organizational design, providing the strategic context for compensation decisions. It is highly valued for those aspiring to become a Manager or Director of Total Rewards.

- Master of Business Administration (MBA): An MBA, especially with a concentration in finance or strategy, signals strong business acumen. It can be a powerful accelerator for moving into senior leadership roles (Director, VP) or specialized areas like executive compensation, where understanding corporate finance is paramount. An MBA can command a salary premium of 15-25% or more at the managerial level.

- Professional Certifications: In the world of compensation, certifications are the gold standard. They are a clear signal to employers that you have mastered a specific body of knowledge and are committed to the profession. The most respected certifications come from WorldatWork, the leading global association for total rewards professionals.

- Certified Compensation Professional (CCP®): This is the most recognized and sought-after certification for compensation practitioners. It requires passing a series of exams covering topics from base pay administration and market pricing to variable pay and job analysis. Earning your CCP can result in a salary increase of 5% to 15% and is often a prerequisite for senior analyst and manager roles. According to Payscale, professionals with a CCP earn significantly more than their non-certified peers.

- Global Remuneration Professional (GRP®): For analysts working in multinational corporations or specializing in international compensation, the GRP is essential. It covers topics like global mobility, expatriate pay, and managing compensation across different countries and currencies.

- Advanced Certified Compensation Professional (ACCP™) and Master Certified Compensation Professional (MCCP™): These advanced designations from WorldatWork are for seasoned veterans and leaders in the field, signaling a mastery of strategic compensation.

- SHRM-CP or SHRM-SCP: While more general HR certifications, credentials from the Society for Human Resource Management (SHRM) are also valuable, as they demonstrate a broad understanding of the HR function in which compensation operates.

###

Years of Experience and Career Progression

Experience is arguably the single most important factor in determining a Compensation Analyst's salary. The profession has a well-defined career ladder, and compensation grows in lockstep with increasing responsibility and strategic impact.

- Entry-Level (0-2 years): Salary: ~$60,000 - $75,000. At this stage, you are learning the fundamentals. Your work is focused on data gathering, running pre-designed reports, assisting with salary survey submissions, and answering basic employee queries. Your value lies in your accuracy, attention to detail, and ability to learn quickly.

- Mid-Career (2-5 years): Salary: ~$75,000 - $95,000. You have moved beyond task execution to analysis and interpretation. You can independently benchmark jobs, analyze market trends, and make recommendations for salary ranges. You might be the primary compensation partner for a specific business unit. Your value is in your analytical skills and growing business acumen.

- Senior Level (5-10+ years): Salary: ~$95,000 - $125,000+. As a Senior or Lead Analyst, you handle the most complex and sensitive projects. This could include leading a company-wide pay equity audit, designing a new sales incentive plan from scratch, or managing the compensation workstream for a merger or acquisition. You may mentor junior analysts. Your value is in your deep subject matter expertise and ability to solve complex, ambiguous problems.

- Managerial Level (8+ years): Salary: ~$120,000 - $160,000+. Your focus shifts from "doing" to "leading." You manage a team of analysts, set priorities, control the compensation budget, and develop the overarching strategy for your area. You spend more time in meetings with senior leaders than in spreadsheets. Your value is in your strategic thinking, leadership, and ability to influence the organization.

###

Geographic Location

Where you work has a massive impact on your salary. Companies adjust their pay structures based on the local cost of labor and cost of living. A Compensation Analyst in a major metropolitan hub will earn substantially more than one in a rural area, though the purchasing power may be similar.

- Top-Paying Metropolitan Areas: According to data from the BLS and salary aggregators like Salary.com, the highest salaries for Compensation Analysts are consistently found in major tech and finance hubs.

- San Jose-Sunnyvale-Santa Clara, CA (Silicon Valley): Often 25-40% above the national average. A mid-career analyst here could easily earn $110,000-$130,000.

- San Francisco-Oakland-Hayward, CA: Similar to San Jose, with salaries 20-35% above average.

- New York-Newark-Jersey City, NY-NJ-PA: A major finance and business center, with salaries typically 15-25% above the national average.

- Boston-Cambridge-Nashua, MA-NH: A hub for tech, biotech, and education, commanding salaries 10-20% above average.

- Seattle-Tacoma-Bellevue, WA: Home to Amazon and Microsoft, driving compensation well above national norms.

- Average and Lower-Paying Areas: States and cities with a lower cost of living will naturally have lower salary ranges. This includes many areas in the Midwest and South, outside of major metropolitan centers like Chicago or Austin. However, the take-home pay can still provide a high quality of life in these regions.

- The Rise of Remote Work: The pandemic accelerated the trend of remote work, which has complicated geographic pay policies. Some companies have adopted a single national pay rate, regardless of location. Others maintain location-based pay, adjusting salaries if an employee moves from a high-cost to a low-cost area. As a Compensation Analyst, you may even be involved in designing these very policies.

###

Company Type & Size

The type of organization you work for plays a huge role in both your compensation and your day-to-day experience.

- Large Corporations (Fortune 500, Publicly Traded): These companies typically offer the highest base salaries and most structured compensation programs. They have large, well-resourced HR and compensation teams, leading to more specialized roles. You might focus exclusively on executive compensation or international mobility. The benefits are usually excellent, and the inclusion of RSUs can significantly boost total compensation.

- Tech Startups (Pre-IPO): Startups offer a very different package. Base salaries may be at or slightly below the market average. The real allure is equity (stock options or RSUs). This is a high-risk, high-reward proposition. If the company is successful and goes public or is acquired, this equity can be worth far more than the salary you sacrificed. The work environment is fast-paced, and you will likely be a generalist handling all aspects of compensation.

- Consulting Firms (e.g., Mercer, Aon, Willis Towers Watson): Working for a major HR consulting firm places you on the other side of the table. You'll work with multiple clients to solve their compensation challenges. The pay is very high, and the learning curve is steep. However, the hours can be long, and the environment is high-pressure. This is an excellent path for those who want to build expertise across many industries quickly.

- Non-Profit and Government: These sectors typically offer lower base salaries than the for-profit world. However, they compensate with exceptional job security, robust pension plans, excellent work-life balance, and a strong sense of mission. A Compensation Analyst in a large university or government agency plays a vital role, albeit within a more bureaucratic and less flexible pay system.

###

Area of Specialization

As you advance in your career, you may choose to specialize. These niche areas often require unique skills and can command significantly higher salaries due to their complexity and impact.

- Executive Compensation: This is one of the most lucrative specializations. These professionals design the pay packages for C-suite executives (CEO, CFO, etc.). This involves complex long-term incentive design, board of directors presentations, and navigating SEC disclosure rules. It requires deep financial acumen and discretion. Senior specialists and managers in this area can easily earn $150,000 - $200,000+.

- Sales Compensation: Designing incentive plans that motivate a sales force without bankrupting the company is a fine art. This specialization requires a deep understanding of sales cycles, performance metrics, and financial modeling. It is a critical, high-impact role, and experts are in high demand.

- International Compensation / Global Mobility: In an increasingly globalized world, managing pay for employees who are moving between countries is a major challenge. These analysts deal with tax equalization, cost of living allowances, housing stipends, and navigating different legal and currency environments. It requires incredible attention to detail and knowledge of international policy.

- Pay Equity Analysis: With the rise of pay transparency laws and a focus on Diversity, Equity, and Inclusion (DEI), this specialization has exploded. These analysts use statistical analysis (often involving regression modeling) to identify and remediate pay gaps based on gender, race, and ethnicity. This role requires strong statistical skills and a deep understanding of employment law.

###

In-Demand Skills

Finally, your specific skillset is a direct lever on your salary. Beyond the general requirements, cultivating these high-value skills will make you a more competitive and highly-paid candidate.

- Advanced Microsoft Excel: This is non-negotiable