Introduction

Have you ever looked at a job offer, seen the salary figure, and immediately wondered about the *rest* of the package? What about paid time off, bonuses, healthcare, and that ever-important question: do salaried employees get holiday pay? These aren't just details; they are the bedrock of financial security and work-life balance. For many, navigating this complex world is confusing. But for a select group of highly analytical and strategic professionals, designing and managing these systems is their career. This is the world of the compensation and benefits professional—the expert who ensures that pay is not just a number, but a fair, competitive, and motivating force within an organization.

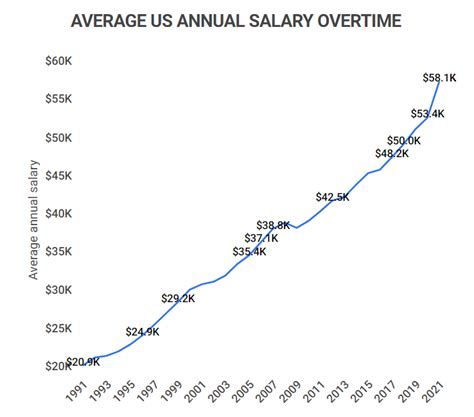

This in-demand and often lucrative career path offers a unique blend of data analytics, human psychology, legal expertise, and business strategy. Professionals in this field are the architects of a company's total rewards, directly influencing employee satisfaction, talent retention, and the overall health of the business. The financial rewards for these experts are significant, with a median salary often exceeding six figures. According to the U.S. Bureau of Labor Statistics, the median pay for Compensation and Benefits Managers in 2023 was $136,470 per year.

I'll never forget a close friend's first salaried job out of college. He was thrilled with the offer but utterly confused when a federal holiday rolled around, and he wasn't sure if he should show up or if he'd be paid. A quick, clear email from his company's HR benefits specialist not only answered his question but also explained the company's entire holiday pay policy, making him feel valued and secure. In that moment, I saw the profound, human impact of this behind-the-scenes role; it’s about providing clarity and fairness that empowers the entire workforce.

This comprehensive guide will serve as your roadmap to a career centered on answering critical questions like "do salaried employees get holiday pay?" and building the frameworks that support them. We will explore everything from the day-to-day responsibilities and salary potential to the specific skills and steps you need to take to enter and excel in this rewarding field.

### Table of Contents

- [What Does a Professional in This Field Do?](#what-does-a-do-salaried-employees-get-holiday-pay-professional-do)

- [Average Salary: A Deep Dive](#average-do-salaried-employees-get-holiday-pay-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Professional in This Field Do?

At its core, a professional whose work revolves around the question "do salaried employees get holiday pay?" is a Compensation and Benefits Manager or Specialist. This role is far more than administrative; it's a highly strategic function within Human Resources that ensures a company can attract, retain, and motivate top talent through a competitive and equitable total rewards package.

These experts are responsible for researching, designing, implementing, and managing the full spectrum of employee compensation and benefits programs. They don't just answer the question about holiday pay; they design the very policy that dictates the answer. Their work requires a delicate balance between meeting employee needs and expectations while staying within the company's budget and adhering to a complex web of government regulations.

Core Responsibilities and Daily Tasks:

- Compensation Strategy & Analysis: They conduct market research and salary surveys to ensure the company's pay scales are competitive with other employers in the industry and region. They analyze internal pay equity to ensure fairness across different roles, departments, and demographics.

- Benefits Administration: This involves managing all non-wage compensation, including health insurance, dental and vision plans, life insurance, disability coverage, and retirement plans (like a 401(k)). They are the primary contact for benefits vendors and brokers.

- Policy Design & Implementation: They write, review, and update company policies related to compensation and time off. This includes creating clear guidelines for everything from salary adjustments and bonus structures to vacation accrual and, yes, paid holidays.

- Legal Compliance: This is a critical function. They must ensure all pay and benefits practices comply with federal, state, and local laws, such as the Fair Labor Standards Act (FLSA), which governs overtime pay, and the Employee Retirement Income Security Act (ERISA), which sets standards for retirement plans.

- Communication & Education: A great benefits package is useless if employees don't understand it. These professionals develop communication materials, host information sessions, and answer individual employee questions to help them make the most of their total rewards.

- Job Evaluation & Leveling: They create systems for classifying jobs based on their responsibilities, scope, and impact on the organization. This job architecture is the foundation for creating fair and consistent salary ranges.

### A Day in the Life of a Compensation & Benefits Manager

To make this tangible, let's imagine a day for 'Alex,' a Senior Compensation & Benefits Manager at a mid-sized tech company.

- 9:00 AM - 9:45 AM: Alex starts the day by reviewing the latest industry salary survey data that just came in. They are preparing for the annual salary review cycle and need to see if the company's pay bands for software engineers are still competitive with the market. They flag a few roles where the market has moved significantly.

- 10:00 AM - 11:30 AM: Alex joins a video call with the company's health insurance broker. They are discussing renewal options for the next year, analyzing claims data to understand cost drivers, and exploring new wellness programs to add to the benefits package to proactively manage employee health and costs.

- 11:30 AM - 12:30 PM: An employee pings Alex with a complex question about their 401(k) vesting schedule after a recent promotion. Alex pulls up the employee's file, reviews the plan documents, and provides a clear, detailed explanation, ensuring the employee feels confident in their retirement planning.

- 1:30 PM - 3:00 PM: Alex leads a meeting with the Head of Sales and the CFO. They are designing a new commission plan for the sales team. Alex presents three models, each with different accelerators and payout structures, using data to show how each plan might motivate specific sales behaviors and impact the company's bottom line.

- 3:00 PM - 4:30 PM: Alex focuses on compliance. A new state law regarding pay transparency is going into effect next month. Alex drafts a communication plan and updates for the company's internal HRIS (Human Resources Information System) to ensure all job postings will meet the new legal requirements.

- 4:30 PM - 5:00 PM: Alex responds to a few final emails, including one from a new manager asking for clarification on the company's paid holiday policy for their salaried, non-exempt team members—a nuanced question Alex is perfectly equipped to answer.

This example illustrates the blend of analytical rigor, strategic thinking, and human-centric problem-solving that defines this critical career.

---

Average Salary for a Career in "Do Salaried Employees Get Holiday Pay?": A Deep Dive

A career focused on designing and managing employee compensation is not only intellectually stimulating but also financially rewarding. The salary for a professional in this field—a Compensation and Benefits Manager—reflects the high level of skill, responsibility, and strategic importance of the role. They are entrusted with managing one of the company's largest expenses (payroll and benefits) and directly impact its ability to compete for talent.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for Compensation and Benefits Managers was $136,470 in May 2023. This is the midpoint, meaning half of the professionals in this field earned more than this amount, and half earned less.

However, a single median figure only tells part of the story. The salary range is quite broad, influenced by factors we'll explore in the next section, such as experience, location, and company size.

- The lowest 10 percent earned less than $80,330. These are typically entry-level roles like Compensation Analysts or HR Generalists with a benefits focus in lower-cost-of-living areas.

- The highest 10 percent earned more than $231,980. These are senior-level positions such as Director or Vice President of Total Rewards at large, complex organizations, often with global responsibilities.

Let's break this down further using data from reputable salary aggregators, which provide a more granular view of the compensation landscape.

### Salary by Experience Level

Salary growth in this field is substantial as professionals gain expertise and take on more strategic responsibility.

| Experience Level | Typical Job Title(s) | Typical Salary Range (Annual) | Source(s) |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 Years) | Compensation Analyst, Benefits Coordinator, HR Generalist | $65,000 - $90,000 | Payscale, Glassdoor |

| Mid-Career (4-8 Years) | Senior Analyst, Compensation & Benefits Manager | $95,000 - $145,000 | Salary.com, Glassdoor |

| Senior/Executive (8+ Years) | Senior Manager, Director of Total Rewards, VP of HR | $150,000 - $250,000+ | Salary.com, BLS |

*Note: These ranges are national averages and can vary significantly based on location, industry, and other factors.*

As you can see, the path from an analyst role to a managerial or director position comes with a significant increase in earning potential. An entry-level analyst might focus on data collection and running reports, while a director is responsible for setting the entire multi-million dollar compensation strategy for the whole company.

### A Deeper Look at Total Compensation

Base salary is just one piece of the puzzle. For compensation and benefits professionals, total rewards are a key part of their own pay package. Understanding these components is crucial.

- Base Salary: This is the fixed, annual amount you are paid. It forms the foundation of your compensation and is what the figures above primarily represent.

- Annual Bonuses / Short-Term Incentives (STI): This is a significant part of the compensation, especially at the manager level and above. Bonuses are typically tied to a combination of company performance (e.g., revenue or profit targets) and individual performance. For a Compensation Manager, this bonus can often range from 10% to 20% of their base salary. For a Director, it could be 25% to 40% or more.

- Long-Term Incentives (LTI): At senior levels (Director and VP), LTI becomes a major component of pay. This often comes in the form of stock options, restricted stock units (RSUs), or other equity grants that vest over several years. This aligns the executive's financial interests with the long-term success of the company and can be worth tens or even hundreds of thousands of dollars annually.

- Benefits Package: As you would expect, companies tend to provide their own compensation and benefits experts with excellent benefits. This includes top-tier health, dental, and vision insurance with low employee premiums, generous 401(k) matching contributions (often 5-6% or more), and substantial paid time off.

- Profit Sharing: Some companies, particularly in finance or professional services, offer profit-sharing plans where a portion of the company's annual profits is distributed among employees. This can add another significant percentage to total earnings in profitable years.

When evaluating a job offer in this field, it's essential to look beyond the base salary and consider the entire "total rewards" package. A job with a slightly lower base salary but a robust bonus structure, excellent benefits, and generous LTI could be far more lucrative in the long run. Professionals in this field are uniquely equipped to perform this analysis on their own offers, understanding the true value of each component.

---

Key Factors That Influence Salary

While the national averages provide a solid benchmark, a professional's actual earnings in the compensation and benefits field are shaped by a combination of personal qualifications, professional choices, and market forces. Understanding these factors is the key to maximizing your earning potential throughout your career. This section, the most detailed in our guide, will break down the primary drivers of salary.

###

Level of Education and Certification

Your educational foundation plays a significant role in both your entry into the field and your long-term salary trajectory.

- Bachelor's Degree: A bachelor's degree is the standard entry-level requirement. Degrees in Human Resources, Business Administration, Finance, or Economics are most common. They provide the foundational knowledge in business operations, statistics, and legal principles necessary for the role.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA) or a master's in Human Resources (MHR), can significantly accelerate career progression and increase earning potential. An MBA, particularly from a top-tier school, is often a preferred qualification for senior leadership roles (Director, VP) in large corporations. Individuals with a master's degree often command a salary premium of 10-20% over those with only a bachelor's, according to various industry surveys. This is because the curriculum develops advanced strategic thinking, financial modeling, and leadership skills.

- Professional Certifications: In the world of compensation and benefits, certifications are not just resume-boosters; they are a direct signal of specialized expertise and can lead to a direct and immediate salary increase. The most respected certifications are:

- Certified Compensation Professional (CCP®): Offered by WorldatWork, this is the gold standard certification for compensation professionals. It requires passing a series of exams covering topics from base pay administration to market pricing and executive compensation. Holding a CCP can increase a professional's salary by as much as 9-15%, according to Payscale data.

- Certified Benefits Professional (CBP®): Also from WorldatWork, this is the premier certification for benefits specialists, covering healthcare, retirement plans, and work-life balance programs.

- SHRM-CP or SHRM-SCP: The Society for Human Resource Management (SHRM) offers these broader HR certifications. While not specific to compensation, they demonstrate overall HR competency and are highly valued, especially for generalist roles or in smaller companies where the C&B manager has wider HR duties.

Possessing both an advanced degree and a key certification like the CCP creates a powerful combination that positions a professional for the highest-paying roles in the field.

###

Years of Experience and Career Trajectory

Experience is arguably the most significant determinant of salary. The field has a clear and rewarding progression path, with compensation growing in step with increasing responsibility and strategic impact.

- Analyst Level (0-3 years): Entry-point roles like Compensation Analyst or Benefits Analyst typically focus on tactical execution. Responsibilities include gathering data for salary surveys, running reports from the HRIS, helping employees with benefits enrollment, and ensuring data accuracy. Salaries at this stage, as noted earlier, typically range from $65,000 to $90,000.

- Manager Level (4-8 years): After mastering the analytical fundamentals, professionals move into manager roles. Here, the focus shifts from *doing* to *designing and managing*. A Compensation Manager owns the salary review process, designs incentive plans, and advises business leaders on pay decisions. A Benefits Manager oversees vendor relationships, leads annual open enrollment, and ensures plan compliance. At this stage, salaries jump significantly into the $95,000 to $145,000 range, with bonuses becoming a standard part of compensation.

- Director/VP Level (8+ years): The most experienced professionals ascend to senior leadership. A Director of Total Rewards or VP of Human Resources is a key strategic partner to the C-suite. They are responsible for the entire philosophy and multi-million dollar budget for all compensation and benefits programs globally. Their work involves long-range planning, designing executive compensation packages, and ensuring the company's rewards strategy supports its overarching business goals. Salaries at this level regularly exceed $150,000 and can easily reach $250,000 or more, supplemented by substantial long-term incentives (equity).

###

Geographic Location

Where you work matters immensely. Salaries are closely tied to the cost of labor and the cost of living in a specific metropolitan area. Companies in high-cost cities must pay more to attract talent.

Here's a look at how salaries for a Compensation and Benefits Manager can vary across different U.S. cities, based on data from Salary.com and Glassdoor:

High-Paying Metropolitan Areas:

- San Jose, CA (Silicon Valley): Often 25-40% above the national average.

- San Francisco, CA: 20-35% above the national average.

- New York, NY: 15-25% above the national average.

- Boston, MA: 10-20% above the national average.

- Seattle, WA: 10-18% above the national average.

In these cities, a mid-career manager might earn $150,000-$170,000 or more in base salary alone, reflecting the intense competition for skilled professionals and the high cost of living.

Areas Closer to the National Average:

- Chicago, IL

- Dallas, TX

- Atlanta, GA

- Denver, CO

Lower-Paying Regions:

- Salaries in smaller cities and more rural areas in the Midwest and South will typically be 10-20% below the national average. While the dollar amount is lower, the purchasing power may be comparable due to a much lower cost of living.

The Rise of Remote Work: The pandemic has complicated this geographic factor. Many companies are now hiring for remote roles. Some have adopted a location-agnostic pay philosophy (paying the same regardless of where the employee lives), while others use geographic pay differentials, adjusting salary based on the employee's location. This is a hot topic and a complex challenge that compensation professionals themselves are actively working to solve.

###

Company Type and Size

The type of organization you work for has a profound impact on both salary and the nature of the work itself.

- Large Public Corporations (Fortune 500): These companies typically offer the highest base salaries and most structured compensation packages. They have complex, multi-layered compensation structures, global operations, and large budgets. Roles are often highly specialized (e.g., Executive Compensation Analyst, International Benefits Manager). They also offer robust bonus programs and lucrative long-term equity incentives for senior leaders.

- Tech Startups (Pre-IPO): Startups may offer a lower base salary compared to large corporations. However, they often compensate for this with potentially high-value stock options or equity grants. The work is fast-paced, less structured, and professionals often wear many hats. A successful IPO can lead to a massive financial windfall for early employees.

- Private Companies: Salaries at private companies can vary widely. They are often competitive with public companies but may have less formal bonus structures and typically use different forms of long-term incentives, like phantom stock or profit-sharing plans, instead of publicly-traded equity.

- Non-Profit Organizations: Non-profits and educational institutions are mission-driven, but this often comes with lower pay scales compared to the for-profit sector. While the base salary may be 15-25% lower, they often compensate with excellent benefits, such as generous retirement contributions and significant paid time off, and a stronger sense of work-life balance.

- Government: Federal, state, and local government jobs offer unparalleled job security and excellent retirement (pension) and health benefits. Salaries are determined by structured pay scales (like the GS scale for federal employees). While the base salary may not reach the peaks of the private sector, the total value of the lifetime benefits package can be extremely high.

###

Area of Specialization

Within the broader field of compensation and benefits, specializing in a high-demand niche can lead to significantly higher earnings.

- Executive Compensation: This is one of the most lucrative specializations. These professionals design the complex pay packages (salary, bonuses, equity, perks, severance) for C-suite executives. The role requires deep financial acumen, knowledge of SEC regulations, and the ability to work closely with the board of directors. Specialists in this area are among the highest earners in the HR field.

- Sales Compensation: Designing incentive plans for sales teams is another highly specialized and valuable skill. This involves creating complex commission and bonus structures that drive specific sales behaviors and align with business goals. It requires a strong understanding of sales cycles, financial modeling, and motivation.

- Global Compensation & Mobility: For multinational corporations, managing pay and benefits across different countries, currencies, and legal systems is a major challenge. Professionals with expertise in international compensation, expatriate pay packages, and global mobility are in high demand and command premium salaries.

- Benefits Strategy: While benefits administration is a core function, benefits *strategy* is a higher-level specialization. This involves long-term planning, cost-containment strategies, and designing innovative wellness and work-life programs to create a competitive advantage in the talent market.

###

In-Demand Skills

Finally, cultivating a specific set of high-value skills will directly translate into higher pay and more significant career opportunities.

- Advanced Data Analytics & Modeling: The ability to go beyond pulling reports is paramount. The highest-paid professionals can build complex financial models to forecast the cost of new bonus plans, conduct regression analysis to identify pay equity gaps, and use data visualization tools (like Tableau or Power BI) to present compelling stories to leadership.

- HRIS/Technology Proficiency: Expertise in leading HR Information Systems (like Workday, SAP SuccessFactors, or Oracle HCM) is essential. Knowing how to configure and leverage these systems for compensation cycles, benefits administration, and reporting is a core competency.

- Business & Financial Acumen: To be a strategic partner, you must speak the language of the business. This means understanding financial statements, how the company makes money, and how your compensation strategies impact the bottom line.

- Legal & Regulatory Knowledge: Deep and up-to-date knowledge of laws like FLSA, ERISA, COBRA, and emerging pay transparency legislation is non-negotiable. Being the resident expert on compliance makes you invaluable.

- Negotiation & Communication: Whether you are negotiating with benefits vendors for better rates, presenting a new salary structure to the executive team, or explaining a complex equity grant to an employee, strong communication and negotiation skills are critical for success and influence.

By strategically developing these factors—pursuing certifications, targeting high-paying locations and industries, and honing in-demand skills—you can proactively guide your career toward the highest echelons of the compensation and benefits profession.

---

Job Outlook and Career Growth

For those considering a career path that deals with questions like "do salaried employees get holiday pay?", the future is bright. The demand for skilled compensation and benefits professionals is strong and expected to grow, driven by a confluence of economic, legal, and social trends that place a premium on strategic rewards management.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation and Benefits Managers will grow by 7 percent from 2022 to 2032. This growth rate is more than twice as fast as the average for all occupations, which stands at 3 percent. This translates to approximately 5,900 job openings projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This robust outlook is not just about creating more jobs; it's about the increasing importance and complexity of the role. Several key trends are fueling this demand and shaping the future of the profession.

### Emerging Trends and Future Challenges

1. The Rise of Pay Transparency: A wave of new state and local laws is requiring companies to disclose salary ranges in job postings. This is a seismic shift. Companies can no longer rely on opacity in pay negotiations. They need sophisticated compensation professionals to build fair, defensible, and clearly-structured pay bands and to communicate their compensation philosophy effectively, both internally and externally.

2. Focus on Diversity, Equity, and Inclusion (DE&I): Organizations