In the world of finance, the role of a Senior Financial Analyst stands out as a critical, influential, and highly rewarding career path. For those with a sharp mind for numbers and a passion for strategic business decisions, this position offers significant earning potential. A typical senior financial analyst salary in the United States often ranges from $90,000 to over $125,000 annually, with top performers in high-demand sectors earning considerably more.

This guide provides a deep dive into what you can expect to earn as a Senior Financial Analyst and, more importantly, how you can maximize your compensation. We will explore the core responsibilities of the role, analyze salary data from authoritative sources, and break down the key factors that will shape your career and your paycheck.

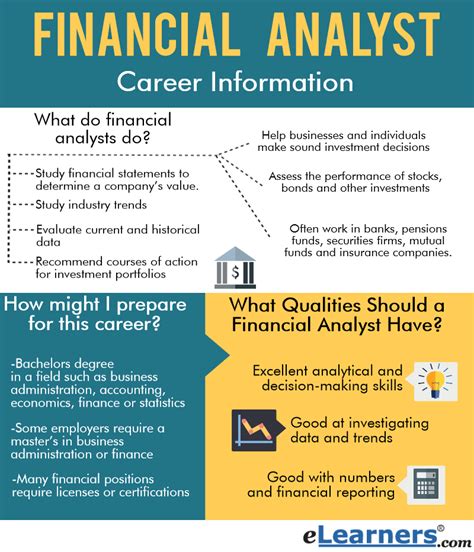

What Does a Senior Financial Analyst Do?

A Senior Financial Analyst is far more than just a number-cruncher; they are a strategic partner to business leadership. While a junior analyst may focus on data collection and basic report generation, a senior analyst is responsible for interpreting complex financial data to drive key business decisions.

Their core responsibilities often include:

- Financial Modeling & Forecasting: Building sophisticated models to predict future revenue, expenses, and profits.

- Budgeting & Variance Analysis: Leading the annual budgeting process and analyzing performance against the budget, explaining why results differed from the plan.

- Strategic Recommendations: Advising management on investment opportunities, pricing strategies, and cost-saving initiatives.

- Mentorship: Guiding and training junior analysts on the team.

- Reporting to Leadership: Creating and presenting clear, concise financial reports and findings to executives and department heads.

In essence, they translate raw data into actionable business intelligence, making them indispensable to a company’s financial health and strategic direction.

Average Senior Financial Analyst Salary

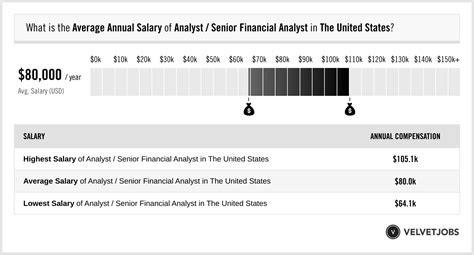

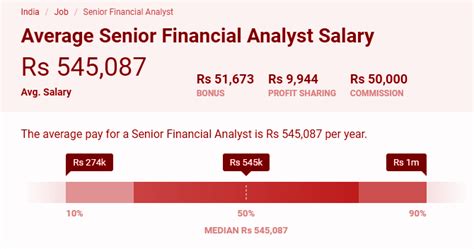

Salary data for a Senior Financial Analyst can vary based on the source's methodology (e.g., including or excluding bonuses and other compensation). To provide a complete picture, we’ve compiled data from several reputable sources.

- Salary.com: As of early 2024, the median salary for a Senior Financial Analyst in the United States is approximately $105,600, with a typical range falling between $96,500 and $115,900.

- Glassdoor: This platform, which incorporates user-submitted data, reports a total pay average of $115,500 per year. This includes an estimated base pay of around $100,000 and additional pay (cash bonus, stock, etc.) of about $15,500.

- Payscale: Data from Payscale shows a median base salary of around $93,000, with the full salary range for the role extending from $72,000 to $124,000 before bonuses.

For a broader industry perspective, the U.S. Bureau of Labor Statistics (BLS) groups all financial analysts together. The BLS reported a median annual wage for Financial Analysts of $95,570 in May 2022. Senior roles, which require more experience and responsibility, naturally command salaries at the higher end of this spectrum and beyond.

Key Factors That Influence Salary

Your final salary is not determined by a single number. It is a complex calculation influenced by several key variables. Understanding these factors is the first step toward maximizing your earning potential.

### Level of Education

A bachelor's degree in finance, accounting, economics, or a related field is the standard entry requirement. However, advanced degrees and certifications can provide a significant salary boost.

- Master of Business Administration (MBA): An MBA, especially from a top-tier business school, can open doors to higher-level roles and significantly increase earning potential. It equips analysts with advanced leadership, strategy, and management skills.

- Certifications: Professional certifications are highly valued in the finance industry. The Chartered Financial Analyst (CFA) designation is considered the gold standard for investment analysis and can lead to a substantial salary premium. The Certified Public Accountant (CPA) is also highly valuable, particularly for roles that overlap with accounting functions.

### Years of Experience

Experience is arguably the most significant driver of salary growth for a financial analyst. The career path typically shows a clear and rewarding progression.

- Entry-Level Financial Analyst (0-2 years): Focuses on learning the fundamentals, gathering data, and supporting senior staff.

- Financial Analyst (2-5 years): Takes on more complex analyses and begins to manage smaller projects independently.

- Senior Financial Analyst (5-8+ years): This is where salaries see a significant jump. Professionals at this level are expected to lead projects, mentor junior staff, and provide strategic insights directly to management.

- Lead Analyst or Finance Manager (8+ years): The next step involves managing a team of analysts and taking on greater strategic responsibility, with compensation rising accordingly.

### Geographic Location

Where you work matters. Salaries for senior financial analysts are often adjusted for local market demand and cost of living. Major financial hubs and tech centers offer the highest salaries.

- Top-Tier Cities: Metropolitan areas like New York City, San Francisco, Boston, and San Jose consistently offer salaries that are 20-35% above the national average to compensate for a higher cost of living and intense competition for talent.

- Other Major Cities: Cities like Chicago, Los Angeles, and Washington D.C. also offer competitive salaries that are above the national median.

- Remote Work: While the rise of remote work has slightly flattened geographic pay disparities, many companies still use location-based pay bands. However, a remote role at a company based in a high-cost area can still be highly lucrative.

### Company Type and Industry

The industry you work in has a massive impact on your compensation package, especially bonuses.

- Top Paying: The most lucrative industries include investment banking, private equity, hedge funds, and securities/commodity trading. These roles are high-pressure but come with extremely high base salaries and substantial performance-based bonuses.

- Corporate Finance (FP&A): Large, publicly traded companies, especially in the technology (e.g., Google, Amazon) and pharmaceutical sectors, offer very competitive salaries and robust benefits packages for their Financial Planning & Analysis (FP&A) teams.

- Other Industries: Sectors like manufacturing, retail, healthcare, and government offer solid, stable careers but generally have lower salary ceilings compared to high finance or big tech.

### Area of Specialization

"Financial Analyst" is a broad title. Specializing in a high-demand area can lead to a higher salary.

- Mergers & Acquisitions (M&A): Analysts who specialize in valuing companies for potential mergers or acquisitions are often among the highest earners due to the direct impact of their work on a company's growth strategy.

- Investment Analysis: Working for a buy-side (e.g., mutual fund) or sell-side (e.g., investment bank) firm to analyze stocks, bonds, and other investment vehicles is a highly sought-after and well-compensated specialty.

- Financial Planning & Analysis (FP&A): This is one of the most common and vital specializations within a corporation, focusing on budgeting, forecasting, and internal strategic planning.

- Treasury Analysis: Specialists in this area manage a company’s cash flow, debt, and foreign exchange risk, a critical function that commands a competitive salary.

Job Outlook

The future for financial analysts is bright. According to the U.S. Bureau of Labor Statistics, employment for financial analysts is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

This growth is fueled by an increasing array of financial products, the growing need for in-depth data analysis in corporate decision-making, and the ongoing globalization of business. As companies become more data-driven, the need for skilled senior analysts who can provide clear, forward-looking insights will only increase.

Conclusion

A career as a Senior Financial Analyst is both intellectually challenging and financially rewarding. With a national median salary comfortably over $100,000 and a clear path for advancement, it represents an excellent goal for ambitious finance professionals.

Your ultimate earning potential will be shaped by your continuous learning, the experience you gain, the industry you choose, and where you decide to work. By strategically pursuing advanced education, sought-after certifications like the CFA, and experience in high-growth specializations, you can position yourself to not only meet but significantly exceed the average salary figures and build a successful, impactful career in finance.