The question, "Do you get paid overtime on salary?" is one of the most persistent and misunderstood aspects of the modern workplace. For many salaried professionals, the lines between standard hours and extra work are often blurred, leading to confusion about rights, regulations, and fair compensation. The answer, which is a resounding "it depends," opens the door to a complex world of labor law, employee classification, and strategic business decisions. It's a world managed by a group of highly specialized and increasingly vital professionals: Compensation and Benefits Managers.

These individuals are the architects of an organization's pay structure, the guardians of legal compliance, and the strategists who ensure a company can attract, retain, and motivate top talent. They operate at the critical intersection of finance, human resources, and legal affairs. Pursuing a career in this field means moving beyond simply processing payroll to designing the very systems that define an employee's financial relationship with their employer. With an average median salary of $136,480 per year as of May 2023, according to the U.S. Bureau of Labor Statistics, it's a career that is as rewarding financially as it is intellectually challenging. I once mentored a junior HR generalist who was fascinated by a single, complex case of employee misclassification. Watching her dive into the nuances of the Fair Labor Standards Act (FLSA) and emerge with a solution that not only corrected the issue but also improved company policy was a powerful reminder that this field is about ensuring fairness and equity on a systemic level.

This ultimate guide will not only definitively answer the question of salaried overtime but will also provide a comprehensive roadmap for those aspiring to a career as a Compensation and Benefits Manager. We will explore everything from the day-to-day responsibilities and salary potential to the specific skills and educational pathways required to succeed in this demanding and influential profession.

### Table of Contents

- [What Does a Compensation and Benefits Manager Do?](#what-does-a-compensation-and-benefits-manager-do)

- [Average Compensation and Benefits Manager Salary: A Deep Dive](#average-compensation-and-benefits-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation and Benefits Manager Do?

At its core, the role of a Compensation and Benefits Manager is to answer the question of "How, and how much, should our employees be paid?" This extends far beyond a simple annual salary. Their primary responsibility is to design, implement, and manage a company's "Total Rewards" strategy. This holistic approach encompasses everything that an employee receives in exchange for their work: salary, bonuses, incentives, health insurance, retirement plans, paid time off, and other perks.

However, a significant and legally critical part of their job is to first answer the question that brought you here: "Do you get paid overtime on salary?"

To do this, they must be experts in labor law, particularly the Fair Labor Standards Act (FLSA) in the United States. The FLSA establishes minimum wage, overtime pay, recordkeeping, and youth employment standards. The key concept for salaried employees is the distinction between Exempt and Non-Exempt status.

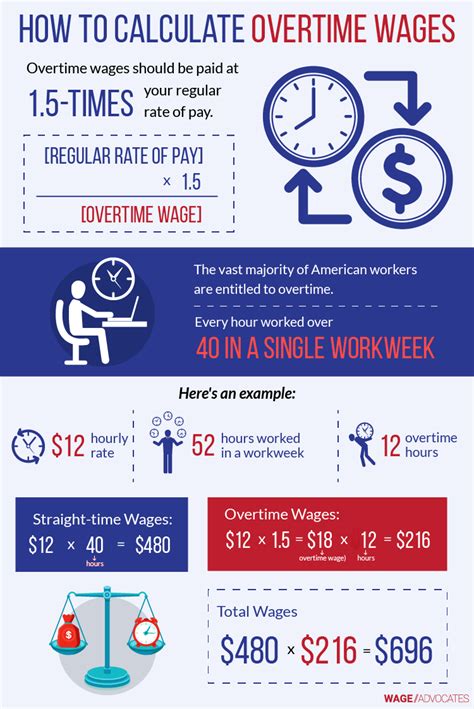

- Non-Exempt Employees: Are entitled to overtime pay (typically 1.5 times their regular rate of pay) for any hours worked over 40 in a workweek. This applies to both hourly and salaried employees who do not meet the specific exemption criteria. Yes, you can be a salaried employee and still be eligible for overtime. This is known as "salaried non-exempt."

- Exempt Employees: Are *not* entitled to overtime pay. To be classified as exempt, an employee must meet three tests:

1. Salary Basis Test: They must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. Salary Level Test: They must be paid a salary that meets a minimum specified amount. As of July 1, 2024, this federal threshold is set at $844 per week ($43,888 annually), and it is scheduled to increase to $1,128 per week ($58,656 annually) on January 1, 2025. Some states (like California and New York) have even higher salary thresholds.

3. Duties Test: Their primary job duties must involve executive, administrative, professional, computer, or outside sales functions as defined by the Department of Labor. This is the most complex part of the classification, requiring a detailed analysis of what an employee *actually does* day-to-day.

The Compensation Manager is the expert who conducts this analysis for every role in the company, ensuring each position is classified correctly to avoid significant legal and financial penalties for the organization.

Beyond this critical compliance function, their daily tasks and projects are diverse and highly analytical:

- Job Analysis and Evaluation: Deconstructing jobs to understand their core functions, responsibilities, and required skill levels to determine their internal value.

- Market Pricing and Salary Benchmarking: Using salary survey data from providers like Radford, Willis Towers Watson, or Mercer to compare the company's pay rates against competitors in the same industry and geographic location.

- Designing Compensation Structures: Creating salary ranges (minimum, midpoint, maximum) for different job levels or "grades" to ensure internal equity and a clear path for pay progression.

- Incentive Plan Design: Developing bonus, commission, and long-term incentive (e.g., stock options) plans that motivate employees and align their performance with company goals.

- Benefits Administration: Overseeing the selection, implementation, and management of health insurance, retirement plans (like 401(k)s), life insurance, and other employee benefits.

- Executive Compensation: A highly specialized area focusing on the complex pay packages for top executives, which often involves collaboration with the Board of Directors.

- Compliance and Reporting: Ensuring all pay practices comply with federal, state, and local laws, including pay transparency and equity reporting.

### A Day in the Life of a Compensation Manager

To make this tangible, imagine a typical Tuesday for Sarah, a Compensation Manager at a mid-sized tech company:

- 9:00 AM - 9:45 AM: Sarah starts her day reviewing a request from the Head of Marketing. A Marketing Coordinator, currently classified as "salaried non-exempt," has been consistently working 50-hour weeks to meet deadlines. The manager wants to know if they can be reclassified to "exempt" to avoid the overtime costs. Sarah pulls the job description and schedules a meeting with the manager and employee to conduct a thorough duties review, cross-referencing their tasks against the FLSA's "administrative" exemption criteria.

- 9:45 AM - 12:00 PM: She dives into a major project: analyzing the company's annual salary survey data. Using advanced Excel functions (VLOOKUPs, pivot tables) and data visualization tools, she benchmarks her company's software engineering salaries against the market. She notices they are lagging by 8% at the senior level and begins modeling the cost of a market adjustment to present to the CFO.

- 12:00 PM - 1:00 PM: Lunch while watching a webinar on new state-level pay transparency laws.

- 1:00 PM - 3:00 PM: Sarah meets with the VP of Sales to design the commission plan for the upcoming fiscal year. They discuss accelerators for over-performance, the right mix of base salary to variable pay, and how to structure the plan to drive the sales of a new product line.

- 3:00 PM - 4:30 PM: It's benefits open enrollment season. Sarah joins a call with the company's health insurance broker to finalize the plan options and communication materials for employees. They review utilization data from the past year to identify trends and potential cost-saving measures.

- 4:30 PM - 5:30 PM: She dedicates the last hour to preparing a presentation for the executive team. The presentation outlines her findings from the market analysis and proposes a new salary structure to ensure the company remains competitive in the fierce battle for tech talent.

This snapshot reveals a role that is part analyst, part strategist, part legal expert, and part trusted advisor.

Average Compensation and Benefits Manager Salary: A Deep Dive

The compensation for professionals in this field reflects the high level of skill, responsibility, and impact they have on an organization. Salaries are consistently strong and significantly above the national average for all occupations.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for Compensation and Benefits Managers was $136,480 in May 2023. This is the midpoint, meaning half of all managers earned more than this amount and half earned less. The BLS also provides a more detailed salary range:

- Lowest 10% earned less than: $78,510

- Highest 10% earned more than: $234,460

This wide range highlights how factors like experience, industry, and location can dramatically influence earnings. Let's break this down further using data from reputable salary aggregators, which often provide a more granular view based on user-reported data.

- Payscale.com reports the average salary for a Compensation & Benefits Manager as approximately $103,400, with a typical range between $72,000 and $145,000 as of late 2024.

- Salary.com provides a higher median salary figure, reporting the U.S. median for a Compensation & Benefits Manager at $130,580, with a range typically falling between $116,420 and $146,360.

- Glassdoor.com estimates the total pay (including base and additional pay like bonuses) for a Compensation & Benefits Manager in the U.S. to be around $148,500 per year, with a likely range of $116,000 to $192,000.

The slight variation between sources is normal and depends on their data sources and methodologies. However, the consistent theme is a six-figure salary with a very high ceiling for top performers in high-paying industries.

### Salary by Experience Level

The career path in compensation offers a clear and lucrative growth trajectory. As professionals gain more experience and take on more strategic responsibility, their earning potential increases substantially.

| Experience Level | Role Title (Typical) | Average Base Salary Range (U.S.) | Description of Role |

| -------------------------------- | --------------------------------------- | ----------------------------------------- | --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Entry-Level (0-3 years) | Compensation Analyst / Benefits Analyst | $65,000 - $90,000 | Focuses on data collection, spreadsheet management, participating in salary surveys, assisting with job evaluations, and supporting open enrollment. Primarily tactical and analytical. |

| Mid-Career (4-9 years) | Senior Analyst / Compensation Manager | $95,000 - $150,000 | Manages compensation programs, designs salary structures, leads annual review cycles, consults with business leaders, and ensures FLSA compliance. A blend of tactical and strategic. |

| Senior-Level (10-15+ years) | Senior Manager / Director of Comp & Ben | $150,000 - $220,000+ | Sets the overall Total Rewards strategy for the organization or a large business unit. Manages a team of analysts and managers. Deep expertise in executive compensation and plan design. |

| Executive-Level (15+ years) | VP of Total Rewards / CHRO | $220,000 - $400,000+ (plus significant LTI) | Oversees the entire HR function or all aspects of global rewards. Works directly with the CEO and Board of Directors. Compensation is heavily weighted towards long-term incentives. |

*(Salary ranges are aggregated estimates based on BLS, Payscale, and Salary.com data for 2023-2024 and can vary significantly.)*

### Beyond the Base Salary: Understanding Total Compensation

For compensation professionals, "salary" is just one piece of the puzzle. Their own pay packages often serve as a model for the "Total Rewards" philosophy they champion.

- Annual Bonuses/Short-Term Incentives (STI): This is a standard component of compensation in this field. Bonuses are typically tied to a combination of company performance (e.g., revenue or profit targets) and individual performance. A manager-level professional might expect a target bonus of 10-20% of their base salary, while a Director's target could be 25-40% or more.

- Long-Term Incentives (LTI): Particularly in publicly traded companies or high-growth startups, LTI is a significant part of the compensation package for senior roles. This can come in the form of:

- Restricted Stock Units (RSUs): Shares of company stock that vest over a period of time (e.g., 4 years).

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Performance Shares: Stock awards that only vest if specific, long-term company performance goals are met.

LTI can often be worth 50-100% (or more) of the base salary for executive-level roles, making it a powerful wealth-building tool.

- Benefits and Perks: Compensation managers receive the same benefits they administer, which are often excellent. This includes top-tier health, dental, and vision insurance; generous 401(k) matching contributions; robust paid time off; wellness stipends; and professional development budgets.

When evaluating a job offer in this field, it's crucial to look beyond the base salary and assess the entire "Total Compensation" package to understand the full earning potential.

Key Factors That Influence Salary

While the national averages provide a solid baseline, a compensation professional's actual earnings are determined by a confluence of specific, interconnected factors. Understanding these levers is key to maximizing one's salary potential throughout their career. As experts in pay, they are uniquely positioned to know precisely what drives value in the market.

### ### Level of Education

Education forms the foundational knowledge base for a career in compensation. While a bachelor's degree is typically the minimum requirement, advanced degrees and, most importantly, professional certifications can significantly boost earning potential and career mobility.

- Bachelor's Degree: A bachelor's degree in Human Resources, Business Administration, Finance, or Economics is the most common entry point. These programs provide essential knowledge in business operations, statistics, and organizational behavior. A candidate with a relevant bachelor's degree can expect to enter the field as an Analyst.

- Master's Degree: An advanced degree can act as a powerful career accelerator. A Master of Business Administration (MBA) is highly valued, as it equips professionals with a deep understanding of business strategy, finance, and analytics, allowing them to better align compensation programs with overall business goals. A Master's in Human Resource Management (MHRM) provides specialized knowledge in HR principles and labor relations. Professionals with a master's degree can often command a starting salary 10-15% higher than those with only a bachelor's and may progress to management roles more quickly.

- Professional Certifications: In the world of compensation, certifications are the gold standard and often a prerequisite for senior roles. They signal a deep level of expertise and a commitment to the profession. The most prestigious certifications are offered by WorldatWork:

- Certified Compensation Professional (CCP®): This is the most recognized certification globally for compensation professionals. It requires passing a series of exams covering topics from base pay and variable pay design to market pricing and global compensation. Earning a CCP can lead to a salary increase of 5-10% and is frequently listed as a "preferred" or "required" qualification in job descriptions for manager-level positions and above.

- Certified Benefits Professional (CBP®): Similar to the CCP, this certification focuses on the benefits side of the house, covering health and welfare plans, retirement plans, and benefits strategy.

- Global Remuneration Professional (GRP®): For those specializing in international compensation, this certification is essential.

Holding one or more of these certifications not only boosts salary but also significantly enhances credibility and marketability.

### ### Years of Experience

As detailed in the salary table above, experience is arguably the single most significant factor in salary growth. The compensation field has a well-defined career ladder, and pay rises in step with increasing responsibility and strategic scope.

- Analyst (0-3 years): In this stage, the focus is on learning the technical ropes: data manipulation in Excel, participating in survey submissions, basic job evaluation, and learning the company's HR Information System (HRIS). The work is highly supervised.

- Senior Analyst / Manager (4-9 years): The transition to a manager role marks a major pay bump. At this stage, professionals move from *doing* the analysis to *interpreting* it. They begin to own major processes like the annual merit cycle, consult directly with business leaders on pay decisions, and may manage one or two junior analysts. Their salary reflects this shift from tactical execution to strategic partnership. For example, a Senior Compensation Analyst at a large corporation might earn $115,000, while a first-time Compensation Manager at the same company could earn $140,000.

- Director / VP (10+ years): At this level, professionals are setting the strategy for the entire organization. They are less involved in day-to-day spreadsheet work and more focused on long-term planning, executive compensation design, managing large teams, and presenting to the C-suite and Board of Directors. Their compensation structure shifts dramatically, with a much larger portion of their pay coming from variable incentives (bonuses and LTI), reflecting their direct impact on the company's overall success. A Director of Total Rewards in a high-paying industry could easily have a total compensation package exceeding $300,000.

### ### Geographic Location

Where you work matters immensely. Salaries for compensation roles vary significantly by state and metropolitan area, driven by local cost of labor, cost of living, and the concentration of large corporate headquarters.

Top-Paying Metropolitan Areas:

According to BLS data and salary aggregators, cities with a high concentration of tech, finance, and biotech industries consistently offer the highest salaries.

| Metropolitan Area | Average Annual Salary (Manager Level) | Rationale |

| ---------------------------------- | ------------------------------------- | -------------------------------------------------------------------------------- |

| San Jose-Sunnyvale-Santa Clara, CA | $190,000 - $220,000+ | Epicenter of the tech industry; intense competition for specialized talent. |

| San Francisco-Oakland-Hayward, CA | $180,000 - $210,000+ | Hub for tech, venture capital, and finance; high cost of living drives up wages. |

| New York-Newark-Jersey City, NY-NJ-PA | $170,000 - $200,000+ | Global financial center; headquarters for numerous Fortune 500 companies. |

| Boston-Cambridge-Nashua, MA-NH | $160,000 - $190,000+ | Strong biotech, pharmaceutical, and technology sectors. |

| Seattle-Tacoma-Bellevue, WA | $155,000 - $185,000+ | Home to major tech giants like Amazon and Microsoft. |

Lower-Paying Regions:

Conversely, salaries tend to be lower in the Southeast and Midwest, outside of major metropolitan hubs. A Compensation Manager role in a city like Des Moines, IA, or Birmingham, AL, might pay closer to the $100,000 - $120,000 range. While the nominal salary is lower, the purchasing power may be comparable or even higher due to a significantly lower cost of living.

The rise of remote work has added a new layer of complexity. Some companies are adopting location-based pay, adjusting salaries based on where the employee lives. Others are moving to a single national rate to attract talent from anywhere. A savvy compensation professional must now not only understand these external markets but also help design their own company's geographic pay strategy.

### ### Company Type & Size

The type, size, and industry of a company are powerful salary determinants.

- Startups vs. Large Corporations:

- Startups (especially pre-IPO): May offer lower base salaries but compensate with significant equity (stock options). The work is often less structured, requiring the compensation professional to build everything from scratch. The risk is higher, but the potential reward from an IPO can be life-changing.

- Large, Publicly-Traded Corporations: Offer higher, more stable base salaries, robust bonuses, and well-defined LTI programs (like RSUs). The roles are more specialized, and the work involves managing and refining existing complex systems. A Director of Compensation at a Fortune 100 company will almost certainly out-earn a "Head of People" at a 50-person startup in terms of cash compensation.

- Industry: Industry profitability and talent demands create huge pay disparities.

- Top-Tier: Technology, Finance/Investment Banking, Pharmaceuticals, and Energy are consistently the highest-paying industries. They are highly profitable and compete fiercely for analytical talent.

- Mid-Tier: Manufacturing, Consumer Packaged Goods (CPG), and large Retail chains offer competitive but generally lower salaries than the top tier.

- Lower-Tier: Non-profit, Education, and Government sectors typically pay the least. A Compensation Director at a large university or non-profit might earn 20-40% less than their counterpart in the tech sector. The trade-off is often better work-life balance, job security, and a mission-driven environment.

### ### Area of Specialization

As compensation professionals advance, they often develop deep expertise in a particular niche. These specializations are highly sought after and command premium pay.

- Executive Compensation: This is one of the most lucrative specializations. These experts design multi-million dollar pay packages for C-suite executives, requiring knowledge of SEC regulations, corporate governance, and long-term incentive vehicle design. They work closely with the CEO and the Compensation Committee of the Board of Directors.

- Sales Compensation: This niche focuses on designing incentive plans (commissions, bonuses, accelerators) that drive sales behavior. It requires a deep understanding of sales cycles, financial modeling, and motivating a sales force. A good sales compensation plan can directly impact a company's revenue, making these professionals extremely valuable.

- Global Compensation: For multinational corporations, managing pay across different countries, currencies, and legal frameworks is a massive challenge. Global compensation specialists are experts in expatriate pay, local labor laws, and balancing global consistency with local market practices.

- Equity Strategy/Stock Plan Administration: In tech and other industries where equity is a key part of compensation, specialists who manage the entire stock plan (from granting to vesting and reporting) are critical.

### ### In-Demand Skills

Beyond formal qualifications, a specific set of skills will differentiate a top-earning compensation professional from an average one.

- Advanced Data Analysis: This is non-negotiable. Mastery of Microsoft Excel (pivot tables, complex formulas, modeling) is the baseline. Increasingly, skills in SQL to pull data from databases, familiarity with HRIS systems (like Workday or SAP SuccessFactors), and experience with data visualization tools (Tableau, Power BI) are required. The ability to not just report the data but to tell a compelling story with it is what sets senior professionals apart.

- Financial Acumen: You must be able to speak the language of the CFO. This means understanding financial statements, modeling the cost impact of compensation programs, and linking pay strategies to financial outcomes like ROI and shareholder value.

- Legal and Regulatory Knowledge: Deep, up-to-date knowledge of the FLSA, Equal Pay Act, ERISA (for benefits), and emerging pay transparency laws is crucial for mitigating risk.

- Exceptional Communication and Influence: A compensation manager must be able to explain complex pay decisions to employees with empathy, advise senior leaders with confidence, and defend their strategies with data-driven arguments. They need to build trust and be seen as a credible, strategic partner.

Job Outlook and Career Growth

The future for Compensation and Benefits Managers is exceptionally bright. As the business world becomes more complex, data-driven, and regulated, the demand for professionals who can strategically manage a company's largest expense—its people—is only growing.

The **U.S.