Table of Contents

- [What Exactly Is a Doctorate of Business Administration?](#what-is-a-dba)

- [Average Doctorate of Business Administration Salary: A Deep Dive](#average-dba-salary)

- [Key Factors That Influence Your DBA Salary](#key-factors)

- [Job Outlook and Career Growth for DBA Holders](#job-outlook)

- [How to Start Your DBA Journey: A Step-by-Step Guide](#how-to-start)

- [Is a Doctorate of Business Administration Worth It?](#conclusion)

---

Are you a seasoned business leader standing at a career crossroads, wondering what it takes to break through the final ceiling into the C-suite or the highest echelons of thought leadership? You’ve mastered the art of management, you’ve executed successful strategies, but you’re seeking a new level of challenge and influence—one built on rigorous, evidence-based decision-making. The Doctorate of Business Administration (DBA) may be the key you’re searching for. This terminal degree is designed not just for academic pursuit, but for the practical application of scholarly research to solve the most complex, real-world business problems.

Pursuing a DBA is a commitment to becoming a "practitioner-scholar," a leader who doesn't just follow best practices but creates them. This path leads to some of the most prestigious and lucrative positions in the corporate and academic worlds. While salaries vary significantly based on role, industry, and experience, it's not uncommon for DBA holders to command compensation packages well into the six figures, frequently ranging from $150,000 to over $300,000 annually.

I once advised a Chief Marketing Officer who, despite her immense success, felt her strategic input was consistently undervalued in boardroom discussions dominated by finance and operations executives. She pursued an executive DBA program. The transformation was profound. The rigorous training in applied research gave her the language and frameworks to model, test, and present her marketing strategies with the same analytical authority as a financial forecast. Two years after graduating, she was appointed Chief Strategy Officer, directly crediting the DBA for providing the intellectual toolkit to elevate her perspective from functional expertise to enterprise-level leadership.

This article is your definitive guide to understanding the true value of a Doctorate of Business Administration. We will move beyond simple salary numbers to explore the roles you can attain, the factors that dictate your earning potential, and the precise steps you need to take to embark on this transformative journey.

---

What Does a DBA Holder Do? The Role of the Practitioner-Scholar

Unlike a Master of Business Administration (MBA), which is a professional degree focused on mastering existing business knowledge, and a Ph.D. in Business, which is a research degree focused on creating new theoretical knowledge for academia, the Doctorate of Business Administration (DBA) carves a unique and powerful niche. It is a terminal, doctoral-level degree designed to create practitioner-scholars: leaders who use advanced research skills to solve complex, tangible problems within their organizations and industries.

A person with a DBA doesn't have a single job title. Instead, the degree qualifies them for two primary career pathways, both of which involve high-level strategy, leadership, and influence.

1. The Applied Business Leader (C-Suite, Executive Leadership, Elite Consulting)

This is the most common path for DBA graduates. They remain in the corporate world but are elevated to roles where their ability to conduct and interpret applied research is a significant competitive advantage. They bridge the gap between academic theory and business practice.

- Core Responsibilities: These leaders are responsible for the highest level of strategic decision-making. Their work moves beyond day-to-day management to shaping the future of the enterprise. They diagnose complex, systemic problems (e.g., declining market share, inefficient supply chains, poor innovation pipeline), design research methodologies to understand the root causes, and develop evidence-based solutions to drive change.

- Typical Projects:

- Leading a full-scale organizational transformation initiative based on a mixed-methods study of employee engagement and operational bottlenecks.

- Developing a new market entry strategy for a multinational corporation by conducting advanced competitor analysis and predictive customer behavior modeling.

- Overhauling a company's approach to corporate social responsibility (CSR) by creating a framework that measurably links ESG initiatives to long-term financial performance.

- Serving as an internal consultant to the board of directors, providing data-driven insights on potential mergers, acquisitions, or divestitures.

2. The Academic Leader (Professor, Dean, Researcher)

The second path is a pivot into academia, but with a practical edge. While a Ph.D. is the traditional route for a tenured research professor, a DBA is highly valued for roles that involve teaching applied subjects, managing business school operations, and strengthening ties between the university and the business community.

- Core Responsibilities: In an academic setting, a DBA holder's duties often revolve around teaching MBA or executive education courses, curriculum development, and administrative leadership. They are prized for their ability to bring real-world, senior-level experience into the classroom.

- Typical Projects:

- Designing and teaching a capstone course for an Executive MBA program where students consult for real companies.

- Publishing research in practitioner-focused journals like *Harvard Business Review* or *MIT Sloan Management Review*.

- Serving as a Program Director or Dean of a business school, responsible for strategic planning, fundraising, and industry partnerships.

- Conducting sponsored research for corporations, helping them solve a specific problem while generating publishable insights.

### A Day in the Life: Dr. Anya Sharma, Chief Operating Officer

To make this tangible, let's imagine a day for a DBA holder in an executive role.

Dr. Anya Sharma is the COO of a $5 billion global logistics company. She completed her DBA five years ago while serving as a Vice President of Operations.

- 7:00 AM - 8:00 AM: Anya starts her day not with emails, but by reviewing the dashboard for a predictive analytics model she developed during her doctoral research. The model forecasts potential supply chain disruptions based on geopolitical risk factors, weather patterns, and shipping data. She notes a heightened risk in the South China Sea and makes a note to discuss contingency plans with her team.

- 8:30 AM - 10:00 AM: She leads a quarterly strategy meeting with her regional VPs. Instead of relying purely on their anecdotal reports, the discussion is structured around a balanced scorecard framework she implemented. They analyze quantitative performance data alongside qualitative feedback from a recent employee survey she designed to measure psychological safety and its impact on operational efficiency.

- 10:30 AM - 12:00 PM: Anya meets with the Chief Information Officer to review the progress of an AI integration project in their warehousing division. Her DBA dissertation focused on change management during technological adoption. She uses this expertise to ask probing questions about employee training, workflow redesign, and metrics for measuring user acceptance, ensuring the project's focus extends beyond the technology to the people using it.

- 1:00 PM - 2:30 PM: She interviews a final-round candidate for a Director of Global Procurement role. She moves past standard interview questions and presents the candidate with a real, anonymized case study of a complex supplier negotiation failure the company experienced last year. She asks the candidate to outline a research approach they would use to diagnose the root cause and propose a new, evidence-based negotiation framework.

- 3:00 PM - 4:30 PM: Anya works on a report for the Board of Directors. The company is considering acquiring a smaller tech firm. Using skills honed in her DBA finance and strategy seminars, she is building a valuation model that incorporates not just financial data, but also qualitative factors like cultural compatibility and intellectual property potential, creating a more holistic risk assessment.

- 5:00 PM - 6:00 PM: She holds a mentoring session with a high-potential manager. They discuss the manager’s career goals, and Anya recommends several academic articles on leadership and organizational behavior, translating complex theories into actionable advice for the manager’s current challenges.

This example illustrates the core value of the DBA in action: it elevates a leader from being an expert *manager* to an expert *problem-solver* who uses rigorous, data-driven methods to navigate uncertainty and drive strategic growth.

---

Average Doctorate of Business Administration Salary: A Deep Dive

Analyzing the salary for a Doctorate of Business Administration (DBA) requires a nuanced approach. The U.S. Bureau of Labor Statistics (BLS) and other salary aggregators do not track "DBA Holder" as a distinct job category. Instead, to understand the financial return on this degree, we must examine the compensation for the senior-level roles that DBA graduates typically occupy.

A DBA is a significant accelerator for both career progression and earning potential. The degree holder's salary is a combination of their extensive prior experience and the new capabilities unlocked by the doctorate. For most, the goal is to secure positions in the top 5% of earners within the business world.

### National Salary Averages for Common DBA Career Paths

The most reliable way to estimate a DBA salary is to look at the national data for C-suite executives, senior management consultants, and senior academic positions.

- Top Executives (C-Suite): This is the primary target for many DBA graduates in the industry. The BLS defines "Top Executives" as those who "plan, direct, and coordinate operational activities of companies and organizations."

- According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Top Executives was $194,920 in May 2023. However, this figure includes a vast range of company sizes and roles. For DBA holders in large corporations, the figures are substantially higher. The top 10% of earners in this category made more than $239,200 in base salary alone.

- Salary.com, which provides more granular data, reports the median total compensation for a Chief Executive Officer (CEO) in the United States as $855,815 as of late 2023, with a typical range between $647,064 and $1,113,853.

- For a Chief Operating Officer (COO), Salary.com reports a median total compensation of $495,152, typically falling between $376,432 and $651,190.

- Management Analysts / Consultants: Many DBA graduates leverage their deep expertise in elite consulting roles.

- The BLS reports a median annual wage of $99,410 for Management Analysts in May 2023. This figure is heavily skewed by junior-level consultants.

- A DBA holder would not be entering at this level. They would target Senior Consultant, Manager, or Partner roles. Payscale data indicates that a Management Consulting Partner can earn an average base salary of around $200,000 to $400,000, with total compensation, including bonuses and profit sharing, often exceeding $500,000 to $1,000,000+ at top firms (like McKinsey, Bain, or BCG).

- Postsecondary Business Teachers (Academia): For those pursuing an academic career, salaries are typically more modest than in the C-suite but still substantial.

- The BLS reports the median annual wage for Postsecondary Business Teachers was $95,370 in May 2023.

- However, this average includes instructors at all levels and institution types. Data from the American Association of University Professors (AAUP) shows that a Full Professor at a private doctoral-granting university earned an average of $212,000 in the 2022-2023 academic year. A Business School Dean's salary can easily range from $250,000 to over $500,000 at a top-tier institution.

### Salary Progression by Career Stage (Post-DBA)

The value of a DBA compounds over time. While graduates already possess significant experience, the doctorate repositions them for an accelerated trajectory. The following table provides a general framework for post-DBA salary expectations, assuming a corporate or consulting career path.

| Career Stage (Post-DBA) | Years of Experience (Post-DBA) | Typical Roles | Estimated Total Compensation Range (Base + Bonus) |

| :--- | :--- | :--- | :--- |

| Early-Career Graduate | 1-4 years | Director, Senior Manager, Principal Consultant, Assistant/Associate Professor | $140,000 - $220,000 |

| Mid-Career Professional | 5-10 years | Vice President, Senior Director, Consulting Partner, Associate Professor/Program Director | $220,000 - $350,000 |

| Senior/Executive Leader | 10+ years | C-Suite (COO, CSO, CEO), Managing Partner, Full Professor, Dean | $350,000 - $750,000+ |

*Sources: Synthesized from BLS, Salary.com, Glassdoor, and Payscale data for the roles listed, contextualized for a DBA holder's qualifications.*

### Breaking Down the Compensation Package

For senior executives, base salary is only one part of the picture. A DBA holder's total compensation package is a sophisticated mix designed to reward performance and long-term value creation.

- Base Salary: This is the guaranteed annual income. For senior roles, it typically constitutes 40-60% of the total compensation.

- Annual Bonus / Short-Term Incentives (STI): This is a variable payment based on the performance of the individual and the company over the preceding year. It is often calculated as a percentage of the base salary and can range from 30% to over 100% for exceptional performance in C-suite roles.

- Long-Term Incentives (LTI): This is where the most significant wealth is often created. LTI plans are designed to align the executive's interests with those of the shareholders over a multi-year horizon.

- Stock Options: The right to buy company stock at a predetermined price in the future.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time, meaning the executive gains full ownership after meeting certain conditions (e.g., staying with the company for 3-4 years).

- Performance Shares: These are stock grants that only vest if specific, long-term company performance goals (e.g., revenue growth, share price appreciation) are met.

- Other Benefits & Perks: Executive-level roles filled by DBA graduates come with a host of other valuable benefits, including:

- Executive retirement plans (e.g., 401(k) with a higher-than-average company match, deferred compensation plans).

- Premium health, dental, and life insurance policies.

- Company car or car allowance.

- Professional development and coaching stipends.

- Potential for a severance package or "golden parachute" clause in their employment contract.

In summary, while the initial investment in a DBA is substantial, it positions graduates for roles where total compensation is not just a salary, but a comprehensive portfolio of short-term and long-term incentives that can lead to significant financial success.

---

Key Factors That Influence Your DBA Salary

A Doctorate of Business Administration opens the door to high-level opportunities, but the final salary figure on your contract will be influenced by a complex interplay of factors. Understanding these variables is crucial for anyone considering the degree, as it allows you to strategically position yourself for maximum earning potential. As a career analyst, I've seen firsthand how each of these levers can dramatically impact an executive's compensation package.

### 1. Level and Prestige of Education

While you will already have a DBA, nuances within your educational background still play a significant role.

- University Prestige and Accreditation: The single most important factor is the accreditation of the institution granting your DBA. AACSB (The Association to Advance Collegiate Schools of Business) is the global gold standard. A DBA from an AACSB-accredited, highly-ranked, and well-known university (e.g., University of Florida, Case Western Reserve, Georgia State University) carries more weight with executive recruiters and boards of directors than a degree from a lesser-known or unaccredited institution. The brand recognition and, more importantly, the powerful alumni network of a top-tier school can directly translate into higher starting offers and more frequent opportunities.

- DBA vs. Ph.D. in Business: While both are terminal degrees, their career paths and salary structures differ. A Ph.D. is traditionally geared toward a career in pure academic research and teaching at a research-intensive university. A DBA is designed for applied research and leadership in the industry. For a C-suite role, a DBA from a strong business school is often seen as more relevant than a highly theoretical Ph.D. However, for a tenured professorship at a top research university, the Ph.D. still holds a slight edge, which can be reflected in academic salary negotiations.

- Complementary Certifications: While the DBA is a terminal degree, possessing elite industry certifications can further enhance your value, especially in specialized C-suite roles. For a future Chief Financial Officer (CFO), having a CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst) designation alongside a DBA is a powerful combination. For a technology leadership role, certifications in cloud architecture (AWS, Azure) or cybersecurity (CISSP) can add a tangible layer of expertise. These certifications signal a deep, functional expertise that complements the broad strategic thinking developed in a DBA program.

### 2. Years and Quality of Experience

Experience is arguably the most significant determinant of a DBA holder's salary, both before and after the degree.

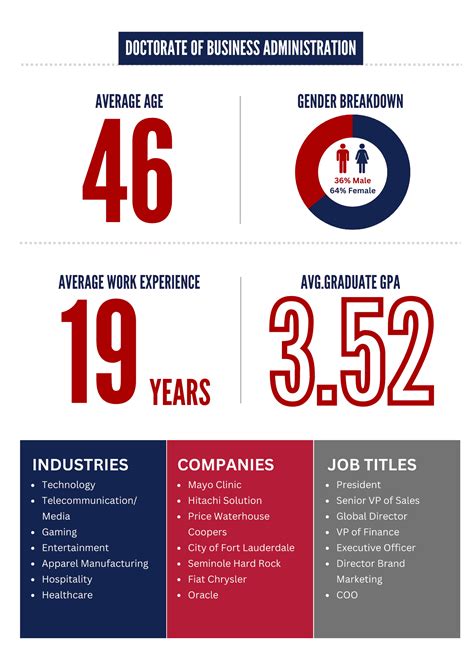

- Pre-DBA Experience (The Foundation): DBA programs are not for recent graduates. They are executive-level programs designed for seasoned professionals. Most competitive programs require at least 7-10 years of significant management experience. The salary you command post-DBA is built upon this foundation. An applicant who enters a DBA program as a Vice President with 15 years of experience at a Fortune 500 company will naturally be positioned for a higher-level (and higher-paying) role upon graduation than a manager with 6 years of experience at a smaller firm. Your industry, the scope of your previous roles (P&L responsibility, team size), and your track record of accomplishments are all priced into your post-DBA market value.

- Post-DBA Career Trajectory: The salary growth post-DBA is steep. The degree acts as an accelerant.

- 1-5 Years Post-DBA: In this phase, professionals move from senior management into executive roles (e.g., Director to Vice President). This is where the first major salary jump occurs, often a 30-50% increase in total compensation as they leverage their new credential to secure broader responsibilities.

- 5-15 Years Post-DBA: This is the prime earning period where DBA holders ascend into the C-suite (COO, CSO, CTO) or become partners in consulting firms. Salaries in this stage, as detailed earlier, regularly cross the $300,000-$500,000 threshold in total compensation, driven heavily by performance-based bonuses and long-term incentives.

- 15+ Years Post-DBA: At this stage, leaders are at the pinnacle of their careers—CEOs, board members, or managing partners. Compensation is highly individualized and can run into the millions, tied directly to the performance and scale of the enterprise they lead.

### 3. Geographic Location

Where you work has a massive impact on your paycheck, not just because of salary norms but also due to the concentration of corporate headquarters and high-value industries.

- High-Paying Metropolitan Hubs: Major economic centers offer the highest salaries due to a high concentration of large corporations, finance, and tech industries, as well as intense competition for top executive talent.

- San Francisco Bay Area (San Jose-San Francisco-Oakland, CA): The epicenter of the tech world offers some of the highest executive salaries nationally. According to BLS data, this metro area is consistently one of the top-paying for Top Executives. A COO here might command a salary 20-40% above the national average.

- New York-Newark-Jersey City, NY-NJ-PA: The heart of finance, media, and international business. C-suite salaries here are exceptionally high to attract and retain talent in a high-cost-of-living area.

- Boston-Cambridge-Nashua, MA-NH: A major hub for biotechnology, higher education, and management consulting.

- Los Angeles and Seattle: Major hubs for entertainment, aerospace, and tech (in Seattle's case) also offer premium executive compensation.

- State-by-State Variations: Salary potential varies significantly by state. Based on BLS data for Top Executives, states like New York, California, New Jersey, Massachusetts, and Connecticut consistently rank among the highest-paying. Conversely, states with fewer large corporate headquarters and a lower cost of living, particularly in the South and Midwest, will typically offer lower executive salary packages.

- The Cost of Living Caveat: It is crucial to analyze salary in the context of cost of living. A $350,000 salary in San Francisco may provide a similar or even lower quality of life than a $250,000 salary in a city like Dallas or Charlotte. Astute professionals analyze total compensation against local housing costs, taxes, and other expenses to determine true earning power.

### 4. Company Type, Size, and Industry

The context of the organization you lead is a powerful salary driver.

- Large Corporations (Fortune 500): These companies offer the most structured and often highest base salaries and total compensation packages. They have established executive compensation committees and benchmarks, providing lucrative, stable, and predictable pay structures with substantial LTI plans (RSUs, performance shares).

- Private Equity-Backed Companies & Tech Startups: The compensation structure here is different. Base salaries may be slightly lower than at a Fortune 500 company, but the potential upside through equity or stock options can be immense. A DBA holder joining a pre-IPO tech company as a COO could see their net worth skyrocket if the company has a successful public offering. This is a high-risk, high-reward environment.

- Management Consulting Firms (e.g., McKinsey, BCG, Bain, Big Four): These firms offer very high earning potential. A DBA graduate might enter as a Principal or Associate Partner. Total compensation is heavily performance-based, with significant bonuses tied to business development and project success. Reaching the Partner or Managing Director level can lead to compensation packages exceeding $1 million annually.

- Non-Profit and Government Sectors: While a DBA is highly valuable for leading large non-profits (e.g., major hospital systems, large foundations) or government agencies, the salaries are generally lower than in the for-profit sector. A CEO of a large national non-profit might earn in the $200,000 - $