Have you ever wondered how major corporations decide to merge, how lawyers quantify damages in a billion-dollar lawsuit, or how governments design policies to manage inflation? Behind these high-stakes decisions is often a team of sharp, analytical minds: economic consultants. This career path isn't just about understanding complex theories; it's about applying them to solve concrete, pressing problems for businesses, law firms, and public institutions. It's a field where intellectual rigor meets real-world impact, and the financial rewards reflect the immense value these professionals provide.

For those with a passion for economics and a drive to influence major outcomes, the role of an economic consultant offers a compelling trajectory. The compensation is a significant draw, with average salaries comfortably in the six-figure range and top earners reaching well over $300,000 annually. However, the path is demanding, requiring a potent combination of quantitative skill, analytical insight, and persuasive communication. I recall a project early in my career analyzing the competitive effects of a proposed merger in the telecommunications industry. Seeing our econometric models and rigorous analysis directly inform the debate and ultimately shape the final regulatory decision was a powerful demonstration of the profession's influence. It’s this ability to translate abstract data into actionable strategy that defines the role and commands its premium salary.

This comprehensive guide will serve as your roadmap to understanding every facet of an economic consultant's career, with a laser focus on compensation. We will dissect salary expectations, explore the factors that drive earnings higher, and lay out the precise steps you can take to enter and excel in this lucrative and intellectually stimulating field.

### Table of Contents

- [What Does an Economic Consultant Do?](#what-does-an-economic-consultant-do)

- [Average Economic Consultant Salary: A Deep Dive](#average-economic-consultant-salary-a-deep-dive)

- [Key Factors That Influence an Economic Consultant's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Economic Consultants](#job-outlook-and-career-growth)

- [How to Become an Economic Consultant: A Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career in Economic Consulting Right for You?](#conclusion)

What Does an Economic Consultant Do?

An economic consultant is fundamentally a specialized problem-solver who uses the principles of economics, econometrics, and data analysis to provide expert advice and analysis to clients. Unlike academic economists who primarily focus on theoretical research, or corporate economists who work for a single entity, consultants apply their expertise to a wide variety of client challenges across different industries and contexts.

Their work is project-based and highly analytical, blending quantitative rigor with strategic communication. They are hired to provide objective, data-driven answers to complex business and legal questions that clients cannot answer in-house. This can range from determining the market power of a company in an antitrust case to estimating the financial damages from a patent infringement.

Core Responsibilities and Daily Tasks:

The day-to-day work of an economic consultant is dynamic and varies significantly based on the project, specialization, and seniority level. However, some common threads run through the profession:

- Data Collection and Analysis: A significant portion of the job involves gathering, cleaning, and analyzing large datasets. This could be public data from government sources (like the Census Bureau or Bureau of Labor Statistics), proprietary client data (like sales records or pricing information), or data purchased from third-party vendors.

- Econometric Modeling: This is the heart of their quantitative work. Consultants build statistical models to test hypotheses, forecast future trends, and isolate causal relationships. For example, they might use a regression model to determine if a company's pricing strategy was predatory or to estimate lost profits due to a breach of contract.

- Research and Literature Review: Consultants must stay on the cutting edge of economic theory and empirical research. They frequently conduct deep dives into academic literature to find established methodologies and support their analytical approach.

- Report Writing and Presentation: The analysis is useless if it cannot be understood by the client, who is often a non-economist (e.g., a lawyer, a judge, or a CEO). Consultants spend considerable time writing detailed reports, creating compelling data visualizations, and preparing presentations that distill complex economic concepts into clear, persuasive arguments.

- Client and Team Collaboration: Economic consulting is a team sport. Junior analysts work closely with senior consultants, managers, and partners. They also interact directly with client teams, including lawyers, business executives, and government officials, to understand their needs, present findings, and answer questions.

### A "Day in the Life" of an Economic Consultant

To make this more concrete, let's imagine a day for "Dr. Elena Vance," a Senior Consultant at a specialized economic consulting firm, working on an antitrust litigation case.

- 9:00 AM - 9:45 AM: Elena joins a video call with her project team and the client's legal team. They discuss the opposing side's expert report that was just released. Elena provides her initial thoughts on its methodological weaknesses and outlines a plan for her team to draft a rebuttal.

- 9:45 AM - 12:00 PM: She dives into the data. Using the statistical software Stata, she works with a junior analyst to run new regressions to counter a specific claim made in the opposing report. They explore alternative model specifications and test the robustness of their own findings.

- 12:00 PM - 1:00 PM: Lunch, often eaten while reviewing industry news or an academic paper relevant to her case.

- 1:00 PM - 3:30 PM: Elena focuses on writing. She begins drafting a section of the rebuttal report, carefully explaining in plain language why the opposing expert's model is flawed. She integrates charts created by an analyst to visually demonstrate the discrepancy.

- 3:30 PM - 4:00 PM: Quick check-in with the junior analyst to review their progress on a separate data task and provide guidance.

- 4:00 PM - 5:30 PM: Elena shifts gears to a different project—a pro bono analysis for a non-profit on the economic impact of a proposed environmental regulation. She reviews the initial research memo prepared by her team.

- 5:30 PM onwards: She responds to emails, plans her tasks for the next day, and does a final review of the code her analyst wrote. Depending on project deadlines, work can often extend into the evening, especially in high-stakes litigation.

This example highlights the blend of deep analytical work, strategic communication, and project management that defines the role and justifies the high economic consultant salary.

Average Economic Consultant Salary: A Deep Dive

The compensation for economic consultants is among the most competitive in the professional services industry, reflecting the high level of education, specialized quantitative skills, and the high-stakes nature of their work. Salaries are composed of a strong base salary supplemented by significant performance-based bonuses.

It is important to differentiate between "Economists" as defined by the U.S. Bureau of Labor Statistics (BLS) and the role of an "Economic Consultant." The BLS category for Economists includes those in academia and government, which can have different pay scales. The May 2022 BLS data reported a median annual wage for economists of $113,940. However, economic consultants, particularly those in private-sector firms specializing in litigation and corporate strategy, typically earn substantially more.

For a more accurate picture of the consulting role, we turn to industry-specific salary aggregators.

- Payscale.com reports the average base salary for an Economic Consultant is approximately $103,500 per year, with a typical range falling between $71,000 and $164,000.

- Salary.com provides a more granular look, showing the median salary for an "Economics Consultant" to be around $124,677, with the top 10% of earners exceeding $160,000 in base pay alone.

- Glassdoor, which incorporates user-submitted data, shows an estimated total pay (including bonuses and other compensation) for an Economic Consultant in the United States at $135,800 per year, with a likely range between $105,000 and $176,000.

Synthesizing this data, a realistic expectation for a qualified economic consultant in the U.S. is a total compensation package well into the six figures, with significant upward mobility.

### Salary by Experience Level

Compensation in economic consulting grows rapidly with experience, responsibility, and the development of a professional reputation. The career ladder is steep, and promotions come with substantial pay increases.

| Experience Level | Typical Title(s) | Typical Years of Experience | Average Base Salary Range | Estimated Total Compensation Range (with Bonus) |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Analyst, Associate, Research Analyst | 0 - 3 years | $80,000 - $110,000 | $90,000 - $125,000+ |

| Mid-Career | Consultant, Senior Consultant, Senior Associate, Project Manager | 3 - 8 years | $115,000 - $170,000 | $140,000 - $220,000+ |

| Senior-Level | Manager, Principal, Vice President | 8 - 15+ years | $175,000 - $250,000+ | $250,000 - $500,000+ |

| Partner / Expert | Partner, Managing Director, Testifying Expert | 15+ years | $250,000 - $400,000+ | $500,000 - $1,000,000+ |

*(Note: These ranges are estimates based on data from Payscale, Glassdoor, and industry reports. Actual figures vary significantly by the factors discussed in the next section.)*

### Deconstructing the Compensation Package

The headline salary is only part of the story. An economic consultant's total compensation is a package of several components:

1. Base Salary: This is the fixed, predictable portion of your annual pay. It is highly dependent on your role, experience level, and educational background. For PhDs entering the field, the starting base salary can be significantly higher than for those with a Bachelor's or Master's degree.

2. Performance Bonus: This is the most significant variable component and a key driver of high earnings. Bonuses are typically awarded annually and are based on a combination of individual performance (billable hours, quality of work), team/project success, and overall firm profitability. In a good year, a bonus can be 20% to 50% (or more) of the base salary, especially at senior levels.

3. Signing Bonus: To attract top talent, especially candidates with advanced degrees or competing offers from other prestigious firms, companies often offer a one-time signing bonus. This can range from $5,000 for recent graduates to over $50,000 for experienced hires.

4. Profit Sharing & Retirement Contributions: Many firms offer profit-sharing plans where a portion of the firm's annual profits is distributed to employees. Additionally, competitive 401(k) plans with generous employer matching (e.g., matching 50-100% of contributions up to a certain percentage of salary) are standard.

5. Other Benefits: The benefits package is typically robust and includes top-tier health, dental, and vision insurance; generous paid time off; paid parental leave; and stipends for wellness, professional development, and graduate school tuition assistance. While not direct cash, these benefits add significant value to the overall compensation.

Understanding this complete picture is crucial. A role with a slightly lower base salary but a history of strong bonuses and excellent benefits can be more lucrative in the long run than a role with a higher base but little else.

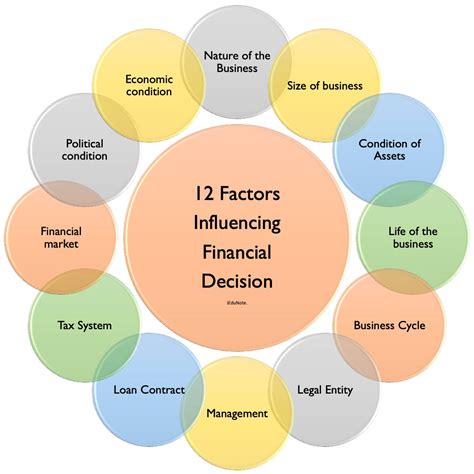

Key Factors That Influence an Economic Consultant's Salary

While the average salaries are impressive, actual earnings can vary dramatically. Several key factors determine where you will fall on the compensation spectrum. Mastering or optimizing these factors is the key to maximizing your earning potential throughout your career. This section provides an in-depth analysis of each driver.

###

1. Level of Education

In economic consulting, education is not just a prerequisite; it is a primary determinant of your starting salary, career trajectory, and ultimate earning ceiling. The field places a very high premium on academic credentials and advanced quantitative training.

- Bachelor's Degree: A Bachelor's degree in Economics, Statistics, Mathematics, or a related quantitative field is the minimum requirement for an entry-level Analyst or Research Associate position. Candidates from top-tier universities with high GPAs and strong quantitative coursework (e.g., econometrics, advanced calculus, linear algebra) are most competitive. While a solid entry point, career progression beyond the Senior Analyst level can sometimes be challenging without an advanced degree, and those with only a bachelor's will start at the lower end of the entry-level salary range (e.g., $80,000 - $95,000).

- Master's Degree: A Master's degree (e.g., M.S. in Applied Economics, M.A. in Economics, or an MBA with a quantitative focus) is often considered the "sweet spot" for a long-term consulting career. It signals a deeper level of theoretical understanding and applied quantitative skill. Candidates with a Master's degree often enter at a higher level (e.g., as a Consultant or Senior Associate), bypassing the initial one or two years of analyst work. Their starting base salaries are typically $15,000 to $30,000 higher than their Bachelor's-level counterparts. They are well-positioned for promotion to Manager and Principal roles.

- Ph.D. in Economics or a related field: The doctorate is the gold standard in economic consulting, particularly in litigation support, antitrust, and intellectual property practices. A Ph.D. qualifies an individual to serve as a "testifying expert," the person who provides sworn testimony in court. This role carries immense responsibility and commands the highest fees. Ph.D. economists enter firms at a very senior level (often as a "Consultant" or "Economist" with a clear path to Principal) and have the highest starting salaries, often exceeding $150,000 to $180,000+ in base pay. The ultimate earning potential for a Partner-level testifying expert can easily reach into the high six or even seven figures, as their personal reputation and credibility become a key asset for the firm.

###

2. Years of Experience

Experience is arguably the most powerful driver of salary growth after education. The profession has a well-defined, apprentice-style career ladder. At each step, consultants take on more responsibility, from pure analysis to project management, client relations, and ultimately, business development.

- Analyst/Associate (0-3 Years): At this stage, the focus is on execution. You are the engine room of the project team, responsible for data cleaning, running models under supervision, creating charts, and drafting initial report sections. Salary growth comes from annual merit increases and growing bonuses as you become more efficient and reliable. Expect total compensation to grow from ~$95,000 to ~$130,000 over this period.

- Consultant/Senior Consultant (3-8 Years): After a few years or upon entering with an advanced degree, you transition to a role with more autonomy. You begin to manage junior analysts, take the lead on specific workstreams within a project, and have more direct client contact. Your analytical contributions become more strategic. This is where salary growth accelerates significantly. Base salaries move into the $115,000 - $170,000 range, and with substantial bonuses, total compensation can push well past $200,000.

- Manager/Principal (8-15+ Years): At this level, your role shifts dramatically towards management and business development. You are responsible for managing multiple projects simultaneously, leading client relationships, and ensuring the quality and timeliness of all deliverables. You begin to develop a reputation in a specific area of expertise. Principals are also expected to start contributing to business development by co-authoring articles, speaking at conferences, and building relationships that lead to new client work. Base salaries are typically $175,000 - $250,000+, but the bonus component becomes a huge part of total compensation, which can range from $250,000 to $500,000 or more.

- Partner/Managing Director (15+ Years): This is the pinnacle of the career path. Partners are the leaders of the firm, responsible for setting strategy, winning major new clients, and serving as the lead testifying experts on the most critical cases. Their compensation is directly tied to the business they generate and the overall profitability of the firm. Total compensation is highly variable but can range from $500,000 to well over $1,000,000 annually.

###

3. Geographic Location

Where you work matters immensely. Salaries are adjusted for the cost of living and, more importantly, the concentration of major clients and top-tier firms. The major economic and legal hubs in the United States command a significant salary premium.

- Top-Tier Cities: These are the epicenters of finance, law, and technology. They have the highest concentration of elite consulting firms and high-stakes client work. Expect salaries here to be 15-25% higher than the national average.

- New York, NY: The financial capital. High concentration of finance, M&A, and securities litigation work.

- San Francisco / Bay Area, CA: The tech hub. Focus on intellectual property, antitrust cases involving tech giants, and valuation.

- Washington, D.C.: The policy and regulatory center. Heavy focus on government contracts, antitrust review by the DOJ/FTC, and international trade cases.

- Boston, MA & Chicago, IL: Major hubs with a mix of industries and a strong presence of top economic consulting firms.

- Mid-Tier Cities: Cities like Los Angeles, Houston, Dallas, and Atlanta have a strong and growing market for economic consultants. Salaries are still very competitive but may be slightly lower than in the top-tier cities, often offset by a lower cost of living.

- Other Regions: In areas with less demand for high-stakes consulting, salaries will be closer to the national average for general economist roles. However, the rise of remote work is beginning to slightly blur these lines, though a physical presence in key markets remains important for networking and client interaction.

###

4. Company Type & Size

The type of firm you work for is a crucial factor in your compensation and work-life experience.

- Elite Economic Consulting Boutiques (e.g., Analysis Group, Cornerstone Research, The Brattle Group, Compass Lexecon): These firms are the specialists. They focus almost exclusively on economic consulting, often for litigation and regulatory matters. They are known for their rigorous academic environment, large number of Ph.D. staff, and work on the most complex and high-profile cases. They pay at the very top of the market to compete for the best talent, with salaries and bonuses that are often the highest in the industry.

- The "Big Four" and other Large Professional Services Firms (Deloitte, PwC, EY, KPMG, FTI Consulting, etc.): These global giants have dedicated economic consulting and transfer pricing practices within their broader advisory services. The work is diverse, spanning litigation, valuation, M&A, and international tax. Compensation is highly competitive, though the bonus structure might be slightly more corporate and less variable than at the pure-play boutiques. These firms offer excellent training and global mobility opportunities.

- Generalist Management Consulting Firms (e.g., McKinsey, BCG, Bain): While not their primary focus, these top-tier strategy firms hire economists (especially Ph.D.s) for their strategic and quantitative expertise. They often work on strategy cases related to pricing, market entry, and competitive dynamics. Compensation here is famously high, often setting the bar for all professional services.

- In-House Corporate Roles: Large corporations, especially in tech (e.g., Amazon, Meta, Google) and finance, have their own internal teams of economists. These roles often focus on internal strategy, such as pricing algorithms, auction design, or forecasting. The salaries are excellent, and they often provide a better work-life balance than client-facing consulting. The bonus component may be smaller but is often supplemented by valuable stock options.

- Government & International Organizations (e.g., Federal Reserve, IMF, World Bank): These prestigious institutions hire economists to work on monetary policy, economic development, and global financial stability. The base salaries are typically lower than in the private sector. However, this is offset by exceptional job security, outstanding benefits, a strong sense of public service mission, and a more predictable work schedule.

###

5. Area of Specialization

Within economic consulting, some practice areas are more lucrative than others, driven by the value of the problems they solve.

- Antitrust & Competition: This is a classic and highly profitable area. Consultants analyze the competitive effects of mergers and acquisitions and assess claims of monopolization or collusion. The stakes are enormous, often involving billions of dollars, making this a premium-paying field.

- Litigation Support & Damages Calculation: This broad area involves calculating economic damages in legal disputes. This can include intellectual property (patent/trademark infringement), breach of contract cases, and securities litigation (e.g., 10b-5 fraud cases). The work is intellectually challenging and directly tied to high-value legal outcomes, leading to high fees and salaries.

- Finance & Securities: This specialization deals with valuation of complex financial instruments, risk management, and analysis in securities fraud cases. It requires a deep understanding of financial markets and quantitative finance, commanding very high salaries.

- Transfer Pricing: A highly sought-after specialization where economists help multinational corporations determine the appropriate "arm's length" price for goods and services transferred between their own international subsidiaries to comply with tax laws. This is a massive and consistently in-demand field.

- Labor & Employment: This area involves analyzing data for class-action lawsuits related to wage discrimination, wrongful termination, and pension issues.

- Energy, Environment & Network Industries: Consultants in these fields analyze markets for electricity, oil, and gas, and assess the economic impact of environmental regulations. This is a growing field driven by climate change and the energy transition.

###

6. In-Demand Skills

Beyond your degree and experience, a specific set of skills can directly increase your value and, therefore, your salary.

- Hard Skills:

- Econometrics & Statistical Programming: Mastery of statistical software is non-negotiable. Stata is the traditional workhorse in litigation consulting, but proficiency in R and Python is becoming increasingly critical for handling massive datasets and implementing more advanced machine learning techniques.

- Data Manipulation & Management: The ability to work with large, messy datasets using tools like SQL, Python (Pandas), or R (dplyr) is a fundamental and highly valued skill.

- Data Visualization: Communicating complex findings requires the ability to create clear and compelling charts and graphs. Expertise in tools like Tableau, ggplot2 (in R), or Matplotlib/Seaborn (in Python) is a major asset.

- Financial Modeling: For roles in finance or valuation, the ability to build sophisticated discounted cash flow (DCF) and other valuation models in Excel is essential.

- Soft Skills:

- **Communication (Written and Verbal):