In the high-stakes world of finance, few roles command as much prestige, intellectual challenge, and financial reward as the quantitative trader. For professionals and students with a mastery of mathematics, statistics, and computer science, this career path offers an unparalleled opportunity. But what does that opportunity look like in concrete numbers?

A career as a quantitative trader, or "quant," can lead to staggering earnings, with entry-level professionals often securing six-figure base salaries and experienced traders earning well into the seven figures through performance bonuses. This article will break down the quantitative trader salary, exploring the factors that shape your earning potential and the future outlook for this demanding yet lucrative profession.

What Does a Quantitative Trader Do?

Before we dive into the numbers, it's essential to understand the role. A quantitative trader is a unique hybrid of a financial trader, data scientist, and software engineer. Instead of relying on intuition or traditional market analysis, they design, build, and execute complex mathematical models and automated algorithms to identify and capitalize on trading opportunities.

Their key responsibilities include:

- Developing Trading Strategies: Researching and creating predictive models based on vast amounts of historical and real-time market data.

- Backtesting: Rigorously testing these strategies against historical data to ensure they are statistically sound and profitable.

- Programming and Implementation: Coding the strategies into high-speed, automated trading systems.

- Risk Management: Building sophisticated risk controls into their algorithms to protect against unforeseen market events.

In essence, a quant trader uses scientific and computational methods to make split-second trading decisions, often at a scale and speed impossible for a human to replicate.

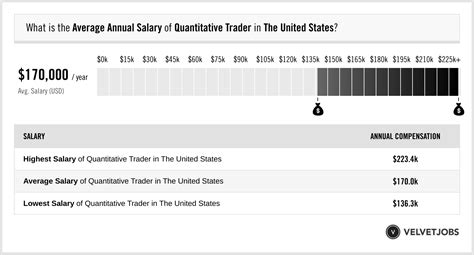

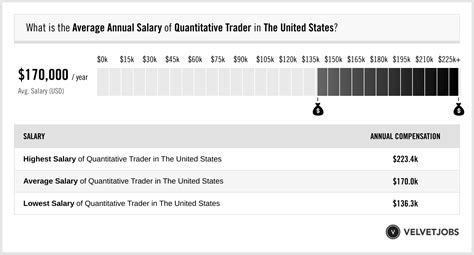

Average Quantitative Trader Salary

Analyzing the salary of a quantitative trader requires looking beyond a simple base salary. The most significant part of their income is the annual performance bonus, which is directly tied to the profitability of their trading strategies. Therefore, it's crucial to consider total compensation (base salary + bonus).

Because "Quantitative Trader" is a highly specialized role, the U.S. Bureau of Labor Statistics (BLS) does not track it as a distinct category. Instead, we turn to industry-specific salary aggregators and reports for a more accurate picture.

- Overall Average: According to Salary.com, the average base salary for a Quantitative Trader in the United States is approximately $158,550 as of May 2024, with a typical range falling between $140,000 and $178,000.

- Total Compensation: This base salary is only the beginning. Glassdoor reports a much wider range for total pay, which includes bonuses and profit sharing. Their data suggests an average total compensation of around $225,000 per year, with top earners at elite firms easily surpassing $500,000 to $1,000,000+.

Here is a typical breakdown based on experience level:

- Entry-Level (0-2 years): Total compensation typically ranges from $150,000 to $300,000, comprising a strong base salary and a first-year bonus.

- Mid-Career (3-7 years): As traders prove their strategies are profitable, their bonuses grow substantially. Total compensation often falls in the $300,000 to $700,000 range.

- Senior/Portfolio Manager (8+ years): Top-performing senior traders who manage significant capital can earn $700,000 to well over $2 million annually. At this level, the bonus can be many multiples of the base salary.

Key Factors That Influence Salary

Compensation for quantitative traders is not one-size-fits-all. Several key factors can dramatically influence your earnings.

### Level of Education

Education is the bedrock of a quant's career. While a bachelor's degree in a quantitative field (like Mathematics, Computer Science, Physics, or Statistics) is the minimum entry requirement, the most coveted and highest-paying roles are reserved for those with advanced degrees.

- Master's Degree: A Master of Financial Engineering (MFE), a Master's in a STEM field, is often the standard for entry into top firms. It signals a deeper level of specialized knowledge.

- Ph.D.: A doctorate in a highly quantitative discipline like theoretical physics, mathematics, or computer science is the gold standard. Ph.D. holders are sought for their advanced research skills, problem-solving abilities, and mathematical maturity, and they command the highest starting salaries.

### Years of Experience

Experience directly correlates with responsibility and, therefore, compensation. A trader's value is measured by their "PnL" (Profit and Loss)—the amount of money their strategies generate.

- Junior Quant/Analyst: In the early years, the focus is on research, model development, and supporting senior traders. The bonus is present but more modest.

- Mid-Level Trader: With a proven track record, a trader gains more autonomy and manages more complex strategies or a larger share of the firm's capital. This direct responsibility for PnL leads to a significant jump in bonus potential.

- Senior Trader/Portfolio Manager: These individuals are responsible for a significant portion of the firm's profitability. Their compensation is heavily skewed towards their performance bonus, which can be life-changing in a good year.

### Geographic Location

Finance is a geographically concentrated industry. Working in a major financial hub not only provides more opportunities but also comes with a significant salary premium to offset a higher cost of living.

- New York, NY: The undisputed center of the U.S. financial world, offering the highest number of opportunities and the highest salaries.

- Chicago, IL: A historic hub for commodities and derivatives trading, home to many leading proprietary trading firms.

- Other Hubs: Other key locations include Boston, Houston (for energy trading), and the San Francisco Bay Area, where finance and tech converge.

According to Payscale, salaries in New York City can be over 25% higher than the national average for similar financial roles.

### Company Type

The type of firm you work for is one of the most significant determinants of your pay structure and earning potential.

- Hedge Funds: These firms (e.g., Renaissance Technologies, Two Sigma) manage pools of capital for high-net-worth and institutional investors. Compensation is heavily performance-driven, and the upside for successful traders is immense.

- Proprietary Trading Firms (Prop Shops): These firms (e.g., Jane Street, Citadel Securities, Hudson River Trading) trade with their own capital. They are known for being technologically advanced and offering extremely competitive compensation packages to attract top-tier talent, even at the entry-level.

- Investment Banks (Sell-Side): Large banks (e.g., Goldman Sachs, JPMorgan Chase) have quantitative trading desks. While still highly lucrative, their compensation structures can sometimes be more bureaucratic and may have a lower ceiling compared to top hedge funds and prop shops.

### Area of Specialization

Within quant trading, different specializations require unique skill sets and can carry different compensation levels.

- High-Frequency Trading (HFT): Involves making thousands of trades per second. This requires exceptional C++ programming skills and an understanding of low-latency systems. Due to its potential profitability, HFT can be one of the most lucrative areas.

- Statistical Arbitrage: This mid-frequency strategy involves finding and exploiting statistical mispricings between related securities. It requires deep knowledge of statistics and econometrics.

- Options and Derivatives Market Making: This area requires a profound understanding of stochastic calculus and volatility modeling. Successful market makers are highly valued and compensated accordingly.

Job Outlook

While the BLS doesn't track quantitative traders directly, we can look at related professions for a directional trend. The BLS projects that employment for Financial and Investment Analysts will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations. The median pay for this broader category was $96,970 per year in 2023, though this figure doesn't capture the elite compensation of the quant niche.

The underlying trend is clear: as financial markets become more complex and automated, the demand for professionals who can fuse advanced quantitative analysis with technology will only increase. While competition for top roles is fierce, the outlook for skilled quants remains exceptionally strong.

Conclusion

A career as a quantitative trader represents the pinnacle of financial and intellectual achievement for many. The path is demanding, requiring an elite educational background and an unwavering commitment to excellence.

For those who succeed, the rewards are extraordinary. The journey begins with a strong base salary and quickly transitions to a model where your performance—your ability to generate profit—directly dictates your seven-figure earning potential. If you have a passion for markets, a gift for numbers, and a flair for technology, the world of quantitative trading offers a career that is as financially rewarding as it is intellectually stimulating.