Introduction

In the intricate world of financial services, behind every successful Financial Advisor (FA) is a powerhouse of organization, client service, and operational excellence. This pivotal role is the Branch Office Administrator (BOA), the very backbone of a thriving financial practice. If you are a meticulously organized, people-oriented professional seeking a stable, rewarding career in a respected industry, the path of an Edward Jones BOA might be your calling. But what does this career truly offer in terms of compensation and growth?

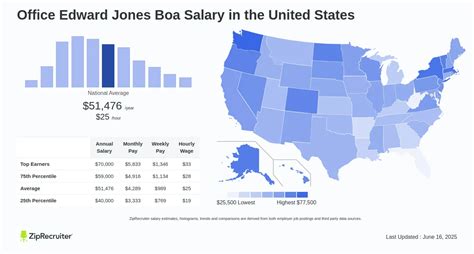

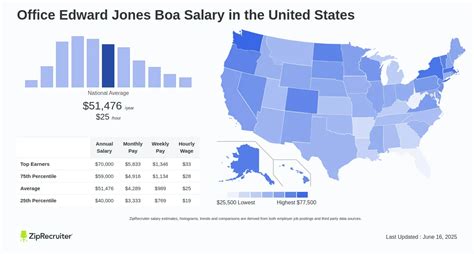

The question of an "edward jones boa salary" is more than just a number; it's a query about value, career trajectory, and financial security. While the national average salary for a BOA at Edward Jones typically ranges from $45,000 to $65,000+ per year with bonuses and other compensation, this figure is just the beginning of the story. The true earning potential is influenced by a rich tapestry of factors, from your geographic location and years of experience to the specific skills you bring to the table.

Early in my career consulting with small businesses, I worked alongside a wealth management firm. I witnessed firsthand how the branch's administrator was not merely a scheduler or a paper-pusher; she was the firm's director of first impressions, a master of complex logistics, and the trusted point of contact who calmed anxious clients during volatile markets. Her impact was undeniable, and it drove home the immense value of this essential role.

This comprehensive guide is designed to be your definitive resource for understanding every facet of an Edward Jones BOA career. We will delve deep into salary data, explore the critical factors that dictate your pay, analyze the long-term job outlook, and provide a clear, step-by-step roadmap for how to launch your own successful career.

### Table of Contents

- [What Does an Edward Jones BOA Do?](#what-does-an-edward-jones-boa-do)

- [Average Edward Jones BOA Salary: A Deep Dive](#average-edward-jones-boa-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for a BOA](#job-outlook-and-career-growth-for-a-boa)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a BOA Career Right for You?](#conclusion-is-a-boa-career-right-for-you)

---

What Does an Edward Jones BOA Do?

The title "Branch Office Administrator" might sound straightforward, but the reality of the role is dynamic, multi-faceted, and mission-critical to the success of an Edward Jones branch. A BOA is the operational hub, the primary client service specialist, and the Financial Advisor's indispensable partner. Their work ensures that the branch runs smoothly, clients feel valued and supported, and the business can grow effectively.

At its core, the BOA role is a unique blend of high-level administrative support, sophisticated client relationship management, and meticulous operational execution. They are not simply assistants; they are co-pilots in a two-person team dedicated to helping clients achieve their financial goals.

Core Responsibilities and Daily Tasks:

The duties of a BOA can be broken down into several key areas:

- Client Service and Relationship Management: This is arguably the most important aspect of the role. BOAs are often the first point of contact for clients, whether by phone, email, or in person. They handle client inquiries, schedule appointments, and provide information, all while maintaining a warm, professional, and empathetic demeanor. They build deep, long-term relationships built on trust and reliability.

- Administrative and Operational Support: BOAs manage the Financial Advisor's calendar, prepare materials for client meetings (including performance reports and proposals), and handle all incoming and outgoing correspondence. They are responsible for processing client transactions, opening new accounts, and managing transfers of assets—all with an extremely high degree of accuracy.

- Compliance and Documentation: The financial industry is heavily regulated. A key part of the BOA's job is to ensure all paperwork and client documentation are completed correctly, filed appropriately, and adhere to strict industry regulations set by bodies like FINRA and the SEC. This requires a keen eye for detail and a commitment to procedural integrity.

- Office Management: From ordering supplies and managing technology to coordinating with vendors and ensuring the office environment is professional and welcoming, the BOA keeps the physical branch running like a well-oiled machine.

- Marketing and Business Development Support: BOAs often assist FAs with marketing efforts. This can include planning and executing client appreciation events, managing social media content for the branch, preparing mailings, and tracking the results of business development campaigns.

### A Day in the Life of an Edward Jones BOA

To make this tangible, let's walk through a typical day:

- 8:30 AM: Arrive at the office. Start the day by reviewing the Financial Advisor's calendar, checking urgent emails, and looking over the daily market summary to be prepared for client questions. You print the necessary reports and prep folders for the day's scheduled client meetings.

- 9:15 AM: The phone rings. It's a long-time client who needs to schedule a review and has a question about a recent account statement. You answer their question with confidence and schedule their meeting, confirming the details via email.

- 10:00 AM: The first client meeting begins. You greet the clients warmly, offer them a beverage, and ensure they are comfortable before the FA joins them. During the meeting, you may be asked to join to take notes or process any necessary paperwork afterward.

- 11:00 AM: A client has decided to open a new IRA. You guide them through the paperwork, ensuring every field is filled out correctly and all compliance disclosures are signed. You then scan and submit the documents for processing, tracking them through the system to completion.

- 12:30 PM: Lunch break.

- 1:30 PM: Time for outbound calls. You contact several clients to confirm their appointments for the following week, using the opportunity to briefly check in and maintain the relationship.

- 2:30 PM: The FA asks you to help plan a small seminar for prospective clients. You research local venues, get quotes for catering, and begin drafting an invitation list from the branch's CRM system.

- 4:00 PM: You spend the last hour of the day on focused administrative work. This includes processing deposits, following up on asset transfers, updating client records in the CRM, and ensuring the office is tidy and prepared for the next day.

- 5:00 PM: Before leaving, you have a quick debrief with the FA to discuss the day's events and confirm priorities for tomorrow.

This "day in the life" illustrates that the BOA role is far from monotonous. It requires constant task-switching, exceptional people skills, and a profound sense of ownership over the branch's operational success.

---

Average Edward Jones BOA Salary: A Deep Dive

When considering a career path, compensation is a primary factor. Understanding the salary structure for an Edward Jones Branch Office Administrator involves looking beyond a single number and examining the complete compensation package, including base salary, bonuses, and benefits, across different stages of a career.

It's crucial to consult multiple authoritative sources to get a well-rounded picture. Financial firms like Edward Jones operate in a competitive landscape, and their compensation packages are designed to attract and retain top talent for this vital role.

National Averages and Typical Salary Ranges

Based on recent data from several reputable salary aggregators, the compensation for an Edward Jones BOA is both competitive and structured for growth.

- Payscale.com: Reports the average base salary for an Edward Jones Branch Office Administrator is approximately $50,117 per year. The typical range falls between $37,000 and $65,000 for base salary alone. When including potential bonuses, the total pay can extend from $38,000 to $71,000.

- Glassdoor.com: Provides a similar picture, with an estimated total pay for a BOA at Edward Jones averaging $57,639 per year. This includes an estimated base pay of around $49,150 and additional pay (bonuses, profit sharing) of approximately $8,489 per year. The likely range for total pay spans from $46,000 to $73,000.

- Salary.com: While not listing the specific "BOA" title, it provides data for the comparable role of "Administrative Assistant III" in the financial services sector, showing a median salary of $57,476, with a range typically between $51,460 and $64,547. This aligns closely with the data specific to Edward Jones, reinforcing the salary band.

For broader context, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for all "Secretaries and Administrative Assistants, Except Legal, Medical, and Executive" was $45,590 in May 2023. The fact that Edward Jones BOA salaries consistently trend higher than this national median highlights the specialized nature and increased responsibility of the role within the financial services industry.

### Salary Brackets by Experience Level

Salary progression is a key indicator of career viability. A BOA's earnings are not static; they are designed to increase significantly with experience, skill development, and proven performance.

Here is a typical salary progression you might expect as an Edward Jones BOA. Note that these are estimates combining base pay and average bonuses.

| Experience Level | Typical Title(s) | Typical Total Compensation Range | Key Attributes |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Branch Office Administrator | $42,000 - $55,000 | Learning the core functions, focusing on accuracy, building initial client relationships, mastering internal systems. |

| Mid-Career (3-8 Years) | Branch Office Administrator, Senior BOA | $55,000 - $68,000 | Fully proficient in all branch operations, independently managing complex client issues, actively assisting in marketing efforts, potentially training new BOAs. |

| Senior/Lead (9+ Years) | Senior BOA, Complex Leader BOA | $68,000 - $80,000+ | A recognized expert within the region, handling the most complex administrative and client challenges, taking a leadership role in regional initiatives, mentoring other BOAs, and contributing significantly to branch growth. |

*Sources: Data synthesized from Payscale, Glassdoor, and industry knowledge of compensation structures.*

### A Closer Look at the Full Compensation Package

The salary figures above are only part of the equation. Edward Jones, as a partnership, is well-known for offering a comprehensive compensation and benefits package that significantly enhances the overall value proposition for its employees.

- Base Salary: This is your guaranteed, regular pay and forms the foundation of your compensation. It is determined by factors we'll explore in the next section, such as location and experience.

- Bonus Potential: This is a critical component of a BOA's earnings. Bonuses are typically tied to a combination of factors:

- Firm Performance: Edward Jones often shares its success with its associates.

- Branch Performance: The growth and success of the specific branch you support directly impact your bonus. This creates a powerful sense of teamwork and shared goals with your Financial Advisor.

- Individual Performance: Your personal contributions, skills, and client service excellence are also recognized.

- Profit Sharing & Retirement Plans: Edward Jones has historically offered a robust profit-sharing program, contributing a percentage of the firm's profits into employees' retirement accounts. This is in addition to a 401(k) plan with a company match, creating a powerful long-term wealth-building tool.

- Health and Wellness Benefits: This includes comprehensive medical, dental, and vision insurance for employees and their families, often with competitive premiums.

- Paid Time Off (PTO): A generous PTO policy, including vacation days, sick leave, and paid holidays, is standard.

- Tuition Reimbursement & Professional Development: Edward Jones encourages continuous learning. They often provide tuition assistance for relevant college courses and support for obtaining industry certifications, which can further boost your career and earning potential.

When evaluating an "edward jones boa salary," you must consider this entire package. The combination of a competitive base salary, significant bonus potential, and top-tier benefits makes the total compensation highly attractive.

---

Key Factors That Influence Your Salary

While we've established a baseline salary range, your specific compensation as an Edward Jones BOA can vary significantly. Understanding the levers that control your pay is essential for maximizing your earning potential throughout your career. These factors are what turn a standard salary into an exceptional one.

###

Level of Education

While a four-year college degree is not always a strict requirement to be hired as a BOA, your educational background plays a definite role in your starting salary and long-term trajectory.

- High School Diploma or GED: This is the minimum educational requirement. Candidates with only a high school diploma will likely start at the lower end of the salary band. They will need to rely heavily on demonstrating relevant work experience in customer service or administrative roles to be competitive.

- Associate's Degree: An A.S. degree, particularly in Business Administration, Accounting, or Office Management, is a significant advantage. It signals a foundational understanding of professional environments and specific skills, often justifying a starting salary that is several thousand dollars higher than that of a candidate with only a high school diploma.

- Bachelor's Degree: This is the gold standard for maximizing your starting potential. A Bachelor of Science (B.S.) or Bachelor of Arts (B.A.) in fields like Finance, Business Administration, Communications, or Economics is highly desirable. It tells the firm that you possess critical thinking, analytical, and communication skills. A candidate with a relevant B.S. can often command a salary at the midpoint or higher of the entry-level range.

- Professional Certifications: Beyond formal degrees, certifications can provide a substantial salary bump. For a BOA, pursuing a certification like the Financial Paraplanner Qualified Professional (FPQP®) from the College for Financial Planning shows a deep commitment to the industry. While not required for the BOA role itself, it signals ambition and expertise that can be leveraged for higher pay or promotion to roles like a paraplanner. Even obtaining the Securities Industry Essentials (SIE) exam on your own shows initiative and a grasp of fundamental market concepts.

###

Years of Experience

Experience is arguably the single most powerful determinant of a BOA's salary. Edward Jones, like most firms, rewards proven performance, loyalty, and the deep institutional and client knowledge that only comes with time.

- 0-2 Years (The Foundation Phase): In this stage, your salary reflects that you are in a learning period. Your primary value is your potential, work ethic, and ability to master the core functions of the role. Salary growth is typically modest, with smaller annual increases as you prove your competence. *Expected Total Compensation: $42,000 - $55,000.*

- 3-8 Years (The Proficiency Phase): This is where significant salary growth occurs. By this point, you are no longer just executing tasks; you are anticipating needs, independently solving complex problems, and becoming a true partner to your FA. You have built strong client relationships and are a trusted resource. Your performance bonuses become more substantial as your contribution to the branch's success is clear and measurable. You may earn the title of "Senior BOA" during this period. *Expected Total Compensation: $55,000 - $68,000.*

- 9+ Years (The Mastery Phase): Senior BOAs with a decade or more of experience are invaluable assets. They possess a deep understanding of compliance, complex client situations, and firm-wide procedures. They often serve as mentors to newer BOAs and may take on leadership responsibilities within their region. Their compensation reflects this high level of expertise and leadership, often pushing into the upper end of the salary band and beyond, with consistent, strong performance bonuses. *Expected Total Compensation: $68,000 - $80,000+.*

###

Geographic Location

Where you work has a dramatic impact on your salary. Companies like Edward Jones adjust their pay scales based on the local cost of living and the competitiveness of the regional job market. A BOA salary in a major metropolitan hub will be significantly higher than in a rural area to account for higher housing, transportation, and daily living expenses.

Salary Variation by Location Examples:

| Location Tier | Example Cities | Estimated Average Base Salary | Why the Difference? |

| :--- | :--- | :--- | :--- |

| Tier 1 (High Cost of Living) | New York, NY; San Francisco, CA; Boston, MA; San Jose, CA | $58,000 - $75,000+ | Extremely high cost of living requires a significant salary premium to attract talent. Fierce competition for skilled administrative professionals. |

| Tier 2 (Medium-High Cost of Living) | Chicago, IL; Denver, CO; Dallas, TX; Atlanta, GA; Seattle, WA | $50,000 - $65,000 | Above-average cost of living and strong, competitive job markets for financial services roles. |

| Tier 3 (Average Cost of Living) | St. Louis, MO (Edward Jones HQ); Phoenix, AZ; Kansas City, MO; Columbus, OH | $45,000 - $58,000 | Salaries are aligned with national averages and provide a comfortable living standard for the region. |

| Tier 4 (Low Cost of Living) | Smaller towns in the Midwest or South; Rural Areas | $40,000 - $52,000 | Lower cost of living means a lower nominal salary can still provide strong purchasing power. Less competition for roles. |

*Note: These are estimates. Use online salary calculators and adjust for location to get a precise local estimate.*

###

Company Type & Size

While our focus is on Edward Jones, it's valuable to understand how its compensation structure fits within the broader industry.

- Large, Established Firms (e.g., Edward Jones, Morgan Stanley, Merrill Lynch): These firms typically offer highly structured compensation. This means well-defined salary bands, consistent annual review processes, and excellent, comprehensive benefits packages (health, retirement, profit sharing). The bonus structure is often formulaic and tied to firm-wide and branch-level metrics. The stability and benefits are a primary draw.

- Small, Independent Registered Investment Advisor (RIA) Firms: A Branch Administrator at a small RIA might have a slightly lower base salary but could have more variable and potentially higher bonus potential if the firm has a great year. Benefits might be less comprehensive than at a corporate giant. The role may also be broader, with more direct involvement in all aspects of the business.

- Banks with Wealth Management Arms (e.g., Bank of America, JPMorgan Chase): Compensation is often similar to large brokerage firms, but the culture can be more traditionally "bank-like." There may be more cross-selling opportunities and integration with other banking services.

Edward Jones's partnership model is unique and often cited by employees as a key benefit, fostering a sense of ownership and shared success that directly translates into compensation through bonuses and profit sharing.

###

Area of Specialization

Within the BOA role itself, specialization can occur, leading to higher pay. This is less about a formal title and more about the nature of the practice you support.

- Supporting a High-Net-Worth (HNW) Practice: An FA who deals exclusively with clients with millions in assets requires a BOA with an exceptional level of sophistication, discretion, and knowledge of complex financial instruments and estate planning logistics. This elevated skill set commands a higher salary.

- Supporting a Niche Practice: An FA might specialize in retirement planning for doctors, managing stock options for tech executives, or 401(k) plans for small businesses. A BOA who develops expertise in that specific niche becomes more valuable and can earn more.

- The "Technology Specialist" BOA: In an increasingly digital world, a BOA who masters the firm's full tech stack—becoming a power user of the CRM, financial planning software, and digital marketing tools—is a massive asset. This technical proficiency can be leveraged for higher compensation.

###

In-Demand Skills

Ultimately, your skills are your currency. Cultivating a specific set of high-value skills will not only make you better at your job but also give you direct leverage in salary discussions.

High-Impact Hard Skills:

- Advanced Microsoft Office Suite Proficiency: This isn't just about typing a Word document. It means mastering Excel for data tracking (pivot tables, VLOOKUPs), creating polished PowerPoint presentations for seminars, and using Outlook for expert-level calendar and contact management.

- CRM Software Mastery: Expertise in Customer Relationship Management (CRM) software like Salesforce (which Edward Jones uses) is non-negotiable. The ability to manage client data, track interactions, and run reports efficiently is a core competency.

- Financial Software Acumen: Familiarity with financial planning software (like MoneyGuidePro or eMoney) or investment reporting tools gives you a significant edge and allows you to provide deeper support to your FA.

- Understanding of Compliance (FINRA/SEC): You don't need to be a compliance officer, but having a working knowledge of the key rules regarding client communication, advertising, and documentation makes you far more effective and reduces risk for the branch.

Essential Soft Skills:

- Exceptional Communication: This includes professional phone etiquette, clear and concise email writing, and the ability to explain complex administrative processes to clients in a simple, understandable way.

- Unwavering Discretion and Confidentiality: You will be privy to sensitive personal and financial information. Demonstrating absolute trustworthiness is paramount.

- Proactive Problem-Solving: The best BOAs don't wait to be told what to do. They see a potential scheduling conflict and resolve it. They notice a client's birthday coming up and suggest sending a card. They anticipate the FA's needs before they are even articulated.

- Empathy and Client-Centricity: The ability to connect with clients on a human level, show genuine care, and remain calm and reassuring during stressful market conditions is a skill that cannot be automated and is highly prized.

By developing a strong profile across these factors, you can actively steer your Edward Jones BOA salary from the starting range toward the highest echelons of potential for the role.

---

Job Outlook and Career Growth for a BOA

Choosing a career is an investment in