Are you a strategic thinker with a knack for numbers? Do you believe that fair and competitive pay is the cornerstone of a great company? If you’re looking for a career that combines analytical rigor with a profound human impact, you may have found your calling. Welcome to the world of Compensation and Benefits Management—the profession dedicated to designing the systems that attract, retain, and motivate top talent. This isn't just about crunching numbers; it's about building the very framework of a company's culture and success.

Professionals in this field are the architects of a company's reward strategy, wielding data and deep legal knowledge to ensure every employee, from an entry-level associate to the C-suite, is compensated fairly and legally. As experts in the complex web of employment rules for salaried employees, they are indispensable guardians of both compliance and morale. The rewards for this expertise are significant, with the U.S. Bureau of Labor Statistics reporting a median annual wage of $136,380 for Compensation and Benefits Managers in May 2023. This is a career where your analytical skills translate directly into high earning potential and strategic influence.

I once worked with a company struggling with high turnover in its engineering department. Morale was low, and they were losing talent to competitors. They brought in a seasoned Compensation Director who, after weeks of meticulous market analysis and internal reviews, discovered their salary bands were 15% below market rate and their bonus structure was misaligned with project goals. By restructuring their entire compensation philosophy, they not only stemmed the tide of departures but also became known as an employer of choice. Witnessing that transformation firsthand solidified my belief in the power of this role—it’s the silent engine that drives organizational excellence.

This guide will provide you with a comprehensive roadmap to this rewarding career. We will delve into the day-to-day responsibilities, unpack salary expectations in detail, explore the critical factors that influence your pay, and lay out a clear path for you to get started.

### Table of Contents

- [What Does a Compensation and Benefits Manager Do?](#what-does-a-compensation-and-benefits-manager-do)

- [Average Compensation and Benefits Manager Salary: A Deep Dive](#average-compensation-and-benefits-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is This the Right Career for You?](#conclusion-is-this-the-right-career-for-you)

---

What Does a Compensation and Benefits Manager Do?

At its core, a Compensation and Benefits (C&B) Manager is a strategic partner to the business who designs, implements, and manages the total rewards strategy for an organization. This "total rewards" package includes everything the company provides to its employees in exchange for their time and effort: salary, bonuses, benefits (health, retirement, etc.), and other non-monetary perks. They are the masters of quantitative analysis and qualitative human psychology, balancing market competitiveness, internal equity, and legal compliance.

Their role is multifaceted, blending the skills of a data scientist, a lawyer, a financial planner, and a human resources strategist. They are the go-to experts for one of the most critical and sensitive areas of business: how people get paid.

Core Responsibilities and Daily Tasks:

The work of a C&B professional can be broken down into several key domains:

- Compensation Strategy and Design: This is the most strategic part of the job. C&B managers develop the company's overall "compensation philosophy." Do we want to lead the market, match it, or lag it? They design salary structures, job grades, and pay bands. This involves job evaluation—a systematic process of determining the relative worth of jobs within the organization to ensure internal equity.

- Market Analysis and Benchmarking: They are constantly gathering and analyzing data from salary surveys (from providers like Radford, Mercer, or Willis Towers Watson) to ensure their company's pay is competitive within its industry and geographic location. They don't just look at base salary; they benchmark variable pay, long-term incentives, and the total value of the benefits package.

- Benefits Administration and Management: This involves selecting and managing the company’s benefits programs, including health, dental, and vision insurance; life and disability insurance; retirement plans (like 401(k)s); paid time off; and other perks like wellness programs or tuition reimbursement. They negotiate with vendors and insurance brokers to get the best plans at the best cost.

- Compliance and Governance: This is a crucial function. C&B managers must have an expert-level understanding of labor laws and regulations. Their world is governed by acronyms:

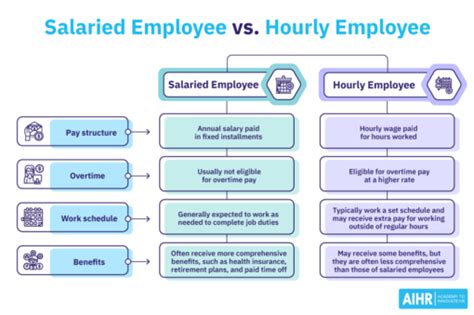

- FLSA (Fair Labor Standards Act): This is paramount. They determine which employees are "exempt" (salaried, not eligible for overtime) and "non-exempt" (hourly, eligible for overtime). Misclassifying employees can lead to massive lawsuits and government fines. Mastering the employment rules for salaried employees under the FLSA is a non-negotiable part of the job.

- Equal Pay Act (EPA) & Title VII of the Civil Rights Act: They conduct regular pay equity audits to ensure there are no discriminatory pay gaps based on gender, race, or other protected characteristics.

- ERISA (Employee Retirement Income Security Act): Governs retirement and health plans.

- COBRA, HIPAA, ACA: Regulate health insurance continuation and privacy.

- Executive and Sales Compensation: In many organizations, C&B managers also design specialized and highly complex pay plans for top executives (including stock options and long-term incentives) and sales teams (commission structures and accelerators).

### A Day in the Life of a Compensation Manager

To make this more concrete, let's imagine a typical Tuesday for "Alex," a Compensation Manager at a mid-sized tech company.

- 9:00 AM - 9:30 AM: Alex starts the day reviewing a new set of salary survey data that just came in. Alex flags that the market rate for Senior Software Engineers in their city has jumped 7% in the last six months.

- 9:30 AM - 11:00 AM: Alex joins a meeting with the VP of Engineering and an HR Business Partner. They are creating a new "Staff Machine Learning Engineer" role. Alex leads the job evaluation process, asking targeted questions to understand the role's scope, impact, and required skills to slot it into the company's job architecture and assign a preliminary salary range.

- 11:00 AM - 12:30 PM: Time for some deep analytical work. Alex opens a complex Excel spreadsheet to run a pay equity analysis for the marketing department ahead of the quarterly talent review. Alex uses regression analysis to identify any pay disparities that can't be explained by legitimate factors like experience, performance, or location.

- 12:30 PM - 1:15 PM: Lunch.

- 1:15 PM - 2:30 PM: A recruiter pings Alex for guidance. They have a top candidate for a Product Manager role, but the candidate's salary expectations are above the top of the approved range. Alex quickly analyzes the candidate's experience against internal peers and market data and advises the recruiter on a potential counteroffer that includes a one-time signing bonus to bridge the gap without breaking the salary structure.

- 2:30 PM - 4:00 PM: Alex works on a presentation for the C-suite. The goal is to propose a 4% budget for merit increases for the upcoming year, using the market data and internal performance metrics to justify the recommendation. The presentation includes charts visualizing market trends and the company's current position.

- 4:00 PM - 5:00 PM: Alex fields emails from employees and managers with questions about the 401(k) plan, bonus calculations, and the criteria for promotions. Alex provides clear, concise, and empathetic answers, demonstrating the human side of this data-driven role.

This "day in the life" illustrates the constant toggle between high-level strategy, deep data analysis, and direct human interaction that defines the C&B profession.

---

Average Compensation and Benefits Manager Salary: A Deep Dive

The role of a Compensation and Benefits Manager is not only strategically critical but also financially rewarding. The expertise required to navigate complex market data and legal frameworks commands a premium salary. Let's break down the compensation landscape for this profession, drawing on data from authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for Compensation and Benefits Managers was $136,380 as of May 2023. This figure represents the midpoint—half of the professionals in the field earned more, and half earned less.

However, a single median number doesn't tell the whole story. The salary range is vast, influenced by experience, location, industry, and the scope of the role. The BLS provides a broader perspective on this range:

- Lowest 10 percent: Earned less than $80,470

- Highest 10 percent: Earned more than $225,970

This indicates a significant potential for income growth as you advance in your career. Reputable salary aggregators provide further granularity, which is essential for understanding your potential earnings at different career stages.

### Salary by Experience Level

Your earnings will grow substantially as you move from an entry-level analyst position to a senior leadership role. Here’s a typical progression, with salary data compiled and averaged from sources like Salary.com, Payscale, and Glassdoor as of late 2023/early 2024.

| Career Stage | Common Titles | Typical Experience | Average Base Salary Range | Key Responsibilities |

| ------------------------- | ------------------------------------------- | ------------------ | ------------------------------ | -------------------------------------------------------------------------------------------------------------------- |

| Entry-Level | Compensation Analyst, Benefits Analyst, HR Analyst | 0-3 years | $65,000 - $90,000 | Gathers survey data, runs reports, administers benefits enrollment, answers basic employee questions, audits data. |

| Mid-Career | Senior Analyst, Compensation Manager, Benefits Manager | 3-8 years | $95,000 - $150,000 | Manages salary structures, leads annual review cycles, benchmarks jobs, negotiates with vendors, ensures FLSA compliance. |

| Senior/Leadership | Senior Manager, Director of Compensation, VP of Total Rewards | 8+ years | $150,000 - $250,000+ | Sets overall rewards strategy, manages the C&B team, presents to the board, designs executive compensation plans. |

*Note: These ranges are national averages and can vary significantly based on the factors discussed in the next section.*

Salary.com provides a very detailed breakdown that aligns with this progression. For instance, it lists the median salary for a "Compensation Manager" at $144,357, while a "Top Compensation and Benefits Executive" can expect a median of $252,198. This demonstrates the clear and lucrative path for advancement.

### Beyond the Base Salary: Understanding Total Compensation

Base salary is just one piece of the puzzle. A C&B professional's total compensation package often includes significant variable pay components.

- Annual Bonus / Short-Term Incentives (STI): This is the most common form of variable pay. It's typically based on a combination of company performance (e.g., revenue or profit targets) and individual performance.

- Manager Level: Bonuses often range from 10% to 20% of base salary.

- Director Level: Bonuses can range from 20% to 40% or more.

- VP/Executive Level: Bonuses can be 50% to 100%+ of base salary.

- Long-Term Incentives (LTI): Particularly common in publicly traded companies or high-growth startups, LTI aligns senior leaders with the long-term success of the company. These can include:

- Stock Options: The right to buy company stock at a predetermined price.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time.

- Performance Shares: Shares awarded only if specific long-term company performance goals are met.

LTI can add tens or even hundreds of thousands of dollars to annual compensation for senior-level professionals.

- Profit Sharing: Some companies, particularly in finance or professional services, distribute a portion of their annual profits to employees.

- Comprehensive Benefits: As the experts in this area, C&B professionals often work for companies that pride themselves on offering top-tier benefits. This includes:

- High-quality, low-cost health, dental, and vision insurance.

- Generous 401(k) matching contributions (e.g., a 100% match on the first 6% of employee contributions).

- Ample paid time off (PTO), parental leave, and flexible work arrangements.

- Other valuable perks like tuition reimbursement, wellness stipends, and commuter benefits.

When evaluating a job offer in this field, it's crucial to look at the "total rewards statement," which outlines the full value of the compensation package. A role with a $130,000 base salary, a 15% bonus target ($19,500), and a $15,000 annual 401(k) match has a total cash and retirement compensation of $164,500—significantly higher than the base salary alone suggests.

---

Key Factors That Influence Salary

While the national averages provide a strong baseline, your actual earning potential as a Compensation and Benefits professional will be determined by a combination of personal and external factors. This is the most critical section for understanding how to maximize your income over the course of your career. Mastering these levers can be the difference between a good salary and an exceptional one.

###

1. Level of Education and Professional Certifications

Your educational foundation sets the stage for your career trajectory. While a bachelor's degree is the standard entry point, advanced degrees and specialized certifications act as powerful salary accelerators.

- Bachelor's Degree: A bachelor's degree in Human Resources, Business Administration, Finance, Economics, or a related field is typically the minimum requirement. Majors that emphasize quantitative skills are highly prized.

- Master's Degree (MBA, MHR): A Master of Business Administration (MBA) or a specialized Master's in Human Resources (MHR) or Industrial and Labor Relations can significantly boost earning potential, particularly for leadership roles. An MBA, especially from a top-tier school, signals advanced business acumen and strategic thinking, often placing graduates on a faster track to Director or VP positions. Payscale data consistently shows that individuals with an MBA earn a substantial premium over those with only a bachelor's degree.

- Professional Certifications: In the world of C&B, certifications are not just resume-boosters; they are a mark of true expertise and are often required for mid-to-senior level roles. The most respected certifications are administered by WorldatWork, the leading professional association for total rewards.

- Certified Compensation Professional (CCP®): This is the gold standard for compensation professionals. Achieving it requires passing a series of rigorous exams covering topics like base pay administration, variable pay, market pricing, and quantitative analysis. Holding a CCP can add 5% to 15% to your base salary, as it signals a proven, standardized level of expertise.

- Certified Benefits Professional (CBP®): This is the parallel certification for the benefits side of the house, covering health and welfare plans, retirement plans, and benefits strategy.

- Global Remuneration Professional (GRP®): For those specializing in international compensation, this certification is essential.

- Certified Executive Compensation Professional (CECP®): A highly specialized and lucrative certification for those who design pay packages for top executives.

Other valuable certifications include the SHRM-CP or SHRM-SCP from the Society for Human Resource Management, which provide a broader HR context.

###

2. Years and Quality of Experience

Experience is arguably the single most significant driver of salary growth in this field. The profession has a clear and steep learning curve, and compensation reflects the accumulation of practical wisdom and proven results.

- 0-3 Years (Analyst Level): At this stage, you are learning the fundamentals. Your value lies in your analytical skills, attention to detail, and ability to execute tasks like running reports, participating in salary surveys, and auditing data. Salary: $65,000 - $90,000.

- 3-8 Years (Manager/Senior Analyst Level): You have moved beyond execution to design and management. You are now leading projects like the annual compensation review cycle, designing new salary structures, selecting benefits vendors, and advising managers on complex pay decisions. You have deep expertise in FLSA and other regulations. This is where salaries see a significant jump. Salary: $95,000 - $150,000.

- 8-15+ Years (Director/Senior Manager Level): You are now a strategic leader. Your focus shifts from managing processes to setting strategy. You manage a team of analysts and managers, present to the executive leadership team and the board's compensation committee, and are responsible for the entire total rewards philosophy of the organization. Your experience in designing executive compensation plans or leading M&A due diligence for benefits integration becomes highly valuable. Salary: $150,000 - $220,000+.

- 15+ Years (VP/Head of Total Rewards): At the pinnacle of the profession, you are a key officer of the company, reporting to the CHRO or CFO. You are responsible for a multi-million dollar budget and your decisions have a direct impact on the company's financial performance and ability to compete for talent globally. Base salaries at this level regularly exceed $250,000, with total compensation often reaching well into the high six figures when LTI is included.

###

3. Geographic Location

Where you work matters—a lot. Salaries for C&B roles vary dramatically based on the cost of labor and cost of living in different metropolitan areas. High-cost hubs with a concentration of large corporate headquarters and high-paying industries (like tech and finance) offer the highest salaries.

Top-Paying Metropolitan Areas (Data from BLS and Salary.com):

| Metro Area | Why It's High-Paying | Typical Salary Premium (vs. National Average) |

| ----------------------------- | -------------------------------------------------- | --------------------------------------------- |

| San Jose-Sunnyvale-Santa Clara, CA | Epicenter of the global tech industry (Silicon Valley). | 25% - 40% higher |

| New York-Newark-Jersey City, NY-NJ-PA | Hub for finance, law, media, and corporate HQs. | 20% - 35% higher |

| San Francisco-Oakland-Hayward, CA | Second major tech hub with high cost of living. | 20% - 35% higher |

| Boston-Cambridge-Nashua, MA-NH | Strong in biotech, finance, and higher education. | 10% - 25% higher |

| Washington D.C.-Arlington-Alexandria, VA-MD | Major government contractors and associations. | 10% - 20% higher |

Lower-Paying Regions:

Conversely, salaries tend to be closer to or below the national average in smaller metropolitan areas and regions with a lower cost of living, particularly in the Southeast and Midwest (outside of major hubs like Chicago). However, the purchasing power in these areas can sometimes make a lower salary feel more substantial.

The rise of remote work has introduced a new dynamic. Some companies have adopted location-based pay, adjusting salaries down if an employee moves to a lower-cost area. Others have moved to a single national pay scale, creating huge opportunities for professionals in lower-cost cities to earn a top-tier salary. This is a key trend to watch.

###

4. Company Type, Size, and Industry

The context in which you work is a major determinant of your compensation.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries and most structured compensation plans. They have complex global needs, large C&B teams, and the resources to pay top dollar for expertise. Roles are often specialized (e.g., Executive Comp Manager, International Benefits Manager).

- Tech Companies / Startups: Compensation in tech can be a different game. While base salaries are very competitive, a significant portion of total compensation, especially at senior levels, comes from equity (stock options or RSUs). A Director of Total Rewards at a pre-IPO "unicorn" startup might have a slightly lower base salary than their F500 counterpart but could have an equity package worth millions upon a successful IPO or acquisition.

- Finance and Consulting: The financial services (investment banking, asset management) and management consulting industries are known for paying top-of-market salaries and extremely high bonuses, and their internal C&B roles are no exception.

- Non-Profit Organizations: These organizations are mission-driven, and while they understand the need to be competitive, their compensation packages are generally lower than in the for-profit sector. The "psychic income" of contributing to a cause is part of the value proposition.

- Government: Federal, state, and local government roles offer immense stability, excellent benefits (pensions are still common), and work-life balance. However, salaries are dictated by rigid pay scales (like the GS scale for federal employees) and are typically lower than in the private sector, especially at senior levels.

###

5. Area of Specialization

Within the broader C&B field, certain niches are more complex and command higher pay.

- Executive Compensation: This is widely regarded as the most lucrative specialty. It involves designing multi-million dollar pay packages for C-suite executives, navigating shareholder scrutiny, and dealing with complex SEC regulations. Professionals with this expertise are highly sought after and well-compensated.

- Sales Compensation: Designing effective sales incentive plans is notoriously difficult and has a direct, measurable impact on company revenue. Experts who can create plans that motivate the sales force without driving the wrong behaviors are extremely valuable.

- Global/International Compensation & Benefits: Managing pay and benefits across different countries, currencies, legal systems, and cultural norms is exceptionally complex. This specialization is critical for multinational corporations and pays a premium.

- Mergers & Acquisitions (M&A): C&B professionals who specialize in M&A due diligence are vital. They are responsible for harmonizing the salary structures, benefits plans, and cultures of two merging companies—a high-stakes, project-based role that commands high consulting fees or internal salaries.

###

6. In-Demand Technical and Soft Skills

Finally, your specific skill set can set you apart and justify a higher salary.

- Advanced Data Analysis: You must be a wizard in Microsoft Excel. This means going beyond VLOOKUPs to mastering pivot tables, complex formulas, and ideally, regression analysis and modeling.

- HRIS/HCM Systems: Deep experience with major Human Capital Management platforms like Workday, SAP SuccessFactors, or Oracle HCM Cloud is essential. The ability to configure and pull data from these systems is a core competency.

- Data Visualization: The ability to take complex compensation data and present it in a clear, compelling way using tools like Tableau or Power BI is a huge differentiator. You need to be able to tell a story with data to influence senior leaders.

- Financial Acumen: Understanding concepts like P&L statements, stock dilution, and valuation is critical, especially when dealing with executive and sales compensation.

- Communication and Influence: You can have the best data in the world, but if you can't explain it clearly, confidently, and empathetically to managers, executives, and employees, you won't be effective. This is perhaps the most important "soft skill" for career advancement.

---

Job Outlook and Career Growth

Investing time and effort into a career path requires a clear understanding of its future viability. For Compensation and Benefits Managers, the outlook is stable, with the profession evolving to meet new workplace challenges and strategic business needs.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation and Benefits Managers will grow by 3 percent from 2022 to 2032. This is on par with the average growth rate for all occupations, indicating a steady and consistent demand for these professionals. The BLS anticipates about 1,400 job openings for C&B managers each year over the decade, stemming from both new job creation and the need to replace workers who retire or transition to different occupations.

While a 3% growth rate may seem modest, it represents a stable, mature profession. The real story, however, lies not in the quantity of new jobs but in the *quality* and *increasing strategic importance* of the role. Several emerging trends are reshaping the profession and creating new opportunities for growth and influence.

### Emerging Trends and Future Challenges

The C&B field is at the epicenter of many of the most significant shifts in the modern workplace. Staying ahead of these trends is key to remaining relevant and advancing your career.

1. The Rise of Pay Transparency: This is the single biggest trend affecting compensation today. A growing number of states and cities (like Colorado, New York City, and California) now require employers to post salary ranges in job advertisements. This shift is moving compensation from a closely guarded secret to an open conversation.

- Impact on C&B Professionals: They are on the front lines, responsible for ensuring the posted ranges are accurate, equitable, and defensible. They must train managers on how to have these conversations and build a robust, data-driven "compensation philosophy" that can withstand public scrutiny. This elevates the role from a back-office function to a public-facing, strategic one.

2. Focus on Pay Equity: Driven by social movements and regulatory pressure, companies are under intense scrutiny to eliminate pay gaps based on gender, race, and ethnicity.

- Impact on C&B Professionals: The demand for skilled analysts who can conduct sophisticated statistical pay equity audits has skyrocketed. These professionals use regression analysis and other tools to proactively identify and remediate disparities, protecting the company from legal risk and building a more inclusive culture. This is a high-value, in-demand skill set.

3. The Remote and Hybrid Work Revolution: The shift away from a fully office-based workforce has thrown traditional, location-based pay models into question. Companies are grappling with key questions:

- Should we pay employees based on the location of the company headquarters or the employee's location?

- How do we adjust pay if an employee moves from San Francisco to Boise?

- How do we ensure our benefits package is valuable to a distributed workforce?

- Impact on C&B Professionals: They are the ones tasked with answering these complex questions and designing the future of work. This requires a new level of strategic thinking, data modeling, and communication.

4. Holistic Well-being and Flexible Benefits: The pandemic accelerated the trend toward a broader definition of employee well-being. Employees now expect more than just traditional health insurance.

- Impact on C&B Professionals: Benefits managers are becoming "well-being strategists," designing