A career in accounting is a cornerstone of the business world, offering a stable and rewarding path with significant potential for growth. For those considering this profession, one of the most pressing questions is: "What can I expect to earn?" The answer is more than just a single number; it's a dynamic figure shaped by your education, location, and career choices.

An entry-level accountant can expect a competitive starting salary, typically ranging from $60,000 to $75,000 per year, with a clear trajectory for substantial income growth. This article will break down what goes into that number, what factors you can control to maximize your earnings, and the bright future this career path holds.

What Does an Entry-Level Accountant Do?

Before diving into the numbers, let's clarify the role. An entry-level accountant, often titled Staff Accountant or Junior Accountant, is the engine of a company's finance department. They are responsible for the fundamental tasks that ensure an organization's financial health and integrity.

Key responsibilities often include:

- Recording financial transactions and maintaining the general ledger.

- Preparing financial statements, such as balance sheets and income statements.

- Assisting with budget preparation and variance analysis.

- Performing bank reconciliations to ensure records are accurate.

- Supporting senior accountants during month-end closes and annual audits.

- Ensuring compliance with financial regulations and reporting standards.

This role provides an essential foundation in practical accounting principles, serving as a launchpad for more specialized and senior positions.

Average Entry-Level Accountant Salary

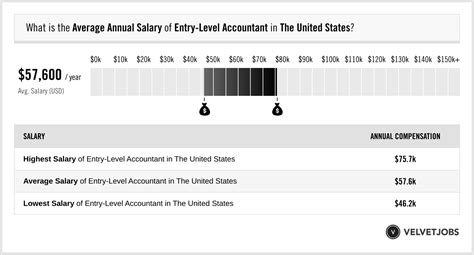

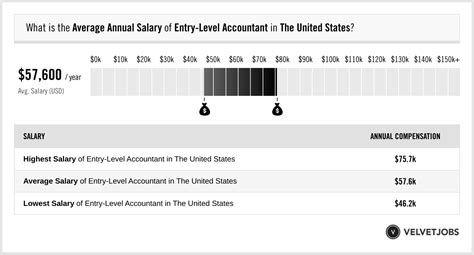

While salaries vary, we can establish a strong baseline using data from authoritative sources.

According to recent data from leading salary aggregators like Salary.com, the average salary for a Staff Accountant I (a typical entry-level role) in the United States falls between $61,200 and $74,800, with a median around $67,700 as of late 2023. Similarly, Glassdoor reports a national average base pay of approximately $65,000 for entry-level accountants.

It is crucial to distinguish this starting salary from the median for the entire profession. The U.S. Bureau of Labor Statistics (BLS) reports the median annual wage for all accountants and auditors was $79,880 in May 2023. This higher figure includes experienced professionals and demonstrates the significant earning potential as you advance in your career.

Key Factors That Influence Salary

Your starting salary isn't set in stone. Several key factors can dramatically influence your initial offer and long-term earning potential.

###

Level of Education

Your educational background is the first major building block of your accounting career.

- Bachelor’s Degree: A bachelor’s degree in accounting is the standard and necessary entry-point for the profession.

- Master’s Degree: Pursuing a Master of Accountancy (MAcc) or a Master of Science in Accounting (MSA) can provide a competitive edge. It often leads to higher starting salary offers and is a common path to fulfilling the 150-credit-hour requirement for the CPA license.

- CPA Certification: The Certified Public Accountant (CPA) license is the gold standard in the accounting industry. While you won't have it at the entry-level, being "CPA-eligible" or having passed parts of the CPA Exam can significantly boost your starting salary. Companies view this as a serious commitment to the profession and an investment that will pay dividends for them. Earning your CPA license is the single most effective way to increase your earning potential throughout your career.

###

Years of Experience

While this is an "entry-level" position, any prior experience can give you a leg up. Relevant internships completed during college are highly valued by employers. An internship at a reputable firm not only looks great on a resume but also often comes with a higher starting offer if you are hired full-time. Even a year or two of experience in a related role, like a bookkeeper or accounting clerk, can position you for a salary at the higher end of the entry-level scale.

###

Geographic Location

Where you work matters—a lot. Salaries are closely tied to the cost of living and the demand for financial professionals in a specific region.

- High-Cost Metropolitan Areas: Major financial hubs like New York City, San Francisco, Boston, and Washington, D.C., will offer the highest starting salaries to offset a much higher cost of living.

- Major Business Centers: Cities like Chicago, Dallas, Atlanta, and Charlotte also have robust markets for accountants and offer competitive salaries that are often very attractive when the cost of living is considered.

- Rural and Lower-Cost Areas: Salaries will generally be lower in smaller towns and rural regions, but so is the cost of living, which can balance out your disposable income.

###

Company Type

The type of organization you work for is a major differentiator in compensation and work environment.

- Public Accounting (The "Big Four" and National Firms): The "Big Four" firms (Deloitte, PwC, EY, and KPMG) and other large national firms are known for offering some of the highest starting salaries. This comes with the expectation of long hours, especially during busy seasons, but the training and resume prestige are unparalleled.

- Corporate/Industry Accounting: Working in the accounting department of a private or public company can offer competitive pay and often better work-life balance. Salaries can vary widely depending on the size and profitability of the company, with Fortune 500 companies generally paying more than small businesses.

- Government: Working for federal, state, or local government agencies (like the IRS or GAO) provides excellent job security and benefits. While starting salaries may be slightly lower than in top-tier public accounting, the work-life balance and stable career progression are major draws.

- Non-Profit: Non-profit organizations typically offer lower salaries than their for-profit counterparts. However, these roles attract individuals who are passionate about a specific mission and find value in contributing to a cause.

###

Area of Specialization

Even at the entry level, the type of accounting you pursue can impact your salary. Certain high-demand fields may offer a premium.

- Audit and Assurance: This is a common starting point, especially in public accounting, involving the review and verification of financial records.

- Tax Accounting: Specializing in tax preparation and planning is consistently in high demand due to the complexity of tax law.

- Forensic Accounting: This niche involves investigating financial fraud and discrepancies. It's a highly specialized field that commands high salaries as you gain experience.

- IT Audit / Information Systems: As technology becomes more integrated with finance, accountants who can audit IT systems and understand data analytics are in extremely high demand and can command a salary premium.

Job Outlook

The future for accountants is bright and stable. According to the U.S. Bureau of Labor Statistics, employment of accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady demand is driven by factors such as economic growth, increasingly complex tax and regulatory environments, and the need for financial accountability in all sectors. As long as businesses and organizations exist, they will need skilled accountants to manage their finances.

Conclusion

Embarking on a career in accounting is a smart, strategic move. An entry-level accountant can expect a solid starting salary in the $60,000 to $75,000 range, but this is truly just the beginning.

Your ultimate earning potential is in your hands. By focusing on key drivers of value—advancing your education, earning your CPA license, gaining experience in a high-demand specialty, and choosing your industry and location strategically—you can build a financially secure and professionally fulfilling career. The path from a driven entry-level professional to a high-earning financial leader is clear, well-trodden, and waiting for you.