Unlocking Your Earnings: A Deep Dive into Chartered Accountant Job Salaries

Choosing a career in accounting is a move toward stability, prestige, and significant financial reward. For those who pursue the premier designation of Chartered Accountant (CA) or its U.S. equivalent, the Certified Public Accountant (CPA), the earning potential is particularly high, with many professionals commanding salaries well into the six figures.

But what does a typical chartered accountant job salary look like, and what factors can propel your earnings to the highest level? This guide will break down the salary expectations, from your first day on the job to a senior leadership role, using data from authoritative industry sources.

What Does a Chartered Accountant Do?

Before we dive into the numbers, it's essential to understand the role. A Chartered Accountant is a highly qualified financial professional responsible for managing finances, providing financial advice, and ensuring fiscal compliance for businesses, individuals, and governments. They are not just number-crunchers; they are strategic advisors who play a critical role in an organization's success.

Key responsibilities often include:

- Performing financial audits and ensuring accuracy in reporting.

- Developing budgets and financial forecasts.

- Advising on tax planning and compliance.

- Managing corporate finance, including mergers and acquisitions.

- Detecting and preventing financial fraud.

A Note on Terminology: The "Chartered Accountant" (CA) designation is prominent in the United Kingdom, Canada, Australia, India, and other Commonwealth nations. In the United States, the equivalent and most recognized designation is the Certified Public Accountant (CPA). For this article, we will refer to U.S.-based data for CPAs as the primary benchmark, as it offers a robust and comparable career path.

Average Chartered Accountant Salary

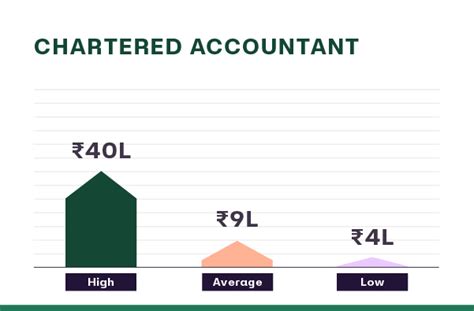

The salary for a Chartered Accountant (or CPA) is not a single figure but a wide spectrum that reflects a professional's journey.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all accountants and auditors was $79,880 in May 2023. However, this figure includes accountants without a professional designation.

For those who have earned their CA/CPA license, the earning potential is significantly higher. Data from reputable salary aggregators confirms this:

- Payscale reports the average salary for a CPA in the U.S. is approximately $82,000, with a typical range falling between $59,000 for entry-level positions and over $135,000 for experienced professionals.

- Salary.com places the median CPA salary higher, at around $98,715, with the top 10% of earners exceeding $160,000.

This demonstrates that while a general accounting role provides a solid income, earning the chartered/certified designation is the key that unlocks a much higher tier of compensation.

Key Factors That Influence Salary

Your salary is not set in stone. It is a dynamic figure influenced by a combination of your qualifications, choices, and professional environment. Here are the most critical factors that determine your earning potential.

Level of Education

While a bachelor's degree in accounting is the standard entry requirement, advanced education directly correlates with higher starting salaries and long-term earning potential. Most states require 150 semester hours of education to become a licensed CPA, which often leads candidates to pursue a master's degree. A Master of Accountancy (MAcc), a Master of Science in Taxation (MST), or an MBA with a concentration in accounting can provide a significant salary bump and open doors to specialized, higher-paying roles.

Years of Experience

Experience is arguably the most significant driver of salary growth in the accounting profession. Your value to an employer increases as you move from executing tasks to managing teams and setting strategy.

- Entry-Level (0-3 Years): As a Staff Accountant or Junior Auditor, you can expect a starting salary in the range of $60,000 to $78,000, particularly if you have passed the CPA exam.

- Mid-Career (4-9 Years): After gaining experience and moving into Senior Accountant or Manager roles, salaries typically rise to the $85,000 to $125,000 range. At this stage, you are leading projects and mentoring junior staff.

- Senior/Experienced (10+ Years): With a decade or more of experience, professionals in Director, Controller, or Partner roles can command salaries well above $150,000, with top executives like Chief Financial Officers (CFOs) earning substantially more, often including significant bonuses and stock options.

Geographic Location

Where you work matters. Major metropolitan areas with a high cost of living and a high concentration of large corporations and financial institutions offer the highest salaries.

According to Glassdoor and other industry reports, cities like New York, San Francisco, San Jose, and Boston consistently offer salaries that are 20-40% higher than the national average to compensate for the cost of living and intense market competition. Conversely, salaries in smaller cities and rural areas will be closer to or slightly below the national median.

Company Type

The type of organization you work for has a profound impact on your compensation and career trajectory.

- The "Big Four" Public Accounting Firms (Deloitte, PwC, EY, KPMG): These firms are known for offering some of the highest starting salaries and unparalleled training. While the work is demanding, a few years at a Big Four firm is a prestigious credential that can fast-track your career.

- Corporate/Industry Accounting: Working in-house for a company in a non-accounting industry (e.g., tech, healthcare, manufacturing) can be highly lucrative. Roles like Financial Controller or Director of Finance can offer competitive salaries, excellent benefits, and potentially a better work-life balance than public accounting.

- Government: Accountants working for federal, state, or local government agencies (e.g., the IRS or FBI) typically earn less than their private-sector counterparts. However, these roles often come with exceptional job security and excellent retirement and health benefits.

- Non-Profit: While driven by mission over profit, non-profits also require skilled accountants. Salaries are generally lower than in the for-profit sector, but the work can be deeply rewarding.

Area of Specialization

General accounting is a valuable skill, but specialization leads to expertise, and expertise commands a premium. Certain niches within accounting are in high demand and offer higher pay.

- Advisory/Consulting: This is one of the most lucrative fields. CPAs who advise on mergers and acquisitions, business strategy, or risk management can earn top-tier salaries.

- Forensic Accounting: These financial detectives investigate fraud and financial crimes. The specialized, high-stakes nature of their work makes them highly paid.

- IT Audit & Cybersecurity: As businesses become more digital, accountants who can audit IT systems and advise on cybersecurity risks are in extremely high demand and are compensated accordingly.

- International Tax: With globalization, experts who can navigate the complex tax laws of multiple countries are invaluable and can command a significant salary premium.

Job Outlook

The future for Chartered Accountants and CPAs is bright and stable. According to the U.S. Bureau of Labor Statistics, employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is as fast as the average for all occupations.

This steady growth is driven by a need for financial accountability, increasingly complex tax regulations, and globalization. As long as businesses exist and manage money, there will be a strong demand for skilled accountants to ensure they do so effectively and ethically.

Conclusion

A career as a Chartered Accountant or CPA is more than just a job—it's an investment in a secure and prosperous future. While the path requires rigorous education and a commitment to continuous learning, the rewards are clear.

Your salary journey will be shaped by your ambition and choices. By focusing on gaining experience, pursuing strategic specializations, and positioning yourself in a high-demand industry or location, you can maximize your earning potential. For anyone considering this path, the data is clear: becoming a Chartered Accountant is a reliable and highly rewarding route to a successful professional life.