---

Introduction

Have you ever looked at a thriving, multi-billion dollar corporation and wondered about the engine humming quietly beneath the surface? The force that ensures stability, guides strategic decisions, and maintains financial integrity? That engine is accounting. For those with a meticulous mind, a passion for order, and a desire to understand the language of business, a career in accounting is not just a job; it’s a gateway to becoming an indispensable part of any organization's success story. It's a path that promises stability, continuous growth, and a surprisingly dynamic future.

But let's talk about the bottom line, because as a future accountant, you know the numbers matter. A common question we hear is, "What can I realistically expect for an entry-level accounting salary?" The answer is both encouraging and complex. While the national average for a starting salary hovers between $55,000 and $75,000 per year, this figure is merely a baseline. With the right credentials, skills, and strategic career moves, that number can climb significantly faster than you might think. This guide is designed to be your comprehensive roadmap to understanding, navigating, and maximizing that potential.

Early in my career analysis journey, I worked alongside a junior accountant who, during a routine audit, uncovered a simple, recurring billing error that was costing a small but growing tech company nearly $50,000 a year. It wasn't a dramatic Hollywood moment, but it was a profound one. It taught me that accounting isn't just about crunching numbers in a spreadsheet; it's about safeguarding a company's health, telling its financial story, and directly contributing to its future. That junior accountant wasn't just doing a job; they were providing immense value, and their career trajectory reflected that from that moment on.

In this ultimate guide, we will dissect every facet of an entry-level accounting career, from your daily responsibilities to the long-term industry outlook. We will explore the precise factors that inflate your paycheck and provide a step-by-step plan to launch your career with confidence and authority.

### Table of Contents

- [What Does an Entry-Level Accountant Do?](#what-does-an-entry-level-accountant-do)

- [Average Entry-Level Accounting Salary: A Deep Dive](#average-entry-level-accounting-salary-a-deep-dive)

- [Key Factors That Influence Your Accounting Salary](#key-factors-that-influence-your-accounting-salary)

- [Job Outlook and Career Growth in Accounting](#job-outlook-and-career-growth-in-accounting)

- [How to Get Started in Your Accounting Career](#how-to-get-started-in-your-accounting-career)

- [Conclusion: Is an Accounting Career Worth It?](#conclusion-is-an-accounting-career-worth-it)

---

What Does an Entry-Level Accountant Do?

Before we dive into salary specifics, it's crucial to understand the role you'll be playing. The title "Entry-Level Accountant" or "Junior Accountant" can encompass a variety of responsibilities depending on the size and type of the company. However, the core function remains the same: to support the financial health and reporting accuracy of the organization. You are the frontline soldier in the battle for financial integrity.

At its heart, the role is about recording, maintaining, and reconciling financial transactions. You are the keeper of the general ledger—the central book of all the company's financial data. Your work ensures that the financial statements—the income statement, balance sheet, and statement of cash flows—are accurate, compliant with regulations like Generally Accepted Accounting Principles (GAAP), and ready for review by management, auditors, and investors.

Common Daily Tasks and Responsibilities:

Your day-to-day work is a blend of routine tasks and ad-hoc projects. You can expect your duties to include:

- Accounts Payable (AP): Processing, verifying, and recording vendor invoices and employee expense reports for payment. You ensure the company pays its bills on time and accurately.

- Accounts Receivable (AR): Preparing and sending out client invoices, tracking payments, and following up on overdue accounts. You ensure the company collects the money it is owed.

- Bank Reconciliations: Comparing the company's financial records against its bank statements to identify any discrepancies and ensure every transaction is accounted for.

- Month-End Close Support: This is a critical period in any accounting department. You will be heavily involved in preparing journal entries, reconciling balance sheet accounts, and helping assemble the financial reporting package for management.

- Data Entry and Ledger Maintenance: Meticulously entering financial data into accounting software (like QuickBooks, Oracle NetSuite, or SAP) and maintaining the accuracy of the general ledger.

- Assisting with Audits: When external or internal auditors come to review the company's books, you will be responsible for providing them with necessary documentation, reports, and explanations.

- Basic Financial Analysis: You might be asked to run reports on spending trends, budget-to-actual variances, or other key performance indicators (KPIs) to support decision-making.

### A "Day in the Life" of a Junior Accountant

To make this more concrete, here’s what a typical day might look like for a junior accountant at a mid-sized corporation, especially during the monthly close process:

- 8:30 AM: Arrive, grab coffee, and review emails. Check for any urgent requests from the Controller or Senior Accountant.

- 9:00 AM: Begin working on bank reconciliations. Download the latest bank statements and start matching transactions to the general ledger, investigating any discrepancies from the previous day.

- 10:30 AM: Shift to Accounts Payable. Review a batch of new vendor invoices that have come in, checking them for proper approval and coding them to the correct expense accounts in the ERP system.

- 11:30 AM: Prepare a journal entry to accrue for expenses that were incurred but not yet invoiced, a key step in the month-end close.

- 12:30 PM: Lunch break.

- 1:30 PM: A department manager emails asking for a detailed report of their team's travel expenses for the quarter. You pull the data from the system, format it in Excel, and send it over.

- 2:30 PM: Attend a short team meeting to discuss the progress of the month-end close. The Senior Accountant assigns you the task of reconciling the fixed assets sub-ledger.

- 3:00 PM: Dive into the fixed assets reconciliation, ensuring that recent purchases are correctly recorded and that depreciation is calculated properly.

- 4:45 PM: A Senior Accountant asks for help pulling supporting documentation for an upcoming audit. You spend the last part of your day gathering and organizing invoices and contracts.

- 5:30 PM: Log off, having made tangible progress on ensuring the company's financial records are accurate and up-to-date.

This role is foundational. It teaches you the mechanics of business finance from the ground up, providing the essential experience you'll need to advance to more senior, strategic roles.

---

Average Entry-Level Accounting Salary: A Deep Dive

Now, let's get to the core of the matter: compensation. Understanding your potential earnings is a key part of planning your career. The salary for an entry-level accountant is not a single number but a range influenced by a multitude of factors we'll explore in the next section. However, by looking at data from authoritative sources, we can establish a reliable baseline.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all accountants and auditors was $78,000 in May 2022. It's important to note that this figure includes professionals at all levels of experience. For those just starting out, the numbers are different but still competitive.

Reputable salary aggregators provide a more focused look at entry-level compensation:

- Salary.com reports that the average salary for an Accountant I (typically 0-2 years of experience) in the United States falls between $62,028 and $71,788, as of late 2023.

- Payscale indicates a similar average base salary for an entry-level Staff Accountant at around $61,400 per year, with a typical range of $49,000 to $77,000.

- Glassdoor reports a national average base pay of $65,839 per year for an entry-level Accountant, based on user-submitted data.

Synthesizing this data, a realistic starting salary range for a candidate with a bachelor's degree in accounting in the United States is generally $55,000 to $75,000. Positions in high-cost-of-living areas or at prestigious firms can push this initial figure closer to $80,000 or even higher, especially for top-tier candidates.

### Salary Progression by Experience Level

Your starting salary is just that—a start. Accounting is a field that rewards experience and expertise with consistent and significant salary growth. Here is a typical salary trajectory you can expect as you advance in your career.

| Experience Level | Typical Role Titles | Years of Experience | Typical Annual Salary Range (USA) | Source Data Synthesis |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Junior Accountant, Staff Accountant I | 0-2 | $55,000 - $75,000 | Payscale, Salary.com |

| Mid-Career | Senior Accountant, Accounting Supervisor | 3-7 | $75,000 - $110,000 | Glassdoor, Robert Half |

| Senior/Manager | Accounting Manager, Controller | 8-15 | $100,000 - $160,000 | BLS, Robert Half |

| Executive | VP of Finance, Chief Financial Officer (CFO) | 15+ | $180,000 - $350,000+ | Salary.com, Industry Reports |

*Note: These ranges are national averages and can vary significantly based on the factors discussed in the next section.*

As you can see, the leap from an entry-level to a mid-career professional often comes with a 30-50% increase in base salary. This jump is typically achieved by mastering the foundational skills, earning a certification like the CPA, and taking on more complex responsibilities like managing projects or junior staff.

### Beyond the Base Salary: Understanding Total Compensation

Your base salary is only one piece of the puzzle. Total compensation includes other valuable components that can significantly increase your overall earnings and quality of life. When evaluating a job offer, be sure to consider:

- Annual Bonuses: These are common in accounting and are typically tied to individual and company performance. An annual bonus can range from 5% to 15% of your base salary, even at the junior level.

- Signing Bonuses: Especially common when hiring from public accounting firms or for in-demand roles, a signing bonus is a one-time payment to entice you to accept an offer. These can range from $2,000 to $10,000 or more.

- CPA Bonus: Many public accounting firms and large corporations offer a substantial one-time bonus (often $3,000 to $5,000) for passing the CPA exam within a certain timeframe after being hired. They also often pay for the study materials and exam fees, which is a benefit worth thousands of dollars.

- Profit Sharing: Some firms, particularly smaller ones, may offer a share of the company's profits to employees, distributed annually.

- Retirement Savings: Look for a strong 401(k) or 403(b) plan with a generous company match. A common match is 50% of your contribution up to 6% of your salary, which is essentially free money for your retirement.

- Health Insurance: A comprehensive health, dental, and vision insurance plan with low premiums and deductibles is an extremely valuable part of your compensation package.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies contribute to a healthy work-life balance.

- Professional Development: Many companies will pay for continuing professional education (CPE) credits, professional association memberships (like the AICPA), and other training, investing directly in your career growth.

When you add these components together, a job offer with a base salary of $65,000 could easily have a total compensation value well over $75,000 in your first year.

---

Key Factors That Influence Your Accounting Salary

This is the most critical section for understanding how to maximize your earning potential. Two candidates with the same bachelor's degree can walk into the job market and receive vastly different salary offers. The discrepancy almost always comes down to a combination of the following key factors.

### 1. Level of Education & Professional Certifications

Your academic and professional credentials are the foundation of your earning power.

- Bachelor's Degree: A Bachelor's in Accounting is the standard, non-negotiable entry ticket. A degree from a highly-ranked, AACSB-accredited business school can give you an edge and may lead to slightly higher starting offers, primarily because these schools attract more aggressive on-campus recruiting from top firms.

- Master's Degree (MAcc or MST): A Master of Accountancy (MAcc) or a Master of Science in Taxation (MST) can provide a notable salary boost. More importantly, it helps you meet the 150-credit-hour requirement needed to sit for the CPA exam in most states. A master's degree can increase your starting salary by $5,000 to $10,000 and signals a higher level of commitment and specialized knowledge to employers.

- The CPA (Certified Public Accountant) License: This is the undisputed gold standard in the accounting profession. Earning your CPA license is the single most impactful thing you can do to increase your salary and career opportunities.

- Salary Impact: According to the AICPA, CPAs earn, on average, 10-15% more than their non-certified counterparts. This premium exists at every stage of your career.

- Opportunity Impact: Many higher-level roles, such as Controller or CFO, explicitly require a CPA license. It unlocks doors that would otherwise remain closed.

- Other Certifications: While the CPA is paramount, other certifications can significantly boost your salary in specialized niches:

- CMA (Certified Management Accountant): Ideal for those in corporate finance and management accounting. It focuses on strategic decision-making and financial planning.

- CIA (Certified Internal Auditor): The premier certification for internal audit professionals.

- CFE (Certified Fraud Examiner): Highly valuable for forensic accountants who investigate financial crimes.

- CISA (Certified Information Systems Auditor): For those specializing in IT audit, a very lucrative and in-demand field.

### 2. Years of Experience and Career Path

As demonstrated in the salary table, experience is a primary driver of compensation. But it's not just the number of years that matters; it's the *type* of experience you gain.

- Public vs. Private Accounting: A common and highly effective career path is to start in public accounting (especially at a "Big Four" firm—Deloitte, PwC, EY, KPMG—or a large national firm). While the hours are notoriously long, the training is exceptional. After 2-4 years in public accounting, professionals are in extremely high demand in the private sector and can often command a 20-30% salary increase when they make the switch to a senior accountant or accounting manager role in a corporation.

- The "Senior" Promotion: The first major pay bump typically comes with the promotion from "Staff" to "Senior" Accountant, usually around the 2-3 year mark. This promotion signifies that you have mastered the basics and are ready to lead small projects, review the work of junior staff, and handle more complex accounting issues. This promotion alone can add $15,000 to $25,000 to your annual salary.

### 3. Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted to reflect the local cost of living and the demand for skilled professionals in that market.

High-Paying Metropolitan Areas:

Major economic hubs with a high concentration of large corporations and financial institutions consistently offer the highest salaries. According to the 2024 Robert Half Salary Guide, cities with salaries significantly above the national average include:

- San Francisco, CA: (Often 35-40% above national average)

- New York, NY: (Often 30-40% above national average)

- San Jose, CA: (Often 30-35% above national average)

- Boston, MA: (Often 25-30% above national average)

- Washington, D.C.: (Often 20-25% above national average)

An entry-level accountant starting at a large company in San Francisco might command a salary of $85,000 or more, while the same role in a smaller city might start at $60,000.

Cost of Living Consideration:

It's crucial to weigh higher salaries against the higher cost of living in these cities. A $85,000 salary in New York City may have less purchasing power than a $65,000 salary in a city like Charlotte, NC, or Austin, TX, where housing, transportation, and taxes are lower. Many mid-sized cities with strong economic growth are becoming "sweet spots" for accountants, offering competitive salaries with a more manageable cost of living.

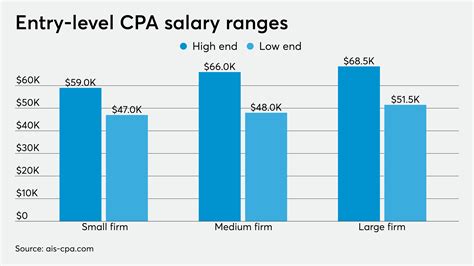

### 4. Company Type and Size

The type of organization you work for will shape your experience and your compensation package.

- The Big Four (PwC, Deloitte, EY, KPMG) & Large National Firms: These firms typically offer the highest starting salaries to attract the best talent from universities. They provide unparalleled training, prestigious resume credentials, and clear paths to advancement. The trade-off is often a demanding work culture with long hours, particularly during "busy season" (January-April).

- Large Corporations (Fortune 500): Working in the internal accounting department of a large public company offers competitive salaries, excellent benefits, and better work-life balance compared to public accounting. Career paths are well-defined, and you can specialize in areas like financial reporting, internal audit, or tax.

- Small and Medium-Sized Businesses (SMBs): Starting salaries might be slightly lower than at large corporations. However, the experience can be invaluable. You will likely wear many hats, gaining a much broader understanding of the entire accounting cycle and business operations. There's often a more direct line of sight to how your work impacts the company's success.

- Government (Federal, State, Local): Government accounting roles (e.g., at the IRS, GAO, or state audit agencies) typically offer lower starting base salaries than the private sector. However, they compensate with exceptional job security, predictable hours, comprehensive benefits, and often a pension plan—a rarity in the private sector.

- Non-Profit Organizations: These roles are often driven by a mission. Salaries tend to be on the lower end of the spectrum due to budget constraints. The reward comes from contributing to a cause you believe in.

### 5. Area of Specialization

As you advance, specializing in a high-demand niche is a powerful way to increase your value.

- Audit/Assurance: The traditional path, focusing on verifying the accuracy of financial statements. It's a great foundation for any accounting career.

- Tax: Specializing in tax compliance and strategy for individuals or corporations. This field is always in demand due to the complexity of tax law.

- Forensic Accounting: An investigative role focused on uncovering fraud, embezzlement, and other financial crimes. It's a highly specialized and often lucrative field.

- Advisory/Consulting: Many large accounting firms have advisory branches that consult on mergers and acquisitions (M&A), risk management, and business processes. These roles are often project-based and can be very high-paying.

- IT Audit & Risk Assurance: This is one of the hottest and highest-paying specializations. It combines accounting and technology, focusing on the controls and risks within a company's IT systems. Professionals with both accounting and tech skills are in extremely high demand.

### 6. In-Demand Skills (Hard and Soft)

In today's market, a degree isn't enough. Demonstrating proficiency in specific technical and soft skills can set you apart and justify a higher salary.

High-Value Technical Skills:

- Advanced Microsoft Excel: You must be a power user. This means mastering PivotTables, VLOOKUP/HLOOKUP/XLOOKUP, INDEX-MATCH, complex formulas, and basic macros.

- Enterprise Resource Planning (ERP) Systems: Experience with major ERP systems like SAP, Oracle NetSuite, Microsoft Dynamics 365, or Workday Financials is a huge plus. Many job descriptions list this as a requirement.

- Data Analytics and Visualization: The future of accounting is in analysis, not just recording. Skills in tools like Tableau or Microsoft Power BI allow you to turn raw financial data into insightful dashboards and reports for management.

- SQL (Structured Query Language): The ability to pull and manipulate data directly from databases is a powerful skill that distinguishes you from your peers and is highly valued.

Essential Soft Skills:

- Communication: You must be able to clearly explain complex financial information to non-financial stakeholders (e.g., marketing managers, engineers).

- Problem-Solving: Accounting is not just data entry; it's about identifying discrepancies, investigating why they occurred, and proposing solutions.

- Attention to Detail: A single misplaced decimal point can have significant consequences. Meticulous accuracy is non-negotiable.

- Business Acumen: Understanding the broader business context of your work—how the numbers you manage affect the company's strategy and operations—will make you a more valuable strategic partner.

- Ethical Judgment: As a steward of financial information, unwavering integrity is the bedrock of your career.

---

Job Outlook and Career Growth in Accounting

Choosing a career isn't just about the starting salary; it's about long-term stability and opportunity. The outlook for accountants and auditors is strong, stable, and evolving in exciting ways.

### A Stable and Growing Profession

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady growth translates to approximately 126,500 openings for accountants and auditors each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

Why the Continued Demand?

- Economic Growth: As the economy grows, more businesses are created, requiring accountants to prepare and examine financial records.

- Globalization: Increasing international trade and business operations require accountants with knowledge of international standards and regulations.

- **Complex Regulatory Environment