Table of Contents

- [Introduction](#introduction)

- [What Does an Accountant in New York Actually Do?](#what-does-an-accountant-do)

- [Average Salary of an Accountant in New York: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence an Accountant's Salary](#key-factors-influencing-salary)

- [Job Outlook and Career Growth for Accountants in New York](#job-outlook-and-career-growth)

- [How to Become an Accountant in New York: A Step-by-Step Guide](#how-to-get-started)

- [Conclusion: Is a Career in Accounting in New York Worth It?](#conclusion)

Introduction

Have you ever stood in the heart of Manhattan, surrounded by the towering skyscrapers of Wall Street and Midtown, and wondered about the financial engines that power it all? Behind every major bank, iconic fashion house, tech startup, and Fortune 500 headquarters is a team of meticulous, strategic, and indispensable professionals: accountants. A career in accounting in New York isn't just about crunching numbers in a back office; it's about being a guardian of financial integrity, a strategic partner in business growth, and a key player in the world's most dynamic economic hub. The allure is undeniable, but the practical question remains: what is the salary of an accountant in New York?

The answer is as complex and rewarding as the city itself. While the figures can be substantial, they are influenced by a multitude of factors. On average, you can expect an accountant in the New York metropolitan area to earn a median salary well into the six figures, often ranging from $80,000 for entry-level positions to over $200,000 for experienced, specialized roles. This guide will dissect those numbers, providing a granular, data-backed analysis to give you a clear and realistic picture of your earning potential.

I'll never forget a conversation with my first professional mentor, a seasoned Certified Public Accountant (CPA) who had spent 30 years navigating the financial maze of New York City. He told me, "Anyone can add and subtract. A great accountant tells the story behind the numbers. We’re not scorekeepers; we’re strategists who turn financial data into actionable intelligence." That insight has always stuck with me, highlighting that this profession is a craft that blends analytical rigor with profound business acumen—a craft that New York's competitive market values and rewards handsomely.

This ultimate guide is designed to be your definitive resource. We will move far beyond a simple salary figure, exploring the day-to-day realities of the job, the critical factors that dictate your pay, the long-term career outlook, and a concrete, step-by-step roadmap to launching your own successful accounting career in the Empire State.

What Does an Accountant in New York Actually Do?

The stereotype of an accountant as a solitary number-cruncher, buried under mountains of paper in a dimly lit office, is a relic of the past. Today’s accountant, especially in a fast-paced environment like New York, is a dynamic problem-solver, a tech-savvy analyst, and a crucial communicator who bridges the gap between raw data and executive decision-making.

At its core, accounting is the systematic process of recording, analyzing, interpreting, and communicating financial information. Accountants ensure that financial records are accurate, that taxes are paid properly and on time, and that organizations run efficiently. Their work is the bedrock of financial stability and compliance for businesses, governments, and non-profits alike.

The responsibilities of an accountant in New York are diverse and can vary significantly depending on whether they work in public accounting, private (or corporate) accounting, or for a government entity.

Core Responsibilities and Daily Tasks:

- Financial Reporting: Preparing and examining financial statements like the balance sheet, income statement, and statement of cash flows. This ensures stakeholders (investors, lenders, management) have a clear view of the company's financial health.

- Bookkeeping and General Ledger Maintenance: Overseeing the recording of all financial transactions, ensuring the general ledger is accurate and reconciled. While much of this is now automated, accountants provide the critical oversight and troubleshooting.

- Tax Preparation and Planning: For tax accountants, this is a primary function. It involves preparing federal, state, and local tax returns for individuals or corporations and, more strategically, advising on how to minimize tax liability legally.

- Auditing: Reviewing a company's financial records to check for accuracy and compliance with laws and regulations.

- Internal Auditors: Work for a company to identify and mitigate risks related to fraud, operational inefficiencies, and compliance.

- External Auditors: Work for a public accounting firm (like the "Big Four") to provide an independent opinion on a company's financial statements.

- Budgeting and Forecasting: Working with management to develop budgets, monitor spending, and forecast future financial performance to guide strategic planning.

- Compliance and Regulation: Ensuring the company adheres to financial principles (like GAAP - Generally Accepted Accounting Principles) and regulations (like the Sarbanes-Oxley Act).

- Advisory Services: This is a growing area where accountants act as consultants, advising on everything from mergers and acquisitions to IT system implementation and business strategy.

### A "Day in the Life" Example: The Tale of Two Accountants

To make this more tangible, let's consider two hypothetical New York accountants on a typical Tuesday.

Sophia, a Senior Associate at a "Big Four" Public Accounting Firm in Midtown Manhattan (during busy season):

- 8:00 AM: Arrives at the client site—a major investment bank in the Financial District. Grabs coffee and syncs up with her audit team to plan the day's tasks.

- 9:00 AM - 1:00 PM: Conducts audit testing. This involves "vouching" revenue samples by tracing them back to contracts and cash receipts, and testing the bank's internal controls over financial reporting. She spends time interviewing the client's controller to understand a complex new financial instrument.

- 1:00 PM: A quick working lunch at her desk, reviewing workpapers prepared by a first-year associate and providing feedback.

- 2:00 PM - 6:00 PM: Participates in a conference call with the audit partner and the client's CFO to discuss a potential audit adjustment. She then shifts focus to documenting her testing procedures meticulously in the firm's audit software.

- 6:00 PM - 8:00 PM: The team reconvenes to update their status report. Sophia spends the last part of her day responding to emails and preparing a "to-do" list for the next day to ensure they stay on track to meet their filing deadline.

David, a Senior Corporate Accountant at a Tech Startup in Brooklyn:

- 9:30 AM: Arrives at the trendy office, grabs a kombucha on tap, and starts his day by reviewing the daily cash reconciliation and bank activity.

- 10:00 AM - 12:00 PM: It's the fifth business day of the month, so he's in "month-end close" mode. He prepares and posts journal entries for accrued expenses, prepaid assets, and revenue recognition under ASC 606.

- 12:00 PM: Joins the marketing team for a catered lunch to build cross-departmental relationships.

- 1:00 PM - 3:00 PM: Works on a variance analysis, comparing actual spending for the R&D department against their budget. He discovers a significant overspend on software licenses and schedules a meeting with the department head to understand why.

- 3:00 PM - 5:00 PM: Helps the Controller prepare a slide deck for the board of directors, providing key financial metrics and visualizations using Tableau.

- 5:30 PM: Wraps up his final tasks, responds to a few Slack messages, and heads out to a team-building event at a local brewery.

As you can see, the core principles are the same—accuracy, analysis, communication—but the application, environment, and work-life balance can be worlds apart. This diversity is one of the profession's greatest strengths.

Average Salary of an Accountant in New York: A Deep Dive

Now for the central question: what financial compensation can you expect for this critical work? The salary of an accountant in New York is consistently higher than the national average, a reflection of the state's high cost of living and its status as the world's financial capital. However, the term "average" can be misleading, so we'll break it down into meaningful segments.

For this analysis, we will draw upon data from the most reputable sources available, including the U.S. Bureau of Labor Statistics (BLS), Salary.com, Glassdoor, and Payscale. (Note: Data is based on reports from late 2023 and early 2024, and figures can fluctuate.)

### National vs. New York State: The Big Picture

First, let's establish a baseline.

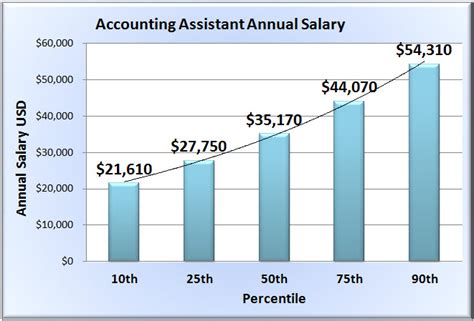

- National Average: According to the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics survey, the median annual wage for accountants and auditors in the United States was $78,000 in May 2022 (the most recent comprehensive data). The lowest 10 percent earned less than $48,560, and the highest 10 percent earned more than $132,690.

- New York State Average: The BLS reports that New York is one of the top-paying states for this profession. The statewide median annual wage for accountants and auditors was $101,320. This significant "New York premium" of over $23,000 illustrates the enhanced earning potential in the state.

- New York City Metropolitan Area: The earning power becomes even more concentrated in the NYC metro area. The BLS data for the New York-Newark-Jersey City, NY-NJ-PA metropolitan area shows a median annual wage of $105,790.

Reputable salary aggregators, which often use more real-time, user-reported data, paint a similar or even more optimistic picture for the heart of the city:

- Salary.com reports that the average salary for an Accountant II (a mid-level role) in New York, NY is around $90,500, with a typical range falling between $81,900 and $100,000.

- Glassdoor places the total pay for an accountant in New York, NY at an average of $98,000 per year, which includes an estimated base pay of $84,000 and additional pay (bonuses, profit sharing) of $14,000.

### Salary by Experience Level in New York City

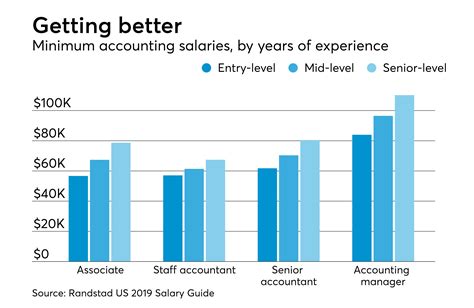

Averages only tell part of the story. Your experience level is arguably the single most important determinant of your base salary. Here’s a breakdown of what you can expect at different stages of your career in the NYC market, compiled from a synthesis of industry data.

| Experience Level | Typical Job Titles | Years of Experience | Estimated NYC Salary Range (Base Pay) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Staff Accountant, Junior Accountant, Audit Associate I | 0-2 years | $70,000 - $85,000 | Data entry, bank reconciliations, preparing journal entries, assisting with month-end close, supporting senior staff on audit testing. |

| Mid-Career | Accountant, Senior Accountant, Audit Senior | 2-5 years | $85,000 - $120,000 | Full ownership of GL accounts, preparing financial statements, complex reconciliations, mentoring junior staff, leading smaller audit engagements. |

| Experienced/Senior | Senior Accountant, Accounting Manager, Controller, Audit Manager | 5-10 years | $120,000 - $180,000+ | Supervising teams, managing the entire accounting cycle, financial planning & analysis (FP&A), strategic budgeting, managing client relationships. |

| Executive/Principal | Controller, VP of Finance, CFO, Audit Partner | 10+ years | $180,000 - $350,000++ | Overall financial strategy, M&A activity, investor relations, risk management, firm leadership, signing audit opinions. |

_Source: Synthesized from 2023-2024 data from BLS, Salary.com, Payscale, and Robert Half Salary Guide._

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. Total compensation provides a more complete picture of your earnings. In a competitive market like New York, benefits packages can be robust.

- Annual Bonuses: This is a major component, especially in public accounting and finance. Bonuses are tied to individual, team, and company performance.

- Public Accounting: Busy season bonuses and year-end performance bonuses can range from 5% to 20% of base salary.

- Private Industry: Annual bonuses are often tied to company profitability and achieving specific key performance indicators (KPIs). These can range from 10% to 25% or more for managerial roles.

- Wall Street/Financial Services: Bonuses in this sector are legendary and can often be 50% to 100%+ of base salary for accountants in high-impact roles (e.g., product control, hedge fund accounting).

- Profit Sharing: Some firms, particularly smaller partnerships, may offer a share of the firm's profits to employees, distributed annually.

- Retirement Savings: A 401(k) or 403(b) plan is standard. A key differentiator is the employer match. A common matching formula is 50% or 100% of your contributions up to a certain percentage of your salary (e.g., 6%). This is essentially free money and a critical part of your long-term wealth building.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a given. Many New York firms also offer wellness stipends (for gym memberships), mental health support (apps like Headspace or Talkspace), and generous paid time off (PTO).

- CPA Exam and Continuing Education Support: A significant perk, especially from public accounting firms. Many will pay for CPA review courses (like Becker or Wiley), cover exam fees, and provide a bonus (often $3,000 - $5,000) for passing the exam within a certain timeframe. They also pay for the Continuing Professional Education (CPE) required to maintain the license.

When evaluating a job offer in New York, it's crucial to look beyond the base salary and calculate the value of the entire compensation package. A job with a slightly lower base salary but a massive bonus potential, excellent 401(k) match, and full CPA support might be more lucrative in the long run.

Key Factors That Influence an Accountant's Salary

The ranges provided above are wide for a reason. Your specific salary within those bands will be determined by a powerful combination of your qualifications, choices, and skills. Understanding these levers is the key to maximizing your earning potential throughout your career. This is the most critical section for anyone looking to strategically build a high-paying accounting career in New York.

### 1. Level of Education and Professional Certifications

Your academic and professional credentials are the foundation of your career and salary.

- Bachelor's Degree: A Bachelor's degree in Accounting is the standard, non-negotiable entry ticket to the profession. A degree from a highly-regarded business school can sometimes provide a slight edge or open doors to more prestigious firms right out of college.

- Master's Degree: A Master of Science in Accounting (MSA) or Master of Science in Taxation (MST) can provide a salary bump of 5% to 15%. More importantly, a Master's degree is the most common way for students to meet the 150-credit-hour requirement to become a licensed CPA in New York and most other states.

- The CPA License (Certified Public Accountant): This is the gold standard and the single most impactful credential you can earn. Becoming a CPA can increase your salary by 10% to 25% or more over your non-certified peers. It is a legal requirement for anyone who wants to sign an audit opinion in public accounting and is highly coveted in private industry for senior-level roles (Controller, CFO). It signals a high level of expertise, ethical commitment, and professional dedication. The salary of an accountant in New York with a CPA license is significantly higher across all industries and experience levels.

- Other Valued Certifications: While the CPA is king, other certifications can boost your salary in specialized niches:

- CMA (Certified Management Accountant): Ideal for corporate accountants in manufacturing, operations, and strategic management. Focuses on internal decision-making.

- CIA (Certified Internal Auditor): The premier certification for internal audit professionals, focusing on risk, controls, and governance.

- CFA (Chartered Financial Analyst): While more of a finance designation, it's highly valuable for accountants working in asset management, investment banking, and equity research.

- CISA (Certified Information Systems Auditor): Essential for IT auditors who assess technology controls and cybersecurity risks.

### 2. Years of Experience and Career Progression

As shown in the table earlier, experience is a direct driver of salary growth. The progression is typically non-linear; the biggest jumps in salary often occur when you change roles or get promoted.

- 0-2 Years (Staff/Associate): The learning phase. Your value is in your potential and willingness to learn. Salary is fairly standardized.

- 2-5 Years (Senior): This is a critical inflection point. You are now a proficient professional who can work independently and mentor others. This is when you often see your first significant salary jump. It's also a popular time for accountants to move from public accounting to a private industry role, often securing a 15-20% pay increase.

- 5-10 Years (Manager): You transition from "doing" the work to "managing" the work and the people. You take on budget responsibility, team leadership, and more strategic tasks. Salaries at this level in NYC easily cross the $150,000 mark.

- 10+ Years (Director/Controller/Partner): Your value is now primarily strategic. You are responsible for the financial health of a department, a division, or the entire company. Earning potential at this level is vast, with compensation heavily tied to performance and company success.

### 3. Geographic Location Within New York

While "New York" is often used synonymously with "New York City," salary levels vary significantly across the state. The cost of living is the primary driver of these differences.

- New York City (Manhattan, Brooklyn, Queens, Bronx, Staten Island): The epicenter. Highest salaries and highest cost of living. This is where you'll find the top-tier figures quoted in this article.

- Suburbs (Long Island, Westchester County): Salaries here are very strong, often 90-95% of Manhattan salaries, as many large corporations have headquarters or major offices in these areas. The slightly lower pay is often offset by a different lifestyle and cost-of-living calculation (e.g., housing, transportation).

- Upstate Cities (Albany, Buffalo, Rochester, Syracuse): Salaries in these metropolitan areas are lower than in the downstate region but are still competitive and often provide a better "real" salary when adjusted for a much lower cost of living.

- According to BLS data, the median accountant salary in the Albany-Schenectady-Troy area is around $81,540.

- In the Buffalo-Cheektowaga-Niagara Falls area, the median is $77,410.

- In the Rochester area, the median is $79,840.

An accountant earning $80,000 in Buffalo may have significantly more disposable income than an accountant earning $100,000 in Manhattan.

### 4. Company Type & Size

Where you work is as important as what you do.

- Public Accounting - The "Big Four" (Deloitte, PwC, EY, KPMG): These firms are known for paying top-of-market starting salaries to attract the best talent. They offer unparalleled training, prestigious clients, and a clear path to a high salary. The trade-off is often a demanding work-life balance, especially during busy season.

- Public Accounting - Mid-Size and Regional Firms: Firms like Grant Thornton, BDO, or strong regional players (e.g., EisnerAmper, Mazars) offer very competitive salaries, sometimes just a slight step below the Big Four. They often provide a better work-life balance and more diverse client exposure earlier in one's career.

- Private Industry (Corporate Accounting): This is a massive category with wide salary variations.

- Fortune 500 Companies: Large, established corporations offer high salaries, excellent benefits, and stability. Roles here can be specialized and siloed.

- Financial Services (Investment Banks, Hedge Funds, Private Equity): This is the most lucrative sector for accountants. Roles like product controller, fund accountant, or valuation specialist can command salaries and bonuses far exceeding other industries.

- Tech Startups: May offer lower base salaries initially but compensate with potentially valuable stock options. The work environment is often dynamic and less structured.

- Government: Accountants working for federal agencies (like the IRS or SEC) or state/city agencies (like the NY State Comptroller's Office) typically earn less than their private-sector counterparts. However, they are compensated with exceptional job security, predictable hours, and excellent government pensions and benefits.

- Non-Profit: Salaries in the non-profit sector are generally the lowest. However, the work can be incredibly rewarding for those passionate about a specific mission.

### 5. Area of Specialization

General accountants are always needed, but specialized experts command a premium. The more complex, in-demand, and profitable your niche, the higher your pay.

- Tax (especially International or M&A Tax): Highly complex and constantly changing, tax specialists are always in demand. Those who can navigate the intricacies of international tax law or the tax implications of mergers and acquisitions are among the highest-paid accountants.

- Forensic Accounting: These financial detectives investigate fraud, financial crimes, and disputes. It's a high-stakes field that requires a unique skillset and pays accordingly.

- Advisory/Consulting (Transaction Services, M&A): Accountants who work on due diligence for mergers and acquisitions play a critical role in high-value corporate deals. This is a pressure-cooker environment with pay to match.

- IT Audit / Risk Assurance: In an age of cyber threats and data privacy regulations, accountants who can bridge the gap between finance and technology are invaluable. Expertise in SOX controls, cybersecurity frameworks, and ERP systems (like SAP or Oracle) is highly compensated.

- Valuation Services: Specialists who determine the value of businesses, intellectual property, and complex financial instruments are crucial in transactions and litigation, and are well-rewarded for their expertise.

### 6. In-Demand Skills

Beyond your formal qualifications, a specific set of technical and soft skills can dramatically increase your market value.

- Advanced Technical Skills:

- Enterprise Resource Planning (ERP) Systems: Deep knowledge of systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is a huge plus.

- Data Analytics and Visualization: The ability to use tools like Tableau, Power BI, or Alteryx to analyze large datasets and create insightful dashboards is no longer a "nice-to-have"—it's a core competency for the modern accountant.

- Advanced Excel: Mastery of pivot tables, complex formulas, Power Query, and VBA scripting remains a fundamental and highly valued skill.

- Programming/Scripting: Basic knowledge of Python or SQL to automate tasks and query databases can set you apart and lead to higher-paying roles in FinTech or data-heavy environments.

- High-Value Soft Skills:

- Communication and Presentation: You must be able to explain complex financial concepts to non-financial stakeholders.

- Business Acumen: Understanding the "why" behind the numbers—the business model, industry trends, competitive landscape—is what elevates you from an accountant to a strategic partner.

- Problem-Solving: The ability to identify a discrepancy, diagnose the root cause, and propose a solution is the essence of high-value accounting work.

- Negotiation and Influence: Particularly important at the managerial level for budgeting, dealing with auditors, and leading teams.

By strategically developing these six areas, you can actively steer your career towards the highest possible salary of an accountant in New York.

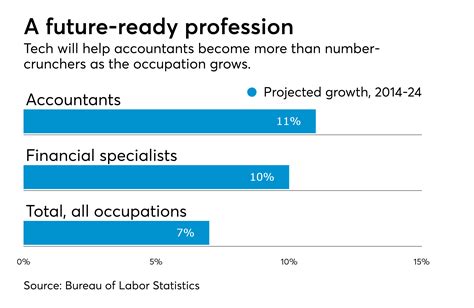

Job Outlook and Career Growth for Accountants in New York

A high salary is attractive, but long-term career viability is paramount. Fortunately, the accounting profession offers both stability and significant growth potential, especially within the robust New York economy.

### National Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects that employment of accountants and auditors will grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. This is expected to result in about 126,500 openings for accountants and auditors each year, on average, over the decade.

While 4% may not sound explosive, it's important to understand the drivers behind this steady demand:

1. Economic Growth: As the economy grows, more businesses are created that require accounting services to manage their finances and comply with regulations.

2. Globalization: Increasing international trade and business operations create a need for accountants skilled in international finance, trade laws, and complex tax codes.

3. Complex Regulatory Environment: Ever-changing tax laws