A career as a financial advisor offers a unique blend of analytical challenge, client-facing interaction, and significant earning potential. For those considering a path with a major firm like Equitable Advisors, understanding the compensation structure is a critical first step. While salaries can vary widely, the median pay for financial advisors sits around $99,580 per year, with top professionals earning well into the six-figure range.

This in-depth guide will break down the salary you can expect as a financial advisor, the key factors that influence your income, and the bright future this career path holds.

What Does a Financial Advisor at a Firm Like Equitable Do?

At its core, a financial advisor helps individuals and organizations achieve their long-term financial goals. At a comprehensive financial services firm like Equitable Advisors, this role is multifaceted. An advisor's day-to-day responsibilities often include:

- Client Consultation: Meeting with clients to understand their financial situation, from income and assets to expenses and long-term aspirations like retirement, education funding, or estate planning.

- Financial Planning: Developing personalized, strategic plans that outline steps for clients to reach their objectives.

- Investment Management: Recommending and managing investment products such as stocks, bonds, mutual funds, and annuities.

- Risk Management: Advising on and providing insurance products, including life, disability, and long-term care insurance, to protect clients from unforeseen events.

- Building a Practice: A significant part of the job, especially early on, involves networking and prospecting to build a book of clients.

This is not a typical 9-to-5 desk job; it's an entrepreneurial career built on trust, expertise, and long-term relationships.

Average Financial Advisor Salary

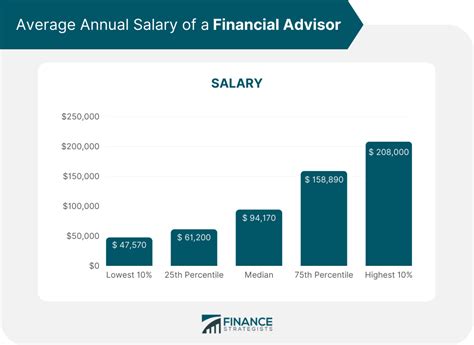

When discussing compensation for a financial advisor, it's crucial to understand that "salary" is often a combination of a base salary, commissions, and bonuses. This performance-based structure means there is a very wide income range.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Personal Financial Advisors was $99,580 as of May 2023. The BLS provides a clear picture of the income spectrum:

- Lowest 10%: Earned less than $47,780

- Median 50%: Earned $99,580

- Highest 10%: Earned more than $239,200

Data from salary aggregators for Equitable Advisors specifically reflects this industry-wide model. For instance, Glassdoor reports a typical total pay range for a Financial Professional at Equitable Advisors from $75,000 to $178,000 per year, which includes base salary, commission, and bonuses. Entry-level advisors often start with a modest base salary or training allowance, with their income growing exponentially as they build their client base and assets under management (AUM).

Key Factors That Influence Salary

Your earnings as a financial advisor are not static. They are directly influenced by a combination of your qualifications, experience, and strategic career choices.

Level of Education

A bachelor's degree in a field like finance, economics, business, or accounting is the standard entry point. While not strictly required, a Master of Business Administration (MBA) or a specialized master's degree can enhance credibility and open doors to roles serving more affluent clients, potentially leading to a higher starting income.

More important than the degree itself are professional certifications. Earning designations like the Certified Financial Planner™ (CFP®), Chartered Financial Consultant® (ChFC®), or Chartered Life Underwriter® (CLU®) is one of the most significant drivers of increased income. These certifications demonstrate a high level of expertise and ethical commitment, which builds client trust and justifies higher fees or commissions.

Years of Experience

Experience is arguably the single most important factor in a financial advisor's compensation.

- Entry-Level (0-3 years): Advisors focus on learning the trade, passing licensing exams (like the SIE, Series 7, and Series 66), and building their client book. Income is often lower during this phase and may be supplemented by training allowances from the firm.

- Mid-Career (4-10 years): By this stage, an advisor has an established practice, a solid referral network, and a growing amount of assets under management. Income potential increases dramatically as their practice matures.

- Senior/Veteran (10+ years): Top-tier advisors manage substantial AUM, often serving high-net-worth individuals and business owners. Their income is derived from recurring fees and commissions from a large, stable client base, placing them in the top earning percentile.

Geographic Location

Where you build your practice matters. Advisors in major metropolitan areas with a high concentration of wealth tend to have higher earning potential. According to Salary.com, financial advisor salaries in cities like New York, NY, and San Francisco, CA, are significantly higher than the national average. This is due to both a higher cost of living and greater access to affluent clientele.

Company Type

Working for a large, established firm like Equitable Advisors provides significant advantages, including brand recognition, a structured training program, marketing support, and a wide array of financial products. This can be an excellent platform for launching a successful career. Alternatively, some advisors may eventually choose to work for smaller, independent Registered Investment Advisor (RIA) firms, which may offer greater autonomy and a different payout structure.

Area of Specialization

Generalist advisors can do well, but specialists often become the highest earners. By developing deep expertise in a specific niche, you become the go-to expert for a particular type of client. High-income specializations include:

- Retirement Planning: Especially for baby boomers and pre-retirees.

- High-Net-Worth Individuals (HNWI): Serving clients with complex investment and estate planning needs.

- Business Owners: Advising on succession planning, employee benefits, and executive compensation.

- Estate Planning: Working with clients to create a lasting legacy and minimize tax burdens.

Job Outlook

The future for financial advisors is incredibly bright. The BLS projects that employment for personal financial advisors will grow by 13% from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth is driven by several factors. As the large baby-boomer generation enters retirement, the demand for sound financial and retirement planning advice will soar. Furthermore, the increasing complexity of investments and the shift away from traditional pensions toward individual retirement accounts like 401(k)s and IRAs mean more people need professional guidance than ever before.

Conclusion

A career as a financial advisor at a firm like Equitable Advisors offers a path of purpose and significant financial reward. While the initial years require dedication and hard work to build a practice, the long-term potential is exceptional.

Key takeaways for anyone considering this career:

- High Earning Potential: Your income is directly tied to your performance, with top advisors earning well over $200,000 annually.

- Experience is King: Your compensation will grow significantly as you gain experience and build your client base.

- Certifications Drive Success: Pursuing advanced designations like the CFP® is a proven way to increase your expertise and income.

- Strong Job Growth: You will be entering a profession with high demand and a secure long-term outlook.

If you are a self-motivated individual with a passion for finance and a desire to help others, the role of a financial advisor is a challenging and highly rewarding career to pursue.