The role of Chief Operating Officer (COO) represents the pinnacle of operational leadership, a position of immense responsibility, strategic influence, and, consequently, significant financial reward. For ambitious professionals who thrive on optimizing systems, leading diverse teams, and turning a CEO's vision into tangible reality, the COO path is the ultimate career aspiration. But what does that aspiration truly translate to in terms of compensation? We're talking about a profession where a base salary well into the six figures is standard, with total compensation frequently reaching seven figures in larger organizations.

I once worked with a COO at a rapidly scaling tech firm who described her job as "being the ultimate puzzle master." She wasn't just managing departments; she was meticulously aligning the gears of sales, marketing, product, and finance to ensure the entire organizational machine moved in perfect, powerful sync. Her success was the company's success, and her compensation package rightly reflected that critical, value-driving role.

This comprehensive guide is designed to be your definitive resource on chief operating officer salaries and the career that commands them. We will move beyond simple averages to dissect the complex factors that determine a COO's earnings, explore the future outlook for this demanding profession, and provide a clear, actionable roadmap for those who dare to aim for this top-tier executive seat.

### Table of Contents

- [What Does a Chief Operating Officer Do?](#what-does-a-coo-do)

- [Average Chief Operating Officer Salary: A Deep Dive](#average-coo-salary)

- [Key Factors That Influence COO Salary](#key-factors-influencing-salary)

- [Job Outlook and Career Growth for COOs](#job-outlook-and-career-growth)

- [How to Become a Chief Operating Officer](#how-to-become-a-coo)

- [Conclusion: Is the Path to COO Right for You?](#conclusion)

What Does a Chief Operating Officer Do?

Often referred to as the "second-in-command," the Chief Operating Officer is the executive responsible for managing the company's day-to-day operations and administrative functions. While the Chief Executive Officer (CEO) is typically focused on long-term strategy, vision, and external relations (like investors and the board), the COO is the internal-facing leader who executes that vision. They are the master implementer, the operational architect, and the person who ensures the business runs efficiently, effectively, and profitably.

The specific duties of a COO can vary significantly depending on the company's size, industry, and the strengths of the CEO. However, their core responsibilities almost always revolve around these key areas:

- Strategic Execution: Translating the high-level strategic plans developed by the CEO and board into actionable, operational plans for all departments.

- Operational Oversight: Managing the core business functions, which could include manufacturing, supply chain, customer service, IT, human resources, and even sales and marketing in some structures.

- Performance Management: Establishing, monitoring, and analyzing Key Performance Indicators (KPIs) across the organization to measure and improve efficiency and profitability. They are accountable for hitting operational and financial targets.

- Process Improvement: Continuously identifying and eliminating bottlenecks, streamlining workflows, and implementing new technologies or methodologies (like Lean or Six Sigma) to enhance productivity and reduce costs.

- Leadership and Team Development: Leading and mentoring a team of senior executives (often Vice Presidents or Directors) who head various departments. They are responsible for fostering a culture of accountability, collaboration, and high performance.

- Resource Allocation: Overseeing the allocation of company resources, including budget, personnel, and technology, to ensure they are used in the most effective way to achieve business goals. This often involves deep P&L (Profit & Loss) responsibility for major segments of the business.

### A Day in the Life of a COO

To make this role more tangible, let's imagine a typical day for the COO of a $500 million manufacturing company:

- 7:30 AM - 9:00 AM: Arrive at the office. Review the daily operational dashboard, checking production outputs, supply chain logistics, quality control metrics from the previous day, and overnight customer service reports. Hold a brief "stand-up" meeting with the VPs of Operations, Supply Chain, and HR to address any immediate issues.

- 9:00 AM - 11:00 AM: Lead a quarterly business review (QBR) for the sales and production divisions. The team presents their performance against KPIs, and the COO challenges assumptions, asks probing questions, and helps brainstorm solutions for underperforming areas.

- 11:00 AM - 12:00 PM: Meet one-on-one with the CEO. They discuss progress on the strategic plan, review the financial forecast for the quarter, and align on messaging for an upcoming all-hands meeting. The CEO might float a new idea for a product line, and the COO's role is to begin thinking through the operational feasibility.

- 12:00 PM - 1:00 PM: Working lunch with the Chief Financial Officer (CFO) to review the budget for a major capital expenditure project—a new factory automation system. They scrutinize the ROI calculations and plan the presentation to the board.

- 1:00 PM - 3:00 PM: Walk the factory floor. This is a critical practice for a hands-on COO. They talk to line managers and front-line workers, observing processes firsthand and gathering qualitative feedback that data dashboards can't provide.

- 3:00 PM - 4:30 PM: Final-round interview for a new Director of Logistics. The COO is looking not just for technical skills but for cultural fit and leadership potential.

- 4:30 PM - 6:00 PM: Focus time. Respond to critical emails. Review and approve departmental budgets. Read an industry report on new supply chain technologies that could represent a competitive advantage.

- 6:00 PM onwards: Often, the day extends with networking dinners, calls with international teams in different time zones, or preparing for the next day's strategic meetings.

This is a high-stakes, high-intensity role that sits at the very heart of a business. The COO is the person who connects strategy to reality, making them one of the most critical—and highly compensated—executives in any organization.

Average Chief Operating Officer Salary: A Deep Dive

The compensation for a Chief Operating Officer is multifaceted, extending far beyond a simple annual salary. It's a comprehensive package designed to attract and retain elite operational talent, typically including a substantial base salary, performance-based bonuses, and long-term equity incentives.

Let's break down the numbers from several authoritative sources to build a clear picture of a COO's earning potential in the United States.

### National Averages and Salary Ranges

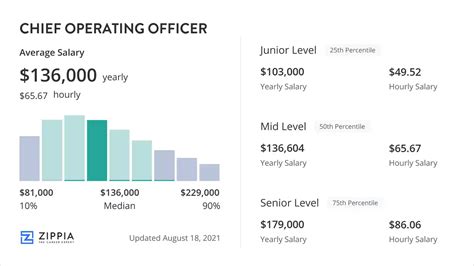

While figures vary based on the data source and methodology (e.g., self-reported data vs. HR-department data), a strong consensus emerges.

- Salary.com: This platform, which aggregates data from HR departments, reports that the median base salary for a Chief Operating Officer in the U.S. is $475,690 as of late 2023. The typical salary range falls between $362,490 and $616,190. It's crucial to note that this is *base salary* only. Total compensation, including bonuses and equity, can push these numbers significantly higher.

- Payscale: Using its self-reported salary data, Payscale puts the median COO base salary at $152,000. However, it also highlights the vast range and the importance of total compensation. Their data shows bonuses can reach up to $98,000, profit sharing can add another $50,000, and total pay can range from $76,000 on the low end (likely at very small non-profits or startups) to over $300,000 for base salary alone at the higher end.

- Glassdoor: This site, combining self-reported salaries and job listings, indicates a median total pay for a COO of $264,659 per year, with a likely range between $170,000 and $429,000. The median base salary is reported around $178,000, with additional cash compensation (bonuses, profit sharing) averaging nearly $87,000.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups COOs under the broader category of "Top Executives." For this group, the median annual wage was $101,250 in May 2022. However, the BLS notes this category is extremely broad and includes executives in much smaller organizations. More revealing is their top-end data: the highest 10 percent of top executives earned more than $239,200. For COOs at mid-to-large-sized companies, their earnings will almost always be in this top decile and often far exceed it.

Key Takeaway: A realistic median base salary for a qualified COO at a small-to-mid-sized company is likely in the $150,000 to $250,000 range. For COOs at large, publicly traded corporations, base salaries routinely exceed $400,000 or $500,000.

### Salary by Experience Level

A COO's salary is directly correlated with their years of proven leadership and operational expertise. The career path is a marathon, not a sprint, and compensation grows accordingly.

| Experience Level | Typical Base Salary Range | Key Characteristics |

| :--- | :--- | :--- |

| "Entry-Level" COO (1-4 years in an executive role) | $90,000 - $160,000 | Often a first-time COO at a startup or a small company. May have been promoted from a VP of Operations role. Focus is on establishing processes and managing a smaller team. |

| Mid-Career COO (5-14 years in executive roles) | $160,000 - $280,000 | Has a proven track record of scaling operations at one or more companies. Manages multiple complex departments and has significant P&L responsibility. Works at mid-sized or high-growth companies. |

| Senior/Late-Career COO (15+ years of experience) | $280,000 - $600,000+ | An established, veteran executive with extensive experience across multiple industries or at very large corporations. Manages global operations and is often seen as the heir apparent to the CEO. Operates at the highest strategic level. |

*(Source: Synthesized from Payscale and Salary.com data, 2023)*

### Beyond the Base: The Components of COO Compensation

For any C-suite executive, base salary is only one piece of the puzzle. The total compensation package is where the true earning potential is revealed.

- Base Salary: The guaranteed annual income. As shown above, this is substantial but is often less than 50% of the total take-home pay for COOs at successful companies.

- Annual Bonus / Short-Term Incentives (STI): This is a cash payment tied to performance over the previous year. It's typically based on a combination of company performance (e.g., hitting revenue or EBITDA targets) and individual performance (e.g., achieving specific operational efficiency goals). A target bonus for a COO might be 50% to 150% of their base salary.

- Long-Term Incentives (LTI): This is the wealth-building component and is designed to align the COO's interests with the long-term health of the company.

- Stock Options: The right to buy company stock at a predetermined price in the future. If the stock price rises, the options become valuable. This is very common in startups and tech companies.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time (typically 3-4 years). Unlike options, RSUs have value even if the stock price doesn't increase. This is more common in established, publicly traded companies.

- Profit Sharing: A percentage of the company's profits is distributed to employees. This is a direct reward for contributing to the company's bottom line.

- Executive Perks & Benefits: These are non-cash benefits that add significant value and are standard for C-suite roles.

- Executive Health Insurance: Premium health, dental, and vision plans.

- Car Allowance or Company Car: A monthly stipend or a provided vehicle.

- Generous Retirement Plans: Enhanced 401(k) matching or other deferred compensation plans.

- Professional Development Budget: Funding for executive coaching, conferences, and continuing education programs.

- Severance Package (Golden Parachute): A pre-negotiated package that provides financial security in the event of termination without cause or a change in company control.

When evaluating a COO offer, it's essential to look at the Total Target Compensation (TTC), which is the sum of the base salary, target bonus, and the annualized value of LTI grants. For a COO at a large public company, a $450,000 base salary could be accompanied by a $400,000 target bonus and a $1,000,000 annual equity grant, leading to a TTC of nearly $2 million.

Key Factors That Influence COO Salary

A COO's salary isn't a single, fixed number; it's a dynamic figure shaped by a confluence of factors. Understanding these variables is critical for both aspiring COOs aiming to maximize their earning potential and for companies seeking to attract top talent. This is the most crucial part of understanding the compensation landscape.

### 1. Level of Education and Certifications

While experience trumps all at the C-suite level, education provides the foundational credibility and strategic framework.

- Bachelor's Degree: A bachelor's degree is a non-negotiable prerequisite. Common and highly valued fields include Business Administration, Finance, Economics, Engineering, or a field directly related to the company's industry (e.g., Computer Science for a tech company).

- Master of Business Administration (MBA): An MBA is not strictly required, but it is extremely common and highly correlated with top-tier COO positions and salaries. An MBA from a prestigious, top-ranked business school (e.g., Harvard, Stanford, Wharton, Kellogg) acts as a powerful signal to boards and investors. It provides advanced training in finance, strategy, marketing, and leadership, and perhaps more importantly, grants access to an elite professional network. A COO with an MBA from a top-10 school can command a significant salary premium over one without.

- Other Advanced Degrees: A Master's in Engineering Management, Finance, or a Ph.D. in a technical field can also be highly valuable, particularly in specialized industries like biotech, deep tech, or quantitative finance.

- Professional Certifications: While less impactful than an MBA, relevant certifications demonstrate a commitment to operational excellence and specialized expertise. These can provide a marginal boost to salary and strengthen a candidate's profile.

- Lean Six Sigma (Green, Black, or Master Black Belt): Signals expertise in process improvement and waste reduction. Highly valued in manufacturing, logistics, and healthcare.

- Project Management Professional (PMP): Demonstrates proficiency in managing large, complex projects, a core function of any COO.

- Certified in Production and Inventory Management (CPIM): Crucial for COOs in industries with complex supply chains.

### 2. Years and Quality of Experience

This is, without a doubt, the single most significant factor. The COO role is not an entry-point; it is a destination arrived at after decades of progressively responsible experience.

- The 15-Year Rule: Most legitimate COO candidates have at least 15-20 years of professional experience. The salary growth trajectory reflects this long journey.

- The Career Ladder:

- Manager/Senior Manager (5-10 years experience): Base salaries from $90k - $140k. Learning to manage teams and projects.

- Director (10-15 years experience): Base salaries from $140k - $200k. Managing entire departments, developing strategy for a specific function.

- Vice President (15+ years experience): Base salaries from $180k - $300k+. Often VP of Operations, VP of Global Supply Chain, etc. Full P&L responsibility for a major business unit. This is the final and most common stepping stone to the COO role.

- Quality over Quantity: It's not just about the number of years. The *quality* of the experience is paramount. A board will pay a premium for a candidate who has:

- Successfully scaled a company: Experience taking a company from $50M to $500M in revenue is immensely valuable.

- Managed through a crisis: Leading a company through a recession, a product recall, or a major supply chain disruption demonstrates resilience and problem-solving skills.

- Led a major transformation: Overseeing a digital transformation, a post-merger integration, or a shift to a new business model is a high-impact achievement.

- International Experience: For global companies, experience managing cross-cultural teams and navigating international regulations is a major salary driver.

### 3. Geographic Location

Where a company is headquartered has a dramatic impact on COO compensation, largely driven by the local cost of living and the concentration of high-paying industries and large companies.

- Top-Tier Metropolitan Areas: These cities are home to major corporate headquarters, a thriving tech scene, and a high cost of living, all of which drive executive salaries upward. According to Salary.com's data, being a COO in these locations can increase your salary by 20-40% or more compared to the national average.

- San Francisco / San Jose, CA: The epicenter of the tech world. Highest demand for operations executives who can scale fast-growing companies.

- New York, NY: The hub of finance, media, and global commerce. Home to countless Fortune 500 headquarters.

- Boston, MA: A major center for biotech, healthcare, and technology.

- Los Angeles, CA: A hub for entertainment, media, and logistics.

- Seattle, WA: Home to tech giants like Amazon and Microsoft.

- Mid-Tier & Lower-Paying Areas: Salaries will generally be lower in smaller cities and states with a lower cost of living and fewer large corporations. However, a COO role in a smaller market can still be extremely lucrative relative to the local economy.

Illustrative City Comparison for a COO (Median Base Salary)

| City | Median Base Salary | Percentage vs. National Median |

| :--- | :--- | :--- |

| San Francisco, CA | $593,690 | +24.8% |

| New York, NY | $573,732 | +20.6% |

| Boston, MA | $538,062 | +13.1% |

| Chicago, IL | $496,629 | +4.4% |

| Dallas, TX | $477,105 | +0.3% |

| Miami, FL | $461,894 | -2.9% |

*(Source: Salary.com, late 2023 data)*

### 4. Company Type, Size, and Industry

The context of the company is a massive determinant of COO pay.

- Company Size (Revenue/Employees): This is a straightforward correlation. More revenue, more employees, more complexity = higher pay.

- Startup (Pre-Series B): $120k - $200k base salary. Compensation is heavily weighted towards equity (stock options). High risk, high potential reward. The COO is often a "jack-of-all-trades."

- Mid-Sized Company ($50M - $500M revenue): $220k - $350k base salary. Solid base pay with significant cash bonus potential and meaningful equity. The role is more defined, focused on scaling established processes.

- Large Corporation ($500M - $10B+ revenue): $350k - $700k+ base salary. Enormous total compensation packages with multi-million dollar potential through bonuses and RSUs. The role is highly strategic, often overseeing global operations.

- Company Type (Public vs. Private vs. Non-Profit):

- Publicly Traded: Generally the highest paying. Salaries are public record (in proxy statements for top executives) and are benchmarked competitively to retain talent. Huge emphasis on stock performance.

- Private/PE-Backed: Highly competitive salaries, often with compensation tied directly to an "exit event" (IPO or acquisition). Private Equity firms are known for paying top dollar for COOs who can drive rapid operational improvements and EBITDA growth.

- Non-Profit: The lowest paying in terms of cash compensation. Base salaries might range from $100k - $250k even for large organizations. The reward is often mission-driven, though benefits can be excellent.

- Industry: The profitability and growth profile of the industry play a huge role.

- High-Paying Industries: Technology (SaaS, FinTech), Financial Services (Hedge Funds, Private Equity), Biotechnology & Pharmaceuticals, and Healthcare. These industries are either high-growth, high-margin, or both, and can afford to pay a premium for top operational talent.

- Mid-Range Industries: Manufacturing, Consumer Packaged Goods (CPG), Retail, and Professional Services.

- Lower-Paying Industries: Education, Government, and Non-Profit sectors.

### 5. Area of Specialization (The "Flavor" of the COO)

Not all COOs are the same. Their background and specific operational expertise can command different salary levels depending on the company's needs.

- The Commercial COO: Rises through the ranks of sales and marketing. Strong at go-to-market strategy, revenue operations, and scaling sales teams. Highly sought after in SaaS and other high-growth companies.

- The Technical/Product COO: Comes from an engineering, product management, or IT background. Excels at managing product development cycles, R&D, and technical infrastructure. Invaluable for technology-driven companies.

- The Finance-Focused COO: Often a former CFO. Masterful at P&L management, financial controls, M&A integration, and capital allocation. A top choice for PE-backed firms or companies undergoing a financial turnaround.

- The "Classic" Operations COO: An expert in supply chain, logistics, and manufacturing. The traditional mold of a COO, essential for any company that makes and moves physical goods.

A tech company trying to scale its user base will pay a premium for a Commercial COO, while a PE firm that just bought a distressed manufacturing company will pay top dollar for a Finance-Focused or Classic Operations COO.

### 6. In-Demand, High-Value Skills

Beyond general leadership, certain specific skills can dramatically increase a COO's value and, therefore, their salary.

- P&L Management: The ability to own and manage a full Profit & Loss statement is non-negotiable and the primary skill that separates a VP from a true C-suite executive.

- Scalability & Growth Hacking: A demonstrated ability to build systems, teams, and processes that can support hyper-growth without breaking.

- Mergers & Acquisitions (M&A) Integration: The skill of successfully merging the operations, cultures, and systems of two companies post-acquisition is rare and highly lucrative.

- Digital Transformation: Leading a traditional company's shift to digital processes