Salaried vs. Hourly: A Comprehensive Guide to Federal Pay Guidelines and Your Career

Understanding your employee classification is one of the most critical yet overlooked aspects of your professional life. Whether you are classified as "salaried" or "hourly" dictates not just how you are paid, but also your eligibility for overtime, your rights under federal law, and often, your overall earning potential. This distinction is governed by a foundational piece of U.S. labor legislation: the Fair Labor Standards Act (FLSA).

Misunderstanding these guidelines can lead to lost income for employees and significant legal risk for employers. This guide will demystify the federal rules, explain how your classification is determined, and explore how it impacts your salary and career trajectory.

What Does It Mean to Be Salaried vs. Hourly?

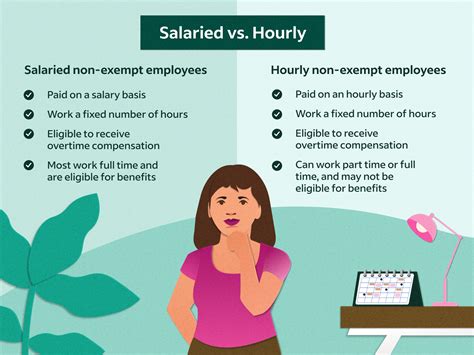

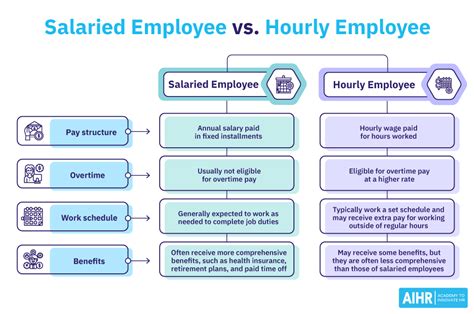

At its core, the distinction is about how your pay is calculated and whether you are eligible for overtime. These classifications are more formally known as Exempt (typically salaried) and Non-Exempt (typically hourly).

- Hourly (Non-Exempt) Employees: You are paid a set rate for each hour worked. Under the FLSA, you must be paid at least the federal minimum wage for all hours worked and are entitled to overtime pay at a rate of 1.5 times your regular hourly wage for any hours worked over 40 in a single workweek. Your paycheck can vary from week to week depending on the exact number of hours you work.

- Salaried (Exempt) Employees: You are paid a fixed, predetermined amount of money each pay period, regardless of the quantity or quality of your work. This salary is your total compensation for the job, even if you work more than 40 hours in a week. To be legally classified as exempt, you must meet specific criteria related to your salary amount and job duties, which we will explore below.

Average Salary: How Classification Impacts Earnings

It's impossible to state a single "average salary" for hourly vs. salaried workers, as the roles they encompass are vastly different. However, we can analyze how the classification structure itself influences compensation.

Salaried, exempt positions are often associated with professional, managerial, and administrative roles that typically command higher base incomes. Hourly, non-exempt roles span from minimum-wage service jobs to highly skilled trades that can earn substantial income, especially with overtime.

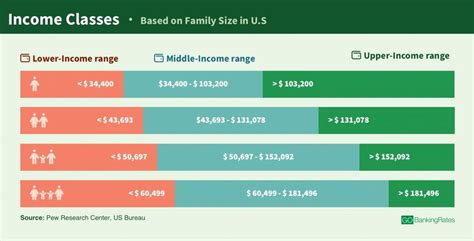

According to the U.S. Bureau of Labor Statistics (BLS), in the first quarter of 2024, the median usual weekly earnings for full-time wage and salary workers was $1,139, which translates to an annual income of $59,228. While this figure includes both hourly and salaried workers, roles classified as exempt generally fall in the upper half of this range and beyond.

For example, a salaried Marketing Manager might have a median salary of $74,590, according to Payscale, while an hourly Administrative Assistant may have a median wage of $20.15 per hour (approximately $41,912 annually). However, if that Administrative Assistant works significant overtime, their total earnings could increase substantially, a benefit the salaried manager does not receive.

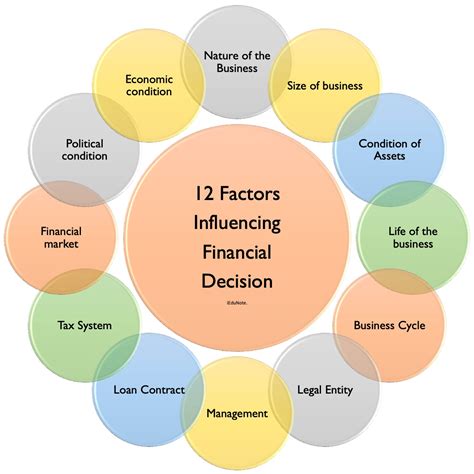

Key Factors That Determine Your Classification and Influence Salary

Your classification as exempt or non-exempt is not a choice made by you or your employer. It is a strict legal definition determined by the Department of Labor's (DOL) criteria under the FLSA. For an employee to be considered "exempt" from overtime, they must meet all three of the following tests.

###

1. The Salary Basis Test

To be exempt, an employee must be paid on a salary basis. This means they receive a fixed, predetermined salary each pay period that is not subject to reduction because of variations in the quality or quantity of the work performed. If an employer docks an employee's pay for working fewer than 40 hours, they may violate this test and invalidate the exempt status.

###

2. The Salary Level Test

This is a straightforward dollar amount. As of the latest federal guidelines, to be classified as exempt, an employee must earn a salary of at least $684 per week, which amounts to $35,568 per year.

Important Note: The Department of Labor has proposed a new rule in 2024 that would significantly increase this threshold. It's critical for both employees and employers to stay informed about these potential changes, as they could reclassify millions of workers from salaried (exempt) to hourly (non-exempt). Furthermore, some states, like California and New York, have much higher salary thresholds that employers must adhere to.

###

3. The Job Duties Test

This is the most complex factor. In addition to meeting the salary tests, an employee's specific job responsibilities must primarily involve exempt-level work. The FLSA outlines several categories:

- Executive Exemption: The employee’s primary duty must be managing the enterprise or a recognized department. They must customarily direct the work of at least two other full-time employees and have the authority to hire or fire (or their recommendations must be given particular weight).

- Administrative Exemption: The primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. The role must also include the exercise of discretion and independent judgment with respect to matters of significance. Examples include roles in HR, finance, and marketing.

- Professional Exemption: This splits into two types:

- Learned Professional: The primary duty requires advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., doctors, lawyers, engineers, accountants).

- Creative Professional: The primary duty requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., writers, artists, musicians).

- Computer Employee Exemption: The employee must be a skilled worker in the computer field, working as a computer systems analyst, computer programmer, software engineer, or other similarly skilled role. They can be paid hourly (at a rate not less than $27.63 per hour) or on a salary basis meeting the standard threshold.

- Outside Sales Exemption: The primary duty must be making sales or obtaining orders, and the employee must be customarily and regularly engaged away from the employer’s place of business.

Job Outlook and Evolving Regulations

The legal landscape governing employee classification is dynamic. As mentioned, the Department of Labor regularly reviews and proposes updates to the FLSA, particularly the salary level test. The trend is toward increasing the salary threshold, which would expand overtime eligibility to more workers.

This means the "job outlook" is less about the creation of new roles and more about the reclassification of existing ones. For professionals earning between $36,000 and $60,000, these regulatory changes are paramount. If the threshold is raised, many salaried employees could become non-exempt, making them eligible for overtime pay and fundamentally changing their compensation structure. Staying informed on these DOL rule changes is crucial for career and financial planning.

Conclusion: Know Your Rights and Your Worth

Understanding whether you should be a salaried or hourly employee is fundamental to ensuring you are paid fairly and legally. The key takeaways for any professional are:

- It's Not a Choice: Your classification is determined by federal and state law, based on your salary and, most importantly, your job duties.

- The Three Tests Are Crucial: The Salary Basis, Salary Level, and Job Duties tests are the definitive criteria for an exempt classification.

- Know Your Duties: Don't be fooled by a job title. An "Administrative Manager" who primarily performs clerical work is likely misclassified. Your actual day-to-day responsibilities are what matter.

- Stay Informed: Regulations change. A job that is legally exempt today might become non-exempt tomorrow due to a new DOL rule.

By arming yourself with this knowledge, you can better advocate for yourself in the workplace, negotiate your compensation effectively, and ensure you are receiving all the pay you have rightfully earned. For employers, strict adherence to these guidelines is not just good practice—it is essential for legal compliance and fostering a fair and transparent work environment.