Unlocking Your Earning Potential: A Deep Dive into Finance Consultant Salaries

Finance consulting is a highly sought-after career path, renowned for its intellectual challenges, significant impact on businesses, and, notably, its substantial earning potential. If you're drawn to the world of finance and strategy, you're likely wondering what compensation you can expect. The short answer: a finance consultant's salary is impressive, often starting strong and growing exponentially with experience, with top performers earning well into the six-figure range and beyond.

This guide will break down everything you need to know about a finance consultant's salary, from the national average to the key factors that can dramatically increase your take-home pay.

What Does a Finance Consultant Do?

Before we dive into the numbers, let's clarify the role. A finance consultant is a professional expert who provides financial guidance and strategic advice to organizations or individuals. Their primary goal is to improve their client's financial health and performance.

Responsibilities are diverse and can include:

- Analyzing financial statements and market data.

- Developing financial models and forecasts.

- Advising on investment strategies, mergers, and acquisitions (M&A).

- Identifying opportunities for cost reduction and profit improvement.

- Managing financial risk and ensuring regulatory compliance.

- Guiding capital allocation and corporate restructuring.

In essence, they are expert problem-solvers, hired to bring an objective, data-driven perspective to complex financial challenges.

Average Finance Consultant Salary

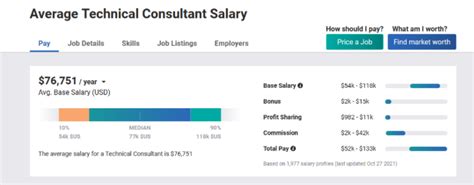

The compensation for a finance consultant is highly competitive but varies widely. It's crucial to look at the full picture, which includes a base salary plus significant potential bonuses, profit-sharing, and commissions.

According to the latest data from leading salary aggregators (as of late 2023/early 2024):

- Salary.com reports the median salary for a Finance Consultant in the United States is approximately $101,500, with a typical range falling between $91,000 and $112,800.

- Payscale indicates an average base salary of around $93,000 per year. However, it notes that total pay, including bonuses and profit sharing, can push the upper end to over $150,000.

- Glassdoor places the average total pay (base plus additional compensation) for a Finance Consultant at $124,500 per year.

This data reveals a typical pathway: an entry-level consultant might start in the $75,000 to $95,000 range, while a senior consultant with significant experience can easily command $150,000 to $250,000+ annually, especially when performance bonuses are factored in.

Key Factors That Influence Salary

Your salary isn't just one number; it's a dynamic figure influenced by several critical factors. Understanding these variables is key to maximizing your earning potential.

###

Level of Education

Your educational background is the foundation of your consulting career.

- Bachelor’s Degree: A bachelor's degree in finance, economics, accounting, or a related field is the standard entry requirement.

- Master’s Degree (MBA): Earning a Master of Business Administration (MBA), particularly from a top-tier business school, is one of the most significant salary accelerators. Companies heavily recruit from these programs and offer substantially higher starting salaries and signing bonuses.

- Professional Certifications: Holding prestigious certifications demonstrates a high level of expertise and can lead to higher pay. The most respected include the Chartered Financial Analyst (CFA), which is the gold standard for investment analysis, and the Certified Public Accountant (CPA), crucial for roles involving accounting and auditing.

###

Years of Experience

Experience is arguably the most powerful driver of salary growth in consulting. The career ladder is well-defined, with compensation increasing at each level.

- Entry-Level (0-2 years): Often an "Analyst" or "Associate Consultant." Focuses on data gathering, financial modeling, and supporting senior team members.

- Mid-Career (3-7 years): "Consultant" or "Senior Consultant." Manages project modules, has more client-facing responsibility, and begins to develop a specialization.

- Senior/Managerial (8+ years): "Manager," "Principal," or "Partner." Leads entire projects, manages client relationships, and is responsible for business development. At this level, performance-based bonuses make up a very large portion of total compensation.

###

Geographic Location

Where you work matters. Salaries are adjusted for the cost of living and the concentration of financial activity. Major financial hubs offer the highest salaries to attract top talent.

Top-paying metropolitan areas in the U.S. include:

- New York, NY

- San Francisco, CA

- Boston, MA

- Chicago, IL

- Los Angeles, CA

Working in these cities can result in a salary that is 15-30% higher than the national average.

###

Company Type

The type of firm you work for has a profound impact on your compensation structure and career trajectory.

- MBB (McKinsey, Bain, & BCG): These top-tier strategy consulting firms are the most prestigious and highest-paying, but they also have the most demanding work environments. While not exclusively "finance" firms, their financial practice areas are extremely lucrative.

- Big Four (Deloitte, PwC, EY, & KPMG): These accounting and professional services giants have massive financial advisory and consulting arms. They offer competitive salaries, excellent training, and a structured career path.

- Boutique & Specialized Firms: These smaller firms focus on a specific niche, such as M&A advisory, risk management, or forensic accounting. Highly successful boutique firms can offer compensation packages that rival or even exceed those of larger players, often with a better work-life balance.

- In-House Corporate Consulting: Large corporations often have internal strategy and finance teams that function as consultants. These roles typically offer strong, stable salaries and excellent benefits, though the bonus ceiling may be lower than at top-tier external consulting firms.

###

Area of Specialization

Within finance consulting, some practice areas are more lucrative than others due to the complexity and value they deliver to clients.

- Mergers & Acquisitions (M&A): Advising on multi-million or billion-dollar deals is highly complex and commands top dollar.

- Corporate Finance & Restructuring: Helping companies optimize their capital structure or navigate financial distress is a high-stakes, high-reward field.

- Private Equity & Venture Capital Advisory: Consultants who advise these investment funds on deal sourcing, due diligence, and portfolio company improvement are among the highest earners.

- Risk Management: With increasing regulation and market volatility, experts who can manage financial, operational, and regulatory risk are in high demand.

Job Outlook

The future for finance consultants is bright. The U.S. Bureau of Labor Statistics (BLS) projects strong growth for related professions. For Management Analysts (a category that includes many consultants), employment is projected to grow 10 percent from 2022 to 2032, much faster than the average for all occupations.

The BLS cites the need for organizations to control costs and operate more efficiently as a primary driver for this growth. As the global economy becomes more complex, the demand for specialized financial expertise will only increase, ensuring robust job security and continued salary growth for skilled consultants.

Conclusion

A career as a finance consultant is undoubtedly demanding, but it offers a clear path to exceptional financial rewards and professional growth. Your earning potential is not static; it is a direct reflection of the strategic choices you make.

To maximize your salary, focus on:

- Building a strong educational foundation, topped with an MBA or a key certification like the CFA.

- Gaining diverse experience and moving up the well-defined consulting career ladder.

- Targeting high-paying industries and locations, such as M&A consulting in New York City.

- Choosing a firm that aligns with your career goals, whether it's the prestige of a top-tier firm or the specialization of a boutique.

For those with a sharp analytical mind and a drive to solve complex problems, finance consulting remains one of the most rewarding and lucrative careers available today.