Introduction

For many ambitious professionals drawn to the high-octane world of automotive retail, the ultimate goal isn't just selling cars—it's running the most profitable department in the entire dealership. This is the realm of the Finance & Insurance (F&I) Manager. It’s a role shrouded in a bit of mystery, often seen as the final step in a long and sometimes stressful car-buying process. But for those inside the glass-walled office, it represents the pinnacle of earning potential, strategic influence, and professional challenge. If you're wondering about a car dealership finance manager salary, you're asking the right question, because this career path offers one of the most direct links between performance and exceptional financial reward in the retail world.

The compensation for a skilled F&I manager is not just a salary; it's a dynamic package heavily influenced by commission, making the earning potential vast. While entry-level or underperforming managers might start around $50,000 to $70,000, it's not uncommon for experienced, high-performing F&I professionals at successful dealerships to earn well into six figures, with top-tier managers regularly exceeding $200,000 or even $300,000 annually. This immense range is precisely why understanding the role, the required skills, and the influencing factors is so critical.

I once had a conversation with a veteran General Manager of a large dealership group who called the F&I office "the heartbeat of the dealership's profitability." He explained that while the sales floor creates the opportunity, the F&I department captures the value, protecting the dealership from losses and generating a significant portion of its net profit. It was a powerful reminder that this role is far more than just paperwork; it’s the strategic financial engine of the entire operation.

This guide will demystify the F&I manager role completely. We will dissect the salary, explore the factors that drive compensation, map out the career trajectory, and provide a clear, actionable roadmap for anyone aspiring to sit in that chair.

### Table of Contents

- [What Does a Car Dealership Finance Manager Do?](#what-do-they-do)

- [Average Car Dealership Finance Manager Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-get-started)

- [Conclusion: Is This High-Stakes Career Right for You?](#conclusion)

What Does a Car Dealership Finance Manager Do?

Often referred to as an "F&I Manager," the Finance & Insurance Manager is a high-stakes sales professional who operates at the intersection of finance, legal compliance, and customer relations within a car dealership. After a customer agrees on a vehicle's price with a salesperson, they are handed off to the F&I manager. This transition moves the process from the "front-end" (the profit made on the vehicle itself) to the "back-end" (the profit made from financing and aftermarket products).

The F&I manager's office is frequently called "the box," and their primary objective is twofold: to secure financing for the customer's purchase and to sell a portfolio of aftermarket products and services. This dual role requires a unique blend of skills. They must be part financial advisor, part legal expert, and part master salesperson, all while ensuring a seamless and positive customer experience.

Core Responsibilities and Daily Tasks:

- Securing Customer Financing: The F&I manager takes the customer's credit application and "shops" it to a network of lenders (banks, credit unions, and captive finance companies like Toyota Financial Services or Ford Motor Credit). Their goal is to find a loan approval that is favorable for both the customer and the dealership. A key part of this is negotiating the interest rate, as the dealership can often earn a commission (known as "reserve" or "rate spread") from the lender for the loan.

- Selling Aftermarket Products: This is a major source of profit. The F&I manager presents and sells a menu of optional products, including:

- Extended Vehicle Service Contracts (Warranties): Protects the customer from costly repair bills after the factory warranty expires.

- Guaranteed Asset Protection (GAP) Insurance: Covers the difference between what an insurance company pays for a totaled or stolen vehicle and what the customer still owes on the loan.

- Tire & Wheel Protection: Covers repair or replacement of tires and rims damaged by road hazards.

- Paint & Fabric Protection: A sealant applied to the vehicle to protect it from environmental damage.

- Pre-paid Maintenance Plans: Allows customers to pay for future oil changes and services upfront.

- Ensuring Legal Compliance: This is a non-negotiable, critical function. The F&I manager is responsible for ensuring all paperwork is completed accurately and in accordance with a vast array of federal and state regulations, including the Truth in Lending Act (TILA), the Gramm-Leach-Bliley Act (GLBA), and various "Red Flag" rules for identity theft prevention. Errors can lead to massive fines and legal trouble for the dealership.

- Completing and Verifying All Paperwork: They meticulously handle the bill of sale, retail installment sales contract, odometer statements, and all other legal documents required to transfer ownership and secure the lien for the lender.

### A Day in the Life of an F&I Manager

To make this more concrete, here’s a snapshot of a typical Tuesday:

- 9:00 AM: Arrive at the dealership. Review deals from the previous night and check the funding status of pending contracts. Meet with the sales managers to discuss the day's goals, current financing promotions from manufacturers, and any challenging deals on the board.

- 10:30 AM: The first customer of the day comes in. A salesperson has just finalized a price on a new SUV. You greet the customer, build rapport, and review their credit application.

- 11:00 AM: While the car is being detailed, you submit the application to three different lenders. Two come back with approvals. You analyze the offers to see which one provides the best combination of a competitive rate for the customer and potential profit for the dealership.

- 11:45 AM: You invite the customer back into your office. You present the financing terms clearly. Then, you transition to your product menu presentation, explaining the value of an extended warranty and GAP insurance based on their driving habits and loan term. After a brief negotiation, the customer agrees to add the warranty.

- 12:30 PM: You print all the contracts. You walk the customer through each document, explaining what they are signing and ensuring full transparency. The deal is signed.

- 1:15 PM: Lunch, often eaten quickly at your desk while you package the completed deal (copy all documents, create a folder for the lender, a folder for the DMV, and a folder for the internal accounting office).

- 2:30 PM: A salesperson brings you a deal with a subprime credit customer. This requires more work. You call the "special finance" lenders, advocating for the customer and structuring the deal (e.g., verifying income, securing a larger down payment) to get an approval.

- 4:00 PM: The lender from the morning deal calls with a question about a signature. You quickly resolve the issue to ensure the deal gets funded promptly. Delayed funding is a major problem for a dealership's cash flow.

- 6:00 PM: The evening rush begins. You have two customers waiting. You work through both deals efficiently, one a simple cash purchase (less profit, but faster) and the other a complex lease deal.

- 8:30 PM: The last customer leaves. You finalize all the paperwork for the day, submit your reports to the general manager, and prepare for tomorrow.

This "day in the life" illustrates the intense, pressure-filled, yet potentially highly rewarding nature of the job. It's a role for individuals who thrive on performance-based metrics and can maintain composure and meticulous attention to detail under pressure.

Average Car Dealership Finance Manager Salary: A Deep Dive

Dissecting the car dealership finance manager salary requires looking beyond a simple average, as compensation in this field is one of the most variable in the entire professional landscape. The structure is fundamentally performance-based, meaning *what you produce* is far more important than *how many hours you work*. The top 10% of F&I managers can easily earn three to four times more than the bottom 10%, even while working at similar dealerships.

For our analysis, we will consult several authoritative sources to build a comprehensive picture. It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups F&I Managers under the broader category of "Financial Managers," which has a median pay of $139,790 per year as of May 2022. While this is an excellent indicator of the high-level potential, it includes corporate finance roles and isn't specific to the commission-heavy automotive industry.

More specialized sources provide a clearer picture for F&I professionals.

- Payscale.com: According to data updated in late 2023, the average base salary for a Finance and Insurance (F&I) Manager is around $60,000. However, this is just the foundation. With commissions, bonuses, and profit sharing, the total pay range is enormous, typically falling between $51,000 and $186,000.

- Salary.com: This platform reports a slightly higher median salary. As of November 2023, the median salary for a Finance and Insurance Manager in the U.S. is $124,196. The salary range typically falls between $107,381 and $143,156, but this does not always fully capture the highest commission-based earnings.

- Glassdoor: Based on user-submitted data, Glassdoor estimates the total pay for an F&I Manager in the U.S. to be around $134,845 per year, with a likely range of $95,000 to $193,000. The "Most Likely Range" represents the 25th to 75th percentile of earners.

Synthesizing this data, a realistic national average total compensation for an experienced and proficient F&I Manager is likely in the $120,000 to $140,000 range. However, the true story is in the distribution.

### Salary by Experience Level

The career trajectory of an F&I Manager sees one of the steepest income climbs tied to experience and proven performance. A manager's value is measured by their PVR (Per Vehicle Retail), which is the average back-end profit they generate for every car sold.

| Experience Level | Typical Time in Role | Typical Annual Salary Range (Total Comp) | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level F&I Manager | 0-2 Years | $55,000 - $90,000 | Recently promoted from sales. Focus is on learning compliance, mastering the basics of loan submission, and becoming comfortable with a menu presentation. PVR is typically lower as they build confidence and technique. |

| Mid-Career F&I Manager | 2-7 Years | $90,000 - $160,000 | Has a strong grasp of compliance, a good network of lender relationships, and a polished, effective product presentation. Can handle most credit situations and consistently generates a solid PVR for the dealership. |

| Senior/Veteran F&I Manager | 7-15+ Years | $160,000 - $250,000+ | A master of the craft. Deep lender relationships allow them to get difficult deals approved. Expert negotiator. Can "read" a customer and tailor their presentation for maximum effect. Often acts as a mentor or F&I Director for a dealership group. The highest earners in this category are found at high-volume luxury or domestic truck dealerships. |

*(Salary ranges are estimates based on aggregated data from Payscale, Salary.com, and industry reports. Actual earnings can vary significantly.)*

### Deconstructing the Compensation Package

Understanding *how* an F&I manager is paid is key to understanding the earning potential. The paycheck is a complex blend of several components.

1. Base Salary: This is the most stable part of the compensation but is almost always the smallest. It can range from $2,000 to $5,000 per month. Some dealerships offer a "draw," which is an advance against future commissions. The base salary provides a safety net, but no F&I manager wants to live on it.

2. Commission: This is the heart of F&I income. Managers are paid a percentage of the total "back-end" profit they generate. This profit comes from two main sources:

- Finance Reserve: As mentioned, this is the difference between the "buy rate" (the interest rate the lender gives the dealership) and the "contract rate" (the interest rate the customer signs for). If a bank approves a loan at 5% and the F&I manager signs the customer at 6.5%, the 1.5% difference over the life of the loan generates profit, of which the manager gets a cut. This is highly regulated and capped in many states.

- Product Sales: The manager receives a commission on the profit from every aftermarket product they sell, such as warranties, GAP, and tire & wheel protection. This is often the largest source of commission income.

Commission plans vary but are often tiered. For example, a manager might earn 15% of the first $50,000 of profit they generate in a month, 20% of the next $25,000, and 25% on anything above that. This structure heavily incentivizes high performance.

3. Bonuses: These are often tied to specific goals:

- Volume Bonus: A flat-rate bonus for hitting a certain number of deals or a certain total profit for the month.

- PVR Bonus: A bonus for achieving a certain PVR target (e.g., an extra $1,000 for maintaining a $1,500 PVR for the month).

- CSI Bonus: A bonus tied to high Customer Satisfaction Index (CSI) scores. Manufacturers and dealerships place a huge emphasis on this, as happy customers lead to repeat business and positive reviews.

- Product Penetration Bonus: A bonus for selling a certain percentage of a specific product (e.g., a $500 bonus if 50% of customers purchase an extended warranty).

4. Other Benefits and Perks:

- Demonstrator Vehicle ("Demo"): Many F&I managers receive a car to drive, with the dealership covering the insurance, maintenance, and sometimes even the fuel. This is a significant non-taxable (or low-tax) benefit worth thousands of dollars per year.

- Standard Benefits: Health, dental, and vision insurance, plus a 401(k) plan, are typically included, as with any professional role.

In summary, the car dealership finance manager salary is a direct reflection of an individual's ability to navigate complex financial transactions, sell effectively, and maintain rigorous compliance, all within a high-pressure environment. The upside is immense, but it is earned, not given.

Key Factors That Influence Your Salary

The vast salary range for F&I managers, from a modest living to a truly exceptional income, is not arbitrary. It is influenced by a predictable set of factors. Aspiring and current F&I professionals who understand and strategically leverage these variables can significantly accelerate their earning potential. This section provides an exhaustive breakdown of the elements that dictate your paycheck.

###

Level of Education and Certification

Unlike fields like medicine or law, a specific advanced degree is not a strict prerequisite for becoming a successful F&I manager. Many top earners in the industry worked their way up from the sales floor with a high school diploma or a bachelor's degree in an unrelated field. However, education and, more importantly, specialized certification, play a crucial role in establishing credibility, building foundational knowledge, and potentially opening doors to higher-tier opportunities.

- Bachelor’s Degree: While not mandatory, a degree in Finance, Business Administration, or Economics is highly advantageous. It provides a strong theoretical understanding of interest rates, amortization, risk assessment, and financial principles. This academic background can speed up the learning curve and is often preferred by larger, more corporate dealership groups like AutoNation or Penske Automotive Group. It signals a level of professionalism and analytical capability.

- Specialized F&I Training Schools: The industry is filled with reputable training programs that offer intensive, week-long courses covering the A-to-Z of the F&I profession. These schools (e.g., the College of Automotive Management, Reahard & Associates) teach the practical skills: deal structuring, menu selling, objection handling, and compliance. Graduating from a well-known F&I school is a powerful signal to a hiring manager that a candidate is serious and has invested in their own development.

- Professional Certifications (The Gold Standard): The most significant educational credential in the F&I world is certification from the Association of Finance & Insurance Professionals (AFIP). The AFIP Certified F&I Professional designation is a rigorous, ethics-based certification that requires passing a comprehensive exam on federal and state regulations.

- Impact on Salary: Holding an AFIP certification directly enhances trustworthiness and reduces liability for a dealership. Many high-end dealership groups now mandate this certification for their F&I staff. It acts as a mark of a true professional and can be a key differentiator in salary negotiations and promotions, especially when moving into a director-level role. It demonstrates a commitment to ethical conduct and legal compliance, which are invaluable to a dealer principal.

###

Years of Experience and Proven Track Record

Experience is arguably the single most important factor in an F&I manager's income. However, it's not just about time served; it's about a demonstrated history of performance. A ten-year veteran with a mediocre PVR will earn less than a three-year "up-and-comer" who consistently delivers top-tier results.

- 0-2 Years (The Learning Curve): At this stage, salary is a secondary concern to skill acquisition. The focus is on mastering the process without making costly compliance errors. Income is typically at the lower end of the spectrum, from $55,000 to $90,000. The key is to absorb everything possible from senior managers and establish a solid, ethical foundation.

- 2-7 Years (The Professional): This is where income skyrockets. The manager now has a rhythm and a refined process. They have built relationships with lenders and can get tougher deals bought. Their product presentations are smooth and effective. Their PVR is consistently high, and their income reflects this, often in the $90,000 to $160,000 range. They are the reliable profit center for the dealership.

- 7+ Years (The Master): The veteran manager operates on another level. They have seen almost every conceivable deal structure and credit scenario. They possess an intuitive understanding of the customer and the lenders. They are often tapped to train new F&I staff or oversee the entire F&I department as an F&I Director. Their compensation can easily push past $200,000, with top performers at elite dealerships earning $300,000 or more. Their value lies not just in their own production but in their ability to elevate the entire department's performance.

###

Geographic Location

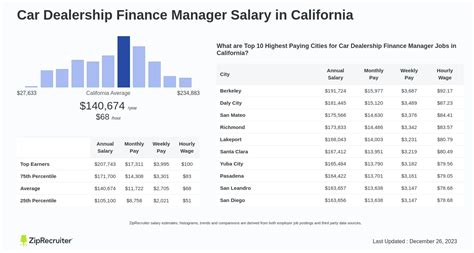

Where you work has a massive impact on your earnings, driven by two forces: cost of living and, more importantly, market volume. High-volume metropolitan areas with a higher cost of living naturally create an environment for higher F&I salaries. More cars sold means more opportunities to generate back-end profit.

- High-Paying States and Cities: States like California, Texas, Florida, New York, and Illinois are known for high F&I compensation. This is due to large populations, a high number of dealerships, and significant vehicle sales volume. Major metropolitan areas within these states are hotspots:

- Los Angeles, CA

- Dallas, TX

- Miami, FL

- Chicago, IL

- New York City, NY (and surrounding suburbs)

- Lower-Paying Areas: Rural areas and states with smaller populations and lower costs of living will generally offer lower compensation. A dealership in rural Wyoming simply doesn't have the same traffic and sales volume as a dealership in suburban Houston, so the earning potential is naturally capped.

- Example Salary Variation by City (Estimates):

- F&I Manager in Los Angeles, CA: Median total compensation could be $150,000 - $175,000+ due to high volume and high vehicle prices.

- F&I Manager in Dallas, TX: A truck-heavy market with huge volume could see medians around $140,000 - $165,000.

- F&I Manager in Des Moines, IA: A solid market, but lower volume and cost of living might result in a median closer to $100,000 - $120,000.

###

Company Type & Size (Dealership Specifics)

Not all dealerships are created equal. The type, brand, and volume of the dealership you work for are enormous determinants of your potential salary.

- Large Publicly-Traded Dealership Groups (e.g., AutoNation, Penske, Lithia Motors):

- Pros: These giants offer structured career paths, excellent training, and potentially better benefits. They often have clear, metric-driven pay plans and opportunities to advance into corporate roles.

- Cons: They can be more bureaucratic, with less flexibility in pay plans and stricter compliance oversight (which is also a pro).

- Salary Impact: Generally strong and stable, with high potential at their high-volume stores. A top F&I manager at a flagship AutoNation Toyota store can be one of the highest earners in the country.

- Private, Family-Owned Dealerships (Single Point or Small Group):

- Pros: Can offer more autonomy and a more flexible, entrepreneurial environment. A star performer can have significant influence and may have a closer relationship with the owner/dealer principal.

- Cons: Training might be less formal, and benefits could be less robust. Career advancement might be limited unless the group is actively acquiring more stores.

- Salary Impact: Highly variable. A well-run, high-volume private dealership can pay its F&I managers exceptionally well, sometimes even more than the corporate stores, as they have more discretion with pay plans.

- Brand of the Dealership: This is a critical factor.

- High-Volume Import/Domestic Brands (Toyota, Honda, Ford, Chevy): These stores are the bread and butter of the industry. They sell a huge number of vehicles, providing F&I managers with a massive number of opportunities each month. High volume often leads to extremely high income potential. Selling F&I on a $30,000 RAV4 or a $60,000 F-150 is the core of the business.

- Luxury Brands (BMW, Mercedes-Benz, Lexus, Porsche): While they sell fewer units, the profit margins on both the cars and the back-end products are much higher. Customers have higher credit scores, making loan approvals easier. Selling a $5,000 warranty on a $90,000 BMW is common. This leads to a very high PVR, and thus, very high income potential.

- Used Car Superstores (e.g., CarMax or independent lots): The F&I process is just as, if not more, important here. However, the profit potential can be limited by the vehicle's age and the credit quality of the customer base. Top performers can still do very well, but the ceiling might be lower than at a new car franchise.

###

Area of Specialization

While most F&I managers are generalists, some develop expertise in niche areas that can significantly boost their value and income.

- Subprime or Special Finance: This specialization involves working with customers who have poor or limited credit histories. It is a challenging and time-consuming niche that requires incredible tenacity, strong relationships with subprime lenders, and the ability to structure deals creatively to get them approved. A manager who is a "subprime wizard" is invaluable to a dealership because they can turn potential losses or unwound deals into profitable sales. They are often compensated with a higher commission percentage for these tougher deals.

- F&I Director / Platform F&I Director: This is the