Considering a career as a financial advisor is an exciting prospect, offering a unique blend of entrepreneurship, personal impact, and significant financial reward. Among the top firms in the industry, Northwestern Mutual stands out for its long-standing reputation and comprehensive approach to financial planning. But what can you realistically expect to earn?

While the path is challenging, the rewards for successful advisors at Northwestern Mutual are substantial. Total compensation can range from approximately $60,000 in the initial years to well over $250,000 for seasoned professionals who have built a strong client base. This article will break down the compensation structure, the factors that influence your income, and the overall outlook for this dynamic career.

What Does a Financial Advisor at Northwestern Mutual Do?

A financial advisor at Northwestern Mutual—often starting with the title of Financial Representative—is a trusted partner who helps clients achieve financial security. Their role is multifaceted and client-centric, revolving around building long-term relationships.

Key responsibilities include:

- Client Consultation: Meeting with individuals, families, and business owners to understand their financial goals, concerns, and current situation.

- Needs Analysis: Conducting a thorough analysis of a client's financial life, including income, assets, insurance coverage, investments, and retirement plans.

- Personalized Planning: Developing and presenting a comprehensive financial plan tailored to each client's unique needs.

- Product Solutions: Recommending and implementing a mix of financial solutions, which at Northwestern Mutual prominently features life and disability insurance, annuities, and a wide range of investment products and services.

- Ongoing Review: Regularly meeting with clients to review and adjust their financial plans as their lives and the market change.

Essentially, you are running your own business under the powerful brand, training, and support of Northwestern Mutual.

Average Financial Advisor Northwestern Mutual Salary

Understanding the salary for a Northwestern Mutual advisor requires looking beyond a simple base pay. The compensation model is heavily performance-based, designed to reward hard work and success in building a client practice.

An advisor's income is primarily a combination of commissions from product sales (insurance and investments), renewal commissions, and various bonuses. While new advisors often receive a stipend or financing to provide stability during their first few years, the long-term earning potential is directly tied to their efforts.

Let's look at the data from reputable sources:

- According to Glassdoor, the estimated total pay for a Financial Advisor at Northwestern Mutual is approximately $101,500 per year in the United States, with an average base salary of $60,000 and additional pay (commissions, bonuses) averaging $41,500. The likely range for total pay spans from $67,000 to $156,000.

- Payscale reports a similar structure, with an average base salary of around $55,000 and a total pay range that can extend from $41,000 to $178,000 when including bonuses and commissions.

It's critical to note that these figures are averages. Entry-level advisors in their first one or two years may earn less as they build their client book, while top-tier veteran advisors can earn significantly more, often exceeding $300,000 annually.

Key Factors That Influence Salary

Your individual earnings as a Northwestern Mutual advisor are not static. They are influenced by several key factors that you can actively develop throughout your career.

###

Level of Education

While a bachelor's degree in finance, business, economics, or a related field is the standard entry requirement, advanced credentials have a much greater impact on earnings. Professional certifications demonstrate a higher level of expertise and commitment, which builds client trust and attracts a more sophisticated clientele. The most impactful certifications include:

- CFP® (Certified Financial Planner™): The gold standard in financial planning, requiring rigorous coursework, a comprehensive exam, and adherence to a strict fiduciary standard.

- ChFC® (Chartered Financial Consultant®): A designation that covers extensive aspects of financial planning, including insurance, retirement, and estate planning.

- CLU® (Chartered Life Underwriter®): A premier designation focused on life insurance and estate planning, highly relevant to Northwestern Mutual's core offerings.

Advisors holding these designations often report higher incomes due to their enhanced credibility and ability to manage more complex financial situations.

###

Years of Experience

Experience is arguably the single most important factor in a commission-based role. An advisor's career and income typically progress through distinct stages:

- Entry-Level (0-3 Years): The primary focus is prospecting, learning the business, and building a client base from the ground up. Income can be volatile, supported by company stipends and initial commissions. Perseverance is key.

- Mid-Career (4-10 Years): By this stage, an advisor has an established book of business. A significant portion of income comes from recurring renewal commissions and referrals from satisfied clients, leading to more stable and substantial earnings.

- Senior/Veteran (10+ Years): These advisors have a mature practice, often work with high-net-worth clients, and may lead their own teams. Their income is high and consistent, built on years of relationship-building and proven success.

###

Geographic Location

Where you build your practice matters. Advisors in major metropolitan areas with a high concentration of wealth and a higher cost of living, such as New York City, San Francisco, or Chicago, often report higher average earnings. This is driven by both the larger potential client pool and the higher asset levels of individuals and businesses in those regions. According to Salary.com, a financial advisor in New York, NY, can expect to earn a higher base salary than one in a smaller, less affluent market.

###

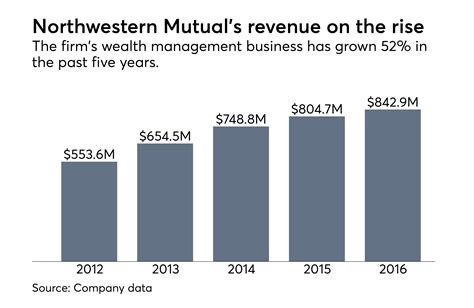

Company Type

Northwestern Mutual operates as a mutual insurance company, meaning it is owned by its policyholders. Its business model emphasizes a comprehensive planning approach that often begins with risk management products (like life and disability insurance) as the foundation of a financial plan. This differs from other models:

- Wirehouses (e.g., Merrill Lynch, Morgan Stanley): Often more investment-centric.

- Independent RIAs (Registered Investment Advisors): Typically charge a fee based on a percentage of assets under management (AUM) and operate under a strict fiduciary duty.

The Northwestern Mutual model means that a significant portion of an advisor's early income may come from insurance commissions, which provides a strong, stable base as they grow the investment side of their practice.

###

Area of Specialization

Developing a niche can significantly boost your earning potential. Instead of being a generalist, specializing allows you to become the go-to expert for a specific demographic or need. This deep expertise attracts higher-value clients and more referrals. Profitable specializations include:

- Retirement Planning: Serving the massive demographic of pre-retirees and retirees.

- Business Owners: Focusing on succession planning, employee benefits, and executive compensation.

- Medical Professionals: Understanding the unique financial challenges and opportunities for doctors and dentists.

- Estate Planning: Working with high-net-worth families to manage wealth transfer and legacy planning.

Job Outlook

The future for financial advisors is incredibly bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Personal Financial Advisors will grow by 13% from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth is fueled by several factors:

- The large baby-boom generation is entering retirement and needs professional guidance to manage their savings.

- Increased life expectancies require more sophisticated, long-term financial planning.

- The growing complexity of investment and insurance products makes professional advice more valuable than ever.

Conclusion

A career as a financial advisor at Northwestern Mutual is not a traditional salaried job; it is an entrepreneurial venture. Your income is a direct reflection of your ability to build trust, provide value, and diligently grow your practice.

While the initial years demand hard work and resilience, the path offers unparalleled autonomy and a direct link between effort and reward. For the driven individual who thrives on building relationships and creating their own success, a career as a Northwestern Mutual financial advisor offers a challenging yet potentially highly lucrative and fulfilling profession. With a strong industry outlook and a top-tier company platform, the opportunity to build a prosperous future—for both you and your clients—is immense.