Unlocking Your Earning Potential: A Deep Dive into the Northwestern Mutual Salary

Considering a career in financial services offers a unique opportunity to build a lucrative and meaningful profession. For many aspiring professionals, Northwestern Mutual stands out as a premier destination. A common and crucial question is: "What is the typical Northwestern Mutual salary?" While the answer is complex, the potential is significant, with total compensation for established advisors often reaching well into six figures.

This article will break down the compensation structure for the most common role at the company—the Financial Advisor—and explore the key factors that determine your ultimate earning potential.

What Does a Financial Advisor at Northwestern Mutual Do?

Before diving into the numbers, it's essential to understand the role. A Financial Advisor (also known as a Financial Representative) at Northwestern Mutual is far more than a salesperson; they are a trusted partner in their clients' financial lives. They operate as entrepreneurs building their own practice under the umbrella of a respected, century-old institution.

Key responsibilities include:

- Building Client Relationships: Proactively networking and prospecting to find individuals, families, and businesses in need of financial guidance.

- Comprehensive Financial Planning: Conducting in-depth analyses of a client's financial situation, goals, and risk tolerance.

- Developing & Presenting Solutions: Creating customized strategies that may include life and disability insurance, investment portfolios, retirement plans, and estate planning.

- Ongoing Service & Reviews: Meeting with clients regularly to review their progress, adjust their plans as life changes, and ensure they remain on track to meet their objectives.

This is a performance-driven career where your effort, skill, and dedication directly translate into both client success and personal income.

Average Financial Advisor Salary at Northwestern Mutual

The most critical thing to understand about a Northwestern Mutual Financial Advisor's compensation is that it is primarily commission-based and performance-driven, not a traditional fixed salary. This means there is no single "average salary," but rather a wide range of potential earnings based on an advisor's success.

While new advisors often receive stipends or a training allowance to provide a stable income floor as they build their business, long-term compensation is derived from commissions on products, fees from assets under management (AUM), and various bonuses.

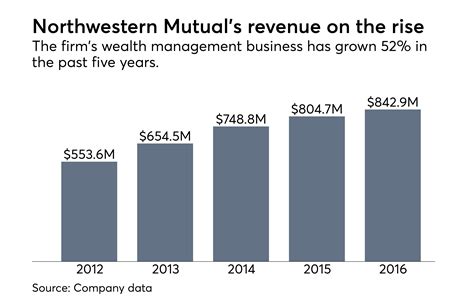

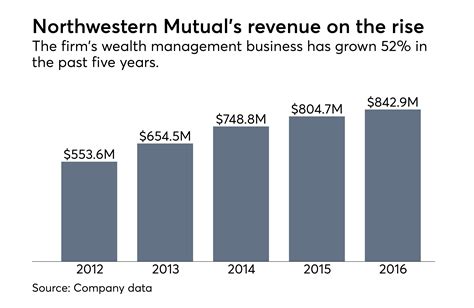

Here’s what authoritative data indicates about total compensation:

- According to Glassdoor, the estimated total pay for a Financial Advisor at Northwestern Mutual is approximately $103,500 per year in the United States, with a likely range between $55,000 and $195,000. This figure includes base pay, commissions, and bonuses.

- Payscale reports a similar wide spectrum, with an average total pay around $73,000 per year. Their data shows that earnings increase dramatically with experience, with late-career advisors earning significantly more due to a large and established client base.

The vast range highlights the entrepreneurial nature of the role. Early years are focused on building a client book, while seasoned advisors benefit from renewal commissions and fees from a mature practice, leading to substantial income growth over time.

Key Factors That Influence Salary

Your earnings as a Northwestern Mutual advisor are not static. They are influenced by several key factors that you can actively develop throughout your career.

###

Years of Experience

Experience is arguably the most significant driver of income. The career path has distinct earning phases:

- Entry-Level (0-2 Years): During this foundational period, advisors focus on training, obtaining licenses (like the Series 7 and Series 66), and building their initial client base. Income is often in the $45,000 to $70,000 range, frequently supported by company stipends and initial commissions.

- Mid-Career (3-10 Years): With an established practice and a strong referral network, advisors see a substantial jump in income. Their earnings become more predictable as they benefit from recurring revenue from investments and insurance policy renewals. Total compensation often moves into the $80,000 to $150,000+ range.

- Senior/Veteran (10+ Years): Highly experienced advisors manage a large book of business and significant assets under management. Their income is robust, stable, and can easily exceed $200,000 or $300,000 annually.

###

Area of Specialization

Developing a niche allows you to become the go-to expert for a specific demographic, which can dramatically increase your earning potential. Specialists can attract higher-net-worth clients and handle more complex, lucrative financial plans. Common specializations include:

- Retirement Planning: Helping clients prepare for and live comfortably in retirement.

- Business Owners: Focusing on succession planning, employee benefits, and executive compensation.

- Medical Professionals: Understanding the unique financial challenges and opportunities for doctors, dentists, and other healthcare practitioners.

- Estate Planning: Working with clients to create a legacy and ensure the efficient transfer of wealth.

###

Level of Education and Certifications

While a bachelor's degree in fields like finance, business, or economics is a common starting point, advanced credentials are a key differentiator. Professional certifications signal a higher level of expertise and dedication, which builds client trust and can lead to higher earnings. The most respected designations include:

- CFP® (Certified Financial Planner™): The gold standard in financial planning.

- ChFC® (Chartered Financial Consultant®): A comprehensive designation covering a wide range of financial topics.

- CLU® (Chartered Life Underwriter®): The premier designation for insurance professionals.

###

Geographic Location

Where you build your practice matters. Advisors in major metropolitan areas or regions with a higher concentration of wealth (e.g., New York City, San Francisco, Chicago) often have a higher ceiling on their earning potential. This is due to a larger pool of potential clients with significant assets. However, a dedicated advisor can build a highly successful practice in any community by becoming a trusted and integral part of the local network.

###

Business Model and Performance

Ultimately, a Northwestern Mutual advisor's "salary" is a direct reflection of their performance as a business owner. This is not a typical corporate job. Your income is directly tied to your ability to:

- Effectively market yourself and your services.

- Build and maintain strong client relationships.

- Provide sound, ethical financial advice.

- Manage your time and resources efficiently.

High-performing advisors who excel in these areas will see their compensation grow year after year.

Job Outlook

The long-term career outlook for this profession is exceptionally strong. According to the U.S. Bureau of Labor Statistics (BLS), employment of personal financial advisors is projected to grow 13% from 2022 to 2032, which is much faster than the average for all occupations.

The BLS attributes this growth to two key factors: an aging population nearing retirement and the increasing complexity of financial instruments, driving more people to seek professional advice. This sustained demand ensures a stable and growing market for the services Northwestern Mutual advisors provide.

Conclusion

A career as a Financial Advisor at Northwestern Mutual offers a pathway to exceptional earning potential, but it is not a traditional salaried job. It is an entrepreneurial venture that rewards hard work, dedication, and a genuine desire to help others.

Key Takeaways:

- Earnings are performance-based: Your income is a direct result of your efforts in building and serving a client base.

- Long-term potential is high: While early years require hustle, the compounding nature of the business can lead to six-figure-plus incomes for established advisors.

- You control the key factors: By gaining experience, pursuing certifications, and developing a specialization, you can actively increase your earning potential.

- The job market is strong: A growing need for financial advice provides a stable foundation for building a long and rewarding career.

For the right individual, a career with Northwestern Mutual is more than a job—it's an opportunity to build a personal business, achieve financial independence, and make a lasting positive impact on the lives of your clients.