Table of Contents

- [What Does a Financial Representative Do?](#what-does-a-financial-representative-do)

- [Average Financial Representative Salary: A Deep Dive](#average-financial-representative-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for Financial Representatives](#job-outlook-and-career-growth-for-financial-representatives)

- [How to Become a Financial Representative: A Step-by-Step Guide](#how-to-become-a-financial-representative-a-step-by-step-guide)

- [Is a Career as a Financial Representative Right for You?](#is-a-career-as-a-financial-representative-right-for-you)

Are you driven by a desire to help others achieve their dreams while building a prosperous future for yourself? The career of a financial representative offers a unique blend of altruism and ambition, placing you at the crossroads of human connection and market dynamics. It's a path where your success is directly tied to the financial well-being of your clients. The potential for this role is immense, with a typical financial representative salary often climbing well into six figures for established professionals. According to the U.S. Bureau of Labor Statistics, the median pay for personal financial advisors was $99,580 per year in May 2023, but this figure only scratches the surface of what's possible.

I once spoke with a recently retired teacher who was terrified she had outlived her savings. Her new financial representative didn't just sell her a product; he sat with her for hours, mapping out a sustainable income stream and a conservative growth strategy that gave her immense peace of mind. That story has always stuck with me—it’s a powerful reminder that this job isn't just about numbers on a spreadsheet; it's about providing security, clarity, and confidence to people when they need it most.

This comprehensive guide will illuminate every facet of a financial representative's career, from the core responsibilities and compensation structures to the critical factors that determine your earning potential. We will explore the robust job outlook, dissect the pathways to entry, and provide actionable steps to not only launch but also accelerate your career in this dynamic and rewarding field.

---

What Does a Financial Representative Do?

At its heart, a financial representative is a guide. They are licensed professionals who help individuals and families navigate the complex world of personal finance. Their primary mission is to understand a client's financial situation, life goals, and risk tolerance, and then develop a strategic plan to help them achieve those objectives. This is far more than simply "selling stocks" or "pushing insurance policies." It's a relationship-based profession built on trust and expertise.

The title "Financial Representative" is often used as a broad term, particularly by large insurance companies and brokerage firms. It can be an entry-point to more specialized roles like Financial Advisor, Wealth Manager, or Retirement Planning Specialist. Regardless of the specific title, the core functions remain consistent.

Core Responsibilities and Daily Tasks:

A financial representative's work can be broken down into several key areas:

1. Prospecting and Client Acquisition: This is the lifeblood of the business, especially in the early years. It involves networking, attending events, asking for referrals, conducting seminars, and using social media (like LinkedIn) to find potential clients.

2. Needs Analysis and Goal Setting: The initial meetings with a client are discovery sessions. The representative asks deep questions to understand the client's income, expenses, assets, debts, and, most importantly, their goals. Are they saving for a house? Planning for retirement? Funding a child's education? Worried about protecting their family in case of death or disability?

3. Financial Planning and Strategy Development: Using the information gathered, the representative analyzes the client's financial state and creates a comprehensive plan. This may involve budgeting, debt management strategies, investment recommendations, and insurance planning.

4. Product Recommendation and Implementation: Based on the plan, the representative recommends specific financial products and services. This could include:

- Investments: Mutual funds, stocks, bonds, ETFs (Exchange-Traded Funds).

- Insurance: Life insurance, disability income insurance, long-term care insurance.

- Retirement Accounts: Traditional and Roth IRAs, 401(k) rollovers, annuities.

5. Ongoing Monitoring and Relationship Management: The job doesn't end after a sale. A great financial representative regularly meets with clients to review their portfolios, assess progress toward their goals, and make adjustments as life circumstances (marriage, new job, inheritance) or market conditions change.

> ### A Day in the Life of a Financial Representative

>

> 8:00 AM - 9:00 AM: Arrive at the office. Start the day by reviewing market news, overnight performance of key indices (S&P 500, NASDAQ), and checking client account alerts. Respond to a few urgent client emails that came in overnight.

>

> 9:00 AM - 10:30 AM: Prospecting Block. This is protected time. Make follow-up calls to people met at a recent networking event. Draft personalized LinkedIn connection requests to local professionals. Call existing clients to ask for referrals.

>

> 10:30 AM - 12:00 PM: Client Prep. Prepare for a 2:00 PM meeting with a couple in their late 40s. Review their existing portfolio, run performance reports, and model a few scenarios for increasing their retirement contributions. Finalize the agenda for the meeting.

>

> 12:00 PM - 1:00 PM: Lunch, often with a "center of influence" like an accountant or an estate planning attorney to build referral partnerships.

>

> 1:00 PM - 2:00 PM: Administrative Work. Process new account paperwork from a meeting yesterday. Follow up with the back office on a client's fund transfer. Document notes from morning calls in the CRM (Customer Relationship Management) software.

>

> 2:00 PM - 3:30 PM: Annual Client Review Meeting. Meet with the couple. Discuss their portfolio's performance, reaffirm their long-term goals, and recommend rebalancing their asset allocation. They agree to increase their monthly contributions and you set a follow-up to implement the changes.

>

> 3:30 PM - 5:00 PM: Team Meeting & Training. Attend a weekly team meeting to discuss sales strategies, new product rollouts, and compliance updates. A senior advisor might lead a brief training on a specific financial planning concept.

>

> 5:00 PM onwards: The "official" day might end, but the work often continues. Tonight, it might be attending a Chamber of Commerce after-hours event or hosting a small educational seminar on "The Basics of Investing."

This example highlights the entrepreneurial nature of the role. It demands discipline, excellent time management, and a constant focus on both servicing existing clients and acquiring new ones.

---

Average Financial Representative Salary: A Deep Dive

Understanding the salary of a financial representative is complex because it's rarely a simple, fixed number. Compensation is heavily influenced by performance, experience, and the specific business model of the employing firm. Unlike a traditional salaried employee, a financial representative's income is a dynamic mix of base pay, commissions, bonuses, and fees.

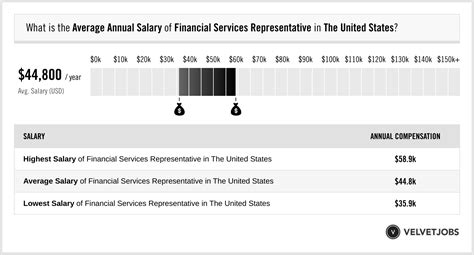

### National Averages and Salary Ranges

To get a clear picture, let's look at data from several authoritative sources. It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups financial representatives under the broader category of "Personal Financial Advisors."

- U.S. Bureau of Labor Statistics (BLS): As of May 2023, the BLS reports the median annual wage for personal financial advisors was $99,580. This means half of the advisors earned more than this, and half earned less. The salary distribution shows a vast potential range:

- Lowest 10% earned less than $47,790.

- Highest 10% earned more than $239,200.

- Salary.com: As of late 2023, this platform reports the median salary for a "Financial Representative" in the United States to be around $73,500. However, the typical range falls between $65,500 and $83,700, which likely reflects the base salary component more than the total compensation. For the more senior "Personal Financial Advisor" title, their data shows a median of $100,530, aligning closely with the BLS.

- Glassdoor: This site, which aggregates self-reported data, shows an estimated total pay for a Financial Representative in the US is $96,629 per year, with an average salary of $68,369 and additional pay (bonuses, commission, etc.) of $28,260.

The takeaway is clear: While an entry-level position might start with a modest base salary, the total compensation for a successful, experienced representative can easily be in the low-to-mid six figures, with top performers earning significantly more. The first few years are often a "building" phase with lower earnings, followed by exponential growth potential.

### Salary Growth by Experience Level

Your income trajectory is directly tied to your ability to build and retain a client base, known as a "book of business." Here is a typical progression, combining data from Payscale and industry observations:

| Experience Level | Typical Total Compensation Range | Key Milestones & Focus |

| :--- | :--- | :--- |

| Entry-Level (0-2 Years) | $45,000 - $70,000 | Heavy focus on training, licensing, and prospecting. Income is often a mix of a small base salary/stipend and initial commissions. High attrition rate. |

| Mid-Career (3-7 Years) | $75,000 - $150,000 | A sustainable book of business is forming. Referrals become a significant source of new clients. Income shifts more towards recurring revenue from assets under management and renewal commissions. |

| Senior/Experienced (8-15+ Years)| $150,000 - $250,000+ | Well-established practice with a large client base. May begin mentoring junior representatives. Potential to specialize in high-net-worth clients. Income is stable and substantial. |

| Top Performers / Principals | $300,000 - $1,000,000+ | These are the elite advisors, partners in a firm, or successful independent practice owners. They manage hundreds of millions in client assets and have a team supporting them. |

### Deconstructing Your Paycheck: The Components of Compensation

It's crucial to understand *how* you get paid. The structure varies significantly by firm but generally includes a mix of the following:

- Base Salary or Stipend: Many firms, especially large ones like Northwestern Mutual or New York Life, offer a training stipend or a modest base salary for the first 1-3 years. This provides a safety net while you build your business. This can range from $30,000 to $60,000.

- Commissions: This is the most traditional form of compensation. You earn a percentage of the premium for insurance products sold or a percentage of the investment amount for certain mutual funds (known as a "load"). For example, selling a life insurance policy with a $2,000 annual premium might generate a 55% first-year commission ($1,100).

- Fees (Assets Under Management - AUM): This is the cornerstone of the modern financial advisor model. Instead of commissions, you charge an annual fee based on the total assets you manage for a client. A typical fee is 1% of AUM. For a client with a $500,000 portfolio, this generates $5,000 in annual recurring revenue for the advisor. This model aligns the advisor's interests with the client's, as the advisor earns more when the client's portfolio grows.

- Bonuses: These are common and can be substantial. They are typically tied to meeting or exceeding production targets, asset growth goals, or firm-wide revenue goals. An annual bonus can easily add $10,000 to $50,000+ to your total compensation.

- Profit Sharing: Some firms offer a profit-sharing plan, allowing employees to share in the company's success.

- Benefits: Standard benefits like health insurance, retirement plans (401k), and paid time off are usually included, especially when working for a large corporation.

The industry is slowly shifting from a pure commission-based model towards a fee-based or fee-only model, which many consider to be a more transparent and ethical standard of care.

---

Key Factors That Influence Your Salary

Your financial representative salary is not set in stone. It's a fluid figure shaped by a powerful combination of your qualifications, choices, and performance. Mastering these factors is the key to maximizing your long-term earning potential. Let's dissect the seven most critical drivers of income in this profession.

###

1. Level of Education and Professional Certifications

While a high school diploma is the absolute minimum, a bachelor's degree is the standard and practically a requirement for any reputable firm.

- Bachelor's Degree: A degree in finance, economics, business administration, or accounting provides the strongest foundation. It equips you with the fundamental knowledge of markets, financial instruments, and economic principles. Employers see it as a baseline indicator of commitment and analytical ability.

- Master's Degree (MBA/MSF): An MBA with a finance concentration or a Master of Science in Finance (MSF) can significantly accelerate your career, particularly if you aim for roles in wealth management for high-net-worth individuals or corporate finance. It not only deepens your technical expertise but also expands your professional network. An MBA can command a starting salary premium of 15-25% and opens doors to leadership tracks.

The Real Game-Changer: Professional Certifications

Certifications are what separate the practitioners from the true professionals. They demonstrate a commitment to expertise and ethics, and they directly translate to higher earnings and client trust.

- CERTIFIED FINANCIAL PLANNER™ (CFP®): This is the gold standard in the personal finance industry. Achieving CFP® certification requires passing a rigorous exam, meeting experience requirements (typically 3 years), and adhering to a strict code of ethics, including a fiduciary duty to act in the client's best interest.

- Salary Impact: According to the CFP Board's research, CFP® professionals report earning 26% more than other financial advisors. This credential unlocks the ability to do comprehensive financial planning and attracts more affluent clients, leading directly to higher AUM and fees.

- Chartered Financial Consultant (ChFC®): Offered by The American College of Financial Services, the ChFC® is similar in scope to the CFP® but with a slightly greater emphasis on insurance and estate planning. It's highly respected and also leads to a significant income boost.

- Chartered Financial Analyst (CFA®): The CFA charter is the pinnacle for investment analysis and portfolio management. It's a grueling, three-level exam process. While less common for general financial representatives, it's essential for those who want to specialize in managing investment portfolios or work in asset management. CFA charterholders are among the highest earners in the financial industry.

###

2. Years of Experience and Book of Business

Experience is arguably the single most important factor in determining a financial representative's income. This career has a distinct, compounding growth curve.

- Years 0-2 (The Grind): As detailed earlier, these years are about survival, learning, and prospecting. Income is low and hours are long. The primary goal is passing licensing exams (SIE, Series 7, Series 66) and making enough contacts to stay in the business.

- Years 3-7 (The Build): This is where momentum takes hold. Your initial clients start to see results, and more importantly, they start referring their friends, family, and colleagues. Your income begins to stabilize and grow as your "book of business" (the total clients and assets you manage) expands. A representative with 5 years of experience and a $20 million AUM book could be earning a solid $120,000 - $180,000.

- Years 8+ (The Harvest): At this stage, you are an established professional. Your business runs on referrals and the recurring revenue from your large AUM. Your focus shifts from frantic prospecting to deepening relationships with your best clients and providing more sophisticated advice. An advisor with 15 years of experience managing $100 million in assets could easily earn $500,000+ per year, depending on the firm's payout structure.

###

3. Geographic Location

Where you work matters immensely. Salaries follow the money, and financial representatives earn the most in areas with a high concentration of wealth and a higher cost of living.

- Top-Paying Metropolitan Areas: According to BLS data, the highest annual mean wages for personal financial advisors are found in cities like:

- New York-Newark-Jersey City, NY-NJ-PA: $178,350

- San Francisco-Oakland-Hayward, CA: $158,160

- Boston-Cambridge-Nashua, MA-NH: $154,670

- Bridgeport-Stamford-Norwalk, CT: $154,340

- Chicago-Naperville-Elgin, IL-IN-WI: $144,320

- Top-Paying States: The states with the highest average salaries are typically New York, Connecticut, Massachusetts, California, and Illinois.

- Lower-Paying Areas: Conversely, rural areas and states with lower average household incomes and a lower cost of living will offer significantly lower earning potential. A financial representative in a small town in Mississippi or Arkansas might have a median salary closer to $60,000-$80,000.

The strategy here is to build your career in a major metropolitan area or a region with a growing population of affluent retirees (e.g., Florida, Arizona) to maximize your access to potential high-value clients.

###

4. Company Type and Business Model

The type of firm you work for dictates your culture, your responsibilities, and, critically, your compensation structure.

- Large Wirehouses (e.g., Morgan Stanley, Merrill Lynch, Wells Fargo Advisors): These firms offer strong brand recognition, extensive training programs, and a flow of potential clients. They often provide a base salary plus a bonus structure tied to a "grid" payout. The grid payout percentage increases as you generate more revenue. The trade-off is less independence and a lower payout percentage compared to independent models.

- Insurance Companies (e.g., Northwestern Mutual, New York Life, MassMutual): This is a very common entry point into the industry. The focus is heavily on insurance products first (life, disability) and investments second. Compensation is almost entirely commission-based, though they often provide training stipends. It's an entrepreneurial, "eat-what-you-kill" environment.

- Independent Broker-Dealers (e.g., LPL Financial, Raymond James, Ameriprise): Here, you act as an independent contractor using the firm's platform for compliance, technology, and product access. You have more freedom to build your own brand and business. The payout is much higher (often 70-90% of the revenue you generate), but you are responsible for all your own business expenses (office space, marketing, staff).

- Registered Investment Advisor (RIA) Firms: These firms are legally bound by a fiduciary standard to always act in their clients' best interests. They are typically "fee-only," charging clients based on AUM, a flat retainer, or an hourly rate. Working for an RIA can provide a more stable salary-plus-bonus structure, with less emphasis on sales and more on holistic financial planning. Starting your own RIA is the ultimate goal for many top advisors, offering the highest autonomy and earning potential.

###

5. Area of Specialization

As your career progresses, developing a niche can dramatically increase your value and income. Generalists are common; specialists are in demand.

- Wealth Management for High-Net-Worth (HNW) Individuals: This involves providing sophisticated financial planning, estate planning, tax strategies, and investment management for clients with $1 million+ in investable assets. This is the most lucrative specialization.

- Retirement Planning: This is a massive and growing field. Specializing in 401(k) rollovers, IRA management, and income distribution strategies for pre-retirees and retirees creates a constant stream of business.

- Business Owners: This niche involves helping entrepreneurs with succession planning, key-person insurance, tax-advantaged retirement plans (like SEP-IRAs or Solo 401ks), and managing both their business and personal wealth.

- Specific Professions: Some advisors build their entire practice around a specific group, such as doctors, dentists, or tech executives. They understand the unique financial challenges and opportunities of that profession, making them a highly sought-after resource.

###

6. In-Demand Skills (Hard and Soft)

Beyond your credentials, a specific set of skills will determine your day-to-day effectiveness and long-term success.

High-Value Hard Skills:

- Financial Planning Software Proficiency: Mastery of tools like eMoney Advisor, MoneyGuidePro, or RightCapital is essential for creating detailed, professional financial plans.

- Investment Analysis: A deep understanding of asset allocation, portfolio construction, risk metrics, and security analysis.

- Tax Planning Knowledge: The ability to advise on tax-efficient investing, retirement withdrawals, and basic estate tax implications adds immense value.

- CRM Mastery: Efficiently using a CRM like Salesforce or Redtail to manage client relationships, track communications, and automate follow-ups.

Crucial Soft Skills (The "X-Factor"):

- Communication & Empathy: The ability to explain complex financial topics in simple, understandable terms and to listen actively to a client's fears and dreams. This builds trust, the currency of this business.

- Sales Acumen & Persuasion: You must be able to ethically persuade clients to take action that is in their best interest, whether it's saving more, buying necessary insurance, or staying invested during a market downturn.

- Networking & Relationship Building: Your ability to build a strong professional network is a direct predictor of your success in acquiring new clients.

- Resilience & Discipline: The first few years involve rejection and long hours. The discipline to stick to your prospecting plan and the resilience to handle "no's" are non-negotiable traits for survival and success.

---

Job Outlook and Career Growth for Financial Representatives

For those considering this career path, the future looks exceptionally bright. The demand for competent and ethical financial guidance is projected to grow significantly over the next decade, driven by powerful demographic and economic trends.

### Strong Projected Job Growth

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative forecast for the profession. In its 2023 Occupational Outlook Handbook, which projects growth from 2022 to 2032, the BLS estimates that employment of personal financial advisors is projected to grow 13 percent.

- Growth Rate: This 13% growth rate is much faster than the average for all occupations (which is 3 percent).

- New Jobs: This translates to an estimated 41,700 new jobs being created in the field over the ten-year period.

- Total Openings: In addition to new jobs, the BLS projects about 27,700 openings for personal financial advisors each year, on average, over the decade. Many of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

### Key Drivers of Industry Growth

What's fueling this robust demand? Several key factors are at play:

1. The Aging Population: The massive Baby Boomer generation is entering and moving through retirement. This demographic wave is creating an unprecedented need for expert advice on retirement income planning, wealth preservation, healthcare costs, and estate planning. They hold a significant portion of the nation's wealth and require guidance on how to make it last.

2. Decline of Traditional Pensions: In the past, many workers could rely on a defined-benefit pension plan from their employer for a secure retirement. Today, the responsibility for saving and investing for retirement has shifted almost entirely to the individual through defined-contribution plans like 401(k)s and 403(b)s. This shift creates a huge demand for professionals who can help people manage these accounts effectively.

3. Increasing Complexity of Financial Products: The financial world is constantly evolving, with a dizzying array of investment options, insurance products, and retirement vehicles. Individuals need trusted advisors to help them cut through the noise