Have you ever wondered about the financial lifeblood of a multi-billion dollar corporation? Who ensures there's enough cash to make payroll for 50,000 employees, fund a major acquisition, or navigate a sudden market downturn? The answer often lies with a small, highly specialized team, and at its core is the Senior Treasury Analyst. This role is far more than just accounting; it is the strategic command center for a company's most critical asset: its cash. For those with a sharp mind for finance, a calm demeanor under pressure, and a desire to play a pivotal role in corporate strategy, a career as a Senior Treasury Analyst offers not only immense satisfaction but also significant financial rewards, with a typical salary ranging from $95,000 to over $140,000 annually.

Early in my career consulting for a major manufacturing firm, I witnessed a treasury team navigate a sudden, unexpected credit crisis that froze key lending markets. While other departments panicked, the treasury team calmly executed contingency funding plans they had modeled months before. It wasn't just about numbers on a spreadsheet; it was about foresight, strategy, and securing the company's very survival. That moment solidified for me that treasury is not a back-office function—it's the financial vanguard of the enterprise.

This comprehensive guide is designed to be your definitive resource, whether you're a finance student mapping out your future, a junior analyst looking to advance, or a professional considering a pivot into corporate treasury. We will dissect every component of the Senior Treasury Analyst salary, explore the factors that can maximize your earning potential, and provide a clear, actionable roadmap to enter and excel in this demanding and rewarding field.

### Table of Contents

- [What Does a Senior Treasury Analyst Do?](#what-they-do)

- [Average Senior Treasury Analyst Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-start)

- [Conclusion: Is a Treasury Career Right for You?](#conclusion)

What Does a Senior Treasury Analyst Do? A Look Inside the Corporate Vault

At its heart, the role of a Senior Treasury Analyst is to manage and optimize a company's liquidity and financial risk. They are the guardians of cash, ensuring the organization has the right amount of money, in the right currency, in the right place, at the right time. While a junior analyst might focus on executing daily transactions, a *senior* analyst takes on a more strategic, analytical, and forward-looking role. They don't just report the numbers; they interpret them, build models to predict them, and develop strategies to improve them.

The scope of their responsibilities is broad and touches nearly every aspect of the business. They work closely with accounting, financial planning and analysis (FP&A), legal, and tax departments, and are a key point of contact for the company's banking partners.

Core Responsibilities and Daily Tasks:

A Senior Treasury Analyst's duties are a blend of routine operational oversight and complex, project-based work.

- Cash Management and Forecasting: This is the bedrock of treasury. Senior analysts are responsible for creating, maintaining, and refining the company's short-term (13-week) and long-term cash flow forecasts. They analyze variances between forecasted and actual cash flows to improve model accuracy.

- Liquidity and Funding: They monitor the company’s daily cash position to ensure sufficient funds are available for operations. This includes managing balances across numerous bank accounts, executing wire transfers for large payments, and deciding whether to borrow from a credit line or invest excess cash in short-term securities.

- Financial Risk Management: This is a highly strategic area. Senior analysts help identify and mitigate financial risks, including:

- Foreign Exchange (FX) Risk: For multinational corporations, they analyze exposure to currency fluctuations and may assist in executing hedging strategies.

- Interest Rate Risk: They model the impact of changing interest rates on the company's debt and investments.

- Counterparty Risk: They assess the financial health of the banks and financial institutions the company partners with.

- Bank Relationship Management: They serve as a primary operational contact for the company's banks, managing bank accounts, negotiating bank fees, and ensuring services meet the company's needs.

- Treasury Technology and Systems: They are often power users or administrators of the Treasury Management System (TMS), a specialized software platform that centralizes and automates treasury operations. They may also lead projects to implement new treasury technology.

- Compliance and Reporting: They prepare reports for senior management (e.g., the Treasurer, CFO) on cash positions, investment performance, and risk exposures. They also ensure compliance with internal controls and regulations like Sarbanes-Oxley (SOX).

### A Day in the Life of a Senior Treasury Analyst

To make this more tangible, let's walk through a typical day for "Alex," a Senior Treasury Analyst at a large technology company.

- 8:00 AM - 9:30 AM: The Morning Read-In. Alex logs in and immediately accesses the company's TMS and various bank portals. The first task is to consolidate the prior day's closing cash balances from dozens of accounts across North America and Europe. Alex reconciles this data, identifies any unexpected transactions, and prepares the "Daily Cash Position Report."

- 9:30 AM - 11:00 AM: Forecasting and Funding Decisions. Alex updates the 13-week cash flow forecast with new data from the accounts payable and receivable teams. The model shows a significant cash surplus building in the main U.S. operating account. Alex analyzes short-term investment options (money market funds, commercial paper) and recommends to the Treasury Manager a specific investment to maximize yield while maintaining liquidity. An email is sent to a banking partner to execute the trade.

- 11:00 AM - 12:00 PM: Project Work - FX Hedging. The company is launching a product in Japan. Alex joins a call with the FP&A and sales teams to model the expected Yen-denominated revenues for the next six months. The goal is to quantify the company's exposure to JPY/USD currency risk. Alex begins building a spreadsheet to analyze the potential P&L impact under different currency scenarios.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 2:30 PM: Bank Fee Analysis. Last quarter's bank fees seem high. Alex pulls detailed "Account Analysis" statements from the company's top three banking partners and begins a deep dive, comparing per-item charges and compensating balances. The goal is to build a case to renegotiate these fees, potentially saving the company hundreds of thousands of dollars annually.

- 2:30 PM - 4:00 PM: Ad-Hoc Requests and Reporting. The Assistant Treasurer pings Alex with an urgent request: "Can you pull our total exposure to Bank XYZ across loans, deposits, and derivatives?" Alex queries the TMS and internal records to consolidate the data and prepares a summary memo. Following this, Alex works on the monthly treasury presentation for the CFO, creating charts that visualize key metrics like investment performance and debt levels.

- 4:00 PM - 5:00 PM: Wrapping Up and Planning. Alex reviews the day's executed transactions to ensure they settled correctly. A final check of the closing cash position is made. Before logging off, Alex reviews the calendar for tomorrow—a meeting with the TMS vendor to discuss a system upgrade—and jots down key talking points.

This snapshot reveals a role that is analytical, detail-oriented, and highly strategic, requiring a professional who can seamlessly switch between tactical execution and long-range planning.

Average Senior Treasury Analyst Salary: A Deep Dive

The compensation for a Senior Treasury Analyst is a compelling aspect of the career path, reflecting the critical nature of the role and the specialized skills required. While the exact figure can vary significantly based on the factors we'll explore in the next section, we can establish a strong baseline using data from leading compensation authorities.

It is crucial to understand that "average salary" is just a midpoint. The actual take-home pay is a package that often includes a substantial performance-based bonus and other valuable benefits.

### National Salary Benchmarks

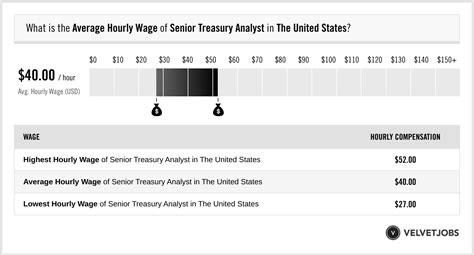

According to recent data, the salary landscape for a Senior Treasury Analyst in the United States is robust. Here’s a synthesis of data from several reputable sources to provide a comprehensive picture:

- Salary.com: As of late 2023 and early 2024, Salary.com reports that the median annual salary for a Senior Treasury Analyst in the U.S. is approximately $115,379. The typical salary range falls between $104,785 and $127,157. This range represents the core 50% of earners, excluding the bottom 25% and top 25%.

- Payscale: Payscale's data, which is crowdsourced from professionals in the field, shows a slightly different but comparable figure. Their reported average salary for a Senior Treasury Analyst is $96,025 per year. However, they also provide a wider total pay range, including bonuses and profit sharing, that extends from $73,000 to $124,000.

- Glassdoor: Glassdoor, which combines user-submitted data with its own estimates, places the total estimated pay for a Senior Treasury Analyst at $126,539 per year in the United States, with an average base salary of $104,772. The difference is made up of additional cash compensation, such as bonuses, which they estimate at an average of $21,767.

Synthesized View: Taking these sources together, a reasonable expectation for a Senior Treasury Analyst's base salary is in the $95,000 to $120,000 range, with a median hovering around $110,000. When you factor in bonuses, the total cash compensation frequently moves into the $115,000 to $140,000 range.

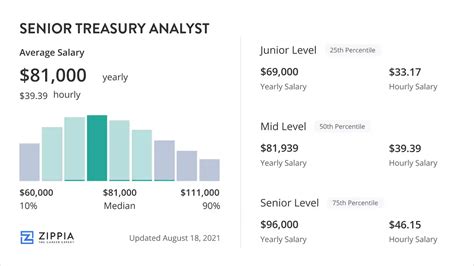

### Salary Progression by Experience Level

A career in treasury offers a clear and rewarding path for salary growth as you accumulate experience and take on more responsibility. Here’s a typical progression:

| Experience Level | Typical Title(s) | Typical Base Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Treasury Analyst, Financial Analyst | $65,000 - $85,000 | Daily cash positioning, wire execution, bank account administration, basic reporting. |

| Mid-Career (3-5 years) | Senior Treasury Analyst | $90,000 - $125,000 | Cash flow forecasting, managing bank relationships, basic risk analysis, mentoring junior staff. |

| Experienced (5-8 years) | Lead Treasury Analyst, Treasury Supervisor | $110,000 - $150,000+ | Complex financial modeling, leading hedging programs, managing treasury systems, supervising analysts. |

| Management (8+ years) | Treasury Manager, Assistant Treasurer | $140,000 - $200,000+ | Setting treasury strategy, managing debt and capital markets, overseeing entire treasury function. |

*Source: Data synthesized from Salary.com, Robert Half Salary Guides, and industry observations.*

As the table shows, the "Senior Treasury Analyst" title is a crucial stepping stone. It marks the transition from being a purely operational employee to a strategic contributor, and the compensation reflects this increased value.

### Deconstructing the Compensation Package: More Than Just a Base Salary

A Senior Treasury Analyst’s offer letter rarely stops at the base salary. The total compensation package is a critical part of the financial equation and can add 10-25% or more to the base salary.

- Annual Performance Bonus: This is the most common additional component. It is typically structured as a percentage of the base salary, contingent on both individual and company performance. For a Senior Analyst, a target bonus of 10% to 15% of base salary is standard at large corporations. If the company has a strong year, this can be significantly higher.

- Profit Sharing: Some companies, particularly privately held or smaller firms, offer a profit-sharing plan where a portion of the company's profits is distributed to employees. This can be a powerful incentive but is less predictable than a structured bonus.

- Stock Options or Restricted Stock Units (RSUs): In publicly traded companies, especially in the tech sector, equity is a major part of compensation. RSUs are grants of company stock that vest over a period of time (e.g., 4 years). This aligns the analyst's financial interests with the long-term success of the company and can be extremely lucrative.

- Comprehensive Benefits: While not direct cash, the value of a strong benefits package cannot be overstated. This includes:

- Health Insurance: Premium medical, dental, and vision plans.

- Retirement Savings: A 401(k) or similar plan with a generous company match (e.g., matching 100% of contributions up to 6% of your salary) is essentially free money.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies.

- Professional Development: Many companies will pay for the cost of obtaining and maintaining certifications like the CTP, as well as for attending industry conferences.

When evaluating a job offer, it's essential to look at the total rewards statement, which quantifies the value of all these components, to understand the true earning potential of the role.

Key Factors That Influence Senior Treasury Analyst Salary

While the national averages provide a useful benchmark, your personal earning potential as a Senior Treasury Analyst will be determined by a specific set of factors. Understanding and strategically navigating these variables is the key to maximizing your compensation throughout your career. This section provides an in-depth analysis of the six primary drivers of salary.

### 1. Level of Education and Professional Certifications

Your academic and professional credentials provide the foundation for your career and are a significant signal of your expertise to employers.

- Bachelor's Degree: A bachelor's degree in Finance, Accounting, or Economics is the standard and non-negotiable entry requirement for a treasury career. This provides the fundamental knowledge of financial statements, corporate finance principles, and economic indicators. There is generally little salary differentiation at the bachelor's level between these majors.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier business school with a finance concentration, can be a powerful salary accelerant. It's less common for a Senior Analyst but becomes a significant differentiator when moving into Treasury Manager or Assistant Treasurer roles. An MBA can command a 15-20% salary premium and often opens doors to leadership positions in Fortune 500 companies.

- Professional Certifications (The Game Changer): This is arguably the most important educational factor for a treasury professional. Certifications demonstrate a commitment to the field and a mastery of a specialized body of knowledge.

- Certified Treasury Professional (CTP): This is the global standard of excellence in the treasury profession, administered by the Association for Financial Professionals (AFP). Holding a CTP signals comprehensive expertise in cash management, risk management, and corporate finance. Job postings for senior roles frequently list the CTP as a "preferred" or even "required" qualification. According to the AFP, professionals who hold the CTP designation can earn up to 16% more than their non-certified peers. It is the single most impactful credential you can earn to boost your salary and career prospects in treasury.

- Certified Public Accountant (CPA): While more an accounting designation, a CPA is highly respected in treasury because of the role's close ties to financial reporting and controls. It demonstrates a deep understanding of financial statements and regulatory compliance, which is very valuable.

- Chartered Financial Analyst (CFA): The CFA charter is the gold standard for investment management. For Senior Treasury Analysts who are heavily involved in managing the company's investment portfolio or in capital markets activities, the CFA is a significant differentiator and can lead to highly specialized, high-paying roles.

### 2. Years of Experience

Experience is the most direct driver of salary growth in treasury. As you progress, you move from executing tasks to managing processes, and finally to setting strategy. This progression is directly reflected in your compensation.

- Analyst Level (0-3 Years): At this stage, you are learning the ropes. Your focus is on operational accuracy and mastering the fundamentals of cash management. Your salary reflects your status as a trainee, typically in the $65,000 to $85,000 range.

- Senior Analyst Level (3-7 Years): This is the core of the career path. You have mastered the daily operations and are now trusted with more complex, analytical tasks like cash flow forecasting, variance analysis, and managing banking relationships. You begin to own processes and projects. This is where salaries jump significantly into the $90,000 to $125,000 bracket. Employers are paying for your proven ability to work independently and add analytical value.

- Lead Analyst / Supervisor Level (7+ Years): After proving yourself as a Senior Analyst, the next step often involves informal or formal leadership. You may be mentoring junior analysts, leading a major TMS implementation, or taking full ownership of a complex area like the company's FX hedging program. Your salary will push into the upper end of the Senior Analyst range and beyond, often reaching $120,000 to $150,000+, especially with a CTP. This experience is the direct stepping stone to a Treasury Manager role.

### 3. Geographic Location

Where you work has a massive impact on your paycheck. Companies adjust salaries based on the local cost of living and the competitiveness of the talent market. A Senior Treasury Analyst in a major financial hub will earn significantly more than one in a lower-cost area, though the purchasing power may be similar.

Here is a comparative look at how salary ranges for a Senior Treasury Analyst can vary across the U.S., using data from Salary.com's location-based tool:

| City / Metropolitan Area | Median Base Salary | Percentage vs. National Median (~$115k) |

| :--- | :--- | :--- |

| San Francisco, CA | ~$144,500 | +25.3% |

| New York, NY | ~$139,500 | +20.9% |

| Boston, MA | ~$130,500 | +13.1% |

| Washington, D.C. | ~$127,000 | +10.0% |

| Chicago, IL | ~$120,000 | +4.0% |

| Dallas, TX | ~$114,000 | -1.2% |

| Atlanta, GA | ~$111,000 | -3.8% |

| Orlando, FL | ~$107,000 | -7.1% |

| Boise, ID | ~$102,500 | -11.2% |

*Source: Data derived from Salary.com's compensation tools, accessed in early 2024. Figures are approximate and subject to change.*

This table clearly illustrates that roles in high-cost-of-living (HCOL) coastal cities like San Francisco and New York offer a salary premium of 20% or more. Conversely, roles in lower-cost-of-living (LCOL) areas may pay less in absolute dollars but can offer a better quality of life for the same income. The rise of remote work has started to blur these lines, but for now, location remains a top determinant of salary.

### 4. Company Type and Size

The type and scale of the organization you work for will shape both the complexity of your role and the size of your paycheck.

- Fortune 500 / Large Public Corporations: These companies offer the highest salaries and most generous bonus structures. Their treasury operations are complex, often involving global cash pools, multinational FX exposures, and sophisticated capital markets activities. A Senior Treasury Analyst here is a specialist, and they are paid a premium for that expertise. These are the roles most likely to exceed $120,000+ in base pay.

- Mid-Sized Companies ($50M - $2B in Revenue): In this environment, the treasury team is smaller. A Senior Analyst will likely be a generalist with a much broader scope of responsibility, which can be excellent for skill development. Salaries are competitive but typically a step below the Fortune 500 level, falling squarely in the $95,000 to $115,000 national average range.

- Startups and Pre-IPO Companies: These roles offer a unique trade-off. The base salary might be below market average, but this is often compensated with potentially lucrative stock options. The work is often less structured, requiring the analyst to build treasury processes from scratch. This can be a high-risk, high-reward environment.

- Non-Profit and Government: These organizations typically offer lower base salaries than their for-profit counterparts. However, they often provide superior benefits, excellent work-life balance, and strong job security. A Senior Analyst in this sector might earn in the $80,000 to $100,000 range.

### 5. Area of Specialization within Treasury

While "Senior Treasury Analyst" is a specific title, the role can have different flavors depending on the company's needs. Developing deep expertise in a high-demand niche can significantly increase your value.

- Treasury Technology / TMS Specialist: An analyst who is not just a user but an expert in implementing, integrating, and optimizing Treasury Management Systems (like Kyriba, FIS Integrity, or GTreasury) is highly valuable. This blend of finance and IT skills can command a salary premium.

- Capital Markets and Debt Management: In large, debt-heavy corporations, an analyst who specializes in managing the company's debt portfolio, ensuring covenant compliance, and assisting with bond issuances or other capital raises has a very specialized and lucrative skill set.

- Financial Risk Management (FX/Interest Rates): An analyst with deep quantitative skills in modeling and hedging foreign exchange or interest rate risk is essentially an in-house quant. This is one of the most complex and highest-paid specializations within treasury.

- Global Cash Management and Pooling: For vast multinational corporations, optimizing global liquidity through cash pooling structures (notional or physical) is a major challenge. An analyst who understands the legal, tax, and operational intricacies of these structures is a critical asset.

### 6. In-Demand Skills

Beyond your formal credentials and experience, a specific set of technical and soft skills can directly impact your salary negotiations and career trajectory.

*