The role of a Chief Executive Officer at a globally recognized institution like Ford Motor Company represents the zenith of a corporate career. It’s a position of immense power, profound responsibility, and, consequently, extraordinary financial reward. When people search for the "Ford Motor CEO salary," they aren't just curious about a number; they are peering into a world of ultimate professional achievement and wondering, "What does it take to get there?" This isn't merely a job; it's the culmination of a lifetime of strategic decisions, relentless drive, and visionary leadership. The compensation package, often running into the tens of millions of dollars, is a direct reflection of the market's valuation of a leader capable of navigating a 120-year-old industrial giant through the turbulent waters of technological disruption, global competition, and economic uncertainty.

For aspiring executives, seasoned professionals, and the simply curious, understanding this career trajectory is a masterclass in professional development. The salary range for top executives in the United States typically spans from a respectable six figures for leaders of smaller organizations to astronomical eight or even nine-figure packages for those at the helm of Fortune 500 companies. I once had the opportunity to sit in on a quarterly town hall led by a senior automotive executive during a major supply chain crisis. Watching him calmly dissect a multi-billion-dollar problem, articulate a clear path forward, and instill confidence in thousands of employees was a profound lesson in the true nature of executive leadership. The pressure is immense, but the potential to shape an industry and impact millions of lives is the real draw.

This guide will demystify the journey to the executive suite. We will dissect the actual compensation of Ford's CEO as a case study, explore the vast landscape of executive salaries, and detail the critical factors that separate a mid-level manager from a C-suite leader. More importantly, we will provide a comprehensive, actionable roadmap for those who dare to aspire to such a role.

### Table of Contents

- [What Does a Chief Executive Officer (CEO) Do?](#what-does-a-chief-executive-officer-ceo-do)

- [The Anatomy of CEO Compensation: A Deep Dive](#the-anatomy-of-ceo-compensation-a-deep-dive)

- [Key Factors That Influence an Executive's Salary](#key-factors-that-influence-an-executives-salary)

- [Job Outlook and Career Growth for Top Executives](#job-outlook-and-career-growth-for-top-executives)

- [How to Get Started on the Path to the C-Suite](#how-to-get-started-on-the-path-to-the-c-suite)

- [Conclusion: Is the Executive Path Right for You?](#conclusion-is-the-executive-path-right-for-you)

What Does a Chief Executive Officer (CEO) Do?

At its core, the Chief Executive Officer is the highest-ranking executive in a company, ultimately responsible for its success or failure. While the title is singular, the role is multifaceted, blending strategic foresight, operational oversight, financial stewardship, and inspirational leadership. The CEO does not manage the day-to-day minutiae of every department; rather, they manage the leaders who do. Their primary function is to set the overarching vision and strategy for the organization and ensure that all its constituent parts are aligned and executing effectively toward those goals.

The responsibilities of a CEO, particularly one leading a complex organization like Ford, can be broken down into several key domains:

- Strategic Direction and Vision: The CEO is the chief architect of the company's future. This involves identifying long-term market trends (like the shift to electric vehicles and autonomous driving), assessing competitive threats, and defining the company's unique value proposition. They must answer the fundamental question: "Where is our company going, and how will we win?"

- Capital Allocation and Financial Performance: CEOs are the ultimate arbiters of how the company's capital is spent. They make the final call on major investments, such as building a new battery plant, acquiring a tech startup, or launching a new vehicle line. They are accountable to the board of directors and shareholders for delivering strong financial results, including revenue growth, profitability, and stock performance.

- Building and Leading the Senior Executive Team: A CEO is only as good as their team. A significant portion of their time is dedicated to recruiting, developing, and mentoring the C-suite (COO, CFO, CTO, etc.). They must foster a culture of high performance, collaboration, and accountability among the company's top leaders.

- Stakeholder Management: The CEO is the primary interface between the company and its key stakeholders. This includes:

- The Board of Directors: The CEO reports directly to the board, seeking their approval for major strategic initiatives and keeping them informed of the company's performance.

- Investors and Analysts: CEOs spend considerable time communicating with Wall Street, participating in quarterly earnings calls, and presenting at investor conferences to maintain confidence in the company's strategy and financial health.

- Employees: A great CEO inspires and aligns the entire workforce, from the factory floor to the executive offices, around a shared mission.

- Customers, Regulators, and the Public: The CEO is the public face of the company, responsible for managing its brand and reputation.

### A Day in the Life of an Automotive CEO

To make this tangible, consider a hypothetical "Day in the Life" for the CEO of a major automotive company:

- 6:00 AM - 7:00 AM: Review overnight market performance from Asia and Europe, read condensed daily briefings on global news, industry trends, and key operational metrics (e.g., daily production numbers, supply chain alerts).

- 7:30 AM - 9:00 AM: Morning "stand-up" meeting with the senior executive team (COO, CFO, Head of Product). The agenda: review critical production bottlenecks at a key plant, discuss the latest competitor EV launch, and approve the talking points for an upcoming government meeting on emissions standards.

- 9:30 AM - 11:00 AM: Deep-dive strategy session with the head of the autonomous vehicle division. They review the technology roadmap, debate a potential partnership with a software company, and allocate R&D budget for the next quarter.

- 11:30 AM - 12:30 PM: Media interview with a major financial news outlet to discuss the company's electrification strategy and recent earnings report.

- 1:00 PM - 2:00 PM: Lunch meeting with the CEO of a key supplier company to negotiate a long-term contract for battery cells.

- 2:30 PM - 4:00 PM: Board of Directors committee call to provide an update on the company's multi-billion-dollar restructuring plan.

- 4:30 PM - 5:30 PM: A virtual "town hall" with employees from the company's European division, answering questions about market strategy and career development.

- 6:00 PM - 7:00 PM: Final check-in with their Chief of Staff to review priorities for the next day and handle any urgent communications.

- 8:00 PM onwards: Dinner with a key government official or industry peer, followed by several hours of reading board materials or strategic documents in preparation for the week ahead.

This grueling schedule highlights that the CEO role is not a 9-to-5 job. It is an all-encompassing commitment that demands extraordinary stamina, intellectual agility, and unwavering focus.

The Anatomy of CEO Compensation: A Deep Dive

Executive compensation, especially at the level of a Fortune 500 CEO, is a complex and often controversial topic. It's rarely just a simple salary. Instead, it is a carefully structured package designed to align the CEO's financial interests with the long-term success of the company and the interests of its shareholders. To understand the "Ford Motor CEO salary," we must first look at the official figures and then break them down into their core components.

According to Ford Motor Company's 2023 proxy statement filed with the U.S. Securities and Exchange Commission (SEC), President and CEO James D. Farley's total compensation for the 2022 fiscal year was $21 million.

This headline number can be misleading. It’s not a $21 million paycheck deposited into his bank account. To truly understand it, we must dissect the package. CEO compensation is typically composed of four main pillars:

1. Base Salary: This is the fixed, guaranteed portion of the CEO's pay. It is what most people think of as "salary." For Jim Farley in 2022, his base salary was approximately $1.7 million. While a substantial sum, it represented only about 8% of his total compensation. For CEOs, the base salary is often a relatively small part of the overall package, as boards prefer to tie the majority of pay to performance.

2. Short-Term Incentives (Annual Bonus): This is a cash bonus paid out based on the company's performance against specific, pre-defined goals over a one-year period. These metrics often include targets for revenue, profit (like Adjusted EBIT), cash flow, and strategic objectives (like EV production targets or quality improvements). If the company exceeds its targets, the bonus can be larger than the target amount; if it falls short, the bonus can be smaller or even zero. In 2022, Mr. Farley's non-equity incentive plan compensation (annual bonus) was approximately $2.5 million.

3. Long-Term Incentives (LTI): This is the largest and most important component of CEO pay. It is designed to reward the executive for sustained performance over a multi-year period (typically 3-5 years) and to align their interests directly with shareholders. LTIs are almost always delivered in the form of equity.

- Stock Awards (Restricted Stock Units - RSUs): These are grants of company stock that vest—meaning the executive gains full ownership—over a set period. For 2022, Mr. Farley received stock awards valued at approximately $15.1 million at the time of the grant. The final value of these awards will fluctuate with Ford's stock price, directly linking his wealth to the company's market performance. A portion of these are often *performance-based* RSUs (PSUs), which only vest if the company achieves certain long-term goals, such as total shareholder return relative to a peer group.

- Stock Options: These give the executive the right to buy company stock at a predetermined price (the "strike price") in the future. Options only have value if the company's stock price rises above the strike price, creating a powerful incentive for the CEO to increase shareholder value.

4. Perquisites ("Perks") and Other Compensation: This is a smaller category that includes all other benefits, such as personal use of the company aircraft, personal security services, contributions to retirement plans, and insurance premiums. For Mr. Farley, this amounted to several hundred thousand dollars, a significant sum but a minor part of the total package.

### General CEO Salary Ranges and Progression

While the Ford example illustrates the top end, it's essential to look at the broader landscape. Salary data for "Top Executives," which includes CEOs, varies dramatically by the size and type of company.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Top Executives was $189,520 in May 2022. However, this figure is heavily skewed by the vast number of executives at smaller and medium-sized businesses. The BLS notes that the top 10 percent earned more than $239,200, with the salary potential being significantly higher in large corporations.

More specific, C-level data from salary aggregators provides a clearer picture:

- Salary.com reports that the median total compensation for a Chief Executive Officer in the United States is $843,281 as of October 2023, with a typical range falling between $636,634 and $1,102,152. This data often reflects a mix of public and private companies of varying sizes.

- For large public companies (like those in the S&P 500), the figures are much higher. A 2023 report by executive compensation firm Equilar found that the median pay for S&P 500 CEOs in 2022 was $14.5 million.

To visualize the journey, consider this simplified career and salary progression model for a path toward a top executive role in a large corporation:

| Career Stage | Typical Years of Experience | Potential Role | Typical Base Salary Range (Corporate) | Typical Total Compensation Range (with bonuses/equity) |

| :--- | :--- | :--- | :--- | :--- |

| Early Career | 0-5 years | Financial Analyst, Engineer, Marketing Coordinator | $70,000 - $110,000 | $75,000 - $130,000 |

| Mid-Career | 5-10 years | Manager, Senior Manager | $120,000 - $180,000 | $150,000 - $250,000 |

| Senior Leader | 10-15 years | Director | $180,000 - $250,000 | $250,000 - $500,000+ |

| Executive | 15-20+ years | Vice President (VP) | $250,000 - $400,000 | $500,000 - $2,000,000+ |

| C-Suite | 20-25+ years | Chief Officer (CFO, COO) | $400,000 - $800,000 | $2,000,000 - $10,000,000+ |

| CEO (Large Corp) | 25+ years | Chief Executive Officer | $900,000 - $2,000,000+ | $10,000,000 - $50,000,000+ |

*Sources: Data synthesized from BLS, Salary.com, Glassdoor, and public company proxy statements. Ranges are estimates and can vary significantly.*

This table illustrates a critical point: the path to an eight-figure compensation package is not a quick one. It is a long, arduous climb where both responsibility and compensation compound significantly at each successive level. The most dramatic leaps in pay occur when an individual moves from managing a function (Director) to owning a business unit with P&L responsibility (VP) and finally to steering the entire enterprise (C-Suite).

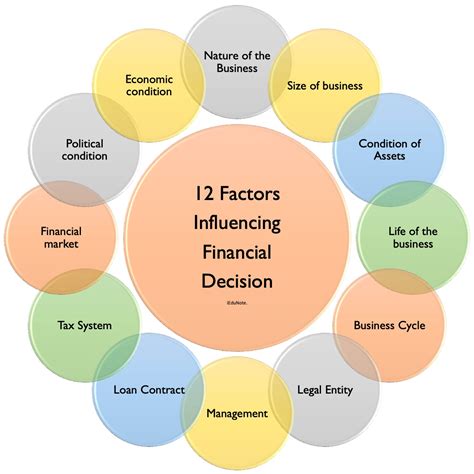

Key Factors That Influence an Executive's Salary

The vast disparity in executive pay—from a small-town manufacturing CEO earning $300,000 to a tech giant CEO earning over $100 million—is driven by a combination of powerful factors. Understanding these variables is crucial for anyone aspiring to maximize their earning potential on the executive track. An executive's compensation is not determined by a single metric but by a complex algorithm of their background, the context of their company, and the value they are perceived to bring.

###

Level of Education

While there is no absolute educational requirement to become a CEO, a strong academic background is a near-universal characteristic of top executives. It serves as a filtering mechanism and a signal of intellectual horsepower, discipline, and commitment.

- Undergraduate Degree: A bachelor's degree is the foundational requirement. Degrees in business, finance, economics, or engineering are the most common pathways into the corporate world that can lead to the C-suite. A degree from a highly prestigious university (e.g., Ivy League, Stanford, MIT) provides not just a top-tier education but also access to a powerful alumni network that can be invaluable for career progression.

- Master of Business Administration (MBA): This is the most significant educational differentiator. An MBA from an elite business school (e.g., Harvard, Stanford GSB, Wharton, Booth, Kellogg) is a powerful accelerant for an executive career.

- Salary Impact: According to a 2022 report by the Graduate Management Admission Council (GMAC), the median starting salary for graduates of top-ranked U.S. business schools was $175,000. More importantly, it places graduates on an accelerated track to leadership roles. Companies often recruit directly from these programs for their leadership development pipelines.

- Network & Credibility: An elite MBA provides an unparalleled network of peers, professors, and alumni who will become future leaders, board members, and investors. It also bestows a level of credibility that can open doors to opportunities and add weight during compensation negotiations. For board members selecting a CEO, a top-tier MBA is often seen as a significant de-risking factor.

- Other Advanced Degrees: While less common than the MBA, other advanced degrees can be highly valuable. A J.D. (law degree) is common for CEOs who rise through the legal or regulatory side of a business. A Ph.D. in a technical field can be the pathway to CEO at a deep-tech or pharmaceutical company.

###

Years of Experience

Experience is arguably the single most important factor in determining executive compensation. However, it's not just the quantity of years but the *quality and trajectory* of that experience that matters most. Compensation committees and boards look for a track record of progressively larger and more complex responsibilities, coupled with demonstrable success at each stage.

- Entry-Level (0-5 years): At this stage, salary is largely determined by function, industry, and educational credentials. High-potential individuals in finance or engineering at a Fortune 500 company might earn in the low six figures, including bonuses. The focus is on mastering a technical skill and proving competence.

- Mid-Career (5-15 years): This is where career paths diverge. Those on the executive track move from being individual contributors to managers and then directors of a function. Salary growth is steady, moving into the $150,000 - $250,000 base range, with total compensation potentially reaching $300,000-$500,000 or more with bonuses and initial equity grants. The key milestone is moving from managing tasks to managing people and projects.

- Senior Leadership (15-25 years): The critical transition to Vice President or General Manager occurs here. This is typically the first time an executive has full Profit & Loss (P&L) responsibility for a business unit. They are no longer just a "cost center" (like HR or marketing) but a "profit center." This is the crucible where future CEOs are forged. Base salaries push into the $300,000-$500,000 range, but total compensation explodes into the seven figures, as a significant portion of their pay is now tied to the performance of their division through large bonus and equity grants.

- C-Suite and CEO Level (25+ years): At this pinnacle, compensation is determined less by internal salary bands and more by the external market for executive talent. The board's compensation committee will hire an external consulting firm to benchmark their CEO's proposed pay against a "peer group" of CEOs at similarly sized companies in the same or adjacent industries. Jim Farley's compensation at Ford is benchmarked against CEOs at companies like General Motors, Boeing, and 3M. His track record—including his role in the successful launch of Ford+ plan—is the primary justification for his pay package.

###

Geographic Location

For most jobs, location is a primary driver of salary due to cost of living and local market demand. For top C-suite executives at global corporations, this factor is more nuanced. While a CEO's salary isn't directly tied to a cost-of-living index, the location of the company's headquarters still has an influence.

- Major Economic Hubs: Companies headquartered in major global cities like New York, London, San Francisco, or Tokyo compete for talent in a highly expensive market. This tends to inflate executive pay scales across the board, even if the executive's role is global. A CEO based in the Bay Area will almost certainly have a higher compensation package than one leading a similarly sized company in the Midwest, partly because the talent pool they recruit from has higher salary expectations.

- Industry Clusters: Certain industries are geographically concentrated, creating competitive hotspots for executive talent. Detroit remains the heart of the U.S. automotive industry, meaning Ford, GM, and Stellantis are in close proximity, creating a competitive environment for automotive-specific executive talent. Similarly, Silicon Valley has an intense concentration of tech companies, and Houston is a hub for energy executives. This regional competition can drive up pay.

- State and Local Tax Burden: The tax environment can also play a role, particularly during negotiations for a new CEO. A company in a high-tax state like California or New York may need to offer a higher gross compensation package to provide the same net, take-home pay as a company based in a no-income-tax state like Texas or Florida.

###

Company Type & Size

This is a massive determinant of executive pay. The scale, complexity, and financial resources of an organization directly correlate with the compensation of its leader.

- Large Public Corporations (Fortune 500): This is the highest-paying segment. These companies have billions or hundreds of billions in revenue, thousands of employees, and global operations. The CEO's decisions have immense financial consequences, and they operate under the intense scrutiny of the public market, regulators, and the media. As seen with Ford, total compensation is typically in the eight figures ($10M+), heavily weighted towards stock-based incentives.

- Mid-Cap and Small-Cap Public Companies: These are smaller publicly traded companies. Their CEOs still face public market pressures but manage less complex organizations. Total compensation is more likely to be in the low-to-mid seven figures ($1M - $8M).

- Private Equity (PE) Owned Companies: The compensation model here is unique. The CEO often receives a lower base salary and annual bonus than their public company counterparts. However, the real prize is a significant direct equity stake in the company. If the PE firm successfully grows and sells the company (or takes it public) in 3-7 years, the CEO's equity can result in a massive one-time payout, potentially worth tens or even hundreds of millions of dollars. The risk is higher, but the potential reward is immense.

- Venture-Backed Startups: Early-stage startup CEOs often take very low salaries, sometimes under $150,000, to preserve cash. Their compensation is almost entirely in the form of equity. The dream is a "unicorn" valuation and a successful IPO or acquisition that makes their founder's stock worth a fortune.

- Non-Profit and Government: Leaders in these sectors are driven more by mission than by money. A CEO of a large national non-profit (like the American Red Cross) might earn a salary in the high six figures (e.g., $500,000 - $700,000), a substantial sum but a fraction of their corporate equivalent. Government executive pay is set by statutory pay scales and is even lower.

###

Area of Specialization (Path to CEO)

The functional background an executive comes from can influence their path to the top and their eventual compensation. Certain backgrounds are seen as more direct training grounds for the CEO role.

- Operations (COO Path): Executives who rise through operations, manufacturing, or supply chain have a deep understanding of how the company actually works. They are masters of efficiency and execution. This is a very common path to CEO in industrial and manufacturing companies, like the automotive industry. A background as a Chief Operating Officer is often the final step before becoming CEO.

- Finance (CFO Path): Chief Financial Officers have mastery over the numbers, capital markets, and investor relations. In an era of complex financial engineering, M&A, and shareholder activism, the CFO path to CEO has become increasingly common across all industries.

- Product/Engineering: In technology and automotive companies, leaders who come from the product development and engineering side bring a deep understanding of the core product. Jim Farley of Ford, for instance, had a long career in product planning and marketing at Toyota before joining Ford. This expertise is critical when the product itself is undergoing a fundamental transformation (e.g., from internal combustion to electric).

- Sales/Marketing: Leaders with a background in sales and marketing are experts in the customer, branding, and revenue generation. This path is common in consumer-packaged goods (CPG) and retail industries.

The "hotter" the functional area is for a given industry's current challenges, the more leverage an executive from that background has. Today, an executive with deep experience in software and digital transformation is incredibly valuable to an automotive company and can command a premium.

###

In-Demand Skills

Beyond a resume, certain intangible skills dramatically increase an executive's value and, consequently, their salary.

- Strategic Vision: The ability to see beyond the next quarter and articulate a compelling, long-term vision for the company in a changing world.

- Financial Acumen: Not just understanding a P&L, but deeply grasping capital allocation, M&A, and how to communicate with Wall Street.

- Transformational Leadership: The proven ability to lead a company through significant change, such as a digital transformation, a major restructuring, or a shift in business models (like Ford's move to EVs).

- Crisis Management: A track record of navigating the company through unexpected crises—a product recall, a cyberattack, a PR disaster—is highly valued by boards.

- Communication & Executive Presence: The ability to command a room, inspire employees, build trust with the board, and act as a polished public spokesperson for the company.

- ESG Expertise: A growing demand for leaders who understand Environmental, Social, and Governance issues and can integrate sustainability and corporate responsibility into the core business strategy.

Job Outlook and Career Growth for Top Executives

The career path to the C-suite is less a clearly marked highway and more like summiting a treacherous mountain. The job outlook for top executives is characterized by slow growth in the absolute number of positions but incredibly intense competition for those that exist. The rewards are high, but the pyramid narrows dramatically at the top.

### The Statistical Outlook

According to the U.S. Bureau of Labor Statistics (BLS) in its 2023 Occupational Outlook Handbook, employment for "Top Executives" is projected to grow by 3 percent from 2022 to 2032. This is on par with the average growth rate for all occupations. The BLS projects about 215,700 openings for top executives each year, on average, over the decade. However, it's crucial to understand that most of these openings are expected to result from the need to replace executives who retire or transfer to different occupations, not from the creation of new positions.

The title