Financial Planning & Analysis (FP&A) has rapidly become one of the most strategic and influential functions within modern business. For professionals with a knack for numbers and a passion for strategy, a career in FP&A offers not only a seat at the decision-making table but also significant earning potential. Salaries for FP&A roles can range from a strong starting point of around $70,000 for entry-level analysts to well over $200,000 for senior directors and VPs.

But what exactly drives this wide salary range? This comprehensive guide will break down the compensation you can expect at every stage of your FP&A career, the key factors that influence your pay, and the promising future of this dynamic profession.

What Does an FP&A Professional Do?

Before diving into the numbers, it's essential to understand the role. FP&A professionals are the financial navigators of a company. They act as the crucial bridge between the accounting team, which records historical performance, and the executive team, which charts the company's future course.

Their core responsibilities include:

- Budgeting and Forecasting: Creating detailed financial plans and predicting future performance.

- Variance Analysis: Analyzing the difference between planned results (budget) and actual results to understand business drivers.

- Financial Modeling: Building complex models to simulate financial outcomes for new projects, investments, or strategic shifts.

- Management Reporting: Preparing insightful reports and presentations for leadership to support data-driven decision-making.

In essence, FP&A professionals use data to tell the story of a company's financial health and help script its next chapter.

Average FP&A Salary

While a single "average" salary can be misleading, it provides a useful benchmark. According to data from major salary aggregators, the average salary for a mid-level FP&A professional in the United States typically falls between $90,000 and $115,000 per year.

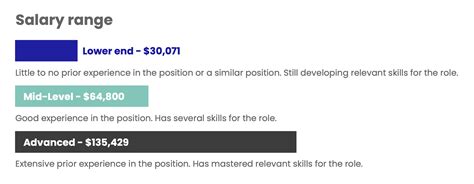

However, compensation in FP&A is heavily tiered by experience and responsibility. Here is a more detailed breakdown:

- Entry-Level FP&A Analyst (0-2 years): $70,000 - $88,000

- Mid-Level FP&A Analyst (3-5 years): $85,000 - $110,000

- Senior FP&A Analyst (5+ years): $95,000 - $125,000

- FP&A Manager: $120,000 - $160,000+

- FP&A Director / VP: $165,000 - $250,000+

*(Source: Data compiled and synthesized from Salary.com, Glassdoor, and the 2024 Robert Half Salary Guide.)*

It's important to note that these figures represent base salary. Many FP&A roles, especially at the senior and management levels, include a significant annual bonus component that can increase total compensation by 10-30% or more.

Key Factors That Influence Salary

Your specific salary within these ranges is determined by a combination of critical factors. Understanding these levers is key to maximizing your earning potential.

###

Level of Education

A strong educational foundation is the price of entry. A bachelor's degree in Finance, Accounting, Economics, or a related field is a standard requirement. However, advanced degrees and certifications provide a significant salary boost.

- Master's Degree: An MBA or a Master of Science in Finance can increase starting salary potential and accelerate your path to leadership roles. Employers often view candidates with a master's degree as having a more developed strategic mindset.

- Certifications: Professional certifications are highly valued as they demonstrate a proven level of expertise. The two most common in FP&A are:

- Certified Public Accountant (CPA): While traditionally an accounting credential, a CPA is highly respected in FP&A for the deep understanding of financial principles it represents.

- Certified Management Accountant (CMA): This certification is specifically focused on management accounting and financial strategy, making it directly relevant to the core functions of FP&A.

###

Years of Experience

Experience is arguably the single most significant factor in determining your FP&A salary. Your career and compensation will typically progress through distinct stages:

- Analyst Level (0-5 years): Early in your career, you will focus on data gathering, report building, and supporting senior team members. As you gain experience, you'll move from an FP&A Analyst I to an FP&A Analyst II or Senior Analyst, taking on more complex modeling and analysis.

- Manager Level (5-10 years): As an FP&A Manager, your role shifts from "doing" to "leading." You will manage a team of analysts, oversee the budgeting and forecasting process, and serve as a key business partner to operational leaders. This leap in responsibility comes with a substantial increase in salary and bonus potential.

- Director/VP Level (10+ years): At the highest levels, FP&A leaders are responsible for the entire financial strategy of a company or a major division. They work directly with the C-suite (CFO, CEO) and the board of directors. Compensation at this level is heavily weighted towards performance bonuses and long-term incentives like stock options.

###

Geographic Location

Where you work matters. Salaries are adjusted for the local cost of labor and living. Major metropolitan hubs with a high concentration of corporate headquarters command the highest salaries.

According to the Robert Half 2024 Salary Guide, you can expect to earn significantly more than the national average in cities like:

- New York City: +39%

- San Francisco Bay Area: +37%

- Boston: +34%

- Los Angeles: +30%

Conversely, salaries in smaller cities and regions with a lower cost of living will likely be closer to or slightly below the national average. The rise of remote work has introduced new complexity, with some companies paying based on headquarters' location while others adjust pay to the employee's location.

###

Company Type

The size and industry of your employer play a major role in your compensation.

- Industry: High-growth, high-margin industries like Technology (SaaS), Financial Services, and Pharmaceuticals typically offer the most competitive salaries for FP&A talent.

- Company Size: Large, publicly traded corporations generally offer higher base salaries and more structured compensation packages. The Robert Half Salary Guide notes that large companies (over $500M in revenue) can pay 10-20% more for the same role compared to small companies (under $50M in revenue).

- Public vs. Private vs. Startup: Public companies often have the highest base salaries. Startups may offer a lower base salary but compensate with potentially lucrative equity options. Private equity-backed companies can also be very competitive, with a strong focus on performance-based bonuses.

###

Area of Specialization

Within FP&A, certain specializations are in high demand and can command a premium salary. While many roles are generalist, developing expertise in one of these areas can accelerate your career:

- Corporate FP&A: Focuses on the consolidated, enterprise-wide financial picture.

- Business Unit FP&A: Embedded within a specific division (e.g., Marketing, R&D) to act as a dedicated finance partner.

- Sales FP&A: Specializes in sales forecasting, commission modeling, and go-to-market strategy.

- Capital Planning / Treasury FP&A: Focuses on long-term capital investments, cash flow management, and balance sheet forecasting.

- M&A Finance: Supports the financial modeling and due diligence for mergers and acquisitions.

Job Outlook

The future for FP&A professionals is exceptionally bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Analysts, the category that includes FP&A, will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations.

This demand is driven by a growing need for organizations to use sophisticated data analysis to guide their business strategy, manage risk, and navigate an increasingly complex global economy. Companies are investing more than ever in their FP&A teams to gain a competitive edge.

Conclusion

A career in Financial Planning & Analysis is a challenging, impactful, and financially rewarding path. Your earning potential is directly tied to your ability to deliver strategic value.

Here are the key takeaways for anyone considering or advancing in an FP&A career:

- Strong Earning Potential: With salaries ranging from $70k to over $200k, FP&A offers a lucrative career trajectory.

- Experience is King: Your salary will grow significantly as you move from analyst to manager to director.

- Invest in Yourself: Advanced degrees (MBA) and certifications (CMA, CPA) are proven ways to boost your compensation and credibility.

- Location and Company Matter: Your choice of city and employer can impact your salary by 30% or more.

- The Future is Bright: The demand for skilled FP&A professionals is strong and expected to grow, ensuring excellent job security and opportunity for years to come.

By focusing on continuous learning, developing specialized skills, and strategically navigating your career choices, you can build a highly successful and prosperous career in the world of FP&A.