Table of Contents

- [Introduction: The Financial Cornerstone of Business](#introduction)

- [What Exactly Does a Full Charge Bookkeeper Do?](#what-does-a-full-charge-bookkeeper-do)

- [Average Full Charge Bookkeeper Salary: A Deep Dive](#average-full-charge-bookkeeper-salary-a-deep-dive)

- [Key Factors That Influence a Full Charge Bookkeeper's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Full Charge Bookkeepers](#job-outlook-and-career-growth)

- [How to Become a Full Charge Bookkeeper: A Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Full Charge Bookkeeper Career Right for You?](#conclusion)

Introduction: The Financial Cornerstone of Business

For every visionary entrepreneur with a groundbreaking idea, for every bustling small business serving its community, there is an unsung hero working diligently behind the scenes: the full charge bookkeeper. This is not just a data entry clerk; this is the financial steward, the master of the ledger, and the individual who translates the chaos of daily transactions into the clear, actionable language of finance. If you are a detail-oriented, analytical individual seeking a stable, in-demand, and rewarding career, you have likely considered this pivotal role. But what does it truly pay?

The financial compensation for a full charge bookkeeper is as multifaceted as the role itself. While national averages provide a solid benchmark—typically ranging from $55,000 to $75,000 per year—the real story lies in the details. A highly skilled professional in a major metropolitan area with specialized expertise can easily command a salary approaching six figures.

I've spent over a decade analyzing career trajectories, and early in my work consulting for a rapidly growing tech startup, I witnessed firsthand the transformative power of a great full charge bookkeeper. They inherited a mess of spreadsheet-based records and, within three months, implemented a streamlined system that provided the CEO with real-time financial clarity, ultimately securing a crucial round of funding. They weren't just a "numbers person"; they were the financial conscience and strategic partner of the company.

This comprehensive guide is designed to be your definitive resource for understanding the full charge bookkeeper salary. We will move far beyond simple averages, dissecting every factor that impacts your earning potential—from your education and certifications to your geographic location and the specific skills you bring to the table. Whether you're just starting out or looking to maximize your income in your current role, this article will provide the authoritative data and expert insights you need to navigate your career path with confidence.

What Exactly Does a Full Charge Bookkeeper Do?

The term "full charge" is the key differentiator. Unlike a general bookkeeper who might handle only accounts payable or payroll, a full charge bookkeeper is responsible for managing the *entire* accounting cycle for a company from start to finish. They are, in essence, the sole accounting professional in a small to medium-sized business (SMB), reporting directly to the owner, CEO, or an external CPA. This level of responsibility requires a broad and deep skill set, blending meticulous record-keeping with light financial analysis.

A full charge bookkeeper is the central hub of all financial activity. Their primary mandate is to ensure that the company's financial records are accurate, up-to-date, and compliant with regulations. This comprehensive oversight allows business owners to make informed decisions about budgeting, spending, and growth.

### Core Responsibilities and Daily Tasks

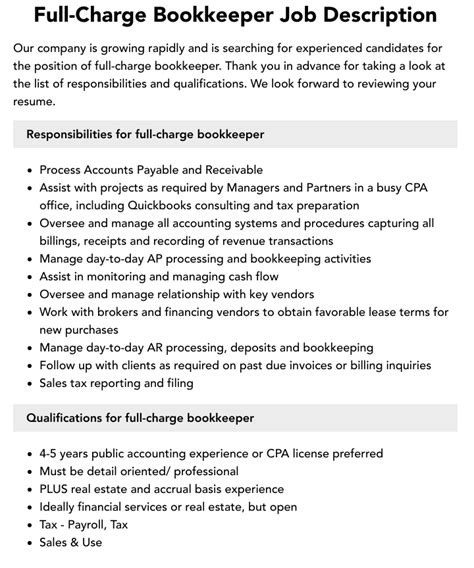

While the specifics can vary by company, the core duties of a full charge bookkeeper are remarkably consistent and comprehensive:

- Accounts Payable (A/P): Managing all vendor bills, ensuring timely and accurate payments, and maintaining vendor records.

- Accounts Receivable (A/R): Creating and sending invoices, tracking payments from customers, and following up on overdue accounts.

- Payroll Processing: Calculating employee hours, processing payroll, managing tax withholdings, and ensuring compliance with federal and state labor laws.

- Bank and Credit Card Reconciliation: Meticulously comparing the company's internal records with bank and credit card statements to identify discrepancies and ensure every transaction is accounted for.

- General Ledger Management: Maintaining the chart of accounts and ensuring all transactions are correctly categorized.

- Month-End and Year-End Closing: The critical process of closing the books for a given period, which includes making adjusting entries, reconciling all accounts, and preparing the records for financial statement generation.

- Financial Reporting: Preparing key financial statements, including the Profit & Loss (P&L) Statement, Balance Sheet, and Cash Flow Statement, for review by management or an external CPA.

- Liaison with CPA: Acting as the primary point of contact for the company's external Certified Public Accountant, especially during tax season or audits.

### A Day in the Life of a Full Charge Bookkeeper

To make this role more tangible, let's walk through a typical day:

- 9:00 AM - 10:30 AM: Start the day by reviewing bank feeds in the accounting software (like QuickBooks or Xero). Categorize overnight transactions, review the company's cash position, and check for any urgent emails from vendors or the CEO. Process any high-priority invoices that came in overnight.

- 10:30 AM - 12:00 PM: Focus on Accounts Payable. Enter new bills, schedule payments for the upcoming week, and respond to vendor inquiries about payment status.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 3:00 PM: Switch to Accounts Receivable. Generate and send out new invoices for services rendered. Make polite follow-up calls or send emails regarding past-due invoices to ensure healthy cash flow.

- 3:00 PM - 4:30 PM: Today is the 15th, so it's payroll day. Double-check employee timesheets, calculate overtime, and run the bi-weekly payroll. Prepare the payroll journal entry for the general ledger.

- 4:30 PM - 5:00 PM: End the day by working on a longer-term project. If it's the end of the month, this time would be dedicated to bank reconciliations and preparing initial month-end reports. Today, it involves cleaning up the chart of accounts to provide more granular reporting for the marketing department.

This structured yet dynamic environment is perfect for individuals who thrive on order, accuracy, and being the go-to financial expert within an organization.

Average Full Charge Bookkeeper Salary: A Deep Dive

Understanding your potential earnings is a critical step in evaluating any career path. For full charge bookkeepers, compensation reflects the significant responsibility and broad skill set required for the role. We've aggregated data from the most reputable sources to provide a clear and comprehensive picture of what you can expect to earn.

### National Averages and Salary Ranges

While figures vary slightly between data providers based on their methodologies, a strong consensus emerges.

- Salary.com: As of late 2023 and early 2024, Salary.com reports that the median annual salary for a Full Charge Bookkeeper in the United States is $65,101. The typical salary range falls between $57,983 and $72,670.

- Payscale: Payscale's data shows an average base salary of around $58,900 per year. Their range is broader, suggesting that total pay (including bonuses and profit sharing) can extend from $44,000 on the low end to $79,000 on the high end for experienced professionals.

- Glassdoor: Based on user-submitted data, Glassdoor lists a national average base pay of approximately $62,500 per year, with a likely range between $52,000 and $76,000.

Consolidated View: Taking these sources together, it's safe to establish a reliable national average salary for a full charge bookkeeper at approximately $62,000 per year, with the majority of professionals earning between $55,000 and $75,000.

However, this national average is just the starting point. Your individual earnings will be heavily influenced by your experience, location, and skills.

### Salary by Experience Level

Career progression brings with it a clear and rewarding increase in earning potential. Here is a breakdown of what you can expect at different stages of your career, based on percentile data from sources like Salary.com.

| Career Stage | Years of Experience | Typical Salary Range (Annual) | Percentile Equivalent | Description |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $45,000 - $55,000 | 10th - 25th Percentile | Learning the company's systems, handling basic A/P and A/R tasks, assisting with reconciliations under supervision. |

| Mid-Career | 3-8 Years | $56,000 - $70,000 | 25th - 75th Percentile | Independently managing the full accounting cycle, handling payroll, preparing monthly financial statements, and becoming the primary financial point of contact. |

| Senior/Lead | 8+ Years | $71,000 - $85,000+ | 75th - 90th+ Percentile | Overseeing complex financial operations, potentially supervising junior staff, providing strategic financial insights, and handling specialized tasks like job costing or multi-entity accounting. |

These figures demonstrate a clear financial incentive for longevity and skill development in the field. A seasoned full charge bookkeeper with a decade of experience can earn significantly more than someone just starting out.

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. Total compensation includes all forms of pay and benefits, which can add significant value to your overall financial package.

- Bonuses: Annual performance bonuses are common, especially in profitable companies. According to Payscale and Glassdoor data, these can range from $1,000 to $5,000 or more, often tied to company performance or individual achievements like a flawless audit or identifying significant cost savings.

- Profit Sharing: This is a particularly attractive benefit offered by many small to medium-sized businesses. A percentage of the company's profits is distributed among employees, directly rewarding them for their contribution to the company's success. This can add several thousand dollars to an annual income.

- Health and Retirement Benefits: The value of a comprehensive benefits package cannot be overstated. This includes:

- Health Insurance: Medical, dental, and vision coverage. A strong employer contribution can be worth over $10,000 per year.

- Retirement Plans: Access to a 401(k) or 403(b) plan, especially one with an employer match, is a crucial component of long-term financial planning. An employer match is essentially free money toward your retirement.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies contribute to a healthy work-life balance and are a key part of the compensation package.

- Professional Development: Many employers will pay for certifications (like the Certified Bookkeeper exam), continuing education courses, and software training. This investment in your skills not only helps the company but also increases your future earning potential.

When evaluating a job offer, it's essential to look beyond the base salary and consider the full value of the total compensation package.

Key Factors That Influence a Full Charge Bookkeeper's Salary

The national average provides a useful baseline, but the $30,000+ gap between the lower and upper ends of the salary range is explained by a specific set of factors. Mastering these variables is the key to maximizing your income. This section, the most critical in our guide, will provide an in-depth analysis of what truly drives your pay.

### 1. Level of Education and Certification

While you can enter the field without a formal degree, your educational background sets the foundation for your career trajectory and earning potential.

- High School Diploma or GED: This is the minimum requirement. Individuals at this level often start in entry-level roles like accounting clerk and work their way up. Their salary will typically start at the lower end of the spectrum, around $45,000 - $50,000.

- Associate's Degree (A.A.) in Accounting or Business: This is a significant step up. A two-year degree provides a structured understanding of accounting principles (like GAAP), business ethics, and foundational software skills. Employers view this favorably, and it can help you secure a full charge bookkeeper role more quickly, often starting in the $50,000 - $58,000 range.

- Bachelor's Degree (B.S. or B.A.) in Accounting or Finance: This is the gold standard for maximizing income. A four-year degree offers a deep, comprehensive knowledge of accounting theory, corporate finance, tax law, and auditing. Graduates are equipped for more complex roles and have a clearer path to advancement (e.g., to Controller or Accounting Manager). A full charge bookkeeper with a Bachelor's degree can command a starting salary of $60,000 or more and will reach the higher end of the salary scale much faster.

The Power of Certifications:

Certifications are one of the fastest ways to validate your skills and boost your salary. They signal a commitment to the profession and a verified level of expertise.

- Certified Bookkeeper (CB): Offered by the American Institute of Professional Bookkeepers (AIPB), this is the premier national standard. It requires verifiable experience, passing a four-part exam covering everything from adjusting entries to payroll and fraud prevention, and adherence to a code of ethics. Holding a CB designation can add 5-15% to your base salary.

- Certified Public Bookkeeper (CPB): Offered by the National Association of Certified Public Bookkeepers (NACPB), this is another highly respected credential that demonstrates proficiency in bookkeeping, payroll, and QuickBooks.

- Software Certifications (e.g., QuickBooks Online Certified ProAdvisor, Xero Advisor Certification): These are essential in the modern accounting world. Mastery of a major accounting platform is non-negotiable. Being certified proves your technical proficiency and makes you immediately valuable to the 90%+ of small businesses that use these tools. While it might not provide the same direct salary bump as a CB, it is often a prerequisite for the highest-paying jobs.

### 2. Years of Relevant Experience

As demonstrated in the salary table, experience is arguably the single biggest driver of salary growth. However, it's not just about the number of years; it's about the *quality* and *scope* of that experience.

- 0-2 Years (The Foundation Stage): At this stage, you are building trust and mastering core functions. Your focus is on accuracy in A/P, A/R, and data entry. Your value is in your reliability and willingness to learn. Salary growth is steady but modest.

- 3-8 Years (The Independent Professional Stage): You are no longer just executing tasks; you are managing the entire financial process. You handle month-end closes independently, prepare accurate financial statements, and begin to offer basic insights ("Our receivables aging is increasing," or "This vendor's costs have gone up 10%"). This is where you see the most significant salary jumps as you prove your ability to run the financial show.

- 8+ Years (The Strategic Advisor Stage): At this senior level, you are a true financial partner to the business owner. You're not just reporting the numbers; you're helping to interpret them. You might be involved in cash flow forecasting, budget preparation, and developing internal controls to prevent fraud. You may also be tasked with training junior staff or implementing new accounting systems. Professionals at this level, especially those with specialized skills, occupy the top 10-15% of the pay scale, often earning $80,000, $90,000, or more.

### 3. Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted based on the local cost of living and the demand for skilled professionals in that market. A high salary in a low-cost city might provide a better quality of life than an even higher salary in an expensive metropolis.

Here is a comparative look at estimated median salaries for a mid-career full charge bookkeeper across various U.S. cities, based on data from salary calculators like Salary.com:

| City | Estimated Median Salary | Cost of Living vs. National Average |

| :--- | :--- | :--- |

| High-Cost Cities | | |

| San Francisco, CA | $82,500 | ~80% Higher |

| New York, NY | $78,100 | ~68% Higher |

| Boston, MA | $75,900 | ~48% Higher |

| Washington, D.C. | $74,200 | ~40% Higher |

| Average-Cost Cities | | |

| Chicago, IL | $68,500 | ~8% Higher |

| Dallas, TX | $65,800 | ~2% Higher |

| Atlanta, GA | $64,900 | On Par |

| Lower-Cost Cities | | |

| St. Louis, MO | $61,300 | ~12% Lower |

| Indianapolis, IN | $60,200 | ~11% Lower |

| Birmingham, AL | $58,500 | ~20% Lower |

The Remote Work Factor: The rise of remote work has introduced a new dynamic. Some companies pay based on the employee's location, while others have a single pay scale regardless of location. A remote full charge bookkeeper living in a low-cost area but working for a company based in a high-cost city can achieve a significant financial advantage.

### 4. Company Type, Size, and Industry

The context in which you work matters greatly.

- Company Size:

- Small Businesses & Startups (<50 employees): This is the natural habitat of the full charge bookkeeper. Salaries can be variable. A cash-strapped startup might offer a lower base salary but supplement it with stock options or generous bonuses if the company succeeds. A stable, profitable small business might offer a competitive salary right at the market average.

- Mid-Sized Companies (50-500 employees): These companies often have a small accounting team (e.g., a Controller, a full charge bookkeeper, and an A/P clerk). Salaries here are often very competitive and come with structured benefits packages. This is often the "sweet spot" for high, stable earnings.

- Large Corporations (>500 employees): The "full charge bookkeeper" title is less common here. The responsibilities are typically broken down into more specialized roles (e.g., Senior Payroll Specialist, General Ledger Accountant). A role with equivalent seniority and responsibility at a large corporation will almost always pay more and have superior benefits, but with less autonomy.

- Company Type:

- For-Profit: The standard business model, offering the salary ranges discussed throughout this article.

- Non-Profit: These organizations typically have tighter budgets. Salaries for full charge bookkeepers in the non-profit sector may be 5-10% lower than in the for-profit world. However, they often offer excellent benefits, a strong sense of mission, and better work-life balance.

- Government: Government bookkeeping jobs offer unparalleled job security and exceptional benefits (pensions, generous leave). However, pay scales are often rigid and may lag behind the private sector, especially at the senior level.

- Industry Specialization: Developing expertise in a complex industry is a powerful way to increase your value.

- Construction: Requires specialized knowledge of job costing, progress billing, and mechanics' liens. This complexity commands a higher salary.

- Manufacturing: Involves intricate inventory tracking, cost of goods sold (COGS) calculations, and understanding supply chain finance.

- Technology (SaaS): Requires understanding complex revenue recognition rules (ASC 606), deferred revenue, and subscription billing models.

- Real Estate: Involves property management accounting, trust accounting, and understanding escrow accounts.

A bookkeeper with proven expertise in one of these niche areas is far more valuable and can demand a premium salary compared to one with only general retail or service-based experience.

### 5. In-Demand Skills

Beyond your formal qualifications, the specific, demonstrable skills you possess are what employers pay for. Here are the skills that will move your resume to the top of the pile and justify a higher salary.

- Advanced Accounting Software Proficiency: It's not enough to know QuickBooks. You need to be a power user. This means mastering bank rules, custom reporting, inventory modules, and integrations with other apps. Expertise in higher-tier systems like NetSuite, Sage Intacct, or industry-specific ERPs can dramatically increase your earning potential.

- Advanced Microsoft Excel: You must be fluent in more than just basic formulas. High-value skills include PivotTables, VLOOKUP/XLOOKUP, INDEX/MATCH, and the ability to create clear, professional-looking reports and dashboards from raw data exports.

- Financial Statement Preparation & Light Analysis: The ability to not only generate the P&L and Balance Sheet but to spot trends, calculate key ratios (e.g., current ratio, debt-to-equity), and present a simple analysis to the owner is a high-value skill that separates a bookkeeper from a strategic partner.

- Payroll and HR Compliance: Deep knowledge of multi-state payroll laws, tax regulations, and benefits administration makes you invaluable. This reduces the company's compliance risk, which is worth a salary premium.

- Tech-Savviness and System Implementation: Are you comfortable researching and integrating new apps (like bill pay or expense reporting software) into the accounting system? Experience with a system migration (e.g., from QuickBooks Desktop to QuickBooks Online) is a highly sought-after and well-compensated skill.

- Communication and Interpersonal Skills: You must be able to clearly explain financial concepts to non-financial people (like the CEO or department heads) and maintain professional relationships with vendors and customers. This "soft skill" has a very real impact on your effectiveness and pay.

Job Outlook and Career Growth for Full Charge Bookkeepers

When investing in a career, understanding its long-term viability is just as important as the starting salary. The field of bookkeeping is currently undergoing a significant transformation, driven by technology and automation. While this presents challenges, it also creates immense opportunities for skilled professionals.

### The Official Outlook: A Nuanced Picture

The U.S. Bureau of Labor Statistics (BLS) groups full charge bookkeepers under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." According to the BLS's most recent Occupational Outlook Handbook, employment in this category is projected to decline 5 percent from 2022 to 2032.

At first glance, this projection may seem alarming. However, it is crucial to understand the story *behind* the statistic. The predicted decline is almost entirely concentrated in lower-level, data-entry-focused roles. The routine tasks of manually entering receipts, coding basic transactions, and simple reconciliation are increasingly being automated by sophisticated accounting software and artificial intelligence.

The role of the full charge bookkeeper, however, is far more resilient. The value of a full charge bookkeeper lies not in data entry, but in oversight, problem-solving, analysis, and management. Software can categorize a transaction, but it cannot investigate a complex discrepancy, manage cash flow strategically, prepare for an audit, or advise a business owner on the financial implications of a major decision.

Therefore, the future of the profession is a story of evolution, not extinction. The demand for "button-pushers" is shrinking, while the demand for tech-savvy financial managers and advisors who can leverage automation is growing.

### Emerging Trends and Future-Proofing Your Career

To thrive in the coming decade, a full charge bookkeeper must embrace change and cultivate higher-level skills. The role is shifting from a *recorder* of past events to a *forward-looking financial guide*.

Key Trends Shaping the Future:

1. **The Rise of the "Advisory