Are you fascinated by numbers, puzzles, and predicting the future? Have you ever searched for a "future salary calculator" not just as a tool, but as a potential career? While that specific job title doesn't exist, the profession that embodies this concept is that of an Actuary. Actuaries are the financial architects who calculate the future cost of risk. This challenging and highly respected career offers exceptional financial rewards, with a median salary well into the six figures and a path to earning over $200,000.

If you're looking for a profession that combines analytical rigor with outstanding compensation and job security, understanding the actuary salary landscape is your first step. Let's break down what this career entails and how much you can expect to earn.

What Does an Actuary Do?

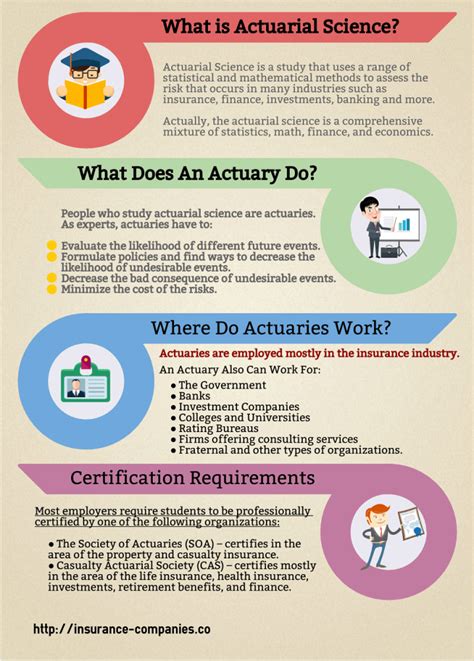

At its core, an actuary's job is to manage risk. They use a powerful blend of mathematics, statistics, and financial theory to analyze the financial consequences of uncertain future events. Think of them as the masterminds behind the insurance and financial industries.

Key responsibilities include:

- Pricing and Analysis: Designing and testing insurance policies, pension plans, and other financial strategies to ensure they are profitable and financially sound.

- Risk Modeling: Building sophisticated models to project the likelihood of events like car accidents, natural disasters, or illnesses, and calculating the potential financial impact.

- Financial Forecasting: Helping companies create budgets and determine the amount of money to set aside (reserves) to pay future claims and benefits.

- Strategic Consultation: Advising company leadership on how to manage risk and maximize profitability, ensuring long-term financial stability.

It's a demanding role that requires sharp analytical skills, but it's essential for the stability of our entire economy.

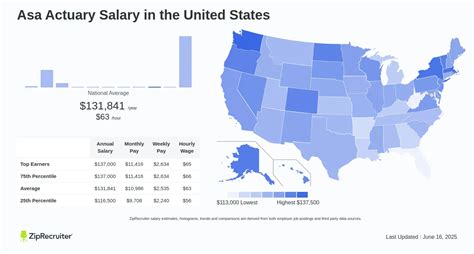

Average Actuary Salary

The compensation for an actuary is among the highest for business professionals, reflecting the rigorous training and high level of responsibility.

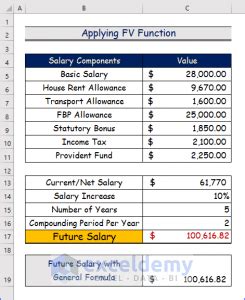

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for actuaries was $113,990 in May 2022. This figure represents the midpoint—half of all actuaries earned more, and half earned less.

However, this single number doesn't tell the whole story. The salary range is quite broad and heavily dependent on progress and experience:

- Entry-Level Actuarial Analyst (0-2 years): Typically earn between $70,000 and $95,000. These professionals have passed one to three actuarial exams and are focused on technical analysis and data support.

- Associate Actuary (ASA/ACAS, 3-7 years): After achieving an associate-level designation, salaries often jump to the $110,000 to $160,000 range.

- Senior/Fellow Actuary (FSA/FCAS, 8+ years): Fully credentialed Fellows with significant experience command top-tier salaries, often ranging from $160,000 to $250,000+. Those in management or executive roles can earn significantly more.

Data from Salary.com as of late 2023 supports this, showing the average actuary salary in the United States to be around $125,700, with a typical range falling between $108,800 and $143,500 before accounting for senior-level fellowship status.

Key Factors That Influence Salary

Several key factors determine an actuary's earning potential. Understanding these is crucial for anyone planning to enter and advance in the field.

###

Level of Education & Professional Exams

While a bachelor's degree in a quantitative field like mathematics, statistics, or economics is the entry requirement, the true driver of an actuary's salary is their progress through a series of rigorous professional exams. These exams are administered by two primary bodies in the U.S.: the Society of Actuaries (SOA), which focuses on life, health, and pension insurance, and the Casualty Actuarial Society (CAS), for property and casualty insurance.

Passing exams directly translates to salary increases and bonuses. The career ladder is tied to these milestones:

1. Student/Analyst: Passed 1-3 exams.

2. Associate (ASA/ACAS): Achieved by passing a comprehensive set of exams, demonstrating core competence. This is a major salary benchmark.

3. Fellow (FSA/FCAS): The highest designation, requiring additional, specialized exams. Achieving fellowship status solidifies one's status as an expert and unlocks the highest earning potential.

###

Years of Experience

Experience works in tandem with exam progress. An entry-level analyst performs foundational data work. With a few years of experience and an Associate designation, they begin managing projects and junior analysts. A Fellow with over a decade of experience often moves into strategic leadership, managing entire departments, shaping company policy, or becoming a partner at a consulting firm. Each step up in responsibility comes with a significant increase in compensation.

###

Geographic Location

Where you work matters. Major financial and insurance hubs offer higher salaries to compensate for a higher cost of living and greater demand for talent. According to BLS data, the top-paying states for actuaries include:

- New York: A global financial center with an abundance of insurance and consulting opportunities.

- Connecticut: Known as the "insurance capital of the world," home to major health and P&C insurers.

- Illinois (Chicago): A major hub for insurance, finance, and consulting firms.

- California: High demand in health insurance and P&C, particularly with risks like wildfires and earthquakes.

Working in these metropolitan areas can result in a salary 15-25% higher than the national average.

###

Company Type

The type of company you work for also plays a significant role in your salary and work environment.

- Insurance Companies: The most common employer. They offer stable career paths, good work-life balance, and competitive salaries with strong benefits.

- Consulting Firms: Often offer the highest base salaries and bonuses. The work is fast-paced, client-facing, and project-based, typically demanding longer hours.

- Government Agencies: Federal and state agencies (like the Social Security Administration or state insurance departments) hire actuaries. Salaries are generally lower than in the private sector, but they offer excellent job security and work-life balance.

- Large Corporations: Non-insurance corporations with large, self-funded pension and health plans may also employ in-house actuaries.

###

Area of Specialization

Within the actuarial field, some specializations are more lucrative than others, often due to the complexity and demand for expertise.

- Property & Casualty (P&C): This field deals with risks for auto, home, and commercial insurance. It's often cited as one of the highest-paying tracks due to the complex modeling required for unpredictable events.

- Health Insurance: A rapidly evolving and highly compensated field, driven by complex healthcare regulations and the need for innovative pricing models.

- Life Insurance & Annuities: The traditional bedrock of the actuarial profession, offering stable and lucrative careers.

- Pensions & Retirement: While still a vital field, it has seen slower growth compared to health and P&C.

Job Outlook

The future for actuaries is exceptionally bright. The BLS projects that employment for actuaries will grow by 23% from 2022 to 2032, which is "much faster than the average for all occupations."

This incredible growth is fueled by several factors:

- The Rise of Big Data: Companies have more data than ever before, and they need actuaries to analyze it and build more precise risk models.

- Evolving Risks: New and complex risks related to climate change, cybersecurity, and global health crises require expert actuarial analysis.

- Changing Regulations: The complex regulatory environment, especially in healthcare, requires constant actuarial oversight.

This high demand and low supply of qualified professionals create fantastic job security and upward mobility for those in the field.

Conclusion

Choosing a career as an actuary is a commitment to lifelong learning and rigorous analytical work. However, the rewards are undeniable. For those who are willing to tackle the challenging exam process, this career offers a clear and structured path to a high six-figure salary, exceptional job security, and the opportunity to solve complex, meaningful problems. If you are a strategic thinker with a passion for numbers, the role of an actuary might be the perfect way to build your own "future salary calculator"—one with a very promising forecast.