Table of Contents

- [What Does a Commercial Underwriter Do?](#what-is-a-commercial-underwriter)

- [Average Commercial Underwriter Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Become a Commercial Underwriter](#how-to-get-started)

- [Conclusion: Is a Career in Commercial Underwriting Right for You?](#conclusion)

---

If you're reading this, you are likely standing at a career crossroads. You're searching for a path that is not just a job, but a profession—one that is intellectually stimulating, financially rewarding, and fundamentally important to the economy. You're looking for stability, growth, and the chance to become a true expert in your field. The role of a commercial underwriter checks all these boxes, and at the heart of its appeal lies the significant commercial underwriter salary potential.

This isn't just about crunching numbers; it's about becoming the financial gatekeeper for the world of business. Commercial underwriters are the highly trained professionals who assess, analyze, and price the risk associated with insuring businesses, from a small local coffee shop to a multinational construction conglomerate. The national average salary for an experienced commercial underwriter often surpasses the six-figure mark, with top earners in specialized fields commanding compensation packages well over $150,000 or even $200,000. But the journey to that level requires a specific blend of analytical skill, business acumen, and continuous learning.

I remember early in my career, I was tasked with analyzing a policy for a complex technology startup that was developing a new form of AI-driven logistics software. It wasn't just a matter of looking at their assets; I had to understand their intellectual property, their potential for cyber threats, and the very future of their market. That’s when it clicked for me: underwriting isn’t a back-office administrative task; it’s the critical juncture where finance, law, technology, and business strategy meet. This guide is designed to give you that same clarity, providing a comprehensive roadmap to a successful and high-earning career in this vital profession.

---

What Does a Commercial Underwriter Do? The Architect of Risk

Before we dive into the numbers, it's crucial to understand the substance of the role. A commercial underwriter is the professional engine of an insurance company. They are the decision-makers who determine whether to accept or reject a business's application for insurance coverage. Their primary mission is to protect their company from excessive financial loss by ensuring the risks they take on are profitable and manageable.

Think of them as a combination of a detective, a financial analyst, and a strategist. They don't just take an application at face value; they dig deep to understand the true nature of a business's operations and its potential for loss. Their work ensures that businesses can operate with a safety net, enabling innovation, construction, and commerce to thrive. Without skilled underwriters, the economy as we know it would grind to a halt.

Core Responsibilities and Daily Tasks:

An underwriter's day is a dynamic mix of analysis, communication, and decision-making. Here’s a breakdown of their typical responsibilities:

- Risk Assessment and Analysis: This is the heart of the job. Underwriters scrutinize insurance applications, financial statements (like balance sheets and income statements), industry reports, loss histories, and site inspection reports to evaluate the level of risk a potential client presents.

- Data-Driven Decision Making: They use sophisticated software, actuarial data, and predictive models to quantify risk. They are not guessing; they are making calculated judgments based on vast datasets and established underwriting guidelines.

- Pricing and Quoting: Based on their risk assessment, they determine the appropriate premium (the price) for the insurance policy. This involves balancing competitiveness (to win the business) with profitability (to protect their company).

- Policy Structuring: Underwriters decide on the specific terms, conditions, limits, and exclusions of an insurance policy. They might require a client to implement specific safety measures (e.g., installing a sprinkler system) before they will offer coverage.

- Collaboration and Negotiation: They work closely with insurance agents and brokers who represent the client. This often involves negotiating terms and explaining the reasoning behind their decisions, requiring strong communication and relationship-building skills.

- Portfolio Management: Senior underwriters are responsible for managing a "book of business." They continuously monitor the performance of the policies they've written to ensure the portfolio remains profitable and aligned with the company's strategic goals.

### A Day in the Life of a Mid-Career Commercial Underwriter

To make this more tangible, let's imagine a day for "Alex," a mid-career underwriter specializing in commercial property.

- 9:00 AM: Alex starts the day by reviewing a high-priority submission from a top broker. It's for a new manufacturing client with a complex supply chain. Alex logs into the underwriting workstation, reviewing the application and flagging key areas for investigation: fire protection systems, business interruption exposure, and the client's past loss history.

- 10:30 AM: Alex joins a call with the broker to ask clarifying questions. "Can you provide more detail on the fire suppression system in the main warehouse? And what are the client's disaster recovery plans for their key suppliers?"

- 11:30 AM: Using the new information, Alex inputs data into a pricing model. The model suggests a baseline premium, but Alex's experience indicates the risk is slightly higher than average due to the client's location in a flood-prone area. Alex adjusts the pricing and adds a specific policy endorsement related to flood coverage.

- 1:00 PM: After lunch, Alex works on two smaller renewals for existing clients. Their loss history is clean, so the process is straightforward. Alex approves the renewals with a minor inflationary rate increase and sends them back to the respective agents.

- 2:30 PM: Alex gets an email from the company's risk control department. A field engineer has just completed an inspection of a construction site Alex is underwriting. Alex reviews the engineer's report, which notes a few safety concerns. Alex drafts an email to the broker outlining the required safety improvements (e.g., better scaffolding standards) needed before the policy can be bound.

- 4:00 PM: Alex dedicates the last hour to portfolio analysis, reviewing the loss ratios for their book of business. Alex notices a trend of increasing water damage claims in a specific geographic area and makes a note to be more cautious when underwriting new business there.

- 5:00 PM: Alex logs off, having made several critical financial decisions that protect both the insurance carrier and the clients they serve.

---

Average Commercial Underwriter Salary: A Deep Dive

Now for the central question: What can you expect to earn? The commercial underwriter salary is highly competitive and reflects the specialized skills and significant responsibility the role entails. Compensation is not just a flat salary; it's a package that often includes substantial performance-based bonuses and excellent benefits.

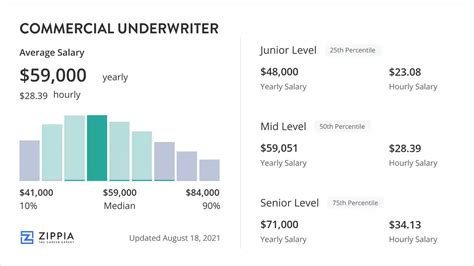

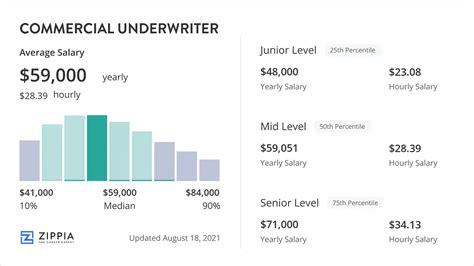

It's important to note that salary data varies slightly between sources due to different methodologies, but they all paint a similar picture of a lucrative career path. We'll synthesize data from the U.S. Bureau of Labor Statistics (BLS), Salary.com, Payscale, and Glassdoor for a comprehensive view.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for insurance underwriters was $76,390 in May 2021. However, this figure includes *all* underwriters, including those in personal lines (auto, home), which typically pay less than commercial lines. For commercial underwriters, the figures are notably higher.

Reputable salary aggregators provide a more granular view for commercial specialists:

- Salary.com reports the average Commercial Underwriter salary in the United States is $88,683 as of late 2023, but the range typically falls between $77,084 and $103,141.

- Payscale estimates the average base salary for a Commercial Underwriter at around $73,000, with a total pay package including bonuses reaching up to $104,000 or more.

- Glassdoor places the average total pay (including base and additional compensation) for a Commercial Underwriter at $96,654 per year in the United States.

These figures confirm that a commercial underwriting career provides a strong income. However, the most telling data comes from breaking down the salary by experience level. This is where the true growth potential becomes clear.

### Commercial Underwriter Salary by Experience Level

The career path in underwriting is well-defined, with clear steps from trainee to senior management. Each step comes with a significant increase in responsibility, autonomy, and, consequently, compensation.

| Career Stage | Typical Title(s) | Experience | Typical Salary Range (Base + Bonus) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Underwriting Trainee, Assistant Underwriter, Associate Underwriter, Underwriter I | 0-2 years | $55,000 - $75,000 | Learning underwriting guidelines, data entry, processing simple renewals, supporting senior underwriters. Limited underwriting authority. |

| Mid-Career | Commercial Underwriter, Underwriter II, Production Underwriter | 2-5 years | $75,000 - $110,000 | Managing a small book of business, analyzing moderately complex risks, building relationships with agents/brokers, making independent decisions. |

| Senior/Experienced | Senior Underwriter, Executive Underwriter, Lead Underwriter, Underwriter III | 5-10 years | $100,000 - $150,000+ | Handling the largest and most complex accounts, mentoring junior staff, having significant underwriting authority, influencing underwriting strategy. |

| Management/Leadership | Underwriting Manager, Director of Underwriting, Chief Underwriting Officer (CUO) | 10+ years | $150,000 - $250,000+ | Managing a team of underwriters, setting regional or national underwriting policy, P&L responsibility for a line of business, strategic leadership. |

*(Salary ranges are estimates synthesized from Salary.com, Payscale, and industry knowledge. Actual figures vary based on the factors discussed in the next section.)*

As you can see, the progression from an entry-level position to a senior role can more than double your salary. This structured growth is a major draw for ambitious professionals.

### Deconstructing the Compensation Package: More Than Just a Salary

A key point to understand is that your annual base salary is only one part of your total compensation. The insurance industry heavily utilizes variable pay to reward performance and profitability.

- Annual Bonuses: This is the most common form of additional compensation. Bonuses are typically tied to both individual and company performance. Individual metrics might include the profitability of your book of business (measured by loss ratio), new business goals, and retention of existing clients. Company performance is based on the overall profitability of the carrier. These bonuses can range from 5% to 25% (or more for senior roles) of your base salary.

- Profit Sharing: Many insurance companies, especially mutual companies (which are owned by their policyholders), offer profit-sharing plans. When the company has a profitable year, a portion of those profits is distributed to employees. This aligns everyone's interests toward smart, profitable underwriting.

- Commissions (for Production Underwriters): Some roles, often called "Production Underwriters" or "Field Underwriters," have a stronger sales and relationship management component. Their compensation may include a commission structure based on the volume and quality of the business they bring in from their assigned brokers or agents.

- Long-Term Incentives (LTI): For management and executive-level positions, compensation packages often include stock options, restricted stock units (RSUs), or other long-term incentives. These are designed to retain top talent and reward them for contributing to the company's long-term success.

- Comprehensive Benefits: The insurance industry is known for offering robust benefits packages. These almost always include excellent health, dental, and vision insurance; generous 401(k) matching programs; and significant paid time off. Furthermore, a major perk is company-sponsored professional development—many carriers will pay for you to earn prestigious designations like the CPCU, which we will cover later.

When evaluating a job offer, it's crucial to look at the *total compensation* potential, not just the base salary. A slightly lower base salary with a strong, achievable bonus structure can often result in higher overall earnings.

---

Key Factors That Influence Your Commercial Underwriter Salary

While the national averages provide a useful benchmark, your individual earning potential will be determined by a combination of key factors. Mastering these elements is the secret to maximizing your commercial underwriter salary throughout your career. This is the most critical section for understanding how to strategically build your value in the marketplace.

Factor 1: Level of Education and Professional Certifications

Your educational foundation sets the stage for your career trajectory.

- Bachelor's Degree: A bachelor's degree is the standard entry-level requirement for a commercial underwriting role. While any degree can be considered if you have strong analytical skills, employers show a strong preference for majors in Finance, Business Administration, Economics, Risk Management and Insurance, or Mathematics. These fields provide the foundational knowledge in financial analysis, statistics, and business principles that are central to the job.

- Master's Degree (MBA, etc.): An advanced degree like an MBA is generally not required for entry- or mid-level underwriting roles. However, it can become a significant differentiator for those aspiring to senior leadership positions, such as an Underwriting Director or Chief Underwriting Officer (CUO). An MBA can provide advanced strategic, financial, and leadership skills that accelerate the path to the executive suite, often leading to a salary premium of 15-20% at the leadership level.

- Professional Certifications (The Game Changer): This is arguably more important than an advanced degree for pure underwriting roles. The insurance industry places an enormous value on professional designations. They are a clear signal of expertise, dedication, and a commitment to lifelong learning. Earning these can lead to direct salary increases, promotions, and access to more complex, higher-paying roles.

The Most Valuable Certifications:

1. Chartered Property Casualty Underwriter (CPCU): This is the gold standard, the "CPA of the insurance industry." The CPCU designation, administered by The Institutes, is a rigorous program covering topics like risk management, insurance operations, insurance law, and finance. Earning your CPCU is a major career milestone that almost universally leads to higher pay and greater opportunities. Many companies offer a cash bonus (often $3,000-$5,000) simply for completing the designation, in addition to the long-term salary benefits.

2. Associate in Commercial Underwriting (AU): Also from The Institutes, the AU is a more focused designation that is perfect for those early in their career. It provides core knowledge specific to commercial underwriting and is often a stepping stone to the CPCU.

3. Associate in Risk Management (ARM): This certification is valuable because it teaches you to think like your clients. The ARM focuses on identifying, analyzing, and treating risk from a business's perspective, which makes you a more insightful and consultative underwriter.

4. Specialty Designations: For those who specialize, designations like the Certified Insurance Counselor (CIC), Cyber Professional Liability Practitioner (CPLP), or Surety and Fidelity Associate (SFA) can provide a significant edge and salary bump within those niches.

Bottom Line: A relevant bachelor's degree gets you in the door. The CPCU designation gets you to the next level.

Factor 2: Years of Experience and Underwriting Authority

Experience is the single most powerful driver of salary growth in underwriting. This isn't just about time served; it's about the accumulation of expertise, judgment, and "underwriting authority."

- 0-2 Years (Trainee/Associate): At this stage, your salary is at its lowest point. You are learning the ropes and have little to no "authority" to make decisions independently. Your work is heavily reviewed by senior staff. Your primary value is your potential and ability to learn quickly.

- 2-5 Years (Mid-Level Underwriter): This is where you begin to see significant salary jumps. You have proven your competence and are granted a "letter of authority," which specifies the size and type of risks you can approve on your own. You are now a direct revenue-enabler for the company, and your compensation reflects this.

- 5-10+ Years (Senior/Lead Underwriter): As a senior underwriter, you have substantial authority and are trusted with the company's most complex and valuable accounts. You are a technical expert and a mentor to others. Your salary enters the top tier, often well into the six figures, because your decisions have a massive impact on the company's bottom line. Your deep knowledge of specific industries or lines of business makes you highly valuable and sought after.

The concept of "Underwriting Authority" is key. As you gain experience and demonstrate good judgment, your company entrusts you to put more of its capital at risk without oversight. A trainee might have an authority of $25,000, while a senior underwriter might have an authority of $5 million or more. This direct correlation between trust and financial responsibility is a primary reason for the steep salary growth curve.

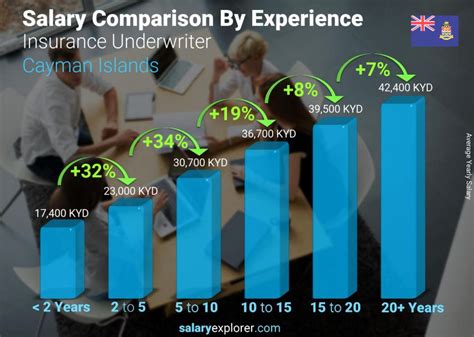

Factor 3: Geographic Location

Where you work matters. Salaries for commercial underwriters vary significantly based on state and metropolitan area, primarily due to cost of living and the concentration of insurance company headquarters and major brokerage firms.

High-Paying States and Cities:

Major financial centers and states with a high concentration of corporate headquarters tend to offer the highest salaries. This is where the largest and most complex risks are located.

- New York, NY: The financial capital of the world, offering top-tier salaries, especially for underwriters specializing in financial lines or large property.

- Stamford, CT / Hartford, CT: Known as the "Insurance Capital of the World," this region is home to numerous major carriers, creating high demand for talent.

- Chicago, IL: A major hub for the Midwest, with a strong presence of large national carriers and brokers.

- San Francisco, CA: Driven by the tech industry, salaries here are high, especially for those specializing in Cyber Liability and Professional Liability (Tech E&O).

- Boston, MA: Another major financial and tech hub with competitive salaries.

- Dallas, TX & Houston, TX: Growing business hubs with increasing demand for skilled commercial underwriters.

Average and Lower-Paying Areas:

Salaries tend to be closer to the national average or slightly below in areas with a lower cost of living and fewer corporate headquarters. However, these roles can still offer an excellent quality of life.

- Midwestern states outside of major hubs like Chicago.

- Southeastern states outside of major cities like Atlanta or Charlotte.

- Rural areas in general.

An underwriter in New York City might earn 20-30% more than an underwriter with the same experience level in Des Moines, Iowa. However, the cost of living in New York is substantially higher. It's crucial to consider the salary in the context of the local cost of living.

Factor 4: Company Type and Size

The type of company you work for has a direct impact on your compensation and work environment.

- Large National/Global Carriers (e.g., Chubb, Travelers, AIG, Zurich): These giants typically offer the highest base salaries and most structured career paths. They have the resources to invest heavily in training, technology, and top talent. They handle the largest and most complex global risks, and the compensation reflects that.

- Regional Carriers and Mutual Companies: These companies may offer slightly lower base salaries than the global giants but often compensate with excellent work-life balance, strong company culture, and robust profit-sharing plans. The overall compensation can be very competitive, especially in good years.

- Managing General Agents (MGAs) and Managing General Underwriters (MGUs): These are specialized firms that have been granted underwriting authority by a carrier to write specific types of business (e.g., a high-risk restaurant program). Roles at MGAs can be very lucrative and entrepreneurial. Compensation may be more heavily weighted towards bonuses and commissions tied to the profitability of their specific program.

- Excess and Surplus (E&S) Lines Carriers: E&S carriers specialize in unique, high-risk, or hard-to-place accounts that standard carriers won't cover. Underwriting in the E&S market is more creative and requires deep expertise. Because of the higher risk and required skill level, salaries and bonuses in the E&S world are often among the highest in the industry.

Factor 5: Area of Specialization (Line of Business)

Just as doctors specialize, so do commercial underwriters. Your chosen specialty is a massive driver of your salary potential. Niche, complex, and high-stakes lines of business command a significant salary premium.

- Standard Lines (Higher Supply of Talent):

- Commercial Property: Insuring buildings and their contents.

- General Liability: Covering third-party bodily injury or property damage.

- Workers' Compensation: Covering employee injuries.

- Commercial Auto: Insuring fleets of vehicles.

- These roles are essential and offer strong, stable careers. Salaries are competitive but generally form the baseline for the industry.

- Specialty & Financial Lines (Higher Demand, Lower Supply of Talent):

- Cyber Liability: This is one of the hottest and highest-paying areas. With the explosion of cyber-attacks, underwriters who can accurately assess and price cyber risk are in extremely high demand.

- Professional Liability (Errors & Omissions - E&O): Insuring professionals like lawyers, architects, and consultants against claims of negligence.

- Directors & Officers (D&O) Liability: Insuring a company's leadership against lawsuits related to their management decisions. This is a high-stakes, high-paying field.

- Surety Bonds: Guaranteeing that contractual obligations will be met. This is a highly specialized field, often likened to a form of credit analysis, and it pays very well.

- Environmental/Pollution Liability: Covering risks related to pollution and environmental damage.

- Marine & Aviation: Highly technical and specialized fields insuring ships, cargo, and aircraft.

An experienced Cyber or D&O underwriter can easily earn $20,000-$40,000 more per year than a General Liability underwriter with the same level of experience. Specializing in a complex, growing field is one of the fastest ways to increase your earning potential.

Factor 6: In-Demand Skills

Finally, your specific skill set can set you apart. Beyond the core competencies, cultivating these high-value skills will make you a more effective underwriter and a more valuable candidate.

- Advanced Analytical and Quantitative Skills: This is more than just being "good with numbers." It means being able to interpret complex financial documents, understand statistical modeling, and use data to tell a story about risk.

- Negotiation and Salesmanship: The best underwriters don't just say "yes" or "no." They work with brokers to find creative solutions. They can expertly articulate the value of their proposal and negotiate terms that are favorable for both the client and the carrier.

- Relationship Management: Strong relationships with brokers are the lifeblood of an underwriter's success. Brokers bring business to underwriters they trust and respect. Building and maintaining this network is a skill that directly translates to a better, more profitable book of business.

- Technological Proficiency: The future of underwriting is data-driven. Proficiency with underwriting workstations, pricing models, and data analytics tools like Excel (at an advanced level), SQL, or even data visualization software like Tableau is becoming increasingly important.

- Critical Thinking and Problem-Solving: Every application is a puzzle. A great underwriter can see beyond the obvious, ask the right questions, and identify hidden risks or opportunities that others might miss.

---

Job Outlook and Career Growth

After exploring the impressive salary potential, the next logical question is about long-term career stability and growth. The narrative around underwriting has been clouded by talk of automation and artificial intelligence, leading some to question the future of the profession. However, a closer look reveals a more nuanced and promising picture.

The U.S. Bureau of Labor Statistics (BLS) projects a 2 percent decline in employment for insurance underwriters from 2021 to 2031. It's essential to understand the context of this number. This decline is almost entirely concentrated in the simpler, more commoditized lines of insurance, particularly personal lines (auto and home). Automated underwriting platforms and AI are becoming highly efficient at processing straightforward applications that have a large volume of historical data to draw from.

The Future is Complex, and So is the Underwriter's Role:

The outlook for *commercial* underwriters, especially those who specialize in complex, high-value risks, is significantly brighter. While technology will handle the mundane, it cannot (yet) replace the human judgment, critical thinking, and negotiation skills required for sophisticated commercial accounts.

Here are the key trends shaping the future of the profession:

- The Rise of the "Bionic Underwriter": The future isn't about AI replacing underwriters; it's about AI *augmenting* them. Underwriters will be freed from tedious data entry and routine analysis, allowing them to focus on higher-value tasks: complex risk assessment, portfolio strategy, building broker relationships, and negotiating intricate deals. The underwriter of the future will leverage technology as a powerful tool to make smarter, faster decisions.

- Emergence of New Risks: The world is becoming more complex, not less. This complexity creates new and evolving risks that require expert human analysis. Fields like cybersecurity, climate change impacts (floods, wildfires), supply chain disruption, and the gig economy are creating massive demand for underwriters who can understand and price these new exposures. These are not risks that can be easily automated.

- The "Graying" of the Industry: The insurance industry is facing a significant talent cliff. A large percentage of experienced senior underwriters are nearing retirement age. This impending "brain drain" is creating a huge opportunity for the next generation of talent to step in and advance quickly. Companies are actively seeking to hire and train new underwriters to fill this gap, which supports strong job security for those entering the field now.

- Shift from Risk Selection to Portfolio Management: The role is evolving from a transaction-based job (approving one policy at a time) to a more strategic one. Senior underwriters are increasingly responsible for managing the profitability and risk profile of an entire portfolio. This requires a blend of underwriting acumen, financial savvy, and strategic thinking.