Landing a role as an Analyst at Goldman Sachs is a career-defining achievement for many ambitious finance professionals. It signifies entry into one of the world's most prestigious investment banks, promising unparalleled experience, a powerful network, and, of course, a highly competitive compensation package. For those aspiring to this coveted position, the question of salary is paramount.

While the numbers are impressive, a Goldman Sachs Analyst's total earnings are a complex mix of base salary, performance-based bonuses, and other factors. This guide will break down what you can expect to earn, the key drivers of your compensation, and the overall career outlook.

What Does a Goldman Sachs Analyst Do?

The title "Analyst" at Goldman Sachs typically refers to the entry-level position for recent undergraduate or master's degree holders. These are the front-line professionals who form the backbone of the firm's various divisions. While responsibilities vary by division (e.g., Investment Banking vs. Global Markets), a typical Analyst is responsible for:

- Financial Modeling and Valuation: Building complex financial models to analyze companies, assess investment opportunities, and perform valuations for mergers, acquisitions, and IPOs.

- Market Research: Gathering and synthesizing vast amounts of data on industries, market trends, and economic conditions to support strategic decisions.

- Creating Presentations: Developing detailed presentation materials, known as "pitch books," for client meetings and internal discussions.

- Supporting Transactions: Assisting senior bankers and traders in every stage of a deal's lifecycle, from initial pitch to final execution.

The role is famously demanding, often requiring long hours and a steep learning curve. However, it provides an intensive, immersive education in finance that is second to none.

Average Goldman Sachs Analyst Salary

It's crucial to understand that compensation for a Goldman Sachs Analyst is broken into two main parts: a fixed base salary and a variable annual bonus.

- Base Salary: For a first-year Analyst in a major financial hub like New York, the base salary has recently been standardized across Wall Street. According to data from salary aggregators like Glassdoor and professional communities like Wall Street Oasis, a first-year Analyst at Goldman Sachs can expect a base salary of approximately $110,000. This figure typically increases for second- and third-year analysts.

- Bonus: The bonus is the highly variable component and is tied to both individual and firm-wide performance. It can significantly increase total compensation. For a first-year analyst, this bonus can range from $40,000 to over $90,000, depending on the year's deal flow and market conditions.

- Total Compensation: Combining the base and bonus, the all-in, first-year total compensation for a Goldman Sachs Analyst often falls in the $150,000 to $200,000 range. Levels.fyi, a reputable source for verified compensation data, reports a median total compensation of approximately $169,000 for new analysts at the firm.

Key Factors That Influence Salary

While the starting salary is relatively standardized, several factors can influence an Analyst's earnings potential throughout their tenure.

###

Years of Experience

Experience is the most direct driver of salary growth in the Analyst program. Goldman Sachs, like other major banks, has a structured progression for its Analysts.

- First-Year Analyst: Base salary of ~$110,000.

- Second-Year Analyst: Typically receives a raise in base salary to ~$125,000, with a higher bonus potential.

- Third-Year Analyst / Promotion to Associate: After two to three years, high-performing Analysts are often promoted to the Associate level. This comes with a significant jump in base salary (often to $175,000+) and a much larger bonus component, pushing total compensation well over $250,000.

###

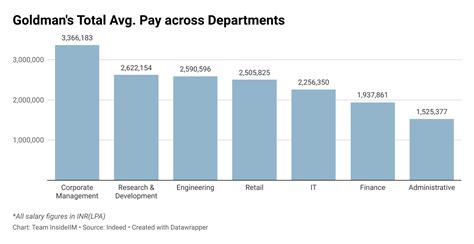

Area of Specialization (Division)

Where you work within Goldman Sachs matters immensely. The firm is organized into distinct divisions, each with its own business model and compensation structure.

- Investment Banking Division (IBD): This is the classic, high-powered division focused on M&A advisory and capital raising. It is known for having the highest bonus potential, as compensation is closely tied to lucrative deal completions.

- Global Markets (Sales & Trading): Analysts in this division have compensation tied to trading performance and market volatility. Bonuses can be exceptionally high in good years but may be more volatile than in IBD.

- Asset & Wealth Management: While still highly compensated, analysts in this division may have a slightly lower bonus ceiling compared to IBD, with a greater emphasis on long-term client relationships and assets under management.

- Platform Solutions / Corporate Roles: Analysts in technology, operations, or other corporate functions have competitive salaries but a different compensation structure, often with a smaller bonus percentage compared to the front-office, revenue-generating divisions.

###

Geographic Location

While New York City is the benchmark, Goldman Sachs has major offices worldwide. Salaries are adjusted based on the cost of living and local market competition.

- Top-Tier Hubs (New York, London, Hong Kong): These locations offer the highest base salaries and bonus potential to attract top talent in hyper-competitive markets.

- Other U.S. Hubs (Salt Lake City, Dallas): Goldman has significantly expanded its presence in these cities. While the base salary may be slightly lower than in New York, the reduced cost of living can result in a higher disposable income. For example, a role in Salt Lake City might have a base salary 10-15% lower than its NYC equivalent.

- International Offices: Compensation in cities like Zurich, Singapore, and Dubai is also highly competitive but will vary based on regional pay scales and currency exchange rates.

###

Company Type

While this article focuses on Goldman Sachs, it's helpful to know how its pay compares to competitors. As a "bulge bracket" bank, Goldman's compensation is a benchmark for the industry, competing directly with firms like Morgan Stanley, J.P. Morgan, and Bank of America. However, so-called "elite boutique" investment banks (e.g., Evercore, Centerview Partners) sometimes offer higher all-in compensation in strong market years, as their smaller size can lead to larger per-capita bonus pools.

###

Level of Education

For the Analyst role, a bachelor's degree from a top-tier university is the standard requirement. While the specific university you attend can influence your chances of securing an interview, it does not typically change the standardized starting salary. An advanced degree like a Master's in Finance may make a candidate more competitive but usually places them in the same Analyst salary band. The Master's of Business Administration (MBA) is the standard degree for entering at the post-analyst "Associate" level, which has a significantly higher compensation structure.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for specific companies, it provides an outlook for the broader profession of "Financial and Investment Analysts." The BLS projects employment in this field to grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is driven by a rising need for financial expertise in a globalized, data-rich economy. However, it's critical to note that competition for roles at elite firms like Goldman Sachs will remain exceptionally fierce. The prestige, training, and compensation ensure that they continue to attract a vast pool of top-tier global talent for a limited number of positions.

Conclusion

A career as a Goldman Sachs Analyst is one of the most challenging and financially rewarding paths a recent graduate can pursue. The journey begins with a powerful combination of a six-figure base salary and a substantial bonus, leading to a first-year total compensation package that is among the highest for any entry-level profession.

For those considering this path, here are the key takeaways:

- Focus on Total Compensation: The base salary is only part of the story; the annual performance bonus is a critical component of your earnings.

- Your Division Matters: The division you join will be a primary driver of your long-term earning potential.

- Performance is Everything: Your career progression, promotion to Associate, and bonus size are directly tied to your performance and the firm's success.

While the demands are significant, the financial rewards, unparalleled training, and future exit opportunities make the Goldman Sachs Analyst program a powerful launchpad for a successful career in finance and beyond.