You’ve done it. You navigated the resumes, the cover letters, the grueling interview rounds, and the tense waiting period. An email lands in your inbox with the subject line "Job Offer," and a wave of relief washes over you. But as you read the details, your excitement fades, replaced by a sinking feeling. The salary isn't just a little low—it's significantly below your expectations and your market value. Now you face a difficult and delicate crossroads: how do you decline a job offer because of salary without burning bridges or damaging your professional reputation?

This situation is far more than a simple "no, thank you." It's a strategic career move that, when handled with expertise and grace, can protect your long-term earning potential and even strengthen your professional network. Handled poorly, it can close doors permanently. This guide is designed to transform that moment of anxiety into an act of professional empowerment. We will dissect every facet of this process, from determining your exact market value to drafting the perfect rejection email, ensuring you can confidently advocate for your worth.

As a career analyst who has coached hundreds of professionals through high-stakes negotiations, I've seen firsthand how pivotal this moment can be. I once worked with a talented data scientist who received an offer from her dream company, but the salary was 20% below the industry standard for her experience. She was terrified of seeming ungrateful, but by following a clear, data-backed strategy, she not only declined the initial offer but did so in a way that left the hiring manager thoroughly impressed. Six months later, a more senior role opened up at a higher pay grade, and the company called her first. This is the power of a professional, strategic decline. This guide will give you that same power.

### Table of Contents

- [Why, When, and How: The Strategic Framework for Declining a Job Offer](#why-when-and-how-the-strategic-framework-for-declining-a-job-offer)

- [Understanding Your Worth: The Foundation of Your Salary Decision](#understanding-your-worth-the-foundation-of-your-salary-decision)

- [Key Factors That Determine Your Market Value](#key-factors-that-determine-your-market-value)

- [The Long-Term Career Impact of Your Decision](#the-long-term-career-impact-of-your-decision)

- [The Step-by-Step Guide to Declining the Offer (With Templates)](#the-step-by-step-guide-to-declining-the-offer-with-templates)

- [Conclusion: Turning a "No" Into a Strategic Career Win](#conclusion-turning-a-no-into-a-strategic-career-win)

---

Why, When, and How: The Strategic Framework for Declining a Job Offer

Before you type a single word of your rejection email, it's crucial to understand the strategic landscape. Declining an offer due to salary is not a single action but the culmination of a process. It requires a clear-eyed assessment of *why* you're declining, the optimal *timing* for your decision, and the overarching *strategy* that will guide your communication.

### The "Why": Moving Beyond a Single Number

The core reason is "salary," but it's never just about the number. Your "why" must be rooted in a more profound and defensible concept: market value. Declining an offer because it doesn't meet your market value is a logical, business-driven decision. Declining it because "you want more money" sounds arbitrary and less professional.

Your internal monologue should shift from "This isn't enough" to "This offer does not align with the market rate for a professional with my skills, experience, and the value I would bring to this role, based on my research." This framing is essential because it serves two purposes:

1. It builds your confidence: You are not being greedy; you are making a rational assessment based on data.

2. It forms the foundation of your communication: Your reasoning, even if not stated explicitly in your final decline, will be professional, objective, and respectful.

Before proceeding, ensure the salary is truly the deal-breaker. Have you considered the total compensation package? A slightly lower base salary might be offset by an exceptional annual bonus, generous stock options, a 100% 401(k) match, or fully paid, top-tier health insurance. If the complete package still falls short, then your "why" is solid.

### The "When": Timing Is Everything

The ideal time to decline an offer due to salary is after you have attempted to negotiate. A job offer is typically an opening bid, not a final statement. Responding to an initial offer with an immediate "no" is a missed opportunity.

The proper sequence is:

1. Receive the Offer: Acknowledge it promptly and express your gratitude and enthusiasm for the role and the company. Ask for a day or two to review the details.

2. Analyze and Research: This is where you double-check your market value, assess the total compensation, and prepare your counteroffer.

3. Negotiate: Present a well-researched counteroffer. This is a critical step. A company's willingness (or inability) to negotiate will give you vital information.

4. Receive the Final Offer: The company will either meet your request, present a revised offer, or state that their initial offer is their best and final.

5. Decline (If Necessary): Only after the negotiation has concluded and the final offer remains unsatisfactory should you move to decline.

Declining prematurely suggests you weren't genuinely interested. Declining after a good-faith negotiation shows that you were serious about the role, but a practical business constraint—compensation—could not be overcome.

### Scenario in the Life of a Job Seeker: Putting it All Together

Let's imagine Alex, a Marketing Manager with 7 years of experience.

- Monday, 10:00 AM: Alex receives a job offer from a tech company, "InnovateCorp." The role is a perfect fit, but the base salary offered is $90,000.

- Monday, 10:05 AM: Alex immediately replies, "Thank you so much for the offer! I'm very excited about the possibility of joining InnovateCorp. I would like to take a day to review the details and will be in touch tomorrow."

- Monday Afternoon: Alex consults Payscale and Glassdoor. He sees that the average salary for a Marketing Manager with his experience in his city (Denver) is between $105,000 and $120,000. He notes his specific skills in marketing automation and SEO, which are in high demand. He decides his target salary is $115,000.

- Tuesday, 11:30 AM: Alex has a call with the HR manager. He reiterates his excitement, then confidently states, "Based on my research into the market rate for this role in Denver, and considering my extensive experience with platforms like HubSpot and Salesforce, I was anticipating a base salary in the range of $115,000. Is there any flexibility on the compensation?"

- Wednesday, 2:00 PM: The HR manager calls back. She explains that due to internal budget constraints, the absolute maximum they can offer is $95,000, but they can add a $5,000 signing bonus.

- Wednesday Afternoon: Alex analyzes the final offer: $95,000 base + $5,000 bonus. It's still $15,000 below his target and well below the market average. The total compensation doesn't bridge the gap. He now has a clear, data-driven, and professionally vetted reason to decline. He has followed the process perfectly and can now proceed with drafting his decline email with full confidence, knowing he did everything right.

This strategic framework—clarifying your why, perfecting your when, and following a professional process—is the bedrock of turning a potentially awkward situation into a demonstration of your business acumen.

---

Understanding Your Worth: The Foundation of Your Salary Decision

You cannot confidently decline a salary offer without an ironclad understanding of your market worth. This section is your arsenal. It’s where we move from feeling to fact, empowering you with the data and methods to build an objective salary benchmark. Your goal is to be able to state, with unshakeable certainty, "I am declining because the offer is X% below the established market rate for my profile."

To do this, you must become an expert researcher on one topic: the market value of your own career.

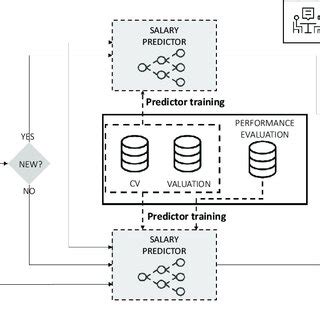

### Step 1: Using Salary Aggregators as a Starting Point

Online salary aggregators are the fastest way to get a general idea of your worth. Use multiple sources to triangulate a credible range, as each has a slightly different methodology.

- Payscale: Excellent for detailed compensation reports that factor in skills, certifications, and years of experience.

- Salary.com: Tends to provide slightly higher, more corporate-focused data. Useful for benchmarking against large, established companies.

- Glassdoor: Provides user-reported salary data for specific companies and roles. This is invaluable for seeing what a particular company *actually* pays.

- Levels.fyi: The gold standard for technology, product, and engineering roles, offering incredibly detailed, level-by-level compensation breakdowns from top tech firms.

How to Use Them Effectively: When you input your data, be as specific as possible. "Software Engineer" is too broad. "Senior Software Engineer" with "5 years of experience," "Python," "AWS," and located in "Austin, TX" will yield a much more accurate result. Collect a range from each site and find the overlapping consensus.

### Step 2: Grounding Your Research in Official Data

While aggregators are useful, they are based on self-reported data. For authoritative, macro-level data, turn to the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics (OEWS) survey. This is the government's comprehensive source for wage data across hundreds of occupations.

- How it works: The BLS provides wage data by percentile. This is incredibly powerful.

- 10th percentile: Typically represents entry-level or lower-paying positions.

- 25th percentile: Early-career professionals.

- 50th percentile (Median): The midpoint for the profession. A solid benchmark for a mid-career professional with standard skills.

- 75th percentile: Experienced, highly skilled professionals.

- 90th percentile: Top-tier experts, specialists, and senior leaders in high-demand, high-paying locations.

Example: Financial Analysts

According to the BLS OEWS data from May 2023, the national salary percentiles for Financial Analysts are:

- Median (50th Percentile): $99,730 per year

- Lowest 10%: $61,770

- Highest 10%: $178,590

If you are a Financial Analyst with 6 years of experience and a CFA charter, you should be looking at salaries well above the median—likely in the 75th percentile range ($135,120) or higher, depending on your location and industry. An offer of $85,000 would be an immediate red flag, and you would have government data to back up your assessment.

### Step 3: Deconstructing Total Compensation

Base salary is only one piece of the puzzle. A sophisticated professional evaluates the entire compensation package. When an offer comes in, break it down and assign a value to each component.

| Compensation Component | What It Is & What to Look For |

| ------------------------ | ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Base Salary | Your guaranteed annual pay. This is the most important component for financial stability and is the basis for future salary increases. |

| Performance Bonus | A variable payment based on your performance and/or the company's performance. Ask if it's "guaranteed" or "target." A "target bonus of 15%" is not guaranteed money. Ask about the company's bonus payout history for the last 3 years. |

| Signing Bonus | A one-time payment to entice you to join. Be aware of clawback clauses—if you leave before a certain date (usually 1-2 years), you may have to pay it back. |

| Stock Options/RSUs | Equity in the company. RSUs (Restricted Stock Units) are shares of stock given to you. Stock Options give you the right to buy shares at a set price. For startups, equity can be highly valuable but is also high-risk. For public companies, RSUs are like a cash bonus that vests over time. Use tools like Levels.fyi to value equity packages. |

| Retirement Savings | 401(k) or 403(b) plans. The crucial factor is the company match. A "100% match up to 6%" is essentially a 6% salary increase that you get by contributing. This is free money. A weak or non-existent match is a significant negative. |

| Health Insurance | The quality of the plan and the cost of premiums. A company that covers 100% of your premium for a Gold-tier PPO plan is offering a benefit worth thousands of dollars a year compared to a company that only covers 70% of a Bronze-tier HMO plan. Ask for the plan details and your monthly premium cost. |

| Paid Time Off (PTO) | Vacation, sick days, and personal days. "Unlimited PTO" can be tricky—research the company culture on Glassdoor to see if people actually take time off. Quantify this: 20 days of PTO is a full month of paid time off, which has a real monetary value. |

| Other Perks | Commuter benefits, wellness stipends, education/training budgets, remote work stipends. These add up and should be factored into your overall assessment. |

By creating a spreadsheet and monetizing each component, you get the Total Annual Compensation Value. You might find that Offer A with a $100,000 base is actually less valuable than Offer B with a $95,000 base but a superior 401(k) match, a higher target bonus, and free health insurance. This comprehensive analysis is what separates amateurs from professional career strategists.

---

Key Factors That Determine Your Market Value

Once you have your foundational data, you need to adjust your expected salary range based on your unique professional profile. These are the levers that move you from the 50th percentile to the 75th or 90th percentile. An offer might be low not just in a general sense, but specifically because it fails to account for your high-value attributes in these key areas.

###

Level of Education & Certifications

Your formal education and specialized credentials are a primary determinant of your value, especially early in your career.

- Degrees: A bachelor's degree is the baseline for most professional roles. A master's degree (e.g., MBA, MS, MA) can command a significant premium. According to a 2022 report from the BLS, individuals with a master's degree had median weekly earnings 18% higher than those with only a bachelor's degree. In fields like data science or finance, a master's or Ph.D. can be a prerequisite for top-tier roles and salaries.

- Certifications: In many fields, certifications are more important than advanced degrees. They demonstrate up-to-date, specialized knowledge.

- IT/Cybersecurity: A CISSP (Certified Information Systems Security Professional) can add $15,000-$25,000 to a cybersecurity professional's salary compared to a non-certified peer.

- Project Management: A PMP (Project Management Professional) certification is the gold standard and can result in a salary premium of up to 20%, according to the Project Management Institute (PMI).

- Finance: A CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant) designation is a powerful salary driver, unlocking access to more senior and lucrative roles.

- Marketing: Certifications in Google Ads, HubSpot, or Salesforce Marketing Cloud demonstrate tangible, in-demand platform expertise.

If an offer doesn't seem to account for your advanced degree or critical certification, it is a valid reason for your salary expectations to be higher.

###

Years and Quality of Experience

Experience is arguably the single most significant factor in salary determination. However, it's not just about the number of years; it's about the *quality* and *relevance* of that experience.

- Entry-Level (0-2 years): Your salary is largely determined by your education and internship experience. You are being paid for your potential.

- Mid-Career (3-8 years): You have a proven track record. Your salary should reflect your demonstrated ability to deliver results. This is where your salary growth should be steepest. For example, a Software Engineer's salary might jump from $85,000 at year 1 to $140,000+ by year 5.

- Senior/Lead (8-15 years): You are now valued not just for your individual contributions but for your ability to lead projects, mentor junior staff, and influence strategy. Your salary should be in the 75th percentile or higher for your role.

- Principal/Director Level (15+ years): At this stage, you are an industry expert. Your compensation is tied to your strategic impact on the business. Base salary becomes a smaller part of your total compensation, with performance bonuses and equity making up a larger share.

Quality of Experience: Did you spend five years maintaining a legacy system, or did you spend five years leading the development of a market-leading new product? Did you manage a $50,000 budget or a $5 million budget? Quantify your accomplishments on your resume and in your mind. This qualitative difference is what justifies a salary at the top of the market range.

###

Geographic Location

Where you work has a massive impact on your salary due to variations in cost of living and labor market demand. A $100,000 salary in San Francisco, CA is very different from a $100,000 salary in St. Louis, MO.

- High Cost of Living (HCOL) Tiers:

- Tier 1 Cities: San Francisco/Bay Area, New York City, San Jose. Salaries here are the highest in the nation to compensate for astronomical living costs.

- Tier 2 Cities: Boston, Los Angeles, San Diego, Seattle, Washington D.C. Also very high salaries, slightly below Tier 1.

- Tier 3 Cities: Denver, Austin, Chicago, Dallas. Strong tech and business hubs with above-average salaries and a more moderate cost of living.

- Remote Work Nuances: The rise of remote work has complicated this. Some companies pay a single "national" rate regardless of location. Others, like Meta and Google, use a location-based pay model, adjusting salaries based on the employee's home address. When evaluating a remote offer, you must clarify the company's pay philosophy. If they are paying a lower, location-adjusted salary, but you are bringing Tier-1 city level skills, that is a point of contention.

Example: A Data Analyst's Salary

According to Salary.com data accessed in 2024, the median salary for a Data Analyst III (an experienced analyst) varies dramatically by location:

- San Francisco, CA: $132,500

- New York, NY: $126,800

- Austin, TX: $111,700

- Chicago, IL: $110,600

- Raleigh, NC: $103,400

If you live in Austin and receive an offer of $95,000, you can see it's about 15% below the local median for an experienced professional. This geographic data is one of the strongest pieces of evidence you can have.

###

Company Type & Size

The type of organization you work for has its own distinct compensation culture.

- Large Public Corporations (e.g., Fortune 500): Tend to have highly structured pay bands. Salaries are often competitive and predictable, with robust benefits, 401(k) matches, and reliable annual bonuses. Examples: Microsoft, Johnson & Johnson, Procter & Gamble.

- Venture-Backed Startups: Cash is often tight, so base salaries may be lower than at large corporations. However, this is often compensated with significant equity (stock options). This is a high-risk, high-reward proposition. An offer from a startup with a low base salary and no meaningful equity is a major red flag.

- "Big Tech" (e.g., FAANG): These companies (Meta, Apple, Amazon, Netflix, Google) are in a league of their own. They pay top-of-market salaries, bonuses, and especially RSUs, creating total compensation packages that are often unattainable elsewhere. Data from Levels.fyi is essential for evaluating these offers.

- Non-Profits & Government: Tend to have lower base salaries than the private sector. They often compensate with excellent job security, strong pensions (in government), and a mission-driven work environment. You must adjust your salary expectations accordingly when considering these sectors.

An offer from a 50-person startup should not be judged by the same standard as an offer from Google. Context is key.

###

Area of Specialization

Within any given profession, certain specializations are more in-demand and command higher salaries.

- Software Engineering: An engineer specializing in Artificial Intelligence/Machine Learning or Blockchain development will earn significantly more than a generalist web developer.

- Marketing: A specialist in Marketing Analytics and Data Science will command a higher salary than a specialist in event marketing.

- Finance: An investment banker specializing in Mergers & Acquisitions (M&A) will earn far more than a corporate financial analyst.

- Human Resources: A specialist in Compensation & Benefits or HRIS (Human Resources Information Systems) will typically earn more than an HR Generalist.

If your skills are in a hot, high-demand niche, but the offer reflects a generalist's salary, you have a clear justification for declining.

###

In-Demand Skills

Beyond official specializations, possessing a portfolio of specific, high-value skills can dramatically increase your worth. These are the keywords that recruiters and hiring managers are actively searching for.

Cross-Industry High-Value Skills:

- Data Analysis & Visualization: Ability to use tools like SQL, Python/R, Tableau, or Power BI.

- Cloud Computing: Proficiency with platforms like AWS (Amazon Web Services), Microsoft Azure, or Google Cloud Platform.

- AI/Machine Learning: Understanding of machine learning models, natural language processing (NLP), and AI tools.

- Cybersecurity: Skills in network security, ethical hacking, and risk management.

- Project & Product Management: Expertise in Agile/Scrum methodologies and tools like Jira.

- Sales & Business Development: Proven ability to manage a sales funnel using CRM software like Salesforce.

When you possess multiple skills from this list, you become a "hybrid professional" who can solve complex, cross-functional problems. Your salary should reflect this enhanced capability. A low offer may indicate the company doesn't fully grasp the value of your unique skill stack.

---

The Long-Term Career Impact of Your Decision

Declining a job offer is not an isolated event. It is a strategic move with long-term consequences for your career trajectory, professional reputation, and future earning potential. Understanding these implications will help you make your decision with foresight and confidence.

### Protecting Your Long-Term Salary Trajectory

This is the most critical financial reason to decline a low offer. Your salary history, while now illegal for employers to ask about in many states, creates a psychological and practical anchor. Each new salary is typically a percentage increase over your previous one.

The Compounding Effect of a Low Salary:

Imagine two professionals, Maria and Ben, with identical skills.

- Maria accepts a job at $80,000.

- Ben holds out and accepts a job at $95,000.

Assuming a conservative 4% average annual raise and a 15% raise for each new job they take every 3 years, let's see their salaries in 6 years:

| Year | Maria's Salary | Ben's Salary |

| ---- | ----------------------------------------------- | ----------------------------------------------- |

| 0 | $80,000 (Initial Offer) | $95,000 (Initial Offer) |

| 1 | $83,200 (4% raise) | $98,800 (4% raise) |

| 2 | $86,528 (4% raise) | $102,752 (4% raise) |

| 3 | $99,507 (15% raise for new job) | $118,165 (15% raise for new job) |

| 4 | $103,487 (4% raise) | $122,892 (4% raise) |

| 5 | $107,626 (4% raise) | $127,808 (4% raise) |

| 6 | $123,770 (15% raise for new job) | $146,979 (15% raise for new job) |

After just six years, Ben is earning over $23,000 more per year than Maria, and the gap will only continue to widen. Declining that initial lowball offer set Ben on a completely different financial trajectory. By saying "no" to an undervalued offer, you are making an investment in your future self.

### Preserving Your Professional Reputation and Network

How you decline is as important as the decline itself. A graceful, professional exit can actually *enhance* your reputation. Hiring managers and recruiters are professionals; they understand that business decisions are not personal.

- A Professional Decline: When you decline with gratitude, transparency (stating the reason is a mismatch on compensation expectations), and well wishes, you come across as a confident, savvy professional who knows their worth. You are memorable in a good way. The recruiter is more likely to keep you in their network and reach out for future, more senior roles that align with your salary needs.

- A Poor Decline: A curt, demanding, or ghosting approach burns the bridge entirely. You will be flagged in the company's Applicant Tracking System (ATS), and the recruiter will remember the negative experience. Recruiters have strong networks, and a bad reputation can follow you.

The Goal: The "Impressive No"

Your aim is to have the hiring manager think, "I'm disappointed we couldn't bring them on board, but I completely respect their position. They handled this very professionally. I'll keep them in mind for the future." This turns a rejection into a long-term networking play.

### Emerging Trends and Future Challenges

The job market is in constant flux. The "Great Resignation" and the subsequent rise of remote work have empowered candidates to be more selective about compensation. However, economic headwinds and corporate belt-tightening can shift the power back to employers.

- Trend: Pay Transparency. More states and cities are enacting pay transparency laws, requiring employers to post salary ranges in job descriptions. This is a massive win for candidates, making it easier to spot lowball offers from the start.

- Trend: Data-Driven Negotiations. The proliferation of tools like Levels.fyi and detailed Glassdoor reports means candidates are coming to the table better prepared than ever. The expectation of a data-backed conversation is increasing.

- Challenge: Economic Uncertainty. During a recession or economic slowdown, companies may implement hiring freezes or be less flexible on salary. In such a market, the risk of declining an offer increases. You must have a realistic assessment of your own financial runway and the number of other opportunities available.

To stay relevant and maintain your negotiating power, you must commit to continuous learning, upskilling in high-demand areas (like AI literacy or data analytics), and consistently tracking the compensation trends in your specific field and location.

---

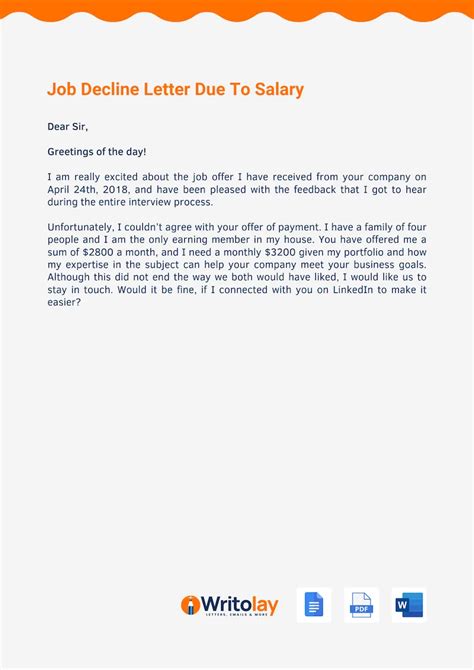

The Step-by-Step Guide to Declining the Offer (With Templates)