Are you trying to determine your potential take-home pay in Illinois? You've likely searched for an "Illinois salary tax calculator." Understanding your net pay after taxes is a critical part of financial planning and career evaluation. But what about the professionals who build and use these calculations every day?

This guide will first demystify the Illinois salary and tax landscape. Then, we will dive deep into the career that is central to these calculations: Accounting. We'll explore the salary, influencing factors, and job outlook for Accountants and Tax Specialists in the Land of Lincoln, offering a clear roadmap for anyone considering this stable and rewarding profession.

What an Illinois Salary Tax Calculator Actually Does

Before we analyze the careers, let's clarify what a salary tax calculator does. It's a digital tool designed to estimate your net (or "take-home") pay after all deductions are subtracted from your gross salary. To do this, it requires several key inputs:

- Gross Salary: Your total annual or per-paycheck earnings before any deductions.

- Pay Frequency: How often you are paid (weekly, bi-weekly, monthly).

- Filing Status: Your federal and state tax status (e.g., Single, Married Filing Jointly).

- Allowances/Dependents: Information from your W-4 form.

- Pre-Tax Deductions: Contributions to retirement plans (like a 401k), health insurance premiums, etc.

The calculator then subtracts federal taxes, FICA taxes (Social Security and Medicare), and, crucially, the Illinois state income tax. A key feature of Illinois is its flat tax rate, which is currently 4.95% of your net income. This simplifies calculations compared to states with progressive tax brackets.

Now, let's explore the earning potential of the experts who navigate these financial landscapes for a living.

Average Accountant Salary in Illinois

Working as an Accountant or Auditor in Illinois offers a competitive salary and a strong career trajectory. These professionals are the backbone of financial integrity for businesses, governments, and individuals.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Employment and Wage Statistics, the average annual salary for Accountants and Auditors in Illinois is $88,960 (May 2023 data).

However, a simple average doesn't tell the whole story. Salaries can vary significantly based on experience, location, and specialization. A more detailed look reveals a typical range:

- Entry-Level (Bottom 10-25%): $51,880 to $63,610

- Mid-Career (Median 50%): $79,810

- Senior/Experienced (Top 25-10%): $102,690 to $131,730

Salary aggregator data aligns with these figures. Salary.com reports the median Accountant salary in Chicago, IL, to be around $93,500, while Glassdoor places the average in the state closer to $78,000, highlighting the impact of location and the specific data sets used.

Key Factors That Influence Salary

Your earning potential is not a single number; it's a dynamic figure shaped by several critical factors. Understanding these levers is key to maximizing your career income.

### Level of Education

A bachelor's degree in accounting or a related field is the standard entry requirement. However, advanced credentials significantly boost earning potential. A Master of Accountancy (MAcc) or a Master of Business Administration (MBA) with a concentration in accounting can open doors to higher-level positions and starting salaries. The most impactful credential is the Certified Public Accountant (CPA) license. Professionals who earn their CPA designation often see a salary increase of 10-15% and are eligible for leadership roles in public accounting and industry.

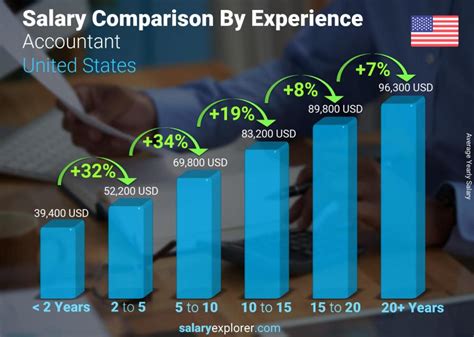

### Years of Experience

Experience is one of the most powerful drivers of salary growth in accounting.

- Junior/Staff Accountant (0-3 Years): Typically handles day-to-day tasks like bookkeeping, reconciliations, and preparing financial statements. Salaries are in the entry-level range cited by the BLS ($52k - $65k).

- Senior Accountant (4-7 Years): Takes on more complex tasks, may supervise junior staff, and gets involved in financial analysis and reporting. Earnings move toward and beyond the state median, often in the $75k - $95k range.

- Manager/Controller (8+ Years): Manages entire accounting departments, oversees financial reporting, budgeting, and strategy. These roles regularly command salaries well over $100,000, with top positions reaching $130,000+ and beyond, especially in large corporations.

### Geographic Location

In Illinois, where you work matters significantly. The Chicago-Naperville-Elgin metropolitan area is the state's primary economic engine and offers the highest salaries for accountants due to a higher cost of living and a greater concentration of large corporations and public accounting firms.

- Chicago-Naperville-Elgin, IL Metro Area: The annual mean wage is $92,020.

- Champaign-Urbana, IL: The annual mean wage is $78,920.

- Springfield, IL: The annual mean wage is $78,350.

- Nonmetropolitan Areas (Central/Southern Illinois): The annual mean wage can be lower, around $70,080 and $67,610, respectively.

*(Source: BLS Metropolitan and Nonmetropolitan Area Occupational Employment and Wage Estimates, May 2023)*

### Company Type

The type of organization you work for directly impacts your compensation and career path.

- Public Accounting: Firms like the "Big Four" (Deloitte, PwC, EY, KPMG) and other large national or regional firms often offer the highest starting salaries to attract top talent. However, they are also known for demanding work hours, especially during tax or audit seasons.

- Corporate/Industry Accounting: Working "in-house" for a company (from a Fortune 500 giant like Caterpillar to a local manufacturing firm) often provides better work-life balance. Salaries are competitive and can grow substantially as you move into management.

- Government: Positions with federal agencies (like the IRS) or state and local governments offer strong job security and excellent benefits, though salaries may start lower than in the private sector.

- Non-Profit: While incredibly rewarding, non-profit organizations typically offer lower compensation than for-profit entities due to budget constraints.

### Area of Specialization

Within the broad field of accounting, specializing can lead to higher pay.

- Tax Accounting: Specialists who focus on complex corporate tax law, international tax, or high-net-worth individuals are always in demand.

- Audit and Assurance: These professionals verify the accuracy of financial records and are the bedrock of public accounting firms.

- Forensic Accounting: This exciting niche involves investigating financial fraud and discrepancies and often commands a premium salary due to its specialized skill set.

- Advisory/Consulting: CPAs who move into financial consulting or risk advisory roles can achieve some of the highest earnings in the profession.

Job Outlook

The future for accountants and auditors is bright and stable. According to the U.S. Bureau of Labor Statistics' Occupational Outlook Handbook, employment for this profession is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

This steady demand is driven by economic growth, increasingly complex tax codes and regulations (like the Sarbanes-Oxley Act), and the ever-present need for financial accountability. As globalization and technology evolve, the expertise of skilled accountants will remain essential, ensuring strong job security for years to come.

Conclusion

While your initial search for an "Illinois salary tax calculator" is a practical step in financial planning, it also opens the door to understanding a vital and prosperous career path. The field of accounting in Illinois offers a competitive salary, a stable job outlook, and numerous avenues for growth and specialization.

For prospective students and professionals, the key takeaways are clear:

- Your earning potential is directly influenced by your education (especially a CPA), experience, and choice of specialty.

- Geographic location within Illinois plays a significant role, with the Chicago metro area offering the highest compensation.

- The career path is reliable, with consistent demand for skilled professionals to navigate the complexities of finance and regulation.

By investing in the right credentials and strategically navigating your career, you can move from simply *using* a salary calculator to becoming the financial expert that companies rely on.